|

市場調查報告書

商品編碼

1689877

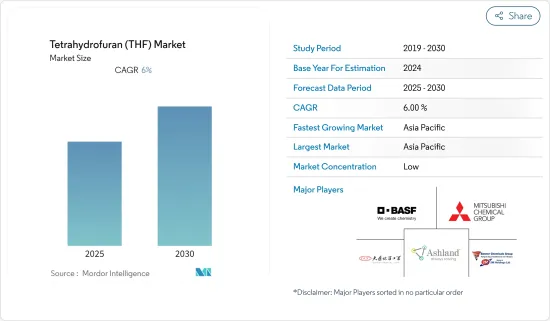

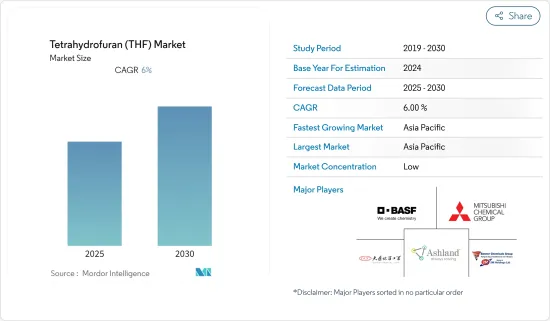

四氫呋喃(THF) -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030)Tetrahydrofuran (THF) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

預計四氫呋喃市場在預測期內的複合年成長率將達到 6%。

主要亮點

- 2020 年,COVID-19 對市場產生了負面影響。與冠狀病毒相關的大規模隔離對聚合物、紡織品、油漆和塗料行業產生了不利影響。在此期間,只有製藥業務受到了有利影響。儘管如此,THF 市場最近開始成長,預計在預測期內將繼續保持相同的軌跡。

- 從中期來看,紡織業對氨綸的需求增加以及聚氯乙烯生產需求的上升是推動市場發展的關鍵因素。另一方面,相近替代品的可用性和 THF 的危險特性(高度易燃和重大健康危害)阻礙了市場擴張。

- 生物基 THF 的最新技術進步可能會為所研究的市場帶來機會。預計亞太地區將在全球整體市場佔據主導地位,其中消費量最高的國家是中國、印度和日本。

四氫呋喃市場趨勢

油漆和塗料行業需求增加

- 四氫呋喃 (THF) 因其獨特的性能在油漆和塗料行業有廣泛的用途。例如黏合劑、特殊油漆和被覆劑、纖維的製備、某些活性物質的萃取和某些化合物的結晶。

- 它們提供均勻的構建厚度,快速乾燥,產生具有高固態和實際工作黏度的溶液,並提供良好的黏度和流變性控制。

- 根據世界油漆和塗料工業協會(WPCIA)的數據,2022年全球油漆和塗料銷售額約為1800億美元。到2027年,油漆和塗料行業的複合年成長率預計將達到3%左右。根據該協會的年度報告,預計2022年北美市場價值將達到339.2億美元,而歐洲市場價值預計將達到423.7億美元。這些地區的成長是由加拿大、德國和美國國內裝修計劃的增加所推動的。

- 許多行業對油漆和被覆劑的消耗正在迅速增加。油漆和被覆劑廣泛應用於汽車、建築和製造業。例如,全球建築市場規模將從 2019 年的 6.6 兆美元成長到 2022 年的 8.4 兆美元。同樣,全球運輸製造市場規模將從 2019 年的 6 兆美元成長到 2022 年的 7.8 兆美元。

- 裝飾性油漆和塗料廣泛應用於建築業,而防護性油漆和塗料與汽車、大型家電和工業設備行業密切相關。因此,預計預測期內終端用戶行業的成長將推動油漆和塗料市場的發展。

- 由於這些因素,各行業的投資增加將增加全球對油漆和被覆劑的需求,進而對四氫呋喃市場產生正面影響。

亞太地區佔市場主導地位

- 由於中國、印度和日本等國家的需求不斷成長,預計預測期內亞太地區將主導四氫呋喃市場。工業和基礎設施建設的興起,尤其是中國、印度和新興國家等開發中國家和基礎設施建設,預計將推動未來對油漆和塗料的需求。

- 2022 年,亞太地區油漆和塗料產業價值為 630 億美元。中國目前在該地區市場佔據主導地位,年複合成長率(CAGR)為 5.8%。 2022年中國市場成長率為5.7%。依照目前的趨勢,2022年中國油漆塗料總銷售額將超過450億美元,在東亞地區佔有最大的市場佔有率,達到78%。

