|

市場調查報告書

商品編碼

1721494

高頻寬記憶體市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測High Bandwidth Memory Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

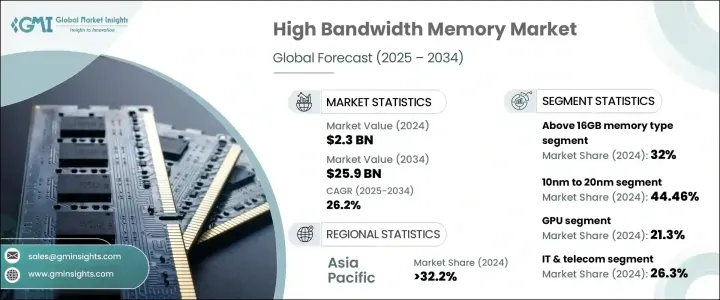

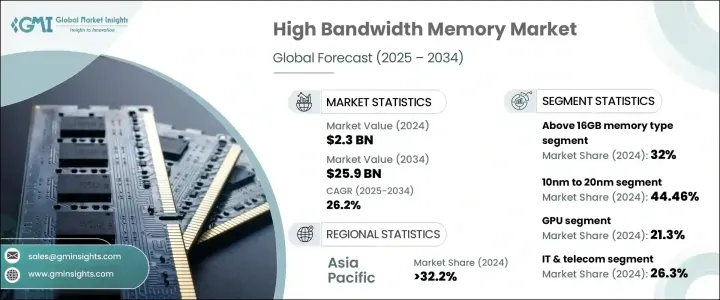

2024 年全球高頻寬記憶體市場價值為 23 億美元,預計到 2034 年將以 26.2% 的複合年成長率成長,達到 259 億美元。全球向以數據為中心的技術的轉變正在重塑記憶體解決方案的格局,高頻寬記憶體正在成為更快資料處理和節能運算的關鍵推動因素。隨著各行業的組織競相採用下一代技術,對高速、低延遲記憶體的需求顯著增加。

人工智慧 (AI)、機器學習 (ML)、進階駕駛輔助系統 (ADAS) 和 5G 網路的影響力日益增強,持續推動對強大記憶體技術的需求。企業嚴重依賴 HBM 來支援巨量資料、高解析度成像、即時分析和深度學習工作負載。隨著汽車、醫療保健、金融服務和媒體等領域的數位轉型加速,HBM 解決方案正迅速成為開發更智慧、更快速、更互聯的系統的基礎。世界各地的公司紛紛投資尖端創新和擴大製造能力,以在這個快速發展的領域中保持競爭力。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 23億美元 |

| 預測值 | 259億美元 |

| 複合年成長率 | 26.2% |

市場依技術節點細分為 10nm 以下、10nm 至 20nm 和 20nm 以上。 10nm 至 20nm 類別在 2024 年的價值為 10 億美元,預計在 2025 年至 2034 年期間的複合年成長率為 26.7%。該節點已被證明非常適合需要平衡效能和成本效益的應用,例如汽車電子、物聯網設備和中端消費產品。它的可擴展性,加上高產量生產和可靠的熱管理,使其成為旨在最佳化性能而不增加製造成本的開發人員的首選。

根據應用,高頻寬記憶體市場分為 GPU、CPU、FPGA、ASIC、AI、ML、HPC、網路和資料中心。受專業和沈浸式遊戲生態系統需求飆升的推動,GPU 領域將在 2024 年佔據 21.3% 的佔有率。隨著超高清圖形、即時渲染和延展實境環境成為主流,圖形處理單元正在整合 HBM3E 等先進的 HBM 技術,以滿足不斷成長的頻寬需求。這種趨勢在遊戲和動畫領域尤其突出,因為快速的刷新率和靈敏的用戶體驗至關重要。

2024 年,亞太地區以 32.2% 的市佔率領先全球市場。同時,受雲端和資料中心基礎設施的數位現代化推動,同年美國高頻寬記憶體市場價值達到 5.23 億美元。該國擁有大量的資料中心,是 HBM 應用的主導力量,即時資料分析和邊緣運算應用為加速部署鋪平了道路。

