|

市場調查報告書

商品編碼

1689690

工程服務-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Engineering Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

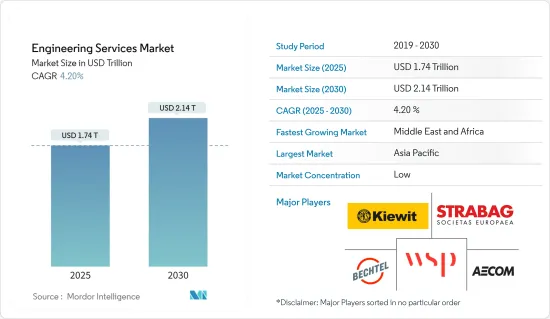

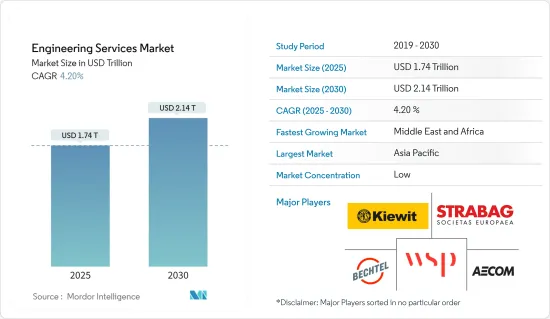

工程服務市場規模預計在 2025 年達到 1.74 兆美元,預計到 2030 年將達到 2.14 兆美元,預測期內(2025-2030 年)的複合年成長率為 4.2%。

關鍵亮點

- 市場規模代表市場參與企業提供的各種服務所產生的收益,例如產品工程、程式工程、自動化相關服務、資產管理相關服務等。

- 基礎設施需求是工程服務業的主要驅動力,因為它創造了對專業技能的需求並鼓勵技術創新。基礎設施計劃通常規模龐大且複雜,需要工程服務供應商來設計、規劃和執行這些計劃,從而為客戶提供增值服務。此外,對基礎設施的需求正在推動工程服務領域的創新,供應商正在創造新的、更有效的方式來設計和建立基礎設施。

- 根據美國人口普查局的數據,美國新基礎建設總價值將從2022年10月的18,083.4億美元增加到2023年2月的18,441億美元。基礎設施的成長推動了工程服務供應商提陞技能並與其他提供者和相關人員互動以滿足客戶需求的需求。

- 人工智慧、物聯網和雲端運算等數位技術的採用也在推動市場的發展。這些技術用於即時收集、處理和分析大量資料,以做出更好的決策。建築設計和工程服務正在被新技術所改變。工程企業必須考慮並接受這些相關創新才能保持競爭力。根據 Deltek 的研究,目前 25% 的建築和工程公司認為自己已經實現了數位化先進,76% 的公司預計在五年內將實現數位化先進。

- 然而,政府、法律和監管變化以及地緣政治衝突等政治動盪可能會為企業和投資者帶來不確定性,從而減少對工程相關服務的投資和需求,阻礙市場成長。

- 新冠疫情凸顯了永續性的必要性,服務供應商幫助客戶實施節能建築、循環經濟計劃和可再生能源。儘管面臨人事費用上升、供應鏈中斷等障礙,但預計後疫情時代該產業仍將繼續穩定發展。

工程服務市場趨勢

汽車領域佔據主要市場佔有率

- 隨著汽車OEM不斷開發乘用車和商用車的電子產品和軟體以在競爭中脫穎而出,對先進連接功能創新的需求不斷成長,推動了市場研究。

- 此外,對 ADAS 的需求不斷成長以提高車輛安全性,以及政府規定必須在新車上安裝 ADAS,進一步推動了市場成長。例如,歐洲將於2022年7月推出新法規,強制要求新車配備ADAS(高級駕駛輔助系統),以提高道路安全性。最新的安全法規將有助於保護整個歐盟的乘客、騎自行車的人和行人,預計到 2038 年將挽救超過 25,000 人的生命,並防止至少 140,000 起嚴重傷害。

- 預計對提供車輛功能遠端控制、網際網路連接和高級安全功能等智慧功能的聯網汽車的需求將進一步推動市場成長。汽車OEM正在與各個公司合作,以加速連網汽車的發展。例如,2022 年 12 月,保時捷工程公司與沃達豐商業公司合作,在納爾多技術中心 (NTC) 建置歐洲首個 5G 混合行動專用網路 (MPN)。

