|

市場調查報告書

商品編碼

1689771

油壓設備:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Hydraulic Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

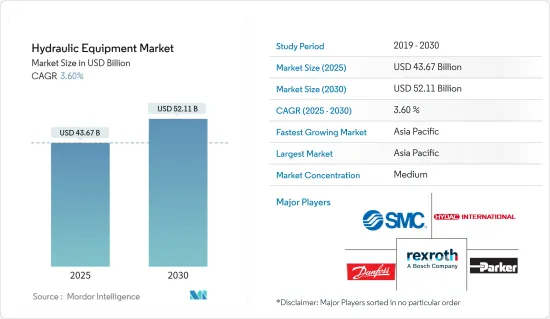

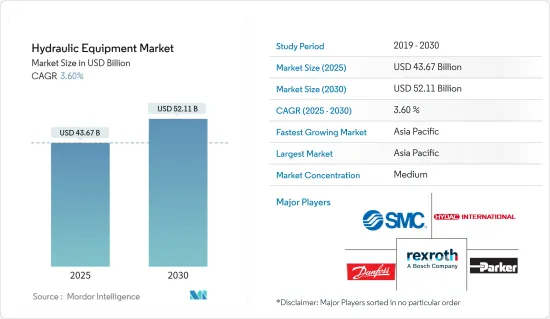

預計 2025 年油壓設備市場規模為 436.7 億美元,到 2030 年預計將達到 521.1 億美元,預測期內(2025-2030 年)的複合年成長率為 3.6%。

流程工業的擴張、物料輸送設備需求的不斷成長以及建築業的蓬勃發展是油壓設備市場的主要驅動力。此外,技術進步不僅推動了油壓設備的發展,也擴大了對智慧液壓解決方案的需求。例如,雖然物聯網主要與電氣系統相關,但它現在也在流體動力系統領域取得重大進展。現代油壓設備擴大整合電子設備以提高機動性,並整合感測器以進行全面的資料收集。

主要亮點

- 油壓設備為了順應新趨勢而發生了重大的變化。最終用戶的需求趨勢決定了產業的發展方向。

- 在技術創新和各類產業需求的推動下,市場不斷發展。智慧系統整合和輕量材料使用等趨勢正在重塑水利工程領域。隨著產業優先考慮效率、永續性和客製化,油壓設備將在推動全球進步的機器和系統方面發揮重要作用。

- 隨著汽車、金屬、建築和採礦等行業擴大採用自動化以及電子商務的興起,物料輸送設備市場有望成長。油壓設備對於改善設備功能、控制、動力和安全性變得越來越重要。因此,對物料輸送設備的需求不斷成長,推動了油壓設備市場的發展。

- 定期維護您的液壓系統對於確保最佳性能至關重要。這包括檢查液壓油位、更換密封件、檢查軟管和閥門等。然而,這些日常任務增加了企業經營成本。較高的維護成本可能會阻礙對油壓設備的投資,尤其是當有需要較少維護的替代方案時。此外,不銹鋼、鐵礦石、鋁、青銅等原料價格的波動也導致油壓設備價格的波動。

- 此外,馬達、閥門、油壓缸等關鍵部件需要大量的前期投資。這些前期成本會影響設備的整體擁有成本,最終降低工廠的利潤率。

油壓設備市場趨勢

物料輸送產業經歷顯著成長

- 流體傳輸解決方案在物料輸送越來越受歡迎。這個過程涉及移動、提升和定位產品、散裝材料和零件,主要是為了分配和保護成品。這個龐大的市場對於各行業的高效運作至關重要,確保產品在整個生命週期中都得到精心和精確的處理。

- 油壓設備是整個供應鏈中物料輸送的核心。它們促進產品的移動、儲存和控制,並實現複雜的移動序列。在配送中心和倉庫中尤其如此,液壓過程的精確性和可靠性對於保持貨物流動和最大限度地減少停機時間至關重要。

