|

市場調查報告書

商品編碼

1689889

鉑金 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Platinum - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

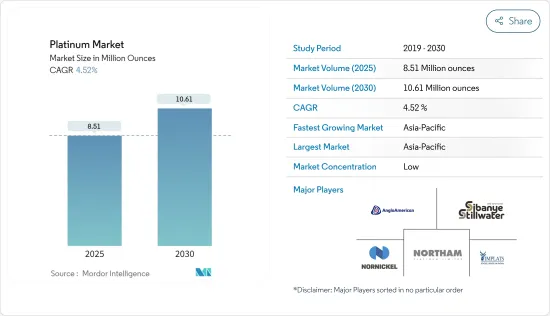

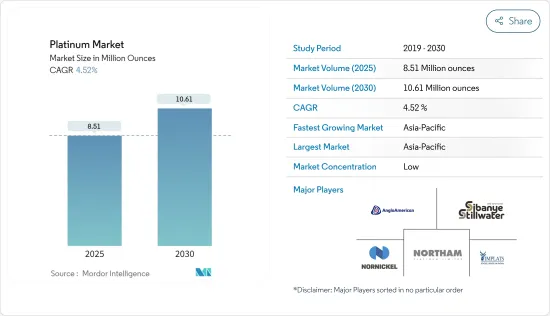

預計2025年鉑金市場規模為851萬盎司,預計2030年將達到1,061萬盎司,預測期間(2025-2030年)的複合年成長率為4.52%。

COVID-19 疫情導致全國範圍內停工、製造活動和供應鏈中斷以及全球生產停頓,所有這些都對 2020 年的市場產生了負面影響。然而,預計情況將在 2021-2022 年開始好轉,從而在預測期內推動市場成長。

主要亮點

- 從長遠來看,鉑金在工業應用中的使用增加將推動市場發展。

- 另一方面,產品價格上漲阻礙了市場成長。

- 電動車(EV)的普及正在推動對燃料電池的需求。這刺激了鉑金的需求,對預測期內的市場來說是個好兆頭。

- 由於排氣系統、電子產品和玻璃製造對鉑金的需求量大,亞太地區是全球最大的市場。

鉑金市場趨勢

汽車產業對排氣系統的需求不斷增加

- 鉑金是一種天然生產的稀有金屬,與其他鉑族金屬一起廣泛用作汽車觸媒轉換器系統中的催化劑。

- 排氣系統是汽車的重要組成部分,由排氣歧管、觸媒轉換器、氧氣感測器、消音器、排氣管組成。這些部件協同工作,以降低噪音並將引擎燃燒室中積聚的有害污染物轉化為危害較小的氣體,然後將其排放車外。

- 汽車廢氣是鉑金最大的應用領域。所有鉑金產量約 40% 的汽車產業消費。典型的柴油引擎廢氣中含有約 3-7 克鉑。具體價值取決於汽車的品牌和類型。

- 根據世界鉑金投資委員會(WPIC)2022年第二季報告,2022年第二季汽車業的鉑金需求為70.8萬盎司,略低於預期。造成這種情況的主要原因是半導體短缺、俄烏戰爭以及中國封鎖導致的產業供應鏈問題。

- 不過,WPIC 預測,由於內燃機汽車的增加,2022 年與前一年同期比較增 3%。

- 美國是僅次於中國的世界第二大汽車生產國。據 OICA 稱,2021 年汽車產量為 9,167,214 輛,較 2020 年的 8,822,399 輛成長 4%。美國全國汽車經銷商協會 (NADA) 預測,2022 年美國新車銷量將成長 3.4%,達到 1,550 萬輛。由於汽車越來越受歡迎且價格更實惠,預計汽車產量在不久的將來會增加。