- 此外,隨著電動車在全球範圍內越來越受歡迎以及電動車充電基礎設施的部署,市場成長預計將進一步增加。根據國際能源總署 (IEA) 的數據,電動車持有(不包括二輪車和三輪車)預計將從 2022 年的 3,000 多萬輛成長到 2030 年的 2.4 億輛左右,平均成長率約為 30%。

- 此外,市場上的供應商正在進行各種策略性投資。例如,2023 年 1 月,Cognizant 同意收購物聯網軟體工程服務供應商 Mobica。此次收購預計將擴大 Cognizant 在科技和汽車產業的物聯網內建軟體工程能力。

亞太地區預計將佔據主要市場佔有率

- 中國擁有全世界最大的建築業。政府法規和政策對該行業有重大影響。由於房地產市場危機,預計2022-2023年住宅和非住宅建築行業發展將較低。獎勵策略帶來的基礎設施投資可能會在未來幾年支持整體工業發展。

- 據 ITA 稱,日本製造商正在數位基礎設施計劃上投資約 8.9 億美元。預計到2030年,這些日本製造商將在數位基礎設施上投資41億美元。過去十年,高附加價值製造業貢獻了日本GDP的20%以上。在日本,採用新製造技術來更新製造設備,特別是工業工具機的資本投資正在逐步發展,預計將繼續穩步擴大。

- 此外,根據ITA,印度也制定了長期和中期可再生能源目標。預計2023年可再生能源發電量將達到175吉瓦,2030年將達到500吉瓦。

- 此外,印度政府在 2023-24 年聯邦預算中為化學和石化部撥款 17.345 億印度盧比(2,093 萬美元)。印度政府對石油和天然氣產業的投資增加了該國對工程服務的需求。

- 總體而言,由於強勁多元化的經濟、訓練有素的勞動力、不斷增加的政府舉措、基礎設施投資和全球化等多種因素,工程服務市場預計在未來幾年將會成長。

工程服務業概況

全球工程服務市場高度分散,擁有數十年商業經驗的本地公司和跨國公司都在爭奪市場佔有率。市場上一些主要的參與企業包括 AECOM 工程公司、Bechtel 公司、Kiewit 公司、WSP Global 公司和 STRABAG SE。該市場的參與企業正在採取合作和收購等策略來增強其服務產品並獲得永續的競爭優勢。

北美學生交通服務公司 First Student 於 2023 年 3 月選擇了 Bechtel Corporation 來繼續其電氣化工作。此次夥伴關係的重點是未來更大規模的電動車部署,由 Bechtel 提供工程、採購和施工服務。該公司已訂單多項合約以滿足其不斷擴大的基本客群。

2023 年 5 月,KSB 和 KSB SupremeServ North America 宣布成立新的工程服務部門,策略性地滿足日益成長的業務需求。新集團包括產品開發、應用工程、自動化數位化、諮詢、備件、技術文件、技術培訓、許可和保固管理。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業相關人員分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場動態

- 市場促進因素

- 工業IoT的演變

- 由於全部區域快速都市化,土木工程服務的成長正在推動整個市場

- 市場限制

- 政治和熟練專業人員的短缺

- COVID-19對工程服務供應鏈分佈的影響

第6章 重大技術投入

- 雲端技術

- 人工智慧

- 網路安全

- 數位服務

第7章市場區隔

- 按工程部門

- 土木工程

- 機器

- 電

- 管道和結構

- 按部署模型

- 海上

- 現場

- 按服務

- 產品工程

- 程式工程

- 自動化相關服務

- 資產管理相關服務

- 按行業

- 航太與國防

- 車

- 化工和石化

- 發電

- 公共工程

- 礦業

- 石油和天然氣

- 製藥

- 運輸

- 通訊

- 核能計劃

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 拉丁美洲

- 巴西

- 阿根廷

- 其他拉丁美洲

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 北美洲

第8章競爭格局

- 公司簡介

- AECOM Engineering company

- Bechtel Corporation

- Kiewit Corporation

- WSP Global Inc

- STRABAG SE

- NV5 Global, Inc.

- Barton Malow

- Gilbane Building Company

- Jones Lang LaSalle Incorporated

- Balfour Beatty Inc.

- Brasfield & Gorrie LLC

- Nearby Engineers

- RMF Engineering Inc.

