|

市場調查報告書

商品編碼

1689716

模塑纖維包裝:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Molded Fiber Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

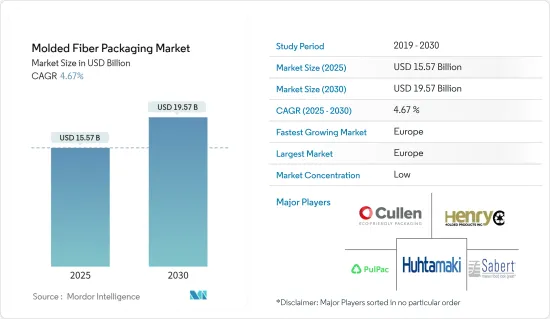

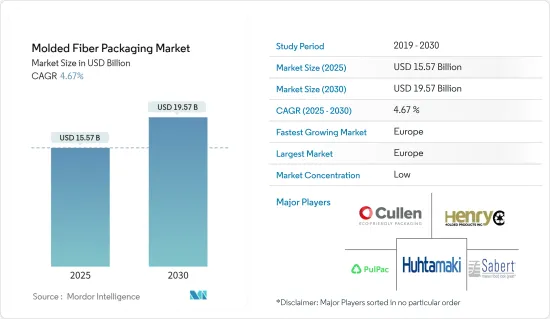

模塑纖維包裝市場規模預計在 2025 年為 155.7 億美元,預計到 2030 年將達到 195.7 億美元,預測期內(2025-2030 年)的複合年成長率為 4.67%。

由於對由可再生和可回收材料製成的永續包裝的需求不斷增加,纖維模塑包裝市場正受到越來越多的關注。

終端用戶產業需求不斷成長以及採用環保保護包裝解決方案等因素正在推動市場向前發展。小麥和甘蔗渣等非木質廢棄物擴大被用於生產紙漿。模塑纖維包裝以其保護性和永續性而聞名,常見於雞蛋盒、飲料托盤、電子保護包裝和食品容器等應用。

關鍵亮點

- 與十年前相比,今天的消費者更加意識到他們的購買選擇的長期影響。隨著環保意識的不斷增強,現今的消費者非常重視包裝的永續性。 Trivium Packaging 的最新報告《全球綠色採購報告》強調,超過 82% 的年輕消費者(44 歲以下)願意為永續包裝的產品支付溢價。此外,到 2023 年,40% 的飲料產品將採用永續包裝,其次是 30% 的食品產品。

- 為了應對日益嚴重的環境問題,世界各國政府正在實施嚴格的法規,限制一次性塑膠的使用,並支持環保替代品。尤其是在歐洲,這些法規不僅僅是合規;他們正在重塑該行業的包裝方式。歐盟委員會的包裝廢棄物指令強調了這一緊迫性,並設定了雄心勃勃的目標:到 2025 年 12 月實現 65% 的回收率,到 2030 年 12 月實現 70% 的回收率。政府的這項措施正在推動對纖維模塑包裝的需求。

- 此外,外帶、已調理食品和送貨宅配的需求激增,推動了符合嚴格衛生和永續性標準的紡織模塑泡殼、托盤和碗的興起。根據沙烏地阿拉伯統計總局的資料,食品和飲料服務活動的收益預計將在 2023 年達到 157.6 億美元,在 2025 年達到 160.3 億美元。

- 纖維模塑包裝市場的一個主要限制因素是確保原料(包括天然纖維和再生紙漿)的穩定和永續供應。這些原料的可用性和品質的變化可能會擾亂生產過程並影響產品品質。為了應對這項挑戰,生產商正致力於建立有彈性的供應鏈,尤其是在模製纖維產品需求激增的情況下。

- 該市場的另一個挑戰是高昂的初始製造成本。儘管模製纖維具有環保優勢,推出和維護製造過程的成本卻很高。這樣的成本可能會阻礙一些公司轉向纖維模塑包裝。隨著技術的進步和規模經濟的實現,預計這一經濟障礙將隨著時間的推移而減少。

