|

市場調查報告書

商品編碼

1689815

水產養殖:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Aquaponics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

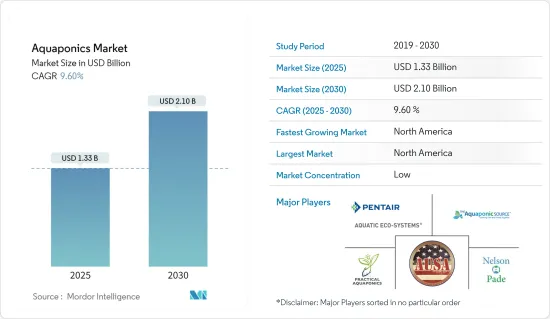

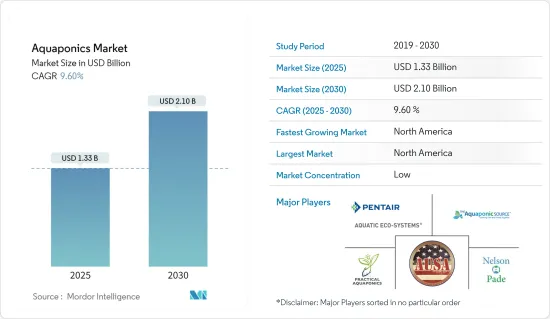

預計 2025 年水產養殖市場規模為 13.3 億美元,到 2030 年將達到 21 億美元,預測期內(2025-2030 年)的複合年成長率為 9.6%。

COVID-19 疫情對水產養殖市場供應鏈產生了重大影響。疫情期間供應鏈中斷導致農民大量養殖活魚和其他水生物種,對農民的成本、支出和風險造成不利影響。

2021年,北美佔據了水產養殖市場的最大佔有率。美國在該地區佔比最大,其次是加拿大。水產養殖業是該地區規模雖小但發展迅速的產業,與多家教育和研究機構以及私人公司建立了合作夥伴關係。這一因素在建立和提高水產養殖農場的知名度方面發揮了關鍵作用。儘管 Superior Fresh 和 Ouroboros Farms 等農場處於商業性水產養殖生產的前沿,但該地區尚未實現水產養殖作物的大規模生產。

水產養殖市場趨勢

有機農產品需求旺盛推動市場

由於水產養殖不使用任何合成肥料或作物保護化學品,且魚類廢物是植物的主要營養物質,因此對有機種植作物的需求潛力很大,這使其成為新興水產養殖農場和水產養殖系統提供者尚未開發的領域。有機貿易協會報告稱,2018 年有機水果和蔬菜的銷售額成長 5.6%,達到 174 億美元,高於去年的 164.2 億美元。因此,美國已成為有機種植水果和蔬菜的主要市場之一。此外,歐洲是世界上有機農地面積最大的國家之一,其中西班牙佔最大佔有率,有機種植面積達 2,246,475.0 公頃。由於水產養殖在有機農產品產業中佔有重要地位,歐洲資助的 COST 行動 FA1305「歐盟水產養殖中心 - 為歐盟實現全面永續魚類和蔬菜生產」加強了研究人員和私人公司之間的網路。因此,預計預測期內對有機農產品的需求將推動全球水產養殖產業的發展。

北美佔據市場主導地位

儘管水產養殖在北美仍是一個小產業,但預計未來幾年將呈指數級成長。 2014 年,威斯康辛大學史蒂文斯分校和 Nelson and Pade Aquaponics 公司達成官民合作關係(PPP),並建立了 Aquaponics研發中心,作為威斯康辛大學系統經濟發展激勵基金的一部分。此類舉措對於提高當地人對水產養殖等永續農業選擇的認知發揮著至關重要的作用。此外,水產養殖有望協助重組美國水產養殖業。威斯康辛州的水產養殖場數量最近從 2,300 個增加到 2,800 個,根據 2018 年美國水產養殖大會的透露,500 個新農場中有 300 個是水產養殖場。目前,美國每年消費的水產品有80.0%以上依賴進口。該國水產養殖場的興起可能有助於逐步減少魚貝類進口。

魚菜共生產業概覽

水產養殖市場高度細分,主要是由於市場不斷發展的特性。一些最活躍的水產養殖農場包括 Superior Fresh、Ouroboros Farms、Garden City Aquaponics Inc.、BIGH、Deep Water Farms 和 Madhavi Farms。一些主要企業包括 Pentair Aquatic Eco-System Inc. (PAES)、Nelson & Pade Aquaponics、Practical Aquaponics、Aquaponics USA 和 The Aquaponic Source。由於市場仍在擴大,新興企業正在製定產品推出和產能擴張策略,以搶佔相當大的市場佔有率佔有率。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概覽

- 市場促進因素

- 市場限制

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場區隔

- 進階系統

- 媒體擠滿了床

- 恆流

- 潮流(洪水和排水)

- 營養膜技術(NFT)

- 筏式或深海養殖(DWC)

- 媒體擠滿了床

- 設施類型

- 聚乙烯或玻璃溫室

- 室內垂直農場

- 其他設施類型

- 魚類

- 吳郭魚

- 鯰魚

- 鯉魚

- 鱒魚

- 觀賞魚

- 其他魚類

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 英國

- 法國

- 德國

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 馬來西亞

- 印尼

- 澳洲

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 非洲

- 南非

- 其他非洲國家

- 北美洲

第6章 競爭格局

- 最受歡迎的策略

- 水產養殖投入品供應商

- 水產養殖農場

- 市場佔有率分析

- 水產養殖投入品供應商

- 水產養殖農場

- 公司簡介 – 魚菜共生投入品供應商

- Pentair Aquatic Eco-System Inc.(PAES)

- Nelson & Pade Aquaponics

- Practical Aquaponics

- Aquaponics USA

- The Aquaponic Source

- 公司簡介 - 魚菜共生農場

- Superior Fresh

- Ouroboros Farms

- Garden City Aquaponics Inc.

