|

市場調查報告書

商品編碼

1740996

模塑紙漿包裝市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Molded Pulp Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

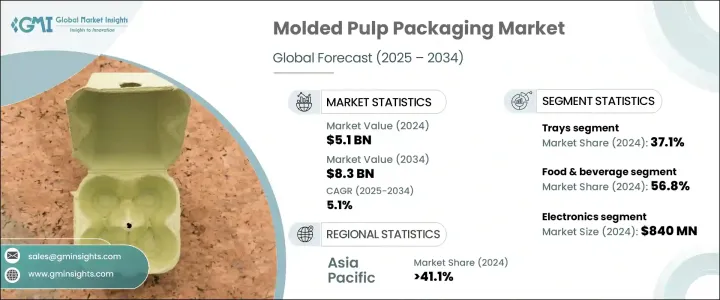

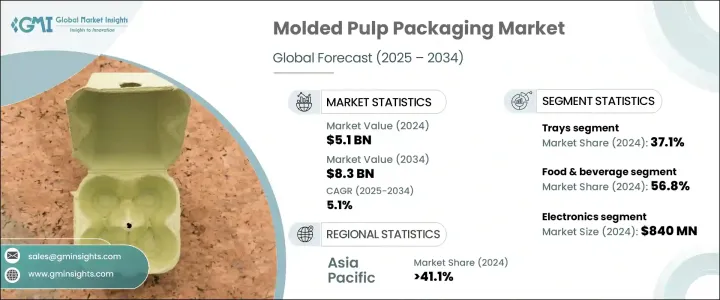

2024年,全球模塑紙漿包裝市場規模達51億美元,預計到2034年將以5.1%的複合年成長率成長,達到83億美元。推動這一成長的因素包括:全球日益轉向永續包裝解決方案,以及全球減少環境浪費的努力。隨著一次性塑膠製品監管趨嚴,消費者環保意識增強,對可生物分解和可回收替代品的需求持續成長。由可再生纖維材料製成的模塑紙漿包裝正在各行各業中日益流行,為傳統塑膠包裝提供了一種永續的替代方案。這種材料的可堆肥性和可回收性使其成為致力於實現環保目標和提升環保形象的品牌的首選。

由於塑膠使用限制日益增多,尤其是在電子商務和零售領域,紙漿模塑包裝市場也呈現強勁成長動能。這些限制措施正促使企業尋求環保包裝解決方案。支持綠色替代品的國家和國際政策進一步加速了該市場的採用,例如美國進口關稅等貿易政策鼓勵國內採購紙漿,有助於加強本地供應鏈。這一趨勢可能會減少對外國供應商的依賴,使區域紙漿生產商受益,尤其是在進口成本持續上升的情況下。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 51億美元 |

| 預測值 | 83億美元 |

| 複合年成長率 | 5.1% |

在產品類型中,紙漿模塑托盤已成為主導細分市場,預計到2024年將創造19億美元的市場價值。受其防護性能和環保理念的驅動,該細分市場預計將以5.2%的複合年成長率成長。隨著各行各業朝著更永續的營運模式發展,對紙漿模塑托盤的需求預計將持續成長,從而推動該細分市場的成長。

食品和飲料產業也是市場擴張的主要驅動力,2024 年其市值將達到 29 億美元。預計到 2034 年,該產業的複合年成長率將達到 4.9%。為了符合監管法規並滿足注重環保的消費者的需求,該行業擴大採用紙漿模塑包裝。隨著企業優先考慮永續性,他們提升了消費者忠誠度,並鼓勵在食品相關應用中繼續採用紙漿模塑包裝。

亞太地區在2024年佔了41.1%的市場佔有率,預計複合年成長率將達到5.6%。快速的工業化進程、蓬勃發展的電子商務產業以及中國、印度、日本和東南亞等主要市場對永續包裝的認知不斷提高,正在推動對紙漿模塑替代塑膠的需求。原料供應充足、生產成本較低以及大規模生產能力進一步增強了該地區的競爭優勢。