- 總體而言,纖維模塑包裝市場對於推動全球包裝產業的永續發展至關重要。儘管面臨挑戰,但對環境目標的承諾和各個領域不斷成長的需求使市場具有巨大的成長潛力。此外,市場還將不斷發展,尤其是在增加對具有成本效益、高品質和多功能解決方案的研發投資的基礎上。此外,循環經濟原則,尤其是回收和減少廢棄物,可能會在引導市場成長軌跡方面發揮關鍵作用。

模塑纖維包裝市場趨勢

食品飲料將成為最大的終端使用者產業

- 隨著對環保和永續解決方案的需求不斷成長,模塑纖維產品正在食品領域逐漸取代塑膠。食品市場對包裝有嚴格的標準並要求遵守。對於食品領域的材料,除了拉伸性能和熱性能等基本強度規格外,增強的阻隔性也至關重要。

- 模製紙漿用於各種食品包裝,包括翻蓋式容器、外帶餐容器、雞蛋托盤、紙盒以及水果、蔬菜、漿果和蘑菇托盤。托盤尤其佔據了食品包裝市場的絕大部分。

- 這些雞蛋也被包裝在模製紙漿托盤或泡殼中,然後出售給餐廳、餐飲服務經營者和私人買家。世界人均雞蛋消費量每年持續增加。根據美國勞工統計局的數據,美國西部家庭的雞蛋消費量位居全國首位,平均每位消費者的雞蛋消費量為 109 美元。由於人口成長、人們對雞蛋健康益處的認知不斷提高以及對蛋白質的需求激增,雞蛋消費量正在上升。這一趨勢將刺激對模塑紙漿包裝產品的需求,並推動市場成長。

- 據加拿大農業和食品部稱,包裝食品銷售額預計到 2023 年將達到 20.2 億美元,到 2026 年將成長到 24.3 億美元。食品業的成長將加強該地區的纖維模塑包裝市場。

- 線上零售的快速成長推動了對保護性、輕質和永續包裝材料的需求。模塑纖維因其減震性能而成為最佳選擇。根據電子通訊辦公室的分析,波蘭的電子商務市場正在經歷令人矚目的成長,目標是到 2023 年達到 1,240 億茲羅提(311.7 億美元),到 2027 年達到 1,870 億茲羅提(470 億美元)。此外,波蘭中央統計局的資料顯示,網路購物購物者數量持續增加,預計到 2023 年,超過 64% 的受訪者將網路購物,比過去五年增加了近 20%。

- 隨著網路購物的興起,企業正在尋找耐用、經濟高效的包裝解決方案來保護運輸過程中的產品。根據國際貨幣基金組織(IMF)的預測,2024年沙烏地阿拉伯的整體零售額將達到1,556億美元。預計到2026年將增至約1765億美元。電子商務和食品宅配行業的快速成長預計將進一步推動對纖維模塑包裝解決方案的需求。

預計歐洲將主導市場

- 歐洲是模塑纖維包裝的一個非常重要的市場。工業國家,尤其是英國,擁有大量城市人口和高可支配收入。根據英國包裝聯合會的報告,英國包裝製造業年營業額達140億英鎊(178.5億美元),僱用員工約8萬人。此外,包裝產業正在經歷顯著成長,各產業投資的增加可望刺激市場需求。

- 在英國,日益增強的環保意識、監管壓力、技術進步和企業永續性目標正在推動人們轉向替代材料,尤其是纖維模塑包裝。食品服務業是模塑纖維市場的主要推動力,佔有相當大的佔有率。如今,模塑纖維包裝常見於雞蛋盒和其他食品包裝等產品。根據GOV.UK的數據,2024年第三季食用雞蛋產量與去年同期相比成長了7.2%。這些成長要素可能會推動市場擴張。