- 透過利用液壓技術,物流中心可以創造更安全、更有效率的工作環境。液壓為重型起重機械提供動力,改善員工的人體工學,並透過傳送系統支援快節奏的環境。例如,快速傳送包裝材料的輸送機不僅可以節省時間,還可以減輕工人的身體負擔,從而使勞動力更健康、更有效率。

- 在電子商務快速成長和物流進步的推動下,該行業的需求正在激增。作為最大的電子商務市場,美國對物料輸送解決方案的需求日益增加。美國人口普查局5月發布的報告強調了這一趨勢,指出2024年第二季美國零售電子商務銷售額達到2,916.4億美國,高於去年同期的2,728.2億美元。電子商務倉庫和配送中心擴大採用大量使用液壓的堆高機等物料輸送解決方案,這一趨勢代表著巨大的市場機會。

亞太地區實現強勁成長

- 在亞太地區,對物料輸送設備的需求不斷成長、對基礎設施建設的投資不斷增加以及降低整體設備成本的趨勢正在推動市場成長。液壓解決方案因其易於控制、緊湊、重量輕和可靠而受到青睞,正在迅速取代傳統方法而受到歡迎。如今,現代油壓設備廣泛應用於建築、屋頂、物料輸送、磚石、汽車、航空和製造等行業。

- 外國投資擴大轉向東南亞各地的基礎設施和建設計劃,增強了市場的前景。 2024年3月,澳洲政府宣布計畫投資13.3億美元用於東南亞基礎建設。同時,中國對東亞國家的資金捐贈也已超過500億美元,達到重要里程碑。

- 2024 年 3 月,德國承諾向菲律賓投資 40 億美元,旨在加強該國的基礎設施,特別是製造業和工廠自動化。同時,馬來西亞正在崛起成為東南亞重要的投資中心。這股資本的湧入將擴大對物料輸送設備的需求並推動市場成長。

- 此外,最近的舉措凸顯了印度成為先進電動車(EV)技術製造領跑者的雄心壯志。此舉符合印度在 2030 年實現 30% 新車電動化的目標,旨在吸引全球公司在快速成長的印度市場立足。鑑於這一發展趨勢,印度汽車市場預計將實現強勁成長,為研究領域創造更多機會。

油壓設備產業概況

油壓設備市場正在變成半固體。博世力士樂股份公司(羅伯特博世有限公司的一部分)、派克漢尼汾公司、HYDAC International GmbH、丹佛斯公司和 SMC 公司等知名供應商已在該行業經營很長時間。我們數十的經驗使我們對市場動態和新興需求有了深刻的了解。因此,這些公司不斷投資創新產品,增強內部生產流程,並提高產品的價值。

憑藉廣泛的地理覆蓋範圍和強大的品牌知名度,博世力士樂股份公司、派克漢尼汾公司、海德克國際有限公司和丹佛斯公司等公司佔據著有利地位,能夠保持主導市場地位。

品質認證、服務產品、定價和技術專長等關鍵因素對於贏得新契約至關重要。此外,隨著數位化趨勢的增強,對智慧油壓設備的需求正在增加,為新參與企業創造了有利可圖的市場機會。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 科技趨勢

- 產業價值鏈分析

- 宏觀經濟因素如何影響市場

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場動態

- 市場促進因素

- 物料輸送設備需求不斷增加

- 由於政府的措施和投資,建設產業的需求增加

- 市場挑戰/限制

- 設備使用壽命期間維護成本高昂

第6章 市場細分

- 按類型

- 泵浦

- 閥門

- 圓柱

- 馬達

- 過濾器和蓄能器

- 傳播

- 其他產品類型

- 按最終用戶產業

- 建造

- 農業

- 物料輸送

- 航太和國防

- 工具機

- 石油和天然氣

- 油壓機

- 塑膠

- 汽車

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Bosch Rexroth AG(Robert Bosch GmbH)

- Parker Hannifin Corporation

- HYDAC International GmbH

- Danfoss A/S

- SMC Corporation

- Festo SE

- Norgren Limited(IMI PLC)

- Bucher Hydraulics GmBH(Bucher Industries AG)

- HAWE Hydraulik SE

- Linde Hydraulics GmbH & Co. KG

- Caterpillar Inc.

