|

市場調查報告書

商品編碼

1766344

工業液壓設備市場機會、成長動力、產業趨勢分析及2025-2034年預測Industrial Hydraulic Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

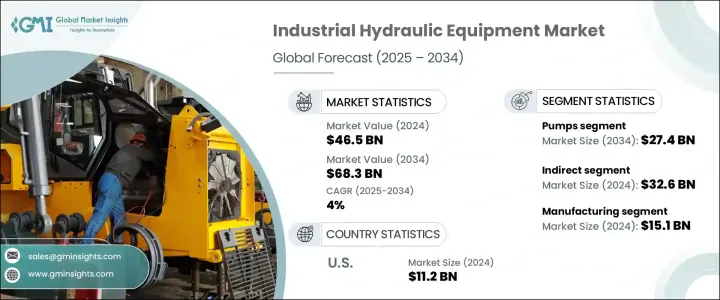

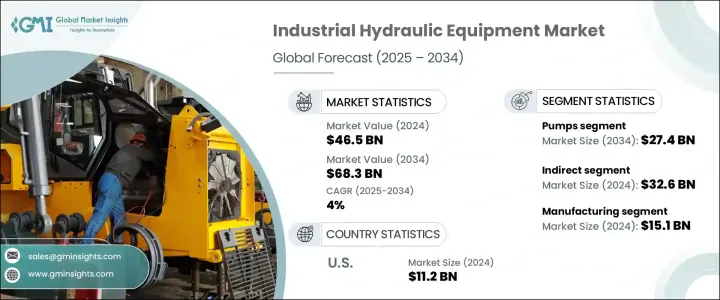

2024年,全球工業液壓設備市場規模達465億美元,預計2034年將以4%的複合年成長率成長,達到683億美元。工業4.0在工業設施中的日益普及,推動著液壓系統整合和應用方式的顯著轉變。透過整合感測器、物聯網模組和人工智慧預測技術等智慧組件,製造商正在提升液壓系統的運作能力。這些先進的解決方案能夠即時追蹤壓力、溫度和流體流量等關鍵參數,從而顯著改進預測性維護策略,最大限度地減少停機時間,並提高整體能源效率。因此,現代電液系統如今已能夠在全自動工業框架內無縫運行,使液壓技術成為智慧製造崛起的重要支柱。

在新興經濟體中,快速的城市發展正推動對重型建築和土方機械的需求激增。液壓系統在這些機械中不可或缺,為極端條件下的作業提供所需的動力和控制。隨著全球基礎設施項目的擴張,對起重機、挖土機和鑽井系統等設備的需求持續成長。這些機械依靠高性能液壓系統來確保精度、可靠性和耐用性。同時,各行各業也越來越重視能夠降低能耗、保障環境安全的永續替代方案。這一趨勢推動著生態高效液壓解決方案的創新,預計在未來幾年開闢新的成長途徑。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 465億美元 |

| 預測值 | 683億美元 |

| 複合年成長率 | 4% |

依產品類型分類,市場可分為泵浦、汽缸、馬達、閥門及其他。其中,泵類產品佔最大市場佔有率,預計2024年市場價值為185億美元,到2034年將達到274億美元。泵浦的廣泛應用源自於其將機械能轉化為液壓能的重要作用,而液壓能對各種工業應用都至關重要。從裝配線到起重系統和物料運輸作業,泵浦是固定和移動工業設備中流體動力系統的支柱。對高精度計量和節能的日益追求,推動了變數泵等先進技術的發展,這些技術能夠提高效率和動態控制能力。

在活躍的工業環境中,日常維護和零件更換週期也支撐了對液壓泵的持續需求。隨著老舊零件的使用壽命臨近,企業會持續投資於符合現代性能標準的更新、更有效率的液壓解決方案。涵蓋泵浦、缸、馬達、閥門等更廣泛的產品領域,其市場規模在 2024 年達到 326 億美元,預計在預測期內的複合年成長率將達到 3.4%。

推動該市場成長的另一個因素是間接分銷管道的擴張。越來越多的授權供應商、專業經銷商和數位平台正在提升產品在不同產業和地區的可及性。這些經銷商通常將核心液壓產品與相關工程服務(例如流體狀態監測、過濾套件和液壓油管理系統)捆綁銷售。這種一體化方案簡化了採購流程,並加強了客戶關係。此外,現場技術支援和即時產品演示進一步增強了工業買家的信心,使分銷商能夠保持強勁且具有競爭力的市場地位。

