|

市場調查報告書

商品編碼

1876806

再生熱塑性塑膠市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Recycled Thermoplastic Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

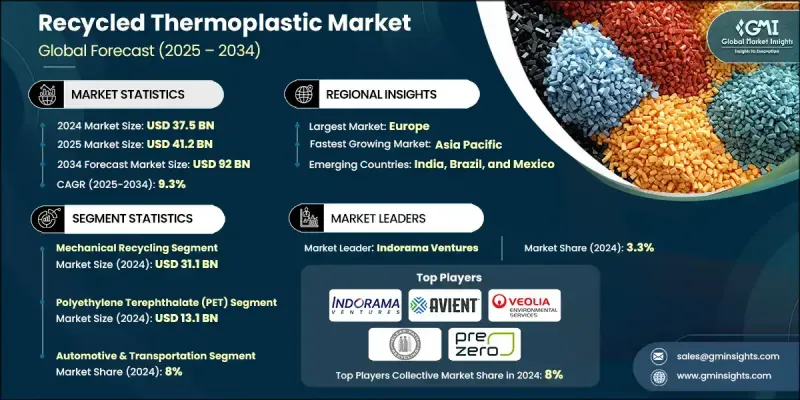

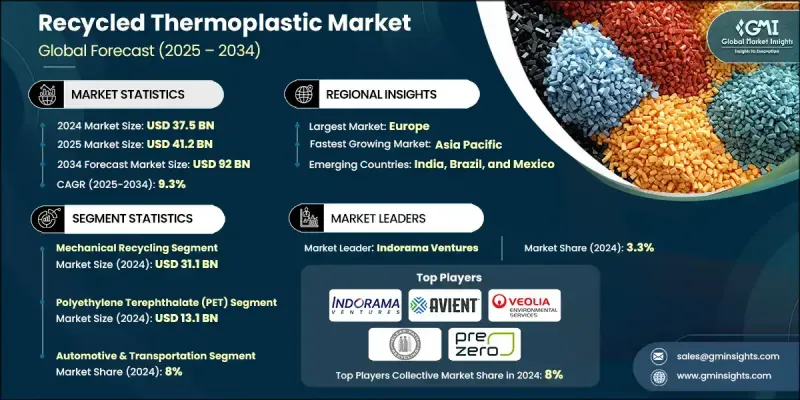

2024 年全球再生熱塑性塑膠市場價值為 375 億美元,預計到 2034 年將以 9.3% 的複合年成長率成長至 920 億美元。

市場正迅速採用先進的回收技術,例如化學解聚、酵素法回收、等離子體處理和微波輔助法。這些技術能夠將混合、受污染和多層塑膠轉化為符合原生材料標準的高品質再生聚合物。循環經濟原則的日益普及、消費者意識的增強以及政府強制規定最低再生材料含量和限制一次性塑膠使用的強力政策,都在推動市場需求。閉迴路系統和回收基礎設施投資的增加,進一步提高了再生熱塑性塑膠的供應量。汽車、包裝和電子產業是主要的終端用戶,他們利用這些材料進行永續製造。預計未來十年,對生態高效生產和高價值應用的日益重視將使市場保持持續成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 375億美元 |

| 預測值 | 920億美元 |

| 複合年成長率 | 9.3% |

先進和混合回收技術領域預計將以複合年成長率成長。 2024 年全球再生熱塑性塑膠市場價值為 375 億美元,預計到 2034 年將以 9.3% 的複合年成長率成長至 920 億美元。

市場正迅速採用先進的回收技術,例如化學解聚、酵素法回收、等離子體處理和微波輔助法。這些技術能夠將混合、受污染和多層塑膠轉化為符合原生材料標準的高品質再生聚合物。循環經濟原則的日益普及、消費者意識的增強以及政府強制規定最低再生材料含量和限制一次性塑膠使用的強力政策,都在推動市場需求。閉迴路系統和回收基礎設施投資的增加,進一步提高了再生熱塑性塑膠的供應量。汽車、包裝和電子產業是主要的終端用戶,他們利用這些材料進行永續製造。預計未來十年,對生態高效生產和高價值應用的日益重視將使市場保持持續成長。

預計到 2034 年,先進和混合回收技術領域的複合年成長率將達到 9.8%。這些方法可以回收複雜且難以處理的塑膠廢料,同時最大限度地減少碳足跡,生產適用於高階應用的高性能聚合物。

2024年,聚對苯二甲酸乙二醇酯(PET)市場規模達131億美元,主要得益於其在飲料瓶、包裝和再生PET(rPET)纖維領域的廣泛應用。由於PET具有高可回收性和多功能性,其回收利用持續成長,尤其是在食品級和紡織品應用領域。

2024年,美國再生熱塑性塑膠市場規模預計將達到94億美元,這得益於先進的回收基礎設施以及分類和收集流程的改進。美國和加拿大都在大力投資機械和化學回收,以提高原料回收率和材料品質。包裝、汽車和電子產業的需求尤其顯著,同時,閉迴路系統和循環經濟措施也日益受到重視。

