|

市場調查報告書

商品編碼

1689873

熱塑性澱粉(TPS) -市場佔有率分析、產業趨勢和成長預測(2025-2030)Thermoplastic Starch (TPS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

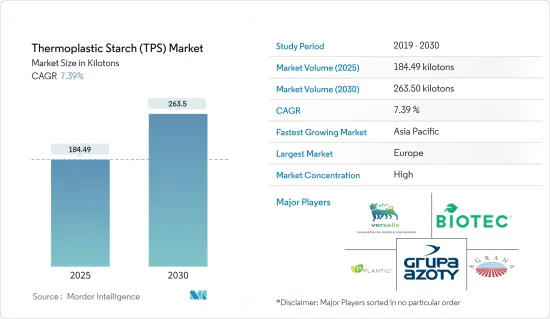

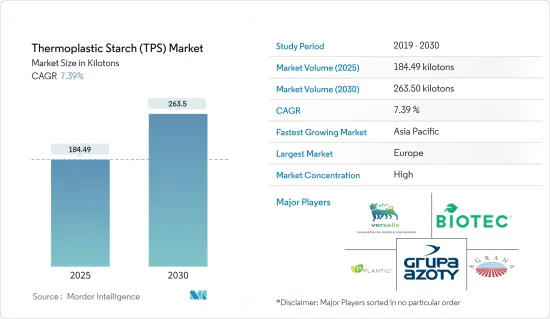

熱塑性澱粉市場規模預計在 2025 年為 184.49 千噸,預計在 2030 年達到 263.50 千噸,預測期內(2025-2030 年)的複合年成長率為 7.39%。

主要亮點

- 短期內,包裝產業不斷成長的需求和政府推廣生質塑膠的有利政策預計將推動所研究市場的成長。

- 然而,與熱塑性澱粉(TPS)相關的一些技術限制可能會阻礙市場成長。

- 在預測期內,熱塑性澱粉性能改善方面的技術進步和創新可能為所研究的市場帶來有利的機會。

- 預計歐洲將成為熱塑性澱粉的最大市場,而亞太地區預計將在 2024 年至 2029 年間實現最高的複合年成長率。

熱塑性澱粉(TPS)市場趨勢

電影領域佔據市場主導地位

- 熱塑性澱粉薄膜顯然利用了自然資源,因此有助於減少環境污染。熱塑性澱粉薄膜具有許多優點,包括生物分解性、成本低、易於加工和可再生潛力。澱粉膜是一種很有前景的商業保鮮膜,可以延長食品的保存期限。

- TPS 薄膜的水蒸氣阻隔性較差,氣體滲透性低,無法承受包裝過程中產生的應變。熱塑性澱粉擴大被用作塑膠薄膜的填料,以提高生物分解性,擴大其在包裝領域的應用。

- 熱塑性澱粉(TPS)是一種澱粉衍生物,被廣泛認為是包裝行業最適合的合成聚合物替代品。

- 作為一種永續包裝材料,水解玉米粉薄膜與其他傳統石油基塑膠相比具有多種優勢,包括生物分解性、再生性和減少對環境的影響。

- 許多公司正在選擇永續的包裝材料。例如,總部位於美國的全球配料解決方案公司 Ingredion 提供脆皮薄膜,一種高直鏈澱粉、白色至灰白色的玉米粉。本產品具有優異的成膜性能,用於包裹油炸食品時可作為優異的保護屏障。

- 據美國農業部稱,農業研究服務局(ARS)的科學家研發出一種被覆劑基薄膜,可以使紙張等材料更耐水性和生物分解性。該薄膜產品廣泛應用於塑膠袋、食品包裝等,有助於減少堵塞垃圾掩埋場的合成產品的數量。

- 根據 Moldo Intelligence 的數據,熱塑性澱粉市場的薄膜部分預計在 2024 年至 2029 年期間實現 6.77% 的複合年成長率。

- 包裝產業的大量投資可能會刺激所調查市場的需求。例如,2023年3月,華天科技取得重大突破,投資28.58億元人民幣,完全子公司江蘇華天科技,建置「高密度、高可靠先進封裝研究及產業化」計劃。建設工期為5年,自2023年6月至2028年6月。