- 預計上述因素將在預測期內推動購買鉑金的興趣增加。

亞太地區佔市場主導地位

- 由於中國、印度和日本等國家的需求不斷成長,預計亞太地區將在預測期內佔據市場主導地位。

- 根據世界黃金協會的調查,中國「Z世代」不喜歡黃金珠寶飾品,更傾向選擇鑽石和鉑金珠寶飾品。未來幾年,很大一部分人口可能會淪為這群人。因此,預計對鉑金首飾的需求將會增加,從而對所研究的市場產生影響。

- 隨著消費者越來越傾向於電池驅動的汽車,中國汽車產業正經歷趨勢轉變。此外,中國政府預測,到 2025 年,電動車普及率將達到 20%。因此,預計中國低摩擦塗層的消費量將會增加。

- 鉑金消費主要集中在汽車領域,特別是觸媒轉換器。印度是世界上最大的汽車市場之一。

- 印度玻璃產業的成長主要受建築業的推動。此外,印度是全球前15大玻璃包裝市場之一,也是繼土耳其和巴西之後成長速度第三快的市場。該國的大部分玻璃需求來自容器玻璃,佔該國玻璃消費量以金額為準的50%。

- 根據電子情報技術產業協會(JEITA)預測,截至2021年12月,包括電子設備、零件、裝置等在內的日本電子及IT產業的全球產值預計將達到2852.4億美元,與前一年同期比較8%;2022年工業產值預計將達到2905.6億美元,與前一年同期比較2%。

- 在預測期內,由於上述因素和政府支持,亞太地區的鉑金需求預計將增加。

鉑金產業概覽

全球鉑金市場格局趨於穩定,主要企業佔較大佔有率。市場上值得關注的公司包括(不分先後順序)英美鉑業有限公司、Impala Platinum Holdings Limited、Shivani 靜水、Northam Platinum Holdings Limited 和諾裡爾斯克鎳業。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 工業應用日益普及

- 汽車產業應用需求不斷成長

- 限制因素

- 產品價格上漲

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 應用

- 排氣系統

- 珠寶飾品

- 化學催化劑

- 玻璃製造

- 電子產品

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 世界其他地區

- 南美洲

- 中東和非洲

- 亞太地區

第6章競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Anglo American Platinum Limited

- Chimet Spa

- Heesung Pmtech

- Heraeus Holding

- Hindustan Platinum

- Impala Platinum Holdings Limited

- Johnson Matthey

- Nihon Material Co. Ltd.

- Norilsk Nickel

- Northam Platinum Holdings Limited

- Sibanye-stillwater

第7章 市場機會與未來趨勢

- 燃料電池的未來

The Platinum Market size is estimated at 8.51 million ounces in 2025, and is expected to reach 10.61 million ounces by 2030, at a CAGR of 4.52% during the forecast period (2025-2030).

The COVID-19 outbreak caused nationwide lockdowns around the world, disruptions in manufacturing activities and supply chains, and production halts, all of which had a negative impact on the market in 2020. However, conditions began to improve in 2021-2022, which is expected to boost market growth during the forecast period.

Key Highlights

- Over the long term, increasing usage of platinum in industrial applications will drive the market.

- On the flip side, the high product prices are hampering the growth of the market studied.

- Electric vehicles (EVs) are becoming more popular, which is driving up the demand for fuel cells. This, in turn, is driving up the demand for platinum, which is good for the market during the forecast period.

- Asia-Pacific was the biggest market in the world because of how much platinum was needed for exhaust systems, electronics, making glass, and other things.

Platinum Market Trends

Growing Demand for Exhaust Systems in Automobile Industry

- Platinum, a naturally occurring rare metal, is widely used in automobile catalytic converter systems as a catalyst in conjunction with other platinum group metals.

- Exhaust systems are an important segment of vehicles that are composed of an exhaust manifold, a catalytic converter, an oxygen sensor, a muffler, and exhaust pipes. Together, these parts reduce noise, turn harmful pollutants that build up in the engine's combustion chamber into less harmful gases, and give those gases a way to get out of the car.

- The automotive exhaust segment constitutes the largest application segment for platinum. Roughly 40% of the total platinum production volume is consumed by the automotive segment. Typically, a diesel automobile exhaust contains about 3-7 grams of platinum. The exact value may vary with the brand and type of vehicle.