Huhtamaki、Eco Pulp Packaging、Dart Container Corporation、Henry Molded Products Inc.、Pactiv Evergreen Inc. 和 UFP Technologies, Inc. 等領先的市場參與者正致力於拓展產品線並投資自動化,以滿足日益成長的需求。與零售商和快速消費品品牌建立的策略合作夥伴關係正在增強其分銷網路,而對永續創新和可生物分解材料的投資則有助於其鞏固市場地位。此外,這些公司正在進軍新的區域市場,並積極回應循環經濟計劃,以提升品牌的長期價值。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 供應商矩陣

- 利潤率分析

- 技術與創新格局

- 專利分析

- 重要新聞和舉措

- 產業衝擊力

- 成長動力

- 電子商務擴大採用永續包裝

- 醫療保健包裝產業的採用率不斷提高

- 促進環保包裝的法規日益增多

- 消費者對環境影響的意識不斷提高

- 新興市場永續實踐的出現

- 產業陷阱與挑戰

- 生產週期長

- 來自生物塑膠的競爭

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

- 未來市場趨勢

- 監管格局

第4章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 托盤

- 蛤殼

- 杯子和碗

- 盤子

- 其他

第5章:市場估計與預測:按成型技術,2021 - 2034 年

- 主要趨勢

- 厚壁成型

- 傳遞模塑

- 熱成型紙漿

- 加工紙漿

第6章:市場估計與預測:按最終用途產業,2021 - 2034 年

- 主要趨勢

- 食品和飲料

- 電子產品

- 衛生保健

- 汽車

- 化妝品和個人護理

- 其他

第7章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 日本

- 中國

- 印度

- 韓國

- 澳新銀行

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 拉丁美洲其他地區

- 中東和非洲

- 南非

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 中東和非洲其他地區

第8章:公司簡介

- Best Plus Pulp Factory

- buhl-paperform GmbH

- CKF Inc.

- Dart Container Corporation

- Eco Pulp Packaging

- EnviroPAK

- Green Pack.

- Hartmann Packaging

- Henry Molded Products Inc.

- Huhtamaki

- HZ Green Pulp Sdn Bhd

- Keiding, Inc.

- Pacific Pulp Molding, Inc

- Pactiv Evergreen Inc.

- Primapack

- Sabert Corporation

- UFP Technologies, Inc.

- Western Pulp Products Company

The Global Molded Pulp Packaging Market was valued at USD 5.1 billion in 2024 and is projected to grow at a CAGR of 5.1% to reach USD 8.3 billion by 2034. This growth is being driven by the increasing shift toward sustainable packaging solutions alongside a global effort to reduce environmental waste. As stricter regulations on single-use plastics take hold and consumers become more environmentally conscious, the demand for biodegradable and recyclable alternatives continues to rise. Molded pulp packaging, made from renewable fiber-based materials, is gaining traction across various industries, offering a sustainable alternative to traditional plastic packaging. This material's compostability and recyclability make it the preferred choice for brands aiming to meet their environmental goals and bolster their eco-friendly image.

The molded pulp packaging market is also experiencing substantial momentum due to growing restrictions on plastic use, particularly in the e-commerce and retail sectors. These restrictions are pushing companies toward eco-friendly packaging solutions. National and international policies favoring green alternatives are further accelerating the market's adoption, with trade policies, like import tariffs in the U.S., helping to strengthen local supply chains by encouraging domestic sourcing of pulp. This trend could reduce reliance on foreign suppliers, benefiting regional pulp producers, especially if import costs continue to rise.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.1 Billion |

| Forecast Value | $8.3 Billion |

| CAGR | 5.1% |

Among product types, molded pulp trays have become a dominant segment, generating USD 1.9 billion in 2024. This segment is expected to grow at a CAGR of 5.2%, driven by the trays' protective properties and eco-conscious appeal. As industries move toward more sustainable operations, demand for molded pulp trays is expected to increase, fueling segment growth.