- 因此,預計所有這些因素都會影響預測期內的市場需求。

預計歐洲將主導市場

- 在德國,我們的包裝解決方案廣泛應用於客製化產品和創新開發。此外,在包裝食品領域,對較小包裝尺寸的需求很高。根據德國聯邦統計局的資料,到 2023 年,德國包裝產業的收益將達到 325 億歐元(約 358.7 億美元)。

- 德國是歐洲領先的3D列印市場之一。該國擁有著名的工程傳統,在各行業建立了一系列製造設施,可協助國際投資者拓展歐洲業務。

- 據英國包裝聯合會稱,英國包裝製造業的年營業額約為 140 億英鎊(約 178.2 億美元)。該公司擁有超過 85,000 名員工,佔英國製造業的 3%。

- 義大利是歐盟最大的農業生產國和食品加工國之一。此外,義大利的農業部門和農業食品體系對該國經濟貢獻巨大,到 2023 年分別佔 GDP 的 2% 和 15% 左右。

- 根據法國國家統計與經濟研究所 (INSEE) 的數據,預計 2023 年農業生產年收益將達到 566 億歐元(約 609.6 億美元),而 2022 年為 587 億歐元(約 632.2 億美元)。不利的宏觀經濟因素和能源成本上升對受調查的市場產生了負面影響。

- 因此,受上述因素影響,歐洲市場對熱塑性澱粉市場的需求可能會受到影響。

熱塑性澱粉(TPS)產業概況

熱塑性澱粉(TPS)市場正在不斷整合。市場的主要企業(不分先後順序)包括 Versalis SpA、BIOTEC、Kuraray (Plantic)、AGRANA Beteiligungs AG 和 Grupa Azoty。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 包裝產業需求不斷成長

- 政府推出優惠政策促進生質塑膠發展

- 限制因素

- 與TPS相關的幾個技術限制

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 按生產類型

- 擠壓

- 射出成型

- 按應用

- 包包

- 電影

- 3D列印

- 其他用途

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 北歐國家

- 其他歐洲國家

- 世界其他地區

- 南美洲

- 中東和非洲

- 亞太地區

第6章競爭格局

- 合併、收購、合資、合作和協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- AGRANA Beteiligungs-AG

- Biome Bioplastics Limited

- Biotec Biologische Naturverpackungen GmbH & Co. KG

- Biologiq Inc.

- Cardia Bioplastics

- Great Wrap

- Grupa Azoty SA

- Kuraray Co. Ltd

- Rodenburg Biopolymers

- Versalis SpA

第7章 市場機會與未來趨勢

- 技術進步和創新增強了熱塑性澱粉的性能

簡介目錄

Product Code: 69028

The Thermoplastic Starch Market size is estimated at 184.49 kilotons in 2025, and is expected to reach 263.50 kilotons by 2030, at a CAGR of 7.39% during the forecast period (2025-2030).

Key Highlights

- Over the short term, increasing demand from the packaging industry and favorable government policies promoting bio-plastics are expected to drive the growth of the market studied.

- However, multiple technical constraints associated with thermoplastic starch (TPS) are likely to hinder the market's growth.

- Technological advancements and innovations to enhance the properties of thermoplastic starch are likely to act as an opportunity for the market studied during the forecast period.

- Europe emerged as the largest market for thermoplastic starch, while Asia-Pacific is expected to witness the highest CAGR between 2024 and 2029.

Thermoplastic Starch (TPS) Market Trends

Films Segment to Dominate the Market

- Thermoplastic starch films lucidly use natural resources, which help reduce environmental pollution. Thermoplastic starch films present many advantages, such as biodegradability, low cost, ease of processing, and renewability. Starch films are being used as promising commercial preservation films to extend the shelf life of food.

- TPS films have poor water vapor barrier properties, low permeability to gases, and resist the tensions arising from their usage in packaging. The increasing use of thermoplastic starch as a filler in plastic films to improve their biodegradability has enhanced their application in the packaging sector.

- Thermoplastic starch (TPS) is a starch derivative and is widely accepted as the most suitable material to replace synthetic polymers in the packaging industry.

