|

市場調查報告書

商品編碼

1689968

高頻寬記憶體:市場佔有率分析、產業趨勢與統計資料、成長預測(2025-2030 年)High Bandwidth Memory - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

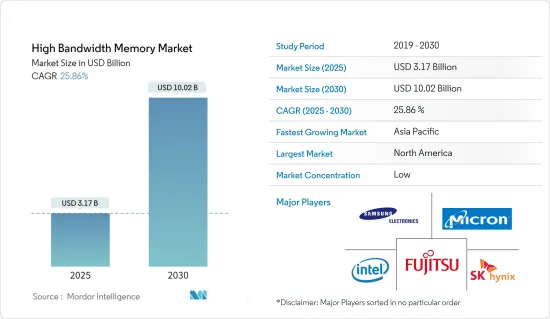

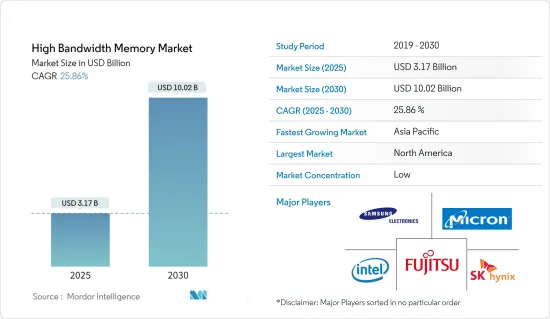

高頻寬記憶體市場規模預計在 2025 年為 31.7 億美元,預計到 2030 年將達到 100.2 億美元,預測期內(2025-2030 年)的複合年成長率為 25.86%。

高頻寬記憶體(HBM)是一種用於 3D 堆疊 SDRAM 的高速電腦記憶體介面,通常用於高效能圖形加速器、網路設備和超級電腦。

推動高頻寬記憶體 (HBM) 市場成長的關鍵因素是對高頻寬、低功耗和高度可擴展記憶體的需求不斷成長、人工智慧的採用日益增加以及電子設備小型化的趨勢日益增強。

透過在電路板上堆疊八個 DRAM晶粒並將它們與 TSV 互連,HBM 可提供更高的頻寬,同時在相對較小的尺寸內消耗更少的功耗。 HBM 具有 128 個通道,總合8 個通道,描述了 1,024 位元介面。具有四個 HBM 堆疊的 GPU 將提供 4,096 位元記憶體匯流排。

例如,2024年6月,美國記憶體晶片製造商美光科技在美國建造了一條先進高頻寬記憶體晶片測試生產線。該公司正考慮首次在馬來西亞生產 HBM,以滿足 AI 熱潮帶來的進一步需求。

隨著圖形應用程式的增加,對更快資訊傳遞(頻寬)的需求也隨之增加。因此,HBM 在性能和功率效率方面優於前代 GDDR5,為高頻寬記憶體市場創造了成長機會。

此外,由於新冠疫情,主要半導體供應商的產能都在下降。此外,由於勞動力短缺,中國許多封裝測試廠已經縮減甚至停止營運。這給依賴此類後端封裝和測試產能的晶片公司造成了瓶頸。

然而,推動市場成長的因素包括人工智慧的日益普及、對低功耗、高頻寬和高度可擴展記憶體的需求不斷成長,以及電子設備小型化的趨勢日益增強。

高頻寬記憶體市場趨勢

汽車和其他應用領域預計將強勁成長

- 隨著自動駕駛汽車和 ADAS 整合的興起,高頻寬記憶體應用在汽車產業正在不斷擴大。汽車行業的進步推動了高性能記憶體的採用,支持了 HBM 市場的成長。

- HBM 透過使用 2.5D 技術來改善傳統 DRAM 而不斷發展,使其更接近 CPU,同時降低驅動訊號所需的功率並最大限度地減少 RC 延遲。自動駕駛市場正在擴大,並廣泛使用資料集來解釋和分析環境。資料處理正在快速進行,以防止故障和即將發生的災難。對於更快、更強大的 GPU 的需求正在推動對系統中高頻寬記憶體的需求。