The food and beverage industry, valued at USD 2.9 billion in 2024, is also a major driver of market expansion. Projected to grow at a CAGR of 4.9% through 2034, the sector is increasingly adopting molded pulp packaging to comply with regulatory mandates and cater to environmentally aware consumers. As companies prioritize sustainability, they enhance consumer loyalty and encourage the continued adoption of molded pulp packaging in food-related applications.

The Asia Pacific region, which held a 41.1% share of the market in 2024, is forecasted to grow at a CAGR of 5.6%. Rapid industrialization, a booming e-commerce sector, and heightened awareness of sustainable packaging in key markets such as China, India, Japan, and Southeast Asia are driving demand for molded pulp alternatives to plastic. The region's competitive edge is further strengthened by the availability of raw materials, lower production costs, and large-scale manufacturing capabilities.

Leading market players such as Huhtamaki, Eco Pulp Packaging, Dart Container Corporation, Henry Molded Products Inc., Pactiv Evergreen Inc., and UFP Technologies, Inc. are focusing on expanding their product lines and investing in automation to meet growing demand. Strategic partnerships with retailers and FMCG brands are enhancing their distribution networks, while investments in sustainable innovations and biodegradable materials are helping them solidify their market position. Additionally, these companies are entering new regional markets and aligning with circular economy initiatives to foster long-term brand value.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates & calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Vendor matrix

- 3.4 Profit margin analysis

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news and initiatives

- 3.8 Industry impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Growing adoption of sustainable packaging in e-commerce

- 3.8.1.2 Increased adoption by healthcare packaging sectors

- 3.8.1.3 Rising regulations promoting eco-friendly packaging

- 3.8.1.4 Rising consumer awareness of environmental impacts

- 3.8.1.5 Emergence of sustainable practices in emerging markets

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 Lengthy production cycles

- 3.8.2.2 Competition from bioplastics

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

- 3.12 Future market trends

- 3.13 Regulatory landscape

Chapter 4 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Bn & Kilo Tons)

- 4.1 Key trends

- 4.2 Trays

- 4.3 Clamshells

- 4.4 Cups and bowls

- 4.5 Plates

- 4.6 Others

Chapter 5 Market Estimates and Forecast, By Molding Technology, 2021 - 2034 (USD Bn & Kilo Tons)

- 5.1 Key trends

- 5.2 Thick-Wall molding

- 5.3 Transfer molding

- 5.4 Thermoformed pulp

- 5.5 Processed pulp

Chapter 6 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Bn & Kilo Tons)

- 6.1 Key trends

- 6.2 Food & beverage

- 6.3 Electronics

- 6.4 Healthcare

- 6.5 Automotive

- 6.6 Cosmetics & personal care

- 6.7 Others

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Bn & Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Rest of Europe

- 7.4 Asia Pacific

- 7.4.1 Japan

- 7.4.2 China

- 7.4.3 India

- 7.4.4 South Korea

- 7.4.5 ANZ

- 7.4.6 Rest of Asia Pacific

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Rest of Latin America

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 UAE

- 7.6.3 Saudi Arabia

- 7.6.4 Rest of Middle East and Africa

Chapter 8 Company Profiles

- 8.1 Best Plus Pulp Factory

- 8.2 buhl-paperform GmbH

- 8.3 CKF Inc.

- 8.4 Dart Container Corporation

- 8.5 Eco Pulp Packaging

- 8.6 EnviroPAK

- 8.7 Green Pack.

- 8.8 Hartmann Packaging

- 8.9 Henry Molded Products Inc.

- 8.10 Huhtamaki

- 8.11 HZ Green Pulp Sdn Bhd

- 8.12 Keiding, Inc.

- 8.13 Pacific Pulp Molding, Inc

- 8.14 Pactiv Evergreen Inc.

- 8.15 Primapack

- 8.16 Sabert Corporation

- 8.17 UFP Technologies, Inc.

- 8.18 Western Pulp Products Company