|

市場調查報告書

商品編碼

1910459

鉑族金屬:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Platinum Group Metals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

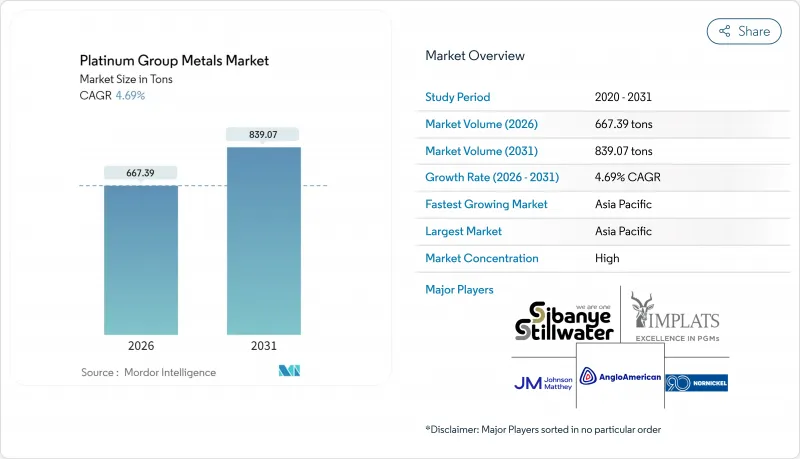

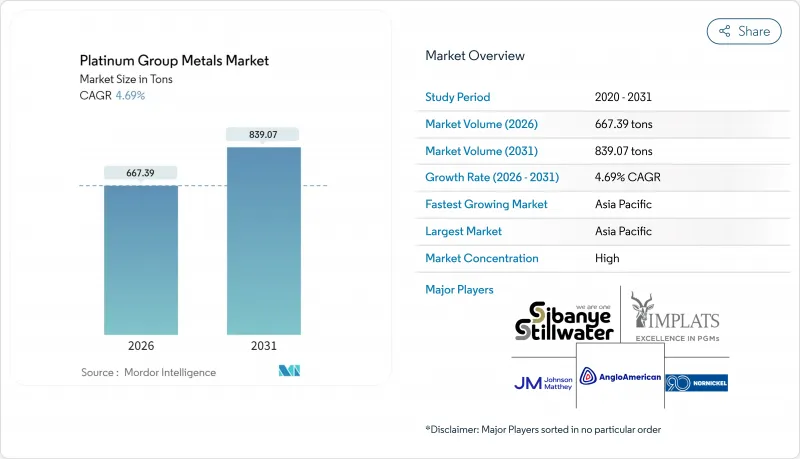

2025 年鉑族金屬市場價值為 637.51 噸,預計從 2026 年的 667.39 噸成長到 2031 年的 839.07 噸,在預測期(2026-2031 年)內,預計複合年成長率為 4.69%。

鉑族金屬市場受惠於兩大需求來源:一是汽油和混合動力汽車對汽車觸媒的持續需求,二是質子交換膜(PEM)氫氣生產技術的快速發展。催化劑中鈀金向鉑金的轉變提振了短期市場情緒,而長期機會則來自綠色氫能的擴張,預計到2025年,綠色氫能將使PEM電解中鉑金的年需求量加倍。銥供應緊張、亞洲珠寶飾品強勁以及鉑族金屬在先進電子產品中應用日益廣泛,這些因素共同支撐了鉑族金屬價格。然而,價格持續波動以及南非不斷上漲的生產成本阻礙了長期供應協議的簽署,尤其是與燃料電池原始設備製造商(OEM)的協議。

全球鉑系元素市場趨勢與洞察

汽車產業對觸媒轉換器的需求不斷成長

2024年,乘用車、混合動力汽車合計佔鉑族金屬總消費量的60%。更嚴格的歐7和國六b排放標準推動了單車鉑族金屬用量的增加,抵消了汽油產量下降的影響。混合動力汽車催化劑中鉑族金屬含量尤其高,預計2025年汽車催化劑對鉑的需求量將達到八年來的最高水平,為324萬盎司。重型車輛需要更高濃度的鉑族金屬,這形成了一個盈利的細分市場,且受乘用車需求放緩的影響較小。亞洲市場的規模,加上政府對清潔引擎的支持,使得鉑族金屬市場高度依賴汽車需求。