- 2024 年 3 月,記憶體晶片製造商三星電子在其記憶體晶片部門內成立了高頻寬記憶體 (HBM) 團隊,以便在開發第六代 AI 記憶體 HBM4 和 AI 加速器 Mach-1 時提高生產產量比率。新團隊將負責DRAM和NAND快閃記憶體快閃記憶體的研發和銷售。

- 先進的駕駛輔助技術以及自動駕駛在汽車行業中正變得相當普遍。先前的 ADAS 設計使用了 DDR4 和 LPDDR4 等記憶體晶片。然而,隨著汽車產業從成本效益轉向更好的性能參數,ADAS 製造商正在將 HBM 技術納入其設計架構中。

- 汽車技術的快速進步和汽車前沿技術的日益廣泛使用預計將推動研究市場中高頻寬記憶體和 DDRAM 的銷售。

北美佔最大市場佔有率

- 北美廣泛採用 HBM 主要是因為高效能運算 (HPC) 應用的成長,這些應用需要高頻寬記憶體解決方案來快速處理資料。由於對人工智慧、機器學習和雲端運算的需求不斷成長,北美對 HPC 的需求也在成長。

- 科技的快速變化和各行各業產生的大量資料使得人們需要高效的處理系統。這些也是推動該地區高頻寬記憶體市場需求的一些因素。

- 此外,美國政府還啟動了資料中心最佳化舉措(DCOI),以整合該國的許多資料中心,從而更好地為公民服務,同時提高納稅人的投資報酬率。這個整合過程包括建立超大規模資料中心並關閉表現不佳的資料。根據Cloudscene預測,截至2024年3月,美國將擁有約5,381個資料中心。

- 北美記憶體製造商正在尋找機會擴大其產品範圍。例如,英特爾宣布推出其新一代具有高頻寬記憶體 (HBM) 的 Sapphire Rapids (SPR) Xeon 可擴充處理器。 Sapphire Rapids 支援 DDR5,預計將支援高頻寬記憶體(HBM),取代目前伺服器記憶體的趨勢 DDR4,並有可能顯著增加 CPU 可用的記憶頻寬。

高頻寬記憶體產業概況

高頻寬記憶體市場高度分散。市場競爭非常激烈,有幾家大型企業參與競爭。該行業競爭對手之間的競爭主要基於透過技術創新、市場滲透和競爭策略獲得永續的競爭優勢。這是一個資本密集型市場,因此退出門檻很高。市場的主要企業包括英特爾公司、東芝公司和富士通有限公司。

- 2024 年 4 月-台積電與 SK 海力士簽署合作備忘錄,開發下一代 HBM(高頻寬記憶體)和下一代封裝技術。 SK海力士打算利用台積電先進的邏輯製程來製造HBM4的底層組件,預計這將提升記憶體晶片的性能和能源效率,旨在在有限的空間內容納更多功能。

- 2024 年 3 月 - Camtek Ltd. 宣布已從一家領先的高頻寬記憶體 (HBM) 製造商贏得價值約 2500 萬美元的新訂單,用於測試和測量 HBM。大多數系統計劃於 2024 年底交付。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

- 市場促進因素

- 對高頻寬、低功耗和高度可擴展記憶體的需求日益成長

- 人工智慧的採用率不斷提高

- 電子設備小型化趨勢日益增強

- 市場問題

- HBM 相關的高成本與設計複雜性

- DRAM市場

- DRAM收益與需求預測(2023-2028)

- DRAM收益按地區分類(與 HBM 市場位於同一地區)

- DDR5 RAM 產品的當前價格

- DDR5 產品製造商列表

第5章市場區隔

- 按應用

- 伺服器

- 聯網

- 消費者

- 汽車和其他應用

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 法國

- 英國

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 其他亞太地區

- 其他

- 北美洲

第6章競爭格局

- 公司簡介

- 主要HBM內存晶粒供應商

- Micron Technology Inc.

