|

市場調查報告書

商品編碼

1689899

氯鹼:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Chlor-alkali - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

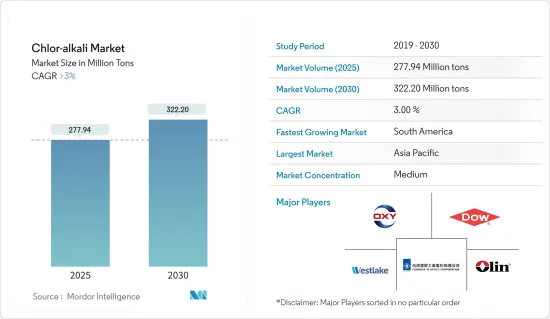

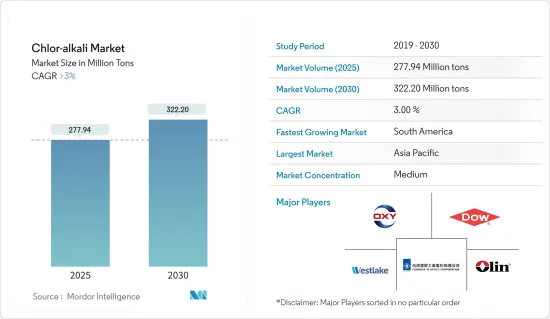

預計2025年氯鹼市場規模為2.7794億噸,到2030年將達到3.222億噸,預測期間(2025-2030年)複合年成長率將超過3%。

新冠疫情對全球氯鹼需求產生了負面影響。疫情期間,封鎖、供應鏈中斷和經濟活動減少導致建築、汽車和製造業等產業對氯鹼產品的需求減少。需求的下降影響了 PVC 生產中的氯消耗。然而,隨著各國放鬆封鎖限制並開始重啟經濟,氯鹼產品的需求開始恢復。受阻的行業逐漸恢復營運,導致對氯和氫氧化鈉的需求增加。

主要亮點

- 推動市場成長的關鍵因素是化學品製造需求的激增和聚氯乙烯(PVC)需求的增加。

- 然而,環境影響和嚴格的環境法規預計會阻礙氯鹼市場的發展。

- 加大對氯鹼研發和新應用的開發投入預計將為產業提供新的成長機會。

- 由於氯鹼產品及其衍生物的生產和消費量龐大,預計亞太地區將佔據最大的市場佔有率。

氯鹼市場趨勢

有機化學品領域佔市場主導地位

- 氯是氯鹼生產過程中透過電解鹽水生成的產物,是生產許多有機化學產品的重要原料。氯是有機合成中用途廣泛的組成部分,是生產氯化溶劑、塑膠、農藥、藥物和其他有機化合物的基礎。

- 氯的最大消費者是塑膠產業,特別是聚氯乙烯(PVC)的生產。 PVC廣泛應用於建築材料、包裝、汽車零件及各種消費品。 PVC 的需求推動了氯的高消耗,使得有機化學品領域成為氯鹼市場的主要貢獻者。

- 各終端用戶產業的氯產量和消費量持續增加。根據歐洲氯氣協會預測,到2023年12月底,歐洲氯氣產量將增加至609,418噸。 2023 年 12 月的平均日產量與 2023 年 11 月(19,659 噸)相比下降了 1.7%,但與 2022 年 12 月(16,573 噸)相比增加了 18.6%。

- 根據歐洲氯氣協會發布的資料,2022年德國氯氣產量為540萬噸,佔國內氯氣產能的最大佔有率。

- 根據BASF2023報告,預計2024年全球化學製造業(不包括製藥業)將成長2.7%,超過前一年(2023年:+1.7%)。中國是全球領先的化學品市場,預計 2023 年將大幅成長 4.0%,儘管這一成長率低於前一年強勁的成長(+7.5%)。

- 因此,受上述因素影響,未來氯鹼需求預計會增加。

亞太地區佔市場主導地位

- 亞太地區包括中國、印度和東南亞等幾個快速成長的經濟體,這些地區正在經歷強勁的工業成長。這種成長將推動建築、製造、化學品和紡織等各行業對氯鹼產品的需求。

- 亞太地區擁有龐大的製造地,許多產業都是氯鹼產品的重要消費者,尤其是聚氯乙烯、紡織品和化學品。該地區的製造業佔全球氯鹼消費量的很大一部分。

- 此外,根據中國國務院新聞辦公室消息,2023年中國主要紡織企業利潤與前一年同期比較成長7.2%。同年,中國紡織品服飾出口額達2,936億美元。紡織品服飾出口2023年12月開始再次增加,與前一年同期比較去年同期成長2.6%。