北美PEM電解的擴張

預計到2030年,與氫氣相關的鉑金需求將達到87.5萬盎司(約佔鉑金總用量的10%),並在2025年再次翻倍。加拿大的清潔氫能稅額扣抵(40%)和美國的《通貨膨脹控制法案》正在推動數吉瓦級電解槽的訂單。銥供不應求是限制因素,預計2024年的產量僅7.7噸。諸如Smoltec公司的奈米塗層技術等技術突破對於擴大供應至關重要,該技術可將PEM電池中銥的使用量減少95%。這些進展為鉑族金屬市場的長期成長奠定了堅實的基礎。

生產成本上升

南非的電力限制和勞工動盪推高了採礦成本。英美資源集團鉑金公司2024年的單位成本為每盎司6E鉑金20,922蘭特,較上年上漲5%。深層礦床需要先進的冷卻技術和礦脈穩定措施,這增加了固定成本。在價格低迷時期,輪流開採的鉑族金屬生產商往往只能勉強維持收支平衡甚至虧損,降低了其擴張所需的資本能力。這些動態增加了鉑族金屬供應安全的下行風險,並限制了鉑族金屬市場的長期合約。

細分市場分析

2025年,鈀金在鉑族金屬(PGM)市場中佔比46.55%,汽油催化劑的持續需求推動了其消費。銥金主要用於PEM電解槽陽極,預計到2031年將以8.92%的複合年成長率成長,在所有鉑族金屬中增速最高。供應緊張和技術依賴性將維持銥金的溢價,使其在未來幾年對鉑族金屬市場的貢獻更大。鉑金的復甦主要受汽油催化劑替代需求的推動,光是2023年就有超過60萬盎司的需求轉移。銠金由於替代品有限,價格將保持高位,而釕和鋨在小眾化學和數據存儲應用領域的需求不斷成長,從而實現了收入來源的多元化。

PEM系統和先進記憶體的持續成長正推動銥和釕從特殊應用領域走向主流應用。預計2024年銠的平均價格將達到每盎司5,375美元,這表明供應將受到限制。鉑供應量的成長和現有的替代需求維持了強勁的需求,並穩定了鉑族金屬市場。技術廢棄物(例如硬碟)回收率的提高提高了釕的供應安全性,緩解了價格壓力,同時增強了其對循環經濟的貢獻,而循環經濟正是電子產品製造商的優先事項。

到2025年,珠寶飾品業仍將佔鉑族金屬消費量的28.75%,鞏固其作為最大應用領域的地位,尤其是在中國、日本和印度。儘管宏觀經濟疲軟,但低調的奢侈品消費趨勢和鉑金的投資吸引力支撐著潛在需求。同時,燃料電池產業正以28.47%的複合年成長率快速成長,這得益於多吉瓦級電解計劃和固定式發電專案的推動。因此,預計到2031年,燃料電池堆用鉑族金屬的市場規模將快速擴張。

隨著排放標準的日益嚴格,汽車催化劑仍然至關重要。隨著半導體製程節點縮小至3奈米及以下,電子應用領域持續成長。玻璃纖維製造和顏料應用充分利用了鉑金的高熔點,而醫療設備產業則強調其在導管和支架製造方面的生物相容性。化學製程催化劑,尤其是在煉油廠的硝酸生產和加氫裂解製程中,鉑族金屬(PGM)的消費量持續保持穩定且龐大,從而提供了多元化且經濟均衡的應用基礎。

鉑系元素報告按金屬類型(鉑、鈀、銠等)、應用領域(汽車催化劑、電氣和電子設備等)、來源(原生(採礦)、回收/再生)、終端用戶行業(汽車、工業化學品等)以及地區(亞太、北美、歐洲、南美、中東和非洲)進行細分。市場預測以噸為單位。

區域分析

預計到2025年,亞洲將佔據鉑族金屬市場51.60%的主導地位,這主要得益於中國作為全球最大的鈀金(用於汽車催化劑)和鉑金(用於珠寶飾品)消費國的地位。隨著北京尋求提升國內定價權,廣州期貨交易所已上市鉑金和鈀金期貨合約,從而增強了市場流動性,並鼓勵工業用戶對沖其長期頭寸(日經亞洲)。日本珠寶飾品需求的復甦以及印度婚禮帶動的飾品需求正在提振區域需求,而台灣和韓國的電子產業叢集則支撐著工業消費。