依最終用途產業細分,市場涵蓋製造業、建築業、林業和農業、採礦業、石油和天然氣、航太業、航空航太業等。製造業在2024年達到151億美元,預計2034年將以4.5%的複合年成長率成長。液壓系統在製造過程中發揮著至關重要的作用,尤其是在用於材料成型、金屬成型和高壓機械任務的設備中。隨著各行各業向全自動生產線邁進,液壓系統必須提供更高水準的回應能力、能源管理和一致性。自動化的推動增加了對整合液壓解決方案的需求,這些解決方案需要提供精確的控制、更短的循環時間和更低的營運成本。

從地區來看,美國引領北美工業液壓設備市場,2024 年市場規模達 112 億美元,預計到 2034 年複合年成長率將達到 3.8%。美國強大的工業基礎和持續的基礎設施投資使其成為區域市場成長的關鍵推動力。汽車製造、建築施工和物料搬運等行業對可靠性和智慧自動化功能的液壓系統的需求持續強勁。數位控制和智慧電液技術的日益普及,進一步推動了美國液壓設備供應商的創新,他們正在不斷擴大業務規模以滿足這一需求。

縱觀整個市場格局,企業正透過推出技術先進、節能高效且可客製化的液壓設備來滿足不斷變化的客戶期望。整合智慧控制功能、物聯網連接和預測性維護功能已成為滿足現代工業需求的核心策略。同時,更嚴格的全球能源和排放標準也迫使製造商採用更環保的設計原則。為了保持競爭力,企業不僅在豐富產品線,還在建立策略合作夥伴關係和進行收購,以擴大其在行動和工業自動化專業領域的影響力。這種持續的轉變正在重塑市場,使其朝著更智慧、更有效率、更環保的液壓系統發展。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 機會

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按產品

- 監理框架

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 波特五力分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- MEA

- 拉丁美洲

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021-2034

- 主要趨勢

- 泵浦

- 圓柱

- 馬達

- 閥門

- 其他

第6章:市場估計與預測:按最終用途產業,2021-2034 年

- 主要趨勢

- 製造業

- 建造

- 林業和農業

- 礦業

- 石油和天然氣

- 海洋

- 航太航太

- 其他

第7章:市場估計與預測:按配銷通路,2021-2034

- 主要趨勢

- 直接的

- 間接

第8章:市場估計與預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第9章:公司簡介

- Bosch Rexroth

- Bucher Hydraulics

- Caterpillar

- Danfoss

- Eaton

- HAWE Hydraulik

- Hitachi Construction Machinery

- HYDAC International

- Kawasaki Heavy Industries

- Komatsu

- KTI Hydraulics

- KYB

- Liebherr-International

- Mitsubishi Heavy Industries

- Parker-Hannifin

The Global Industrial Hydraulic Equipment Market was valued at USD 46.5 billion in 2024 and is estimated to grow at a CAGR of 4% to reach USD 68.3 billion by 2034. The growing adoption of Industry 4.0 across industrial facilities is driving a notable shift in how hydraulic systems are integrated and utilized. By incorporating intelligent components such as sensors, IoT-enabled modules, and AI-powered predictive technologies, manufacturers are enhancing the operational capabilities of hydraulic systems. These advanced solutions enable real-time tracking of essential parameters, including pressure, temperature, and fluid flow, which significantly improves predictive maintenance strategies, minimizes downtime, and boosts overall energy efficiency. As a result, modern electro-hydraulic systems now function seamlessly within fully automated industrial frameworks, establishing hydraulics as an essential pillar in the rise of smart manufacturing.

In emerging economies, rapid urban development is fueling a surge in demand for heavy-duty construction and earth-moving machinery. Hydraulic systems are indispensable in these machines, delivering the power and control required for operations under extreme conditions. As infrastructure projects expand globally, there is a continuous need for equipment such as cranes, excavators, and drilling systems. These machines depend on high-performance hydraulic systems for precision, reliability, and durability. In parallel, industries are increasingly focusing on sustainable alternatives that promote lower energy consumption and environmental safety. This trend is prompting innovation toward eco-efficient hydraulic solutions, which is expected to unlock new growth avenues in the years ahead.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $46.5 Billion |

| Forecast Value | $68.3 Billion |

| CAGR | 4% |

By product type, the market is segmented into pumps, cylinders, motors, valves, and others. Among these, the pump segment held the largest value share, estimated at USD 18.5 billion in 2024, and is projected to reach USD 27.4 billion by 2034. The widespread use of pumps stems from their fundamental role in converting mechanical energy into hydraulic power, which is vital across a variety of industrial applications. From assembly lines to lifting systems and material transport operations, pumps serve as the backbone of fluid power systems in both fixed and mobile industrial equipment. The increasing push for high-precision metering and energy conservation has led to the development of advanced technologies such as variable displacement pumps, which offer improved efficiency and dynamic control.