- 預計法國食品業的投資增加和成長也將推動市場成長。最近,法國消費者對永續和道德食品消費的興趣日益濃厚。因此,對本地生產和有機產品的需求正在飆升,同時人們對環保包裝的偏好越來越強烈。此外,人們明顯轉向以植物和素食為主的飲食習慣,證明人們對健康和環境問題的認知不斷提高。這一發展趨勢將對市場動態產生重大影響。

- 德國的包裝產業很大程度上受到食品業的服務。消費者優先考慮產品的便利性、保護性和易於運輸,這推動了對多樣化包裝解決方案的需求。對於乳製品、肉類和預製家常小菜等食品中的塑膠替代品尤其如此。此外,對一次性塑膠的嚴格監管和對永續包裝的不斷成長的需求進一步推動了市場成長。

- 此外,義大利電子產業的強勁成長將推動對市場解決方案的需求。義大利的半導體生產和銷售正在蓬勃發展,為模製纖維封裝公司提供了豐厚的利潤機會。 2024年,義大利電子產業將在全球市場創新和需求的推動下快速發展。義大利旨在透過策略推動鞏固在歐洲半導體產業的地位,並計劃今年在該領域投資約 100 億歐元(107 億美元)。這項重要措施將擴大市場機會。

模塑纖維包裝產業概況

市場呈現細分化,許多全球和地區參與企業爭奪主導地位。這些參與企業正努力透過創新、客製化和改進包裝美觀脫穎而出。例如,2024 年 4 月,乾模纖維技術先驅 PulPac 加入了印刷和造紙行業領先的倡導組織 Two Sides。 Palpac 為包裝生產商提供先進的製造技術,推廣永續包裝,滿足產業對可擴展性、快速生產和成本效益的需求。 PulPac 價格具有競爭力的基於纖維的解決方案使生產商能夠響應行業和地球對負責任包裝的呼籲,從而使他們成為其領域的領導者。

不斷變化的立法和消費者對永續性的偏好正在重塑包裝行業。隨著人們越來越認知到環保包裝的環境效益,對金屬、玻璃、塑膠和紙張等傳統材料的需求正在發生變化,人們明顯轉向更環保的替代品。

模塑纖維因其環保特性而成為包裝的首選。這種可堆肥包裝由可回收材料製成,最大限度地減少了我們對環境的影響。紙漿模塑包裝不僅具有生態效益,而且還有降低運輸成本、減少倉庫空間等經濟優勢。總體而言,競爭對手之間的競爭非常激烈,預計在預測期內將保持不變。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

- 按上市國家/地區分類的模塑纖維進出口分析

- 美國- 進出口分析

- 英國—進出口分析

- 法國——進出口分析

- 德國——進出口分析

- 義大利進出口分析

- 西班牙—進出口分析

- 中國進出口分析

- 日本——進出口分析

- 印度—進出口分析

- 巴西——進出口分析

- 墨西哥——進出口分析

- 阿拉伯聯合大公國—進出口分析

- 沙烏地阿拉伯—進出口分析

第5章市場動態

- 市場促進因素

- 消費者偏好轉向可回收和環保材料

- 可支配所得增加

- 最終用戶對可重複使用和永續包裝的需求不斷增加

- 市場問題

- 嚴格的政府法規

- 原料成本波動

第6章市場區隔

- 按類型

- 厚壁

- 轉移

- 熱成型

- 加工

- 按類型

- 濕的

- 乾燥

- 按最終用戶產業

- 飲食

- 電子產品

- 醫療保健

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 法國

- 德國

- 義大利

- 西班牙

- 亞洲

- 中國

- 日本

- 印度

- 澳洲和紐西蘭

- 拉丁美洲

- 巴西

- 墨西哥

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 北美洲

第7章競爭格局

- 公司簡介

- Huhtamaki Oyj

- Henry Molded Products Inc.