全球再生熱塑性塑膠市場的主要參與者包括PreZero Polymers AG、威立雅環境服務公司(Veolia Environmental Services)、伊士曼化學公司(Eastman Chemical Company)、KW Plastics Manufacturing、Loop Industries Inc.、Republic Services Inc.、Carubios SA、利安德巴塞爾德公司(Lyon Basul Holdings. Inc.、蘇伊士集團(SUEZ Recycling & Recovery)、Avient Corporation、Clear Path Recycling和Indorama Ventures Public Company Limited。這些企業正採取多種策略來提升市場地位並擴大業務範圍。這些策略包括投資先進的化學和機械回收技術以提高聚合物品質、擴大加工能力以及與原料供應商建立合作關係以確保穩定的原料供應。許多企業正致力於開發閉迴路系統和高性能再生聚合物,以滿足高階終端應用的需求。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 產業陷阱與挑戰

- 市場機遇

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲 (MEA)

- 波特的分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 透過加工方法

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依加工方式分類,2021-2034年

- 主要趨勢

- 機械回收

- 收集和分類系統

- 洗滌和清潔過程

- 粉碎和尺寸縮減

- 熔化和造粒

- 化學回收

- 熱解技術

- 解聚過程

- 氣化方法

- 溶劑分解技術

- 催化裂解

- 酵素解聚

- 先進技術

- 生物基回收方法

- 基於等離子體的技術

- 微波增強處理

- 其他新興技術

第6章:市場估算與預測:依產品類型分類,2021-2034年

- 主要趨勢

- 寵物

- 高密度聚乙烯

- 低密度聚乙烯

- PP

- PS

- 其他

第7章:市場估計與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 包裝

- 食品和飲料容器

- 非食品包裝

- 軟性包裝和薄膜

- 瓶蓋和封口

- 汽車與運輸

- 內部組件

- 引擎蓋下應用

- 外板和裝飾條

- 電池外殼和電動車組件

- 建築施工

- 管道及配件

- 絕緣材料

- 屋頂和露台

- 視窗輪廓

- 電學

- 設備外殼

- 連接器和組件

- 電纜絕緣

- 消費品和家具

- 家居用品

- 戶外家具

- 玩具和體育用品

- 農業與園藝

- 溫室電影

- 灌溉系統

- 花盆和容器

- 紡織品和服裝

- 合成纖維

- 地毯和地板

- 非織物

第8章:市場估算與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第9章:公司簡介

- Avient Corporation

- Biffa plc

- Carbios SA

- Clear Path Recycling

- Eastman Chemical Company

- Indorama Ventures Public Company Limited

- KW Plastics Manufacturing

- Loop Industries Inc.

- Lyondell Basell

- Plastipak Holdings Inc.

- PreZero Polymers AG

- Remondis Recycling GmbH

- Republic Services Inc.

- SUEZ Recycling & Recovery

- Veolia Environmental Services

The Global Recycled Thermoplastic Market was valued at USD 37.5 billion in 2024 and is estimated to grow at a CAGR of 9.3% to reach USD 92 billion by 2034.

The market is witnessing rapid adoption of advanced recycling technologies such as chemical depolymerization, enzymatic recycling, plasma processing, and microwave-assisted methods. These techniques enable the transformation of mixed, contaminated, and multilayer plastics into high-quality recycled polymers that meet the standards of virgin materials. Rising adoption of circular economy principles, growing consumer awareness, and strong government policies mandating minimum recycled content and restricting single-use plastics are fueling demand. Closed-loop systems and increased investments in recycling infrastructure are further enhancing the availability of recycled thermoplastics. The automotive, packaging, and electronics industries are among the primary end-users, leveraging these materials for sustainable manufacturing. Rising emphasis on eco-efficient production and high-value applications is expected to sustain consistent growth in the market over the coming decade.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $37.5 Billion |

| Forecast Value | $92 Billion |

| CAGR | 9.3% |

The advanced and hybrid recycling technologies segment is projected to grow at a CAGR The Global Recycled Thermoplastic Market was valued at USD 37.5 billion in 2024 and is estimated to grow at a CAGR of 9.3% to reach USD 92 billion by 2034.

The market is witnessing rapid adoption of advanced recycling technologies such as chemical depolymerization, enzymatic recycling, plasma processing, and microwave-assisted methods. These techniques enable the transformation of mixed, contaminated, and multilayer plastics into high-quality recycled polymers that meet the standards of virgin materials. Rising adoption of circular economy principles, growing consumer awareness, and strong government policies mandating minimum recycled content and restricting single-use plastics are fueling demand. Closed-loop systems and increased investments in recycling infrastructure are further enhancing the availability of recycled thermoplastics. The automotive, packaging, and electronics industries are among the primary end-users, leveraging these materials for sustainable manufacturing. Rising emphasis on eco-efficient production and high-value applications is expected to sustain consistent growth in the market over the coming decade.