全球高頻寬記憶體市場的領導者包括 Cadence Design Systems, Inc.、Advanced Micro Devices, Inc. (AMD)、Broadcom Inc.、GlobalFoundries Inc.、IBM Corporation、Fujitsu Limited 和 Infineon Technologies AG。這些公司正在大力投資研發,以提高其 HBM 產品的速度、可擴展性和效率。人工智慧、遊戲和半導體領域的戰略聯盟進一步支持了他們的全球擴張努力。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商矩陣

- 利潤率分析

- 技術與創新格局

- 專利分析

- 重要新聞和舉措

- 產業衝擊力

- 成長動力

- 數據密集型應用的擴展

- 高效能運算的成長

- 下一代平台整合

- 增強的遊戲和圖形需求

- 資料中心和雲端服務的擴展

- 產業陷阱與挑戰

- 生產成本高

- 技術整合的複雜性

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

- 未來市場趨勢

- 監管格局

第4章:市場估計與預測:按記憶體容量,2021 年至 2034 年

- 主要趨勢

- 小於4GB

- 4GB 至 8GB

- 8GB 至 16GB

- 16GB以上

第5章:市場估計與預測:按技術節點,2021 年至 2034 年

- 主要趨勢

- 10奈米以下

- 10奈米至20奈米

第6章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 圖形處理單元 (GPU)

- 中央處理器 (CPU)

- 現場可程式閘陣列(FPGA)

- 專用積體電路(ASIC)

- 人工智慧(AI)和機器學習(ML)

- 高效能運算 (HPC)

- 網路與資料中心

- 其他

第7章:市場估計與預測:依最終用途產業,2021 年至 2034 年

- 主要趨勢

- IT與電信

- 遊戲和娛樂

- 醫療保健與生命科學

- 汽車

- 軍事與國防

- 其他

第8章:市場估計與預測:按地區,2021-2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 日本

- 中國

- 印度

- 韓國

- 澳新銀行

- 拉丁美洲

- 巴西

- 墨西哥

- 拉丁美洲其他地區

- 中東和非洲

- 南非

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

第9章:公司簡介

- Advanced Micro Devices, Inc. (AMD)

- Broadcom Inc.

- Cadence Design Systems, Inc.

- Fujitsu Limited

- GlobalFoundries Inc.

- IBM Corporation

- Infineon Technologies AG

- Intel Corporation

- Marvell Technology Group Ltd.

- Micron Technology, Inc.

- Nanya Technology Corporation

- NVIDIA Corporation

- Qualcomm Incorporated

- Rambus Inc.

- Samsung Electronics Co., Ltd.

- SK Hynix Inc.

- Synopsys, Inc.

- Taiwan Semiconductor Manufacturing Company Limited (TSMC)

- Toshiba Corporation

The Global High Bandwidth Memory Market was valued at USD 2.3 billion in 2024 and is estimated to grow at a CAGR of 26.2% to reach USD 25.9 billion by 2034. The global shift toward data-centric technologies is reshaping the landscape of memory solutions, with high bandwidth memory emerging as a critical enabler for faster data processing and energy-efficient computing. As organizations across various sectors race to adopt next-generation technologies, the demand for high-speed, low-latency memory has seen a notable surge.

The growing influence of artificial intelligence (AI), machine learning (ML), advanced driver-assistance systems (ADAS), and 5G networks continues to fuel demand for powerful memory technologies. Enterprises are leaning heavily on HBM to support big data, high-resolution imaging, real-time analytics, and deep learning workloads. With digital transformation accelerating in sectors like automotive, healthcare, financial services, and media, HBM solutions are rapidly becoming foundational to the development of smarter, faster, and more connected systems. Companies worldwide are responding by investing in cutting-edge innovations and expanding manufacturing capabilities to stay competitive in this rapidly evolving space.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.3 Billion |

| Forecast Value | $25.9 Billion |

| CAGR | 26.2% |

The market is segmented by technology node into below 10nm, 10nm to 20nm, and above 20nm. The 10nm to 20nm category accounted for USD 1 billion in 2024 and is projected to grow at a CAGR of 26.7% between 2025 and 2034. This node has proven ideal for applications requiring balanced performance and cost-efficiency, such as automotive electronics, IoT devices, and mid-range consumer products. Its scalability, coupled with high-yield production and reliable thermal management, continues to make it a go-to option for developers aiming to optimize performance without inflating manufacturing costs.