- Samsung Electronics Co. Ltd

- SK Hynix Inc.

- 主要相關利益者概況

- Intel Corporation

- Fujitsu Limited

- Advanced Micro Devices Inc.

- Xilinx Inc.

- Nvidia Corporation

- Open Silicon Inc.

- 主要HBM內存晶粒供應商

第7章投資分析

第8章 市場機會與未來趨勢

The High Bandwidth Memory Market size is estimated at USD 3.17 billion in 2025, and is expected to reach USD 10.02 billion by 2030, at a CAGR of 25.86% during the forecast period (2025-2030).

High bandwidth memory (HBM) is a high-speed computer memory interface for 3D-stacked SDRAM, usually used with high-performance graphics accelerators, network devices, and supercomputers.

Major factors driving the growth of the high bandwidth memory (HBM) market include the growing need for high bandwidth, low power, and highly scalable memories, increasing adoption of artificial intelligence, and a rising trend of miniaturization of electronic devices.

By stacking up 8 DRAM dies on the circuit and interconnecting them with TSVs, HBM offers a substantially higher bandwidth while using less power in a relatively minor form factor. Also, with 128-bit channels and a total of 8 channels, the HBM offers a 1,024-bit interface. A GPU with four HBM stacks would provide a memory bus with 4,096 bits.

For instance, in June 2024, US memory chip maker Micron Technology built test production lines for advanced high bandwidth memory chips in the United States. The company is considering manufacturing HBM in Malaysia for the first time to capture more demand from the AI boom.

With the growing graphics application, the appetite for fast information delivery (bandwidth) has also increased. Therefore, HBM performs better than GDDR5, which was used earlier in terms of performance and power efficiency, resulting in growth opportunities for the high bandwidth memory market.

Moreover, the major semiconductor vendors worked with reduced capacity due to the COVID-19 pandemic. Additionally, due to the shortage of laborers, many packages and testing plants in China reduced or even stopped operations. This created a bottleneck for chip companies that rely on such back-end packages and testing capacity.

However, some factors driving the market's growth include the increasing adoption of artificial intelligence, increasing demand for low power consumption, high bandwidth, highly scalable memories, and a rising trend of miniaturization of electronic devices.

High Bandwidth Memory Market Trends

The Automotive and Other Applications Segment is Expected to Grow Significantly

- The applications of high bandwidth memory are spanning the automotive industry due to the rise of self-driving cars and ADAS integration. Advancements in the automotive industry have driven the adoption of high-performance memory, which supports the growth of the HBM market.

- HBM has evolved by improving upon conventional DRAM using 2.5D technology, bringing it closer to the CPU while requiring less power to drive a signal and minimizing RC latency. The autonomous driving market is expanding, extensively using data sets to interpret and analyze the environment. In order to prevent mishaps and impending catastrophes, data processing is carried out at a very rapid pace. The demand for quick and potent GPUs has increased the demand for high bandwidth memory to be included in the systems.

- In March 2024, Samsung Electronics Co., a memory chipmaker, set up a high bandwidth memory (HBM) team within the memory chip division to raise production yields as it is developing a sixth-generation AI memory HBM4 and AI accelerator Mach-1. The new team is in charge of the development and sales of DRAM and NAND flash memory.

- Advanced driver-assistance technologies have become quite popular in the car industry alongside autonomous driving. Earlier ADAS designs used memory chips like DDR4 and LPDDR4 since they were readily available at the time. However, the automobile industry's transition from cost-effectiveness to better performance parameters pushes ADAS makers to incorporate HBM technology into their design architecture.

- The rapid advancement of technology in automobiles and increasing usage of edge technologies in cars are expected to boost the sales of high bandwidth memory and DDRAM in the market studied.