- Omni-PAC Group UK

- Cullen Packaging

- Brodrene Hartmann A/S

- Enviropak Corporation

- Heracles Packaging Company SA

- Sabert Corporation

- Keiding, Inc.

- International Paper

- PulPac AB

第8章 投資展望

第9章:市場的未來

The Molded Fiber Packaging Market size is estimated at USD 15.57 billion in 2025, and is expected to reach USD 19.57 billion by 2030, at a CAGR of 4.67% during the forecast period (2025-2030).

The molded fiber packaging market is witnessing heightened interest, driven by the increasing demand for sustainable packaging made from renewable and recyclable materials.

Factors such as a growing demand in end-user industries and the adoption of eco-friendly protective packaging solutions are propelling the market forward. Non-wood waste products, including wheat and bagasse, are increasingly used to produce pulp. Molded fiber packaging, known for its protective and sustainable attributes, is commonly found in applications like egg cartons, drink trays, electronic protective packaging, and food containers.

Key Highlights

- Today's consumers are more aware of the long-term implications of their purchasing choices than a decade ago. With heightened environmental concerns, modern consumers are emphasizing package sustainability significantly. A recent report by Trivium Packaging, the Global Buying Green Report, highlights that over 82% of younger consumers (aged 44 and under) are willing to pay a premium for sustainable packaging products. In addition, as of 2023, 40% of beverage products were bought in sustainable packaging, followed by 30% of food products.

- In response to rising environmental concerns, governments globally are implementing stringent regulations to curb single-use plastics and champion eco-friendly alternatives. These regulations, especially in Europe, are not just about compliance but are reshaping the industry's approach to packaging. The European Union (EU) Commission's Packaging and Packaging Waste Directive, with its ambitious recycling targets of 65% by December 2025 and 70% by December 2030, underscores the urgency. Such governmental pushes are bolstering the demand for molded fiber packaging.

- Furthermore, surging demand for takeout, ready-to-eat meals, and food delivery has driven the rise of molded fiber clamshells, trays, and bowls, all of which adhere to stringent hygiene and sustainability standards. Data from the General Authority for Statistics (Saudi Arabia) reveals that revenue from food and beverage service activities hit USD 15.76 billion in 2023, with projections reaching USD 16.03 billion by 2025.

- A significant limitation in the molded fiber packaging market is ensuring a steady and sustainable supply of raw materials, including natural fibers and recycled paper pulp. Variations in the availability and quality of these materials can disrupt production processes and compromise product quality. Producers are focusing on building resilient supply chains to address this challenge, especially given the surging demand for molded fiber packaging.

- Another challenge in this market is the high initial production costs. While molded fibers boast environmental benefits, the expenses associated with setting up and maintaining manufacturing processes can be substantial. Such costs might dissuade certain companies from transitioning to molded fiber packaging. Nevertheless, with technological advancements and the realization of economies of scale, this financial barrier is expected to diminish over time.

- Overall, the molded fiber packaging market is pivotal in promoting sustainable development within the global packaging industry. Despite facing challenges, its commitment to environmental objectives and a surging demand across various sectors position it as a market with immense growth potential. Further, the market is poised for evolution, driven by heightened investments in research and development, especially in crafting cost-effective, high-quality, and versatile solutions. In addition, principles of the circular economy, notably recycling and waste reduction, will be instrumental in steering the market's growth trajectory.

Molded Fiber Packaging Market Trends

Food and Beverages to be the Largest End-user Industry

- Molded fiber products are increasingly replacing plastics in the food sector, driven by a rising demand for eco-friendly and sustainable solutions. The food market imposes stringent standards on its packaging, necessitating compliance. Beyond basic strength specifications like tensile and thermal qualities, enhanced barrier properties are paramount for materials in the food sector.