在歐洲,德國和英國更嚴格的排放法規導致鉑族金屬(PGM)消費量顯著增加,催化劑用量也隨之提高。即將實施的歐7排放標準預計將進一步增加乘用車和重型車輛的鉑族金屬用量,而向電動車的轉型則使供需平衡變得更加複雜。歐洲在鉑族金屬回收領域也處於領先地位。莊信萬豐(Johnson Matthey)和優美科(Umicore)經營先進的設施,在回收汽車催化劑金屬的同時最大限度地減少排放,從而支持循環經濟的目標,並有助於穩定鉑族金屬市場。

在氫能政策和汽油動力汽車持續銷售的推動下,北美正在崛起為成長中心。加拿大是世界第三大鈀金生產國和第四大鉑金生產國,預計2022年將開採71萬盎司鉑金,主要產自安大略省。渥太華的清潔氫能稅收優惠政策正在刺激電解計劃,進一步提振該地區對鉑金和銥的需求。美國《通膨控制法案》將透過資助氫能中心建設來鞏固這一趨勢,從而鞏固鉑族金屬市場的長期前景。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 汽車產業對觸媒轉換器的需求不斷成長

- 北美PEM電解的擴張推動了鉑金需求。

- 電子業對鉑、鈀和釕的需求不斷成長

- 鈀金替代鉑金催化劑將推動對這種雙金屬催化劑的需求。

- 亞太地區國家珠寶飾品消費成長

- 市場限制

- 高成本

- 價格波動阻礙燃料電池原始設備製造商的長期承保

- 回收競賽

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 按金屬類型

- 鉑

- 鈀

- 銠

- 銥

- 釕

- 鋇

- 透過使用

- 汽車觸媒

- 電氣和電子設備

- 燃料電池

- 玻璃、陶瓷、顏料

- 珠寶飾品

- 醫療(牙科和製藥)

- 化工

- 其他(航太、感測器、水處理、法醫學)

- 按來源

- 初級(採礦)

- 繁殖/次要

- 按最終用途行業分類

- 車

- 工業化學品

- 可再生能源和氫能

- 電子和半導體

- 珠寶飾品和奢侈品

- 醫療設備

- 玻璃製造

- 煉油

- 其他

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- ASEAN

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- African Rainbow Minerals Limited

- Anglo American plc

- BASF SE

- DOWA Holdings Co., Ltd

- Glencore

- Heraeus Group

- Impala Platinum Holdings Ltd

- Ivanhoe Mines

- Jinchuan Group International Resources Co. Ltd

- Johnson Matthey

- Norilsk Nickel

- Northam Platinum Holdings Limited

- Platinum Group Metals Ltd

- Sibanye-Stillwater Limited

- TANAKA PRECIOUS METAL GROUP Co., Ltd.

- Umicore

- Vale

第7章 市場機會與未來展望

The Platinum Group Metals Market was valued at 637.51 tons in 2025 and estimated to grow from 667.39 tons in 2026 to reach 839.07 tons by 2031, at a CAGR of 4.69% during the forecast period (2026-2031).

The Platinum group metals market benefits from a dual-track demand profile: sustained autocatalyst requirements in gasoline and hybrid vehicles and fast-accelerating adoption in proton-exchange-membrane (PEM) hydrogen technologies. The ongoing palladium-for-platinum shift in catalysts buoys short-term sentiment, while longer-term opportunity stems from green-hydrogen build-outs expected to double platinum demand for PEM electrolysers year-on-year through 2025. Iridium supply constraints, jewelry's resilience in Asia, and increasing PGM intensity in advanced electronics collectively support price fundamentals. Simultaneously, persistent price volatility and rising South African production costs inhibit long-dated offtake contracts, especially for fuel-cell OEMs.

Global Platinum Group Metals Market Trends and Insights

Growing Demand for Catalytic Converters from the Automotive Sector

Passenger cars, hybrids, and heavy-duty trucks together consumed 60% of all PGMs in 2024. Stricter Euro 7 and China VI-b standards raise PGM loadings per vehicle, offsetting lower gasoline production volumes. Hybrid-vehicle catalysts are especially PGM-dense, pushing projected platinum autocatalyst demand to an eight-year high of 3.24 million oz in 2025. Heavy-duty vehicles require even higher PGM doses, creating a profitable niche that shields producers from passenger-car headwinds. Asia's scale, coupled with government incentives for cleaner engines, keeps the Platinum group metals market firmly reliant on automotive offtake.

