|

市場調查報告書

商品編碼

1689852

英國合約物流:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)United Kingdom Contract Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

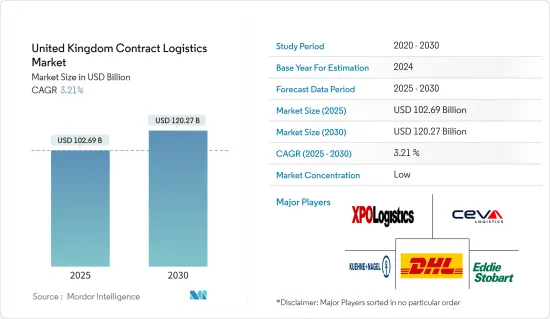

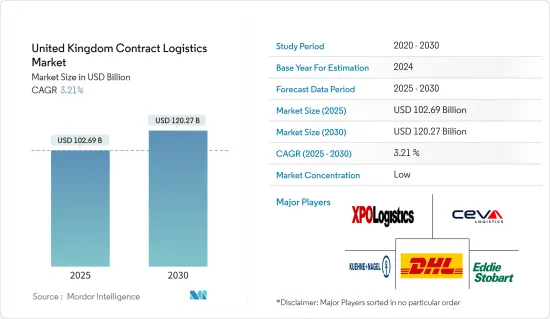

英國合約物流市場規模預計在 2025 年為 1,026.9 億美元,預計到 2030 年將達到 1,202.7 億美元,預測期內(2025-2030 年)的複合年成長率為 3.21%。

關鍵亮點

- 自2020年3月以來,儘管面臨嚴重的業務和財務中斷,物流業仍繼續向國家供應食品、個人防護裝備和其他物資。為了應對新冠疫情,物流公司透過縮減業務、內部生產和減少對第三方服務的依賴來管理風險。同時,許多公司將重點放在核心車型上以削減成本。

- 英國擁有歐洲最先進的物流業。由於電子商務的多樣性和高滲透性,這種情況可能不會改變 - 由於對合約物流服務的需求增加,合約物流市場正受益於電子商務的擴張。由於電子商務的蓬勃發展,物流公司正在擴大其服務範圍。

- 隨著國際貿易和經濟互聯互通的擴大,英國企業擴大參與全球商業活動。這導致對高效、精簡的物流服務的需求激增,以促進貨物跨境運輸。

- 擴大運輸網路的需求、全球供應鏈的日益複雜、技術進步以及電子商務的興起都在影響英國合約物流的成長和演變。

- 由於零售業電子商務的蓬勃發展,合約物流服務的需求量大。過去十年,電子商務已成為英國最熱門的零售趨勢。電子商務平台已經存在了一段時間,但直到最近才引起主流關注。為了跟上世界其他地區的步伐,英國的網路購物成長驚人。

英國合約物流市場趨勢

製造業對合約物流的需求不斷增加

- 英國製造業多種多樣,包括汽車、航太、製藥和電子。每個行業都有自己獨特的物流要求,合約物流供應商專門滿足這些特定需求。這種專業化使製造商能夠受益於行業特定的專業知識和最佳實踐。

- 合約物流在製造業的一個主要好處是提高了靈活性。製造商可以根據需求波動擴大其物流業務,有效利用資源並最佳化成本。

- 合約物流供應商提供可客製化的解決方案以滿足製造商的特定需求,使他們能夠快速回應不斷變化的市場條件。

- 透過將物流業務外包給專家,製造商可以從簡化流程、最佳化路線和改善庫存管理中受益。這意味著更短的前置作業時間、更低的成本和更高的整體業務效率。

- 合約物流在確保供應鏈的可見性和可追溯性方面也發揮關鍵作用。借助追蹤和追蹤系統等先進技術,製造商可以監控整個供應鏈中的貨物流動。這種可見性有助於識別瓶頸、最佳化存量基準並確保及時交付給客戶。

電子商務成長支持市場發展

電子商務產業的顯著成長和消費者對網路購物的偏好日益增強是推動英國市場前景光明的關鍵因素之一。物流對於倉儲、運輸、航運和線上交付的順利運作起著至關重要的作用。該解決方案的流行還可以歸因於逆向物流業務的興起,例如簡化的退貨和退款政策以及各種電子商務平台提供的靈活的追蹤功能,預計這將推動市場成長。

此外,由於人們越來越意識到物流的好處,例如減少投資、加快交貨時間以及消費者更加關注管理業務,物流在多個行業領域的廣泛應用也促進了成長要素。技術主導的物流服務和物聯網 (IoT) 的引入使得能夠追蹤物體和遠端控制運輸過程元素的連網型設備正在推動市場成長。