- 此外,根據Invest India的數據,印度佔全球紡織品和服飾貿易的4%。預計到 2030 年,紡織品製造業產值將達到 2,500 億美元,出口額將達 1,000 億美元。

- 此外,根據中國國家統計局發布的資料,2023年12月中國塑膠製品產量為698萬噸。

- 因此,預計上述因素將增加亞太地區氯鹼市場的需求。

氯鹼產業概況

氯鹼市場部分分散。市場的主要企業(不分先後順序)包括 Olin Corporation、西方石油公司、台塑股份有限公司、陶氏化學、Westlake Vinnolit GmbH &Co.KG 等。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 化學製造需求激增

- 聚氯乙烯(PVC)需求不斷增加

- 限制因素

- 環境影響和嚴格的環境法規

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 進出口趨勢

第5章 市場區隔

- 產品

- 苛性鈉

- 氯

- 堿灰

- 製造過程

- 膜細胞

- 隔膜電池

- 其他製造程序

- 應用

- 紙漿和造紙

- 有機化學

- 無機化學品

- 肥皂和清潔劑

- 氧化鋁

- 紡織品

- 其他用途(食品工業)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 土耳其

- 俄羅斯

- 北歐的

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 奈及利亞

- 埃及

- 卡達

- 阿拉伯聯合大公國

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- ANWIL SA(ORLEN SA)

- BorsodChem(Wanhua)

- Ciner Group

- Covestro AG

- Dow

- Ercros SA

- Formosa Plastics Corporation

- Genesis Energy LP

- Hanwha Solutions Chemical Division Corporation

- INEOS

- KEM ONE

- Kemira

- Micro Bio Ireland Limited

- NIRMA

- Nouryon(NOBIAN)

- Occidental Petroleum Corporation

- Olin Corporation

- PCC SE

- Shandong Haihua Group Co. Ltd

- Solvay

- Spolchemie(Euro Chlor)

- Tata Chemicals Ltd

- Tosoh Asia Pte Ltd

- Vynova Group

- Westlake Vinnolit GmbH & Co. KG

第7章 市場機會與未來趨勢

- 開發氯鹼的新用途

The Chlor-alkali Market size is estimated at 277.94 million tons in 2025, and is expected to reach 322.20 million tons by 2030, at a CAGR of greater than 3% during the forecast period (2025-2030).

The COVID-19 pandemic negatively affected the demand for chlor alkali across the world. During the pandemic, demand for chlor alkali products decreased in sectors such as construction, automotive, and manufacturing due to lockdowns, supply chain disruptions, and reduced economic activity. This decline in demand affected the consumption of chlorine for PVC production. However, as countries began to ease lockdown restrictions and reopen their economies, the demand for chlor alkali products rebounded. Industries that had experienced disruptions gradually resumed operations, leading to increased demand for chlorine and sodium hydroxide.

Key Highlights

- The major factors driving the market's growth are the surging demand in chemical manufacturing and the growing demand for polyvinyl chloride (PVC).

- However, the environmental impact and stringent environmental regulations are expected to hinder the chlor alkali market.

- The increasing investment in research and development and exploration of new applications of chlor alkali are expected to offer new growth opportunities to the industry.

- Asia-Pacific is likely to hold the largest market share due to the large-scale production and consumption of chlor alkali products and their derivatives.

Chlor Alkali Market Trends

The Organic Chemical Segment to Dominate the Market

- Chlorine, produced as a co-product in the electrolysis of brine during chlor alkali production, serves as a crucial feedstock in producing numerous organic chemicals. Chlorine is a versatile building block in organic synthesis, forming the basis for the production of chlorinated solvents, plastics, agrochemicals, pharmaceuticals, and other organic compounds.

- The largest consumer of chlorine is the plastics industry, particularly the production of polyvinyl chloride (PVC). PVC is widely used in construction materials, packaging, automotive parts, and various consumer goods. The demand for PVC drives significant consumption of chlorine, making the organic chemicals segment a major contributor to the chlor alkali market.

- Chlorine production and consumption continue to increase in its various end-user industries. According to Euro Chlor, by the end of December 2023, chlorine production in Europe climbed to 609,418 tonnes. On average, in December 2023, there was a decrease of 1.7% in daily production compared to November 2023 (which saw 19,659 tonnes) but an increase of 18.6% compared to December 2022 (with 16,573 tonnes).