- According to the World Platinum Investment Council's (WPIC) Quarterly Q2 2022 Report, the demand for platinum in the automotive sector was slightly lower than expected at 708 Koz during Q2 2022. This was mostly because of supply chain problems in the industry caused by a lack of semiconductors, the Russia-Ukraine war, and a lockdown in China.

- However, WPIC states that overall platinum demand will go up by 3% year over year in 2022 because more cars with internal combustion engines will be made.

- The United States is the second-largest automotive manufacturing country on the globe, falling only behind China. According to OICA, the automotive production in 2021 accounted for 9,167,214 units, an increase of 4% in comparison to the production in 2020, which was reported to be 8,822,399 units. The National Automobile Dealers Association (NADA) predicts that US new light-vehicle sales are likely to increase by 3.4% to 15.5 million units in 2022. The production of automobiles is anticipated to increase in the near future owing to their rising popularity and affordability.

- During the forecast period, the above factors are likely to make more people want to buy platinum.

Asia-Pacific to Dominate the Market

- Asia-Pacific is expected to dominate the market studied during the forecast period due to an increase in demand from countries like China, India, and Japan.

- As per a survey conducted by the World Gold Council, the Chinese "Gen-Z" dislike gold jewelry goods and tend to opt for diamond and platinum jewels. In the coming years, a large portion of the population will fall into this group. This will increase the demand for jewelry made with platinum, which will affect the market that was studied.

- The automobile industry in China is witnessing a switch in trends as consumer inclination toward battery-operated vehicles is on the rise. Moreover, the government of China estimates a 20% penetration rate of electric vehicle production by 2025. Hence, it is anticipated that this will increase the consumption of low-friction coatings in the country.

- The majority of platinum consumption is in the automotive sector, especially in catalytic converters. India has one of the largest automobile markets in the world.

- The Indian glass industry's growth has been driven primarily by the construction sector. Furthermore, India is one of the top 15 glass packaging markets in the world, and it is the third fastest-expanding market after Turkey and Brazil. Most of the glass demand in the country originates from container glass, which accounts for 50% of the country's glass consumption by value.

- The Japan Electronics and Information Technology Industries Association (JEITA) says that by December 2021, the global production of the Japanese electronics and IT industry, which includes electronic equipment, components, devices, and more, will have grown by 8% Y-o-Y to USD 285.24 billion, and the industrial production is expected to grow by 2% Y-o-Y to USD 290.56 billion in 2022.

- During the forecast period, the demand for platinum in Asia-Pacific is expected to rise due to the factors listed above and the help from the government.

Platinum Industry Overview

The global platinum market is consolidated, with top players accounting for a major share of the market. Some of the companies in the market that were looked at were Anglo American Platinum Limited, Impala Platinum Holdings Limited, Sibanye-Stillwater, Northam Platinum Holdings Limited, and Norilsk Nickel, among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Usage in the Industrial Applications

- 4.1.2 Growing Demand for Applications in the Automotive Industry

- 4.2 Restraints

- 4.2.1 High Product Prices

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Exhaust Systems

- 5.1.2 Jewelry

- 5.1.3 Chemical Catalysts

- 5.1.4 Glass Production

- 5.1.5 Electronics

- 5.1.6 Other Applications

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Rest of Europe

- 5.2.4 Rest Of The World

- 5.2.4.1 South America

- 5.2.4.2 Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Anglo American Platinum Limited

- 6.4.2 Chimet Spa

- 6.4.3 Heesung Pmtech

- 6.4.4 Heraeus Holding

- 6.4.5 Hindustan Platinum

- 6.4.6 Impala Platinum Holdings Limited

- 6.4.7 Johnson Matthey

- 6.4.8 Nihon Material Co. Ltd.

- 6.4.9 Norilsk Nickel

- 6.4.10 Northam Platinum Holdings Limited

- 6.4.11 Sibanye-stillwater

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Future Of Fuel Cells