- 四氫呋喃在製藥業中用於生產止咳血清、利福黴素、黃體素和其他荷爾蒙藥物,以及作為格氏合成過程中的反應介質。印度的製藥業佔全球供應量的20%,產量位居全球第三。四氫呋喃市場可能會受到需求成長和製藥業務擴張的推動。

- 根據服務於醫療資訊科技和臨床研究綜合體的美國跨國公司 IQVIA 估計,中國是全球第二大醫藥消費國,預計未來五年中國醫藥銷售量8%,而醫藥支出將增加 19%。

- 印度政府預計,到2030年,印度醫藥市場規模將達到1,300億美元。此外,印度目前向200多個國家供應藥品,未來很可能還會繼續這樣做。截至2021年,該國是全球最大的疫苗生產國,佔疫苗總產量的60%,也是全球第三大藥品製造國。

- 在印度,人均收入的增加、有利的人口結構以及對品牌產品的偏好的轉變正在推動對紡織業的需求,從而促進所研究的市場的發展。根據印度品牌股權基金會(IBEF)估計,到 2025 年,印度紡織業的產值將達到 2,200 億美元左右。

- 除上述因素外,政府支持以及全球投資和擴張正在推動亞太地區對四氫呋喃的需求不斷成長。

四氫呋喃行業概況

全球四氫呋喃市場部分分散,主要參與者僅佔有一小部分佔有率。主要公司包括 Ashland、 BASF SE、三菱化學、DCC 和 Banner Chemicals。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 紡織業對氨綸的需求不斷增加

- PVC生產需求不斷成長

- 限制因素

- 相近替代品的可用性

- THF 的危險性(高度易燃、危害健康)

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 應用

- 聚四亞甲基醚二醇(PTMEG)

- 溶劑

- 其他用途

- 最終用戶產業

- 聚合物

- 纖維

- 製藥

- 油漆和塗料

- 其他最終用戶產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Ashland

- Banner Chemicals Limited

- BASF SE

- BHAGWATI CHEMICALS

- DCC

- Hefei TNJ Chemical Industry Co.,Ltd.

- Henan GP Chemicals Co., Ltd

- Mitsubishi Chemical Corporation

- NASIT PHARMACHEM

- REE ATHARVA LIFESCIENCE PVT. LTD

- Riddhi Siddhi Industries

- Shenyang East Chemical Science-Tech Co., Ltd.

- Sipchem Company

第7章 市場機會與未來趨勢

- 生物基四氫呋喃(THF)開發的創新

- 其他機會

簡介目錄

Product Code: 69066

The Tetrahydrofuran Market is expected to register a CAGR of 6% during the forecast period.

Key Highlights

- COVID-19 negatively impacted the market in 2020. The coronavirus-related mass quarantines negatively affected the polymer, textile, paints, and coatings industries. The pharmaceutical business was the only one to have a beneficial impact during that time. Nonetheless, the THF market has started to grow in the recent past and is predicted to expand with the same trajectory over the forecast years.

- In the medium term, growing demand for spandex from the textile industry and increasing demand for polyvinyl chloride manufacturing are the major factors driving the market. On the other hand, the availability of close replacements and THF's hazardous characteristics (very flammable and health hazards) are impeding the market's expansion.

- The recent innovations in bio-based THF will likely act as an opportunity for the market studied. The Asia-Pacific region is expected to dominate the market across the world, with the largest consumption from countries such as China, India, and Japan.

Tetrahydrofuran Market Trends

Increasing Demand from the Paints and Coatings Industry

- Tetrahydrofuran (THF) serves a variety of purposes in the paints and coatings industry due to its unique properties. It is commonly used as a solvent, reaction medium, and starting material for various syntheses in the chemical industry, for example, for preparing adhesives, special paints, coatings, and fibers, and in the extraction of specific active substances, for the recrystallization of certain compounds.

- It provides uniform coating thickness and rapid drying, forms a solution with high solids and practical working viscosities, and provides good viscosity and rheology control, which in turn helps reduce smearing.

- According to Worlds Paint and Coatings Industry Association (WPCIA), global sales of paints and coatings were around USD 180 billion in 2022. By 2027, the paints and coatings industry is predicted to have a compound annual growth rate (CAGR) of around 3%. The annual report by the association also stated that in 2022, the North American market was worth USD 33.92 billion, while the European market was worth USD 42.37 billion. The expansion of these individual regions is ascribed to an uptick in domestic remodeling projects in Canada, Germany, and the United States.