此外,人們對永續發展的興趣日益濃厚,推動了對綠色物流的需求,從而支持了市場的成長。此外,無線射頻識別 (RFID) 和藍牙的廣泛使用、無人機送貨和無人駕駛汽車等新技術正在對市場成長產生積極影響。廣泛的研發活動和全國對安全冷藏運輸的需求不斷增加等其他因素也有望推動市場成長。該建築配備了新技術和最新的儲存軟體,進一步擴大了其管理全方位服務的物流能力。電子商務行業正在透過廣泛的自動化推動客戶服務的新時代。物流業不斷適應新技術和創新。

無人機送貨可能很快就會在英國變得非常普遍。同時,超當地語系化服務將協助企業配送貨物,加快各大零售商電商訂單的最後一哩配送。

英國合約物流行業概況

該市場相對細分,有許多本地和國際參與企業,其中 DHL Supply Chain、Wincanton、Clipper Logistics 和 UPS 是主要企業。隨著參與企業專注於增強對國內和國際市場的控制,市場正在經歷擴張、併購。

英國合約物流市場是近乎完全競爭的典範,因為許多買家和賣家都在市場上活躍。規模較大的企業在該地區擁有強大的影響力,佔據了相當大的市場佔有率。市場在某種程度上是細分的,許多公司提供不同層次的合約物流服務。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態與洞察

- 市場概覽

- 市場動態

- 市場促進因素

- 全球化程度的提高正在推動市場

- 技術進步賦能市場

- 市場限制

- 基礎建設限制影響市場

- 勞動力短缺影響市場

- 市場機會

- 國際貿易促進市場

- 專業服務推動市場

- 市場促進因素

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 市場技術趨勢

- 行業法規政策

- 產業價值鏈分析

- 國內電商產業洞察(國內及跨境)

- 售後服務/逆向物流背景下的合約物流洞察

- 合約物流參與企業提供的各種服務概述

- 運費/費率考慮

- 深入了解英國脫歐對英國物流業的影響

- COVID-19 市場影響

第5章市場區隔

- 按類型

- 內部資源

- 外包

- 按最終用戶

- 製造/汽車

- 消費品和零售

- 製藥和醫療

- 高科技

- 其他最終用戶(能源、建築、航太等)

第6章競爭格局

- 市場集中度概覽

- 公司簡介

- DHL Supply Chain

- UPS

- Wincanton

- XP Supply Chain

- Eddie Sobert

- CEVA Logistics

- Clipper Logistics

- FedEx

- Rhenus Logistics

- EV Cargo*

- 其他公司(關鍵資訊/概述)

第7章:市場的未來

第 8 章 附錄

The United Kingdom Contract Logistics Market size is estimated at USD 102.69 billion in 2025, and is expected to reach USD 120.27 billion by 2030, at a CAGR of 3.21% during the forecast period (2025-2030).

Key Highlights

- Despite facing significant operational and financial disruption since March 2020, the logistics industry continued to supply the nation with goods, including food supplies and PPE. To deal with the COVID-19 pandemic, logistics businesses managed risks by scaling back operations, taking work back in-house, and reducing their reliance on third-party services. At the same time, many also focused on their core fleet of vehicles to save costs.

- The United Kingdom has the most advanced logistics industry in Europe. Owing to the variety and higher prevalence of e-commerce, this may not change-the contract logistics market benefits from expanding e-commerce due to increased demand for contract logistics services. As a result of the e-commerce boom, logistics companies are expanding their services.

- With the expansion of international trade and the interconnectedness of economies, companies in the UK are increasingly engaging in global business activities. This has led to a surge in the demand for efficient and streamlined logistics services to facilitate the movement of goods across borders.

- The Need for expanded transportation networks, the complexity of global supply chains, advancements in technology, and the rise of e-commerce have all influenced the growth and evolution of contract logistics in the UK.

- Contract logistics services are in high demand as a result of the retail e-commerce boom. Over the last decade, e-commerce has become the most popular retail trend in the United Kingdom. Even though e-commerce platforms have been around for a long time, they have only recently gained mainstream notice. In order to keep up with the rest of the globe, the expansion of internet shopping in the United Kingdom has been phenomenal.

UK Contract Logistics Market Trends

Growing demand for contract logistics in the manufacturing segment

- The manufacturing sector in the UK is highly diverse, encompassing industries such as automotive, aerospace, pharmaceuticals, electronics, and more. Each industry has its unique logistics requirements, and contract logistics providers specialize in catering to these specific needs. This specialization allows manufacturers to benefit from industry-specific expertise and best practices.

- One of the key benefits of contract logistics in the manufacturing sector is increased flexibility. Manufacturers can scale their logistics operations based on demand fluctuations, ensuring efficient utilization of resources and cost optimization.