- Corporation

- 供應商排名

- 供應商列表

第 8 章:市場的未來

The Hydraulic Equipment Market size is estimated at USD 43.67 billion in 2025, and is expected to reach USD 52.11 billion by 2030, at a CAGR of 3.6% during the forecast period (2025-2030).

The expansion of process industries, rising demand for material handling equipment, and the burgeoning construction sector are the primary drivers of the hydraulics market. Moreover, technological advancements are not only spurring the development of hydraulic equipment but also amplifying the demand for intelligent hydraulic solutions. For instance, while the IoT has predominantly been associated with electric systems, it's now making significant strides into fluid power systems. Modern hydraulic equipment increasingly integrates electronics for enhanced mobility and sensors for comprehensive data collection.

Key Highlights

- Responding to emerging trends, hydraulic equipment has evolved significantly. The dynamics of end-user demand have been instrumental in steering the industry's direction.

- Driven by technological innovations and varied industry demands, the market is perpetually evolving. Trends like smart system integration and the use of lightweight materials are reshaping the hydraulic engineering domain. With industries placing a premium on efficiency, sustainability, and customization, hydraulic equipment is poised to play a pivotal role in energizing the machinery and systems that drive global progress.

- As sectors such as automotive, metal, construction, and mining increasingly embrace automation and e-commerce rise in prominence, the material handling equipment market is set for growth. Hydraulics is becoming increasingly crucial in boosting equipment functions, controllability, power, and safety. As a result, the heightened demand for material handling equipment is propelling the hydraulics market.

- To ensure optimal performance, regular maintenance of hydraulic systems is essential. This encompasses checking fluid levels, replacing seals, and inspecting hoses and valves. Yet, these routine tasks contribute to a business's operational costs. Elevated maintenance expenses can deter companies from investing in hydraulic equipment, especially when alternatives with reduced maintenance demands are available. Moreover, fluctuations in raw material prices-such as stainless steel, iron ore, aluminum, and bronze-have introduced volatility in hydraulic equipment pricing.

- Furthermore, essential components like motors, valves, and hydraulic cylinders come with a hefty price tag, requiring a substantial initial investment. This upfront cost influences the overall ownership expenses of the equipment, ultimately tightening profit margins for factories.

Hydraulic Equipment Market Trends

Material Handling Segment to Witness Major Growth

- Fluid transfer solutions are increasingly being adopted in material handling. This process involves moving, lifting, and positioning products, bulk materials, and components, primarily for distribution and safeguarding finished goods. The vast market is crucial for the efficient operation of various industries, ensuring products are handled with care and precision throughout their lifecycle.

- Hydraulics are central to material handling across the supply chain. They facilitate the movement, storage, and control of products and enable intricate motion sequences. This is especially true in distribution centers and warehouses, where the accuracy and reliability of hydraulic processes are vital for maintaining the flow of goods and minimizing downtime.

- By leveraging hydraulics, distribution centers can create safer and more efficient work environments. Hydraulics empower machinery for heavy lifting, enhance employee ergonomics, and support swift-paced environments with conveyor systems. For example, a conveyor belt that quickly transports materials for packaging not only saves time but also reduces physical strain on workers, leading to a healthier and more productive workforce.

- Driven by the rapid growth of e-commerce and logistical advancements, this sector is witnessing a surge in demand. The United States, as the largest e-commerce market, is seeing heightened demand for material handling solutions. A report from the US Census Bureau in May 2024 highlighted this trend, noting that US retail e-commerce sales for Q2 2024 hit USD 291.64 billion, a rise from USD 272.82 billion in the same quarter the previous year. As e-commerce warehouses and distribution centers increasingly adopt material handling solutions-like forklifts, which prominently utilize hydraulics-these trends underscore significant market opportunities.