- There is a rapid growth in the consumption of paints and coatings in many industries. Paints and coatings are widely used in the automotive, construction, and manufacturing industries. For instance, the global buildings construction market increased from USD 6.6 trillion in 2019 to USD 8.4 trillion in 2022. Similarly, the global transportation manufacturing market is increased from USD 6 trillion in 2019 to USD 7.8 trillion in 2022.

- Decorative paints and coatings are widely used in buildings and construction whereas protective paints and coatings are linked closely to the automotive, major appliance, and industrial equipment industries. Therefore, growth in end-user industries is expected to drive the paints and coatings market during the forecast period..

- Owing to all these factors, the rising investments in different industries will increase the demand for paints and coatings from all around the world and thus positively influence the market of tetrahydrofuran

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to dominate the market for tetrahydrofuran during the forecast period due to an increase in demand from countries like China, India, and Japan. The future demand for paints and coatings is expected to be driven by rising industrial and infrastructure construction in developing countries, particularly China, India, and ASEAN countries.

- In 2022, the Asia-Pacific paints and coatings industry was worth USD 63 billion. China now dominates the region's market, which is growing at a compound annual growth rate (CAGR) of 5.8%. In 2022, the Chinese market grew by 5.7%. According to current trends, China's total paints and coatings sales exceeded USD 45 billion in 2022. In East Asia, the country had the largest market share at 78%.

- Tetrahydrofuran is used in the pharmaceutical industry to make cough serum, rifamycin, progesterone, and other hormone medicines, as well as a reaction medium in the Grignard synthesis process. India's pharmaceutical business accounts for 20% of global supply by volume and ranks third in terms of production volume. The market for tetrahydrofuran is likely to be driven by rising demand and the expansion of pharmaceutical businesses.

- According to the estimations by IQVIA, a US multinational company serving the combined industries of health information technology and clinical research, China, the world's second-largest pharmaceutical spending country, will increase the volume of the segment by 8% over five years while spending will increase by 19%, a slower rate than in previous years but still at a focus on extending access to innovative drugs.

- According to the Government of India, the Indian pharmaceutical sector market will be worth USD 130 billion by 2030. Furthermore, India has supplied pharmaceutical products to over 200 countries and will continue to do so in the future. As of 2021, the country was the world's largest producer of vaccines, accounting for 60% of overall vaccine production, and ranked third in pharmaceutical manufacturing by volume.

- In India, the rising per capita income, favorable demographics, and a shift in preference for branded products boost the demand for the textile industry, thus, boosting the market studied. According to the India Brand Equity Foundation (IBEF), the textile industry in India is estimated to reach about USD 220 billion by 2025.

- The aforementioned causes, together with government backing and global investments and expansions in the region, are driving growing demand for tetrahydrofuran in Asia-Pacific.

Tetrahydrofuran Industry Overview

The global tetrahydrofuran market is partially fragmented, with major players accounting for a marginal share of the market. A few companies include Ashland, BASF SE, Mitsubishi Chemical Corporation, DCC, and Banner Chemicals Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for Spandex from the Textile Industry

- 4.1.2 Increasing Demand for PVC Manufacturing

- 4.2 Restraints

- 4.2.1 Availability of Close Substitutes

- 4.2.2 Hazardous Nature (Highly Flammable and Health Hazard) of THF

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Application

- 5.1.1 Polytetramethylene Ether Glycol (PTMEG)

- 5.1.2 Solvent

- 5.1.3 Other Applications

- 5.2 End-User Industry

- 5.2.1 Polymer

- 5.2.2 Textile

- 5.2.3 Pharmaceutical

- 5.2.4 Paints and Coatings

- 5.2.5 Other End-User Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) **/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Ashland

- 6.4.2 Banner Chemicals Limited

- 6.4.3 BASF SE

- 6.4.4 BHAGWATI CHEMICALS

- 6.4.5 DCC

- 6.4.6 Hefei TNJ Chemical Industry Co.,Ltd.

- 6.4.7 Henan GP Chemicals Co., Ltd

- 6.4.8 Mitsubishi Chemical Corporation

- 6.4.9 NASIT PHARMACHEM

- 6.4.10 REE ATHARVA LIFESCIENCE PVT. LTD

- 6.4.11 Riddhi Siddhi Industries

- 6.4.12 Shenyang East Chemical Science-Tech Co., Ltd.

- 6.4.13 Sipchem Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovations in Development of Bio-based Tetrahydrofuran (THF)

- 7.2 Other Opportunities

02-2729-4219

+886-2-2729-4219