- Molded pulp is used for various food packaging items, including clamshell containers, takeout meal containers, egg trays, cartons, and trays for fruits, vegetables, berries, and mushrooms. Notably, trays dominate the food packaging market.

- In addition, eggs are sold to restaurants, food service operators, and individual buyers after being packaged in molded pulp trays and clamshells. Global per capita egg consumption continues to rise annually. The Bureau of Labor Statistics reports that households in the Western U.S. lead the nation in egg spending, averaging USD 109 per consumer unit. With a growing population, heightened awareness of health benefits, and a surge in demand for protein, egg consumption is on the rise. This trend is set to boost the demand for molded pulp packaging products, driving market growth.

- According to Agriculture and Agri-Food Canada, the sales value of packaged foods was USD 2.02 billion in 2023 and is projected to grow to USD 2.43 billion by 2026. This growth in the food industry is set to bolster the market for molded fiber packaging in the region.

- The swift ascent of online retailing amplifies the demand for protective, lightweight, and sustainable packaging materials. Molded fiber stands out as an optimal choice due to its shock-absorption properties. Insights from the Office of Electronic Communications spotlight the Polish e-commerce market's impressive growth, achieving PLN 124 billion (USD 31.17 billion) in 2023 and eyeing a target of PLN 187 billion (USD 47 billion) by 2027. Moreover, data from the Central Statistical Office of Poland reveals a consistent uptick in online shoppers, with over 64% of those surveyed making online purchases in 2023, a nearly 20% surge over the past five years.

- With online shopping on the rise, businesses are looking for durable, cost-effective packaging solutions to safeguard products during transit. According to the International Monetary Fund (IMF), retail sales across Saudi Arabia were projected at USD 155.6 billion in 2024. Looking ahead, 2026 forecasts an uptick to approximately USD 176.5 billion. This burgeoning growth in the E-Commerce and Food Delivery Sectors is set to amplify the demand for molded fiber packaging solutions.

Europe is Expected to Dominate the Market

- Europe stands out as a pivotal market for molded fiber packaging. Industrialized nations, notably the United Kingdom, boast larger urban populations and elevated disposable incomes. The UK Packaging Manufacturing Industry, as reported by the Packaging Federation of the United Kingdom, generates annual sales of GBP 14 billion (USD 17.85 billion) and employs around 80,000 individuals, accounting for 3% of the nation's manufacturing workforce. Furthermore, with the packaging sector witnessing significant growth, heightened investments across various industries are poised to bolster market demand.

- In the UK, rising environmental awareness, regulatory pressures, technological advancements, and corporate sustainability goals are driving a shift towards alternative materials, notably molded fiber packaging. The food service industry is the primary driver of the molded fiber market, holding a significant share. Today, molded fiber packaging is commonly seen in products like egg cartons and other food packaging. According to GOV.UK, egg production for human consumption in Q3 2024 saw a 7.2% increase compared to the same quarter last year. Such growth factors could bolster the market's expansion.

- The increasing investments and growth in France's food sector are also expected to drive the market's growth. Recently, French consumers have shown an increasing interest in sustainable and ethical food consumption. Consequently, there's been a surge in demand for locally sourced and organic products, alongside a preference for eco-friendly packaging. Furthermore, a notable shift toward plant-based and vegetarian diets underscores a heightened awareness of health and environmental issues. This evolving trend is poised to influence market dynamics significantly.

- Germany's packaging industry is heavily utilized by the food sector. Consumers prioritize convenience, protection, and transport ease in products, fueling the demand for diverse packaging solutions. This is especially true for plastic alternatives in food items, notably in dairy, meat, and prepared meals. Additionally, stringent regulations on single-use plastics and a rising demand for sustainable packaging further propel the market's growth.