North America to Hold the Largest Share in the Market

- The high adoption of HBMs in North America is primarily due to the growth in high-performance computing (HPC) applications that require high bandwidth memory solutions for fast data processing. HPC demand in North America is growing due to the increase in demand for AI, machine learning, and cloud computing.

- The rapidly changing technologies and high data generation across industries create a need for efficient processing systems. These are also some of the factors driving the demand for the high bandwidth memory market in the region.

- Additionally, the US government started the Data Center Optimization Initiative (DCOI) to deliver better services to the public while increasing return on investment to taxpayers by consolidating many data centers in the country. The consolidation process includes building hyper-scale data centers and shutting off the underperforming ones. According to Cloudscene, the country had around 5,381 data centers in the United States as of March 2024.

- Memory manufacturing companies in North America are seeking opportunities for product expansions. For instance, Intel announced the launch of the next generation Sapphire Rapids (SPR) Xeon Scalable processor with high bandwidth memory (HBM). DDR5, supported by Sapphire Rapids, is expected to replace DDR4, the current trend in server memory, with high bandwidth memory (HBM) support, which may significantly expand the memory bandwidth available to the CPU.

High Bandwidth Memory Industry Overview

The high bandwidth memory market is highly fragmented. The market is highly competitive and consists of several major players. This industry's competitive rivalry primarily depends on sustainable competitive advantage through innovation, market penetration, and competitive strategy power. Since the market is capital-intensive, the barriers to exit are also high. Some of the key players in the market are Intel Corporation, Toshiba Corporation, and Fujitsu Ltd.

- April 2024 - TSMC signed a Memorandum of Understanding with SK Hynix to develop next-generation HBM (high bandwidth memory) and a next-generation packaging technology. SK Hynix intends to utilize TSMC's sophisticated logic processes for the foundational component of HBM4, aiming to incorporate more features within the confined space, which is anticipated to boost both the performance and energy efficiency of its memory chips.

- March 2024 - Camtek Ltd announced that it received a new order for approximately USD 25 million from a tier-1 HBM manufacturer for the inspection and metrology of high bandwidth memory (HBM). Most of the systems are expected to be delivered in the second half of 2024.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

- 4.5 Market Drivers

- 4.5.1 Growing Need for High Bandwidth, Low Power Consuming, and Highly Scalable Memories

- 4.5.2 Increasing Adoption of Artificial Intelligence

- 4.5.3 Rising Trend of Miniaturization of Electronic Devices

- 4.6 Market Challenges

- 4.6.1 Exorbitant Costs and Design Complexities Associated with HBM

- 4.7 DRAM MARKET

- 4.7.1 DRAM Revenue and Demand Forecast (2023-2028)

- 4.7.2 DRAM Revenue by Geography (Same Geographical Regions as in the HBM Market)

- 4.7.3 Current Pricing of DDR5 RAM Products

- 4.7.4 List of DDR5 Product Manufacturers

5 MARKET SEGMENTATION

- 5.1 By Application

- 5.1.1 Servers

- 5.1.2 Networking

- 5.1.3 Consumer

- 5.1.4 Automotive and Other Applications

- 5.2 By Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 France

- 5.2.2.3 United Kingdom

- 5.2.2.4 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 India

- 5.2.3.2 China

- 5.2.3.3 Japan

- 5.2.3.4 Rest of Asia-Pacific

- 5.2.4 Rest of the World

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Key HBM Memory Die Suppliers

- 6.1.1.1 Micron Technology Inc.

- 6.1.1.2 Samsung Electronics Co. Ltd

- 6.1.1.3 SK Hynix Inc.

- 6.1.2 Key Stakeholders Profiles

- 6.1.2.1 Intel Corporation

- 6.1.2.2 Fujitsu Limited

- 6.1.2.3 Advanced Micro Devices Inc.

- 6.1.2.4 Xilinx Inc.

- 6.1.2.5 Nvidia Corporation

- 6.1.2.6 Open Silicon Inc.

- 6.1.1 Key HBM Memory Die Suppliers