- According to the data published by the Euro Chlor, Germany produced 5.4 million metric tons of chlorine in 2022, accounting for the country's largest chlorine production capacity.

- As per the BASF Report 2023, chemical manufacturing worldwide, not including the pharmaceutical industry, is anticipated to expand by 2.7% in 2024, a rate higher than the year before (2023: +1.7%). In China, which holds the top position in the global chemical market, a decrease in growth but still significant expansion of 4.0% compared to the robust growth in the year prior (2023: +7.5%) is anticipated.

- Thus, the factors mentioned above are expected to increase the demand for chlor alkali in the upcoming period.

Asia-Pacific to Dominate the Market

- Asia-Pacific is home to rapidly growing economies such as China, India, and Southeast Asia, which are experiencing robust industrial growth. This growth drives the demand for chlor alkali products in various industries, including construction, manufacturing, chemicals, and textiles.

- Asia-Pacific has a large manufacturing base, particularly in industries that are significant consumers of chlor alkali products such as PVC, textiles, and chemicals. The region's manufacturing sector accounts for a significant portion of global chlor alkali consumption.

- Additionally, as per China's State Council Information Office, the total profits of China's leading textile companies increased by 7.2% Y-o-Y in 2023. In the same year, China's exports of textiles and clothing reached USD 293.6 billion. The exports of textiles and clothing began to grow again in December 2023, showing a 2.6% increase from the previous year.

- Moreover, according to Invest India, India accounts for 4% of the worldwide textile and clothing trade. It is projected to reach USD 250 billion in textile manufacturing and USD 100 billion in exports by 2030.

- Furthermore, according to the data released by the National Bureau of Statistics of China, 6.98 million metric tons of plastic products were produced in December 2023 in China.

- Thus, the factors mentioned above are expected to increase the market demand for chlor alkali in Asia-Pacific.

Chlor-alkali Industry Overview

The chlor alkali market is partially fragmented. The major players in the market (not in any particular order) include Olin Corporation, Occidental Petroleum Corporation, Formosa Plastics Corporation, Dow, and Westlake Vinnolit GmbH & Co. KG.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Surging Demand in Chemical Manufacturing

- 4.1.2 Growing Demand for Polyvinyl Chloride (PVC)

- 4.2 Restraints

- 4.2.1 Environmental Impact and Stringent Environmental Regulations

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Import and Export Trends

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product

- 5.1.1 Caustic Soda

- 5.1.2 Chlorine

- 5.1.3 Soda Ash

- 5.2 Production Process

- 5.2.1 Membrane Cell

- 5.2.2 Diaphragm Cell

- 5.2.3 Other Production Processes

- 5.3 Application

- 5.3.1 Pulp and Paper

- 5.3.2 Organic Chemical

- 5.3.3 Inorganic Chemical

- 5.3.4 Soap and Detergent

- 5.3.5 Alumina

- 5.3.6 Textile

- 5.3.7 Other Applications (Food Industry)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Turkey

- 5.4.3.7 Russia

- 5.4.3.8 NORDIC

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Nigeria

- 5.4.5.4 Egypt

- 5.4.5.5 Qatar

- 5.4.5.6 UAE

- 5.4.5.7 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ANWIL SA (ORLEN SA)

- 6.4.2 BorsodChem (Wanhua)

- 6.4.3 Ciner Group

- 6.4.4 Covestro AG

- 6.4.5 Dow

- 6.4.6 Ercros SA

- 6.4.7 Formosa Plastics Corporation

- 6.4.8 Genesis Energy LP

- 6.4.9 Hanwha Solutions Chemical Division Corporation

- 6.4.10 INEOS

- 6.4.11 KEM ONE

- 6.4.12 Kemira

- 6.4.13 Micro Bio Ireland Limited

- 6.4.14 NIRMA

- 6.4.15 Nouryon (NOBIAN)

- 6.4.16 Occidental Petroleum Corporation

- 6.4.17 Olin Corporation

- 6.4.18 PCC SE

- 6.4.19 Shandong Haihua Group Co. Ltd

- 6.4.20 Solvay

- 6.4.21 Spolchemie (Euro Chlor)

- 6.4.22 Tata Chemicals Ltd

- 6.4.23 Tosoh Asia Pte Ltd

- 6.4.24 Vynova Group

- 6.4.25 Westlake Vinnolit GmbH & Co. KG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Exploring New Applications of Chlor Alkali