Asia Pacific to Register Major Growth

- In the Asia-Pacific region, rising demand for material handling equipment, increased investments in infrastructure development, and a trend toward reducing overall equipment costs are driving the market's growth. Hydraulic solutions, favored for their ease of control, compactness, lightweight nature, and reliability, have surged in popularity, outpacing traditional methods. Today, sectors such as construction, roofing, material handling, masonry, automotive, aviation, and manufacturing are all leveraging modern hydraulic equipment.

- Foreign investments are increasingly eyeing infrastructure and construction projects across Southeast Asia, bolstering the market's outlook. In March 2024, the Australian government unveiled a substantial USD 1.33 billion investment plan for Southeast Asian infrastructure. At the same time, China's financial commitments to East Asian nations have surpassed a significant milestone, exceeding USD 50 billion.

- In March 2024, Germany also made headlines with a notable USD 4 billion investment in the Philippines, aimed at bolstering the nation's infrastructure, especially in manufacturing and factory automation. Meanwhile, Malaysia is emerging as a key investment hub in Southeast Asia. These influxes of capital are poised to amplify the demand for material handling equipment, fueling market growth.

- Additionally, a recent initiative underscores India's ambition to establish itself as a frontrunner in advanced electric vehicle (EV) technology manufacturing. This move dovetails with India's target of electrifying 30% of its new vehicles by 2030 and aims to lure global firms to strengthen their foothold in India's burgeoning market. Given this trajectory, forecasts suggest robust growth for India's auto market, unlocking further opportunities in the studied domain.

Hydraulic Equipment Industry Overview

The hydraulic equipment market is semi-consolidated. Established vendors like Bosch Rexroth AG (a part of Robert Bosch GmbH), Parker Hannifin Corporation, HYDAC International GmbH, Danfoss A/S, and SMC Corporation have been in the industry for an extended period. Their longevity has granted them a deeper insight into market dynamics and emerging needs. As a result, these companies consistently channel investments into innovative products, enhancing their internal production processes and adding more value to their offerings.

Companies like Bosch Rexroth AG, Parker Hannifin Corporation, Hydac International GmbH, and Danfoss A/S, with their extensive geographical reach and strong brand recognition, are poised to uphold their dominant market presence.

Key factors such as quality certification, service offerings, pricing, and technical expertise are crucial in securing new contracts. Additionally, as digitization trends gain momentum, there's a rising demand for smart hydraulic equipment, presenting a lucrative opportunity for newcomers in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Technological Trends

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Macroeconomic Factors on the Market

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Material Handling Equipment

- 5.1.2 Increasing Demand From the Construction Industry via Government Initiatives and Investments

- 5.2 Market Challenges/Restraints

- 5.2.1 High Maintenance Cost Over the Equipment's Lifespan

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Pumps

- 6.1.2 Valves

- 6.1.3 Cylinders

- 6.1.4 Motors

- 6.1.5 Filters and Accumulators

- 6.1.6 Transmission

- 6.1.7 Other Product Types

- 6.2 By End-user Industry

- 6.2.1 Construction

- 6.2.2 Agriculture

- 6.2.3 Material Handling

- 6.2.4 Aerospace and Defense

- 6.2.5 Machine Tools

- 6.2.6 Oil and Gas

- 6.2.7 Hydraulic Press

- 6.2.8 Plastics

- 6.2.9 Automotive

- 6.2.10 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Bosch Rexroth AG (Robert Bosch GmbH)

- 7.1.2 Parker Hannifin Corporation

- 7.1.3 HYDAC International GmbH

- 7.1.4 Danfoss A/S

- 7.1.5 SMC Corporation

- 7.1.6 Festo SE

- 7.1.7 Norgren Limited (IMI PLC)

- 7.1.8 Bucher Hydraulics GmBH (Bucher Industries AG)

- 7.1.9 HAWE Hydraulik SE

- 7.1.10 Linde Hydraulics GmbH & Co. KG

- 7.1.11 Caterpillar Inc.

- 7.1.12 Corporation

- 7.2 Vendor Ranking

- 7.3 List of Vendors