- BIGH

- Deep Water Farms

- Madhavi Farms

- ECF Farm Berlin

第7章 市場機會與未來趨勢

第8章 COVID-19 市場影響評估

The Aquaponics Market size is estimated at USD 1.33 billion in 2025, and is expected to reach USD 2.10 billion by 2030, at a CAGR of 9.6% during the forecast period (2025-2030).

The COVID-19 pandemic majorly impacted the supply chain of the aquaponics market. Supply chain disruptions amid the pandemic led farmers to rear many live fishes and other aquatic species, which negatively impacted the farmers' cost, expenditure, and risk.

In 2021, North America occupied the largest share in the aquaponics market. The United States contributed the largest share in the region, followed by Canada. Aquaponic is a small but rapidly growing industry in the region, with several partnerships among educational and research institutions and private companies. This factor played a pivotal role in establishing and increasing awareness about aquaponic farms. However, mass-scale production of aquaponic crops is yet to take form in the region, although farms such as Superior Fresh and Ouroboros Farms are at the forefront of commercial aquaponics production.

Aquaponics Market Trends

Substantial Demand for Organic Produce Driving the Market

As aquaponics are free from chemical fertilizers and crop protection chemicals, with fish waste serving as the prime nutrients for plants, the demand for organically grown crops holds high potential and an untapped space for emerging aquaponic farms and aquaponic system providers. As reported by the Organic Trade Association, sales of organic fruits and vegetables rose by 5.6% to USD 17.40 billion in 2018 from USD 16.42 billion in the previous year. Thus, the United States became one of the leading markets for organically grown fruits and vegetables. Moreover, Europe holds one of the largest organic farmland areas globally, with Spain accounting for the largest share with 2,246,475.0 ha of the area under organic farming. As a result of the underlying scope for aquaponic farming in the organic produce industry, the European-funded COST Action FA1305, 'The European Union Aquaponics Hub-Realising Sustainable Integrated Fish and Vegetable Production for the EU', strengthened the network between researchers and private players. Therefore, the demand for organically grown produce is expected to drive the global aquaponics industry during the forecast period.

North America Dominates the Market

Although still a small industry in North America, aquaponic farming is expected to witness exponential growth in the coming years. In 2014, the University of Wisconsin - Stevens Point and Nelson and Pade Aquaponics entered a Public-Private Partnership (PPP) to establish an Aquaponics Innovation Center as part of the UW-System Economic Development Incentive Grant. Such initiatives have played a pivotal role in raising awareness about sustainable farming alternatives, such as aquaponics, in the region. Additionally, aquaponics is expected to help rebuild the aquaculture industry in the United States. In Wisconsin, the number of aquaculture farms recently rose from 2,300 to 2,800, with 300 out of the 500 new farms being aquaponic farms, as revealed at the Aquaculture America Conference in 2018. Currently, the United States imports more than 80.0% of the seafood it consumes annually. The rising number of aquaponic farms in the country may help it reduce its seafood import over time.

Aquaponics Industry Overview

The aquaponics market is highly fragmented, primarily due to the evolving nature of the market. Some of the most active aquaponic farms are Superior Fresh, Ouroboros Farms, Garden City Aquaponics Inc., BIGH, Deep Water Farms, and Madhavi Farms. Some major aquaponic input providers are Pentair Aquatic Eco-System Inc. (PAES), Nelson & Pade Aquaponics, Practical Aquaponics, Aquaponics USA, and The Aquaponic Source. As the market is still expanding, emerging players are strategizing product launches and capacity expansions to secure a substantial share in the market studied.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Growing System

- 5.1.1 Media Filled Beds

- 5.1.1.1 Constant Flow

- 5.1.1.2 Ebb and Flow (Flood and Drain)

- 5.1.2 Nutrient Film Technique (NFT)

- 5.1.3 Raft or Deep Water Culture (DWC)

- 5.1.1 Media Filled Beds

- 5.2 Facility Type

- 5.2.1 Poly or Glass Greenhouses

- 5.2.2 Indoor Vertical Farms

- 5.2.3 Other Facility Types

- 5.3 Fish Type

- 5.3.1 Tilapia

- 5.3.2 Catfish

- 5.3.3 Carp

- 5.3.4 Trout

- 5.3.5 Ornamental Fish

- 5.3.6 Other Fish Types

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 France

- 5.4.2.3 Germany

- 5.4.2.4 Italy

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Malaysia

- 5.4.3.4 Indonesia

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.1.1 Aquaponics Input Providers

- 6.1.2 Aquaponic Farms

- 6.2 Market Share Analysis

- 6.2.1 Aquaponics Input Providers

- 6.2.2 Aquaponic Farms

- 6.3 Company Profiles - Aquaponics Input Providers

- 6.3.1 Pentair Aquatic Eco-System Inc. (PAES)

- 6.3.2 Nelson & Pade Aquaponics

- 6.3.3 Practical Aquaponics

- 6.3.4 Aquaponics USA

- 6.3.5 The Aquaponic Source

- 6.4 Company Profile - Aquaponic Farms

- 6.4.1 Superior Fresh

- 6.4.2 Ouroboros Farms

- 6.4.3 Garden City Aquaponics Inc.

- 6.4.4 BIGH

- 6.4.5 Deep Water Farms

- 6.4.6 Madhavi Farms

- 6.4.7 ECF Farm Berlin