Consistent demand for hydraulic pumps is also supported by routine maintenance and part replacement cycles in active industrial environments. As older components reach the end of their service lives, businesses continue to invest in newer, more efficient hydraulic solutions that align with modern performance standards. The broader product segment, encompassing pumps, cylinders, motors, valves, and others, reached USD 32.6 billion in 2024 and is anticipated to grow at a CAGR of 3.4% during the forecast period.

Another factor contributing to the growth of this market is the expansion of indirect distribution channels. A growing number of authorized vendors, specialized dealers, and digital platforms are enhancing product accessibility across diverse industries and geographies. These distributors often bundle core hydraulic products with related engineering services such as fluid condition monitoring, filtration packages, and hydraulic fluid management systems. This all-in-one approach simplifies procurement and strengthens customer relationships. Additionally, on-ground technical support and real-time product demonstrations further reinforce confidence among industrial buyers, enabling distributors to maintain a resilient and competitive market presence.

When segmented by end-use industry, the market includes manufacturing, construction, forestry and agriculture, mining, oil and gas, marine, aerospace and aviation, and others. The manufacturing sector accounted for USD 15.1 billion in 2024 and is projected to grow at a CAGR of 4.5% through 2034. Hydraulics play a critical role in manufacturing operations, particularly in equipment used for material forming, metal shaping, and high-pressure mechanical tasks. As industries move toward fully automated production lines, hydraulic systems must deliver higher levels of responsiveness, energy management, and consistency. The push for automation has increased the demand for integrated hydraulic solutions that provide precise control, reduced cycle times, and lower operational costs.

Regionally, the United States led the North America industrial hydraulic equipment market, which was valued at USD 11.2 billion in 2024 and is forecast to expand at a CAGR of 3.8% through 2034. The country's robust industrial base and consistent investment in infrastructure development have made it a key contributor to regional market growth. Industries such as automotive manufacturing, building construction, and material handling continue to generate strong demand for hydraulic systems that offer reliability and intelligent automation features. The growing emphasis on digital control and smart electro-hydraulics is further fueling innovation across U.S.-based hydraulic equipment suppliers, who are increasingly scaling their operations to meet this demand.

Across the market landscape, companies are responding to evolving customer expectations by introducing technologically advanced, energy-efficient, and customizable hydraulic equipment. Integrating intelligent control features, IoT connectivity, and predictive maintenance capabilities has become a central strategy for meeting modern industrial demands. At the same time, stricter global energy and emissions standards are compelling manufacturers to adopt greener design principles. To stay competitive, businesses are not only diversifying their product lines but also forming strategic partnerships and acquisitions to expand their presence in specialized segments of mobile and industrial automation. This ongoing shift is reshaping the market, steering it toward more intelligent, efficient, and environmentally responsible hydraulic systems.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 End use industry

- 2.2.4 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory framework

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's five forces analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 MEA

- 4.2.1.5 LATAM

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Pumps

- 5.3 Cylinder

- 5.4 Motors

- 5.5 Valves

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By End Use Industry, 2021-2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Manufacturing

- 6.3 Construction

- 6.4 Forestry & agriculture

- 6.5 Mining

- 6.6 Oil & Gas

- 6.7 Marine

- 6.8 Aerospace & aviation

- 6.9 Others

Chapter 7 Market Estimates & Forecast, By Distribution Channel, 2021-2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Direct

- 7.3 Indirect

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034, ($Bn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 The U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 Saudi Arabia

- 8.6.2 UAE

- 8.6.3 South Africa

Chapter 9 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 9.1 Bosch Rexroth

- 9.2 Bucher Hydraulics

- 9.3 Caterpillar

- 9.4 Danfoss

- 9.5 Eaton

- 9.6 HAWE Hydraulik

- 9.7 Hitachi Construction Machinery

- 9.8 HYDAC International

- 9.9 Kawasaki Heavy Industries

- 9.10 Komatsu

- 9.11 KTI Hydraulics

- 9.12 KYB

- 9.13 Liebherr-International

- 9.14 Mitsubishi Heavy Industries

- 9.15 Parker-Hannifin