- Moreover, robust growth in Italy's electronics industry will drive the demand for market solutions. As Italy witnesses a surge in semiconductor production and sales, molded fiber packaging companies stand to gain lucrative opportunities. In 2024, Italy's electronics sector is rapidly evolving, spurred by global market innovations and demands. With a strategic push, Italy aims to cement its position in Europe's semiconductor landscape, channeling an investment of approximately EUR 10 billion (USD 10.7 billion) into the sector this year. These pivotal moves are set to amplify market opportunities.

Molded Fiber Packaging Industry Overview

The market is fragmented, with numerous global and regional players vying for dominance. These players strive to stand out through innovation, customization, and enhanced packaging aesthetics. For instance, in April 2024, PulPac, the trailblazers of Dry molded fiber technology, joined Two Sides, a leading advocacy group for the print and paper sector. PulPac empowers packaging producers with advanced manufacturing technology, promoting sustainable packaging that meets industry demands for scalability, swift production, and cost-effectiveness. With PulPac's competitively priced, fiber-based solutions, producers respond to the industry's and planet's call for responsible packaging and establish themselves as leaders in the field.

Legislative changes and a rising consumer inclination towards sustainability are reshaping the packaging sector. As the environmental benefits of eco-friendly packaging gain recognition, the demand for traditional materials like metal, glass, plastic, and paper is evolving, with a noticeable shift towards greener alternatives.

Molded fiber is a premier packaging choice due to its eco-friendly nature. Crafted from recycled materials, this compostable packaging boasts a minimal environmental footprint. Beyond its ecological advantages, molded pulp packaging offers economic benefits, such as reduced transportation costs and space-saving warehouse designs. Overall, competitive rivalry is expected to be high and to remain the same during the forecast period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Import Export Analysis of Molded Fiber for Listed Countries

- 4.4.1 United States - Import and Export Analysis

- 4.4.2 United Kingdom - Import And Export Analysis

- 4.4.3 France - Import and Export Analysis

- 4.4.4 Germany - Import and Export Analysis

- 4.4.5 Italy - Import and Export Analysis

- 4.4.6 Spain - Import and Export Analysis

- 4.4.7 China - Import and Export Analysis

- 4.4.8 Japan - Import and Export Analysis

- 4.4.9 India - Import and Export Analysis

- 4.4.10 Brazil - Import and Export Analysis

- 4.4.11 Mexico - Import and Export Analysis

- 4.4.12 United Arab Emirates - Import and Export Analysis

- 4.4.13 Saudi Arabia - Import and Export Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Shift in Consumer Preferences Toward Recyclable and Eco-friendly Materials

- 5.1.2 Growing Disposable Income

- 5.1.3 Augmented Demand For Reusable and Sustainable Packaging From End-users

- 5.2 Market Challenges

- 5.2.1 Strict Government Rules and Regulations

- 5.2.2 Fluctuations in the Cost of Raw Materials

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Thick wall

- 6.1.2 Transfer

- 6.1.3 Thermoformed

- 6.1.4 Processed

- 6.2 By Formal Type

- 6.2.1 Wet

- 6.2.2 Dry

- 6.3 By End-user Industry

- 6.3.1 Food and Beverages

- 6.3.2 Electronics

- 6.3.3 Healthcare

- 6.3.4 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 France

- 6.4.2.3 Germany

- 6.4.2.4 Italy

- 6.4.2.5 Spain

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.5.1 Brazil

- 6.4.5.2 Mexico

- 6.4.6 Middle East and Africa

- 6.4.6.1 United Arab Emirates

- 6.4.6.2 Saudi Arabia

- 6.4.6.3 South Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Huhtamaki Oyj

- 7.1.2 Henry Molded Products Inc.

- 7.1.3 Omni-PAC Group UK

- 7.1.4 Cullen Packaging

- 7.1.5 Brodrene Hartmann A/S

- 7.1.6 Enviropak Corporation

- 7.1.7 Heracles Packaging Company SA

- 7.1.8 Sabert Corporation

- 7.1.9 Keiding, Inc.

- 7.1.10 International Paper

- 7.1.11 PulPac AB