Based on application, the high bandwidth memory market is categorized into GPUs, CPUs, FPGAs, ASICs, AI, ML, HPC, networking, and data centers. The GPU segment captured a 21.3% share in 2024, supported by soaring demand in professional and immersive gaming ecosystems. As ultra-high-definition graphics, real-time rendering, and extended reality environments become mainstream, graphics processing units are integrating advanced HBM technologies such as HBM3E to meet rising bandwidth needs. This trend is particularly prominent in the gaming and animation sectors, where rapid refresh rates and responsive user experiences are essential.

The Asia Pacific region led the global market with a 32.2% share in 2024. Meanwhile, the U.S. high bandwidth memory market was valued at USD 523 million in the same year, driven by the digital modernization of cloud and data center infrastructures. The country's vast number of data centers makes it a dominant force in HBM adoption, with real-time data analytics and edge computing applications paving the way for accelerated deployment.

Leading players in the global high bandwidth memory market include Cadence Design Systems, Inc., Advanced Micro Devices, Inc. (AMD), Broadcom Inc., GlobalFoundries Inc., IBM Corporation, Fujitsu Limited, and Infineon Technologies AG. These companies are investing heavily in R&D to boost the speed, scalability, and efficiency of their HBM offerings. Strategic alliances across AI, gaming, and semiconductor sectors further support their global expansion efforts.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates & calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Vendor matrix

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news and initiatives

- 3.7 Industry impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Expansion of Data-Intensive Applications

- 3.7.1.2 Growth of High-Performance Computing

- 3.7.1.3 Next-Generation Platform Integration

- 3.7.1.4 Enhanced gaming and graphics demand

- 3.7.1.5 Expansion of the data center and cloud services

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High Production Costs

- 3.7.2.2 Technical Integration Complexity

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

- 3.11 Future market trends

- 3.12 Regulatory landscape

Chapter 4 Market Estimates and Forecast, By Memory Capacity, 2021 – 2034 ($ Mn & Bn GB)

- 4.1 Key trends

- 4.2 Less than 4GB

- 4.3 4GB to 8GB

- 4.4 8GB to 16GB

- 4.5 Above 16GB

Chapter 5 Market Estimates and Forecast, By Technology Node, 2021 – 2034 (USD Mn & Bn GB)

- 5.1 Key trends

- 5.2 Below 10nm

- 5.3 10nm to 20nm

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Mn & Bn GB)

- 6.1 Key trends

- 6.2 Graphics Processing Units (GPUs)

- 6.3 Central Processing Units (CPUs)

- 6.4 Field-Programmable Gate Arrays (FPGAs)

- 6.5 Application-Specific Integrated Circuits (ASICs)

- 6.6 Artificial Intelligence (AI) and Machine Learning (ML)

- 6.7 High-Performance Computing (HPC)

- 6.8 Networking and Data centers

- 6.9 Others

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021 – 2034 (USD Mn & Bn GB)

- 7.1 Key trends

- 7.2 IT & telecom

- 7.3 Gaming & entertainment

- 7.4 Healthcare & life Sciences

- 7.5 Automotive

- 7.6 Military & defense

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021– 2034 (USD Mn & Bn GB)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 Japan

- 8.4.2 China

- 8.4.3 India

- 8.4.4 South Korea

- 8.4.5 ANZ

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 UAE

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 Advanced Micro Devices, Inc. (AMD)

- 9.2 Broadcom Inc.

- 9.3 Cadence Design Systems, Inc.

- 9.4 Fujitsu Limited

- 9.5 GlobalFoundries Inc.

- 9.6 IBM Corporation

- 9.7 Infineon Technologies AG

- 9.8 Intel Corporation

- 9.9 Marvell Technology Group Ltd.

- 9.10 Micron Technology, Inc.

- 9.11 Nanya Technology Corporation

- 9.12 NVIDIA Corporation

- 9.13 Qualcomm Incorporated

- 9.14 Rambus Inc.

- 9.15 Samsung Electronics Co., Ltd.

- 9.16 SK Hynix Inc.

- 9.17 Synopsys, Inc.

- 9.18 Taiwan Semiconductor Manufacturing Company Limited (TSMC)

- 9.19 Toshiba Corporation