The advanced and hybrid recycling technologies segment is projected to grow at a CAGR of 9.8% through 2034. These methods can recycle complex and hard-to-process plastic waste streams while minimizing carbon footprint, producing high-performance polymers suitable for premium applications.

In 2024, the polyethylene Terephthalate (PET) accounted for USD 13.1 billion, driven by its use in beverage bottles, packaging, and recycled PET (rPET) fibers. PET recycling continues to expand, particularly for food-grade and textile applications, due to its high recyclability and versatility.

U.S. Recycled Thermoplastic Market reached USD 9.4 billion in 2024, supported by advanced recycling infrastructure and improved sorting and collection processes. Both the U.S. and Canada are investing heavily in mechanical and chemical recycling to enhance feedstock recovery and material quality. Key demand stems from the packaging, automotive, and electronics sectors, with increasing focus on closed-loop systems and circular economy initiatives.

Leading players in the Global Recycled Thermoplastic Market include PreZero Polymers AG, Veolia Environmental Services, Eastman Chemical Company, KW Plastics Manufacturing, Loop Industries Inc., Republic Services Inc., Carbios SA, Lyondell Basell, Biffa plc, Remondis Recycling GmbH, Plastipak Holdings Inc., SUEZ Recycling & Recovery, Avient Corporation, Clear Path Recycling, and Indorama Ventures Public Company Limited. Companies in the Recycled Thermoplastic Market are employing multiple strategies to enhance their market position and expand their reach. These include investing in advanced chemical and mechanical recycling technologies to improve polymer quality, expanding processing capacity, and establishing partnerships with feedstock suppliers to secure consistent input. Many players are focusing on developing closed-loop systems and high-performance recycled polymers to cater to premium end-use applications.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Processing method

- 2.2.3 Product type

- 2.2.4 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa (MEA)

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By processing method

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code)( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Processing Method, 2021-2034 (USD Billion & Tons)

- 5.1 Key trends

- 5.2 Mechanical recycling

- 5.2.1 Collection & sorting systems

- 5.2.2 Washing & cleaning processes

- 5.2.3 Shredding & size reduction

- 5.2.4 Melting & pelletizing

- 5.3 Chemical recycling

- 5.3.1 Pyrolysis technologies

- 5.3.2 Depolymerization processes

- 5.3.3 Gasification methods

- 5.3.4 Solvolysis techniques

- 5.3.5 Catalytic cracking

- 5.3.6 Enzymatic depolymerization

- 5.4 Advanced technologies

- 5.4.1 Bio based recycling methods

- 5.4.2 Plasma based technologies

- 5.4.3 Microwave enhanced processing

- 5.4.4 Other emerging technologies

Chapter 6 Market Estimates and Forecast, By Product Type, 2021-2034 (USD Billion & Tons)

- 6.1 Key trends

- 6.2 PET

- 6.3 HDPE

- 6.4 LDPE

- 6.5 PP

- 6.6 PS

- 6.7 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021-2034 (USD Billion & Tons)

- 7.1 Key trends

- 7.2 Packaging

- 7.2.1 Food & beverage containers

- 7.2.2 Non-food packaging

- 7.2.3 Flexible packaging & films

- 7.2.4 Caps & closures

- 7.3 Automotive & transportation

- 7.3.1 Interior components

- 7.3.2 Under-hood applications

- 7.3.3 Exterior panels & trim

- 7.3.4 Battery housing & EV components

- 7.4 Building & construction

- 7.4.1 Pipes & fittings

- 7.4.2 Insulation materials

- 7.4.3 Roofing & decking

- 7.4.4 Window profiles

- 7.5 Electronics & electrical

- 7.5.1 Device housings

- 7.5.2 Connectors & components

- 7.5.3 Cable insulation

- 7.6 Consumer goods & furniture

- 7.6.1 Household items

- 7.6.2 Outdoor furniture

- 7.6.3 Toys & sporting goods

- 7.7 Agriculture & horticulture

- 7.7.1 Greenhouse films

- 7.7.2 Irrigation systems

- 7.7.3 Plant pots & containers

- 7.8 Textiles & apparel

- 7.8.1 Synthetic fibers

- 7.8.2 Carpeting & flooring

- 7.8.3 Non-woven fabrics

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion & Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Avient Corporation

- 9.2 Biffa plc

- 9.3 Carbios SA

- 9.4 Clear Path Recycling

- 9.5 Eastman Chemical Company

- 9.6 Indorama Ventures Public Company Limited

- 9.7 KW Plastics Manufacturing

- 9.8 Loop Industries Inc.

- 9.9 Lyondell Basell

- 9.10 Plastipak Holdings Inc.

- 9.11 PreZero Polymers AG

- 9.12 Remondis Recycling GmbH

- 9.13 Republic Services Inc.

- 9.14 SUEZ Recycling & Recovery

- 9.15 Veolia Environmental Services