PEM Electrolyser Build-out in North America

Platinum demand linked to hydrogen is expected to double again in 2025, after reaching 875 koz by 2030, roughly 10% of total platinum use. Canada's 40% clean-hydrogen tax credit and the United States' Inflation Reduction Act underpin multi-gigawatt electrolyser orders. Iridium scarcity is an obstacle: 2024 production barely reached 7.7 tons. Technology breakthroughs, such as Smoltek's nanoscale coatings that reduce iridium loading in PEM cells by 95%, are vital for scaling supply. These developments solidify a long-run growth platform for the Platinum group metals market.

High Production Costs

Electricity load shedding and labor unrest in South Africa elevated mining costs: Anglo American Platinum's unit cost rose 5% to ZAR 20,922 per 6E oz in 2024. Deep-level deposits require advanced refrigeration and reef stabilization, elevating the fixed-cost base. During price troughs, swing producers operate at breakeven or losses, reducing capital capacity for expansion. These dynamics add downside risk to supply stability and limit long-term contracts for the Platinum group metals market.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Electronics Demand

- Palladium-for-Platinum Substitution

- Price Volatility Deterring Long-Term Off-Take

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Palladium captured 46.55% of the Platinum group metals market in 2025 as gasoline catalysts continued to dominate consumption. Iridium, used chiefly in PEM electrolyser anodes, is projected to grow at a 8.92% CAGR through 2031, the fastest among all PGMs. Tight supply and technological reliance sustain iridium's price premium, magnifying its contribution to the Platinum group metals market size in later years. Platinum's renaissance stems from its substitution into gasoline catalysts; over 600 koz converted demand in 2023 alone. Rhodium's limited substitutes command high pricing, while ruthenium and osmium gain traction in niche chemical and data-storage applications, diversifying revenue streams.

Persistent load-growth in PEM systems and advanced memory drives iridium and ruthenium from specialty to mainstream status. Prices for rhodium averaged USD 5,375 /oz in 2024, indicative of constrained supply. Platinum's wider availability and ongoing substitution lock-in robust demand, stabilizing the Platinum group metals market. Recycling yields of technological scraps such as disk drives improve ruthenium supply security, tempering upward price pressure but reinforcing circular-economy credentials prized by electronics firms.

Jewelry retained 28.75% of PGM consumption in 2025, cementing its status as the largest application, especially across China, Japan, and India. Quiet-luxury trends and platinum's investment appeal sustain baseline volumes despite macroeconomic softness. The fuel-cell segment, however, is racing ahead with a 28.47% CAGR, supported by multi-gigawatt electrolyser initiatives and stationary power programs. The Platinum group metals market size allocated to fuel-cell stacks is thus expected to expand rapidly through 2031.

Autocatalysts remain indispensable as lawmakers raise emission-control thresholds. Electronics applications keep climbing as semiconductor nodes shrink below 3 nm. Glass fibre production and pigment uses leverage platinum's high melting point, while medical devices rely on its biocompatibility for catheters and stents. Chemical-process catalysts, notably in nitric-acid and refinery hydrocracking, continue to consume sizable but steady PGM volumes, offering a diversified application base that hedges cyclical swings.

The Platinum Group Metals Report is Segmented by Metal Type (Platinum, Palladium, Rhodium, and More), Application (Auto Catalysts, Electrical and Electronics, and More), Source (Primary (Mined), Recycled/Secondary), End-Use Industry (Automotive, Industrial Chemicals, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Volume (tons).

Geography Analysis

Asia held a commanding 51.60% share of the Platinum group metals market in 2025, underpinned by China's status as the largest consumer of palladium for autocatalysts and platinum for jewelry. Beijing's pursuit of domestic pricing power led the Guangzhou Futures Exchange to list platinum and palladium contracts, deepening liquidity and encouraging industrial users to hedge long-term positions Nikkei Asia. Japan's jewelry rebound and India's wedding-driven ornament demand strengthen regional pull, while the region's electronics clusters in Taiwan and South Korea reinforce industrial consumption.