- Hydrolyzed cornstarch films, as a sustainable packaging material, offer several advantages, such as biodegradability, reusability, and reduced environmental impact compared to other traditional petroleum-based plastics.

- Many companies are opting for sustainable packaging materials. For instance, Ingredion, a US-based global ingredients solutions company, offers CRISP FILM, a high amylose, white to off-white colored corn starch. The products offer good film-forming characteristics and act as an excellent protective barrier when it is used as a coating for fried foods.

- According to the United States Department of Agriculture, scientists from the Agricultural Research Service (ARS) developed starch-based films, or coatings, that can make paper and other materials more water-resistant and biodegradable. The film product is widely used in plastic bags, food packaging, and other products, thus reducing the amount of synthetic products that are clogging landfills.

- As per the analysis of Mordor Intelligence, the films segment in the thermoplastic starch market is expected to register a CAGR of 6.77% between 2024 and 2029.

- Significant investment in the packaging sector is likely to boost demand in the market studied. For instance, in March 2023, Huatian Technology made significant strides by investing CNY 2.858 billion (~USD 0.42 billion) in its wholly-owned subsidiary, Huatian Technology (Jiangsu) Co. Ltd, for the construction of the "High-Density, High-Reliability Advanced Packaging Research and Industrialization" project. The construction period spans five years, from June 2023 to June 2028.

- Therefore, all these factors are expected to impact the market's demand during the forecast period.

Europe is Expected to Dominate the Market

- In Germany, packaging solutions are used for various customized products and innovation development. Further, smaller pack sizes are in high demand across the county in the packaged food sectors. According to the Statistisches Bundesamt's data, the revenue of the packaging sector in Germany in 2023 accounted for EUR 32.5 billion (~USD 35.87 billion).

- Germany is one of the leading 3D printing markets in Europe. The country has a renowned engineering heritage, which led to the establishment of various manufacturing facilities in industries that can assist international investors with their expansion into Europe.

- According to the Packaging Federation of the United Kingdom, the UK packaging manufacturing industry registers annual sales of around GBP 14 billion (~USD 17.82 billion). It employs over 85,000 people, representing 3% of the UK manufacturing workforce.

- Italy is one of the largest agricultural producers and food processors in the European Union. Moreover, Italy's agricultural sector and agri-food system strongly contribute to the country's economy, accounting for around 2% and 15% of the GDP, respectively, in 2023.

- According to the National Institute of Statistics and Economic Studies (INSEE), in 2023, agricultural production generated an annual revenue of EUR 56.6 billion (~USD 60.96 billion) compared to EUR 58.7 billion (~USD 63.22 billion) in 2022 due to unfavorable macroeconomic factors, high energy costs, and others, thus negatively impacting the market studied.

- Hence, with the abovementioned factors, demand in the thermoplastic starch market is likely to be affected in the European market.

Thermoplastic Starch (TPS) Industry Overview

The thermoplastic starch (TPS) market is consolidated in nature. Some of the major players (not in any particular order) in the market include Versalis SpA, BIOTEC, Kuraray Co. Ltd (Plantic ), AGRANA Beteiligungs AG, and Grupa Azoty.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Packaging Industry

- 4.1.2 Favorable Government Policies Promoting Bio-plastics

- 4.2 Restraints

- 4.2.1 Multiple Technical Constrains Associated with TPS

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Manufacturing Type

- 5.1.1 Extrusion Molding

- 5.1.2 Injection Molding

- 5.2 By Application

- 5.2.1 Bags

- 5.2.2 Films

- 5.2.3 3D Print

- 5.2.4 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 NORDIC Countries

- 5.3.3.6 Rest of Europe

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AGRANA Beteiligungs-AG

- 6.4.2 Biome Bioplastics Limited

- 6.4.3 Biotec Biologische Naturverpackungen GmbH & Co. KG

- 6.4.4 Biologiq Inc.

- 6.4.5 Cardia Bioplastics

- 6.4.6 Great Wrap

- 6.4.7 Grupa Azoty SA

- 6.4.8 Kuraray Co. Ltd

- 6.4.9 Rodenburg Biopolymers

- 6.4.10 Versalis SpA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements and Innovation to Enhance the Properties of Thermoplastic Starch

02-2729-4219

+886-2-2729-4219