- Contract logistics providers offer customizable solutions tailored to the specific needs of manufacturers, allowing them to adapt quickly to changing market conditions.

- By outsourcing logistics activities to experts, manufacturers can benefit from streamlined processes, optimized routing, and improved inventory management. This leads to reduced lead times, lower costs, and enhanced overall operational efficiency.

- Contract logistics also plays a vital role in ensuring supply chain visibility and traceability. With the help of advanced technologies such as track and trace systems, manufacturers can monitor the movement of goods throughout the supply chain. This visibility helps in identifying bottlenecks, optimizing inventory levels, and ensuring timely delivery to customers.

Growth in e-commerce supporting the market advancement

Significant growth in the e-commerce industry and increasing consumer propensity to shop online are among the key factors creating a positive outlook for the UK market. Logistics plays a vital role in the smooth functioning of warehousing, transportation, shipping, and online delivery. The widespread adoption of this solution is also due to the increase in reverse logistics operations, such as simple return and refund policies offered by various e-commerce platforms with flexible tracking capabilities will drive market growth.

In addition, the widespread use of logistics by several industrial sectors is another growth driver due to growing awareness of the benefits of logistics, such as reduced investment, faster delivery times, and a greater focus on consumers rather than administrative tasks. The introduction of technology-driven logistics services and the Internet of Things (IoT)-)-enabled connected devices, enabling the tracking of objects and remote control of elements of the transportation process, is driving the market growth.

Moreover, growing interest in sustainable development has increased the demand for green logistics to support the growth of the market. Furthermore, the prevalence of radio frequency identification (RFID), Bluetooth, and other emerging technologies, such as drone delivery and unmanned vehicles, are having a positive impact on the market growth. Extensive research and development (R&D) activities and other factors, such as increasing demand for safe refrigerated transportation across the country, are expected to boost market growth. The building is equipped with new technology and the latest storage software, further expanding the logistical capacity to manage all services. The e-commerce industry is driving a new era in customer service with extensive automation. The logistics industry is constantly adapting to new technologies and innovations.

Soon, drone deliveries might become more common in the United Kingdom. At the same time, hyperlocal services would help businesses deliver their goods, thus fast-tracking last-mile delivery for a quick turnaround time on e-commerce orders from major retailers.

UK Contract Logistics Industry Overview

The market is relatively fragmented, with a large number of local and international players, including DHL Supply Chain, Wincanton, Clipper Logistics, and UPS as its key players. The market is experiencing expansions, mergers, and acquisitions as players focus on increasing their grasp over the nation as well as the international market.

The UK contract logistics market provides an example of near-perfect competition, as many buyers and sellers are operating in the market. Even though major players have a strong footprint across the region and account for a significant market share, the market is still fragmented to some extent, with many players providing contract logistics services at different levels.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Dynamics

- 4.2.1 Market Drivers

- 4.2.1.1 Increased Globalization boosting the market

- 4.2.1.2 Technological advancements bolstering the market

- 4.2.2 Market Restraints

- 4.2.2.1 Infrastructure limitation affecting the market

- 4.2.2.2 Shortage of Labour force affecting the market

- 4.2.3 Market Opportunities

- 4.2.3.1 International trade boosting the market

- 4.2.3.2 Specialized services boosting the market

- 4.2.1 Market Drivers

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Technological Trends in the Market

- 4.5 Industry Policies and Regulations

- 4.6 Industry Value Chain Analysis

- 4.7 Insights into the E-commerce Industry in the Country (both Domestic and Cross-border)

- 4.8 Insights into Contract Logistics in the Context of After-sales/Reverse Logistics

- 4.9 Brief on Different Services Provided by Contract Logistics Players

- 4.10 Spotlight on Freight Transportation Costs/Freight Rates

- 4.11 Insights into the Effect of Brexit in the UK Logistics Industry

- 4.12 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Insourced

- 5.1.2 Outsourced

- 5.2 By End-User

- 5.2.1 Manufacturing and Automotive

- 5.2.2 Consumer Goods and Retail

- 5.2.3 Pharmaceuticals and Healthcare

- 5.2.4 Hi-tech

- 5.2.5 Other End-Users (Energy, Construction, Aerospace, etc.)

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 DHL Supply Chain

- 6.2.2 UPS

- 6.2.3 Wincanton

- 6.2.4 XP Supply Chain

- 6.2.5 Eddie Sobert

- 6.2.6 CEVA Logistics

- 6.2.7 Clipper Logistics

- 6.2.8 FedEx

- 6.2.9 Rhenus Logistics

- 6.2.10 EV Cargo*

- 6.3 Other Companies (Key Information/Overview)