Europe, driven by stringent emissions mandates in Germany and the United Kingdom, has experienced significant growth in consumption, leading to heightened catalyst loadings. The forthcoming Euro 7 framework stimulates additional PGM intensity in both passenger and heavy-duty platforms, although the electric-vehicle transition creates a complex demand balance. Europe also champions PGM recycling: Johnson Matthey and Umicore run state-of-the-art facilities that recover autocatalyst metals with minimal emissions, supporting circular-economy targets and stabilizing the Platinum group metals market.

North America is emerging as a growth pole thanks to hydrogen policies and sustained gasoline vehicle sales. Canada is the world's third-largest palladium and fourth-largest platinum producer, with 710,000 oz mined in 2022, chiefly in Ontario Natural Resources Canada. Ottawa's clean-hydrogen tax incentive accelerates electrolyser projects, channelling additional platinum and iridium demand into the region. The United States' Inflation Reduction Act amplifies this trajectory by funding hydrogen hubs, reinforcing long-run prospects for the Platinum group metals market.

- African Rainbow Minerals Limited

- Anglo American plc

- BASF SE

- DOWA Holdings Co., Ltd

- Glencore

- Heraeus Group

- Impala Platinum Holdings Ltd

- Ivanhoe Mines

- Jinchuan Group International Resources Co. Ltd

- Johnson Matthey

- Norilsk Nickel

- Northam Platinum Holdings Limited

- Platinum Group Metals Ltd

- Sibanye-Stillwater Limited

- TANAKA PRECIOUS METAL GROUP Co., Ltd.

- Umicore

- Vale

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand for Catalytic Converters from the Automotive Industry

- 4.2.2 PEM Electrolyser Build-out in North America Accelerating Platinum Demand

- 4.2.3 Increasing Demand for Platinum, Palladium, and Ruthenium from the Electronics Industry

- 4.2.4 Palladium-for-Platinum Catalyst Substitution Creating Dual-Metal Upswing

- 4.2.5 Growing Jewelry Consumption in Asia-Pacific Countries

- 4.3 Market Restraints

- 4.3.1 High Costs Involved in Production and Maintenance

- 4.3.2 Price Volatility Deterring Long-Term Off-Take by Fuel-Cell OEMs

- 4.3.3 Recycling Competition

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Metal Type

- 5.1.1 Platinum

- 5.1.2 Palladium

- 5.1.3 Rhodium

- 5.1.4 Iridium

- 5.1.5 Ruthenium

- 5.1.6 Osmium

- 5.2 By Application

- 5.2.1 Auto Catalysts

- 5.2.2 Electrical and Electronics

- 5.2.3 Fuel Cells

- 5.2.4 Glass, Ceramics and Pigments

- 5.2.5 Jewellery

- 5.2.6 Medical (Dental and Pharma)

- 5.2.7 Chemical Industry

- 5.2.8 Other (Aerospace, Sensors, Water, Forensics)

- 5.3 By Source

- 5.3.1 Primary (Mined)

- 5.3.2 Recycled/Secondary

- 5.4 By End-Use Industry

- 5.4.1 Automotive

- 5.4.2 Industrial Chemicals

- 5.4.3 Renewable Energy and Hydrogen

- 5.4.4 Electronics and Semiconductors

- 5.4.5 Jewellery and Luxury Goods

- 5.4.6 Healthcare Devices

- 5.4.7 Glass Manufacturing

- 5.4.8 Petroleum Refining

- 5.4.9 Others

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN

- 5.5.1.6 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 African Rainbow Minerals Limited

- 6.4.2 Anglo American plc

- 6.4.3 BASF SE

- 6.4.4 DOWA Holdings Co., Ltd

- 6.4.5 Glencore

- 6.4.6 Heraeus Group

- 6.4.7 Impala Platinum Holdings Ltd

- 6.4.8 Ivanhoe Mines

- 6.4.9 Jinchuan Group International Resources Co. Ltd

- 6.4.10 Johnson Matthey

- 6.4.11 Norilsk Nickel

- 6.4.12 Northam Platinum Holdings Limited

- 6.4.13 Platinum Group Metals Ltd

- 6.4.14 Sibanye-Stillwater Limited

- 6.4.15 TANAKA PRECIOUS METAL GROUP Co., Ltd.

- 6.4.16 Umicore

- 6.4.17 Vale

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Usage of Platinum in Green Technology