第9章投資分析

第10章 市場機會與未來趨勢

The Engineering Services Market size is estimated at USD 1.74 trillion in 2025, and is expected to reach USD 2.14 trillion by 2030, at a CAGR of 4.2% during the forecast period (2025-2030).

Key Highlights

- The market size represents the revenue generated from various types of services, such as product engineering, process engineering, automation-related services, and asset management-related services, offered by market players.

- Infrastructure demand is a significant driver of the engineering services industry since it creates a need for specialized skills and encourages innovation. Infrastructure projects are often vast and complicated, necessitating the need for engineering service providers to design, plan, and execute these projects, thereby delivering value-added services to their customers. Furthermore, the need for infrastructure is pushing innovation in the engineering services sector as suppliers create new, more efficient methods of designing and building infrastructure.

- The value of all new infrastructure buildings in the United States reached USD 1844.10 billion in February 2023, up from USD 1808.34 billion in October 2022, according to the US Census Bureau. Growing infrastructure is increasing the need for engineering service providers to increase their skills and interact with other providers and stakeholders to satisfy the demands of clients.

- The use of digital technologies such as AI, iot, and cloud computing also drives the market. These technologies are used to gather, process, and analyze massive volumes of data in real-time to make better decisions. Architectural design and engineering services are being transformed by new technology. Engineering businesses must examine and adopt these relevant technological innovations to remain competitive. According to Deltek's research, 25% of architectural and engineering businesses perceive their firms to be digitally advanced now, while 76% anticipate it to be in five years.

- However, political insecurity, such as changes in government, laws, and regulations or geopolitical conflicts, can cause uncertainty for businesses and investors, lowering investment and demand for services related to engineering and stifling market growth.

- The COVID-19 pandemic highlighted the need for sustainability, with service providers assisting customers in implementing energy-efficient buildings, circular economy projects, and renewable energy. Despite obstacles, including growing labor costs and supply chain interruptions, the industry is expected to develop steadily in the post-pandemic era.

Engineering Services Market Trends

Automotive Sector Holds Major Market Share

- With the rising demand for innovation in advanced connectivity features, automotive OEMs are regularly developing electronics and software for passenger and commercial vehicles to stay ahead of their competitors, which is driving the market study.

- Moreover, the increasing demand for ADAS for vehicle safety and government regulations for the mandatory use of ADAS in new vehicles are further boosting market growth. For instance, in July 2022, a new set of European rules were introduced, requiring new vehicles to be equipped with mandatory advanced driver-assist systems to improve road safety. The latest safety regulations are expected to help protect passengers, cyclists, and pedestrians across the European Union and are expected to save more than 25,000 lives and avoid at least 140,000 severe injuries by 2038.

- The demand for connected vehicles that offer smart features such as remote operation of vehicle functions, internet connectivity, and advanced security features is further anticipated to boost market growth. Automotive OEMs are collaborating with various firms to accelerate the advancement of connected vehicles. For instance, in December 2022, Porsche Engineering partnered with Vodafone Business to establish Europe's first 5G hybrid mobile private network (MPN) at Nardo Technical Center (NTC).

- Moreover, the increasing adoption of electric vehicles globally and the deployment of EV charging infrastructure are expected to further boost market growth. According to the International Energy Agency (IEA), the total EV fleet (excluding two- and three-wheelers) is anticipated to increase from over 30 million in 2022 to approximately 240 million by 2030, attaining an average growth rate of about 30%.

- Moreover, the market is witnessing various strategic investments by vendors to innovate their offerings. For instance, in January 2023, Cognizant agreed to acquire Mobica, an IoT software engineering services provider. The acquisition is expected to expand Cognizant's IoT-embedded software engineering capabilities across the technology and automotive industries.

Asia-Pacific is Expected to Hold Significant Market Share

- China has the largest construction sector in the world. Government rules and policies have had a significant influence on this sector. Due to the property market crisis, low development was expected in the residential and non-residential building sectors in 2022-2023. Infrastructure investment generated by the stimulus is likely to support the industry's overall development over the next few years.

- According to ITA, Japanese manufacturers have invested almost USD 890 million in digital infrastructure initiatives. These Japanese manufacturers are expected to have invested a total of USD 4.1 billion in digital infrastructure improvements by 2030. In Japan, value-added manufacturing has contributed over 20% of GDP over the last decade. Capital investments in Japan to update manufacturing facilities, particularly industrial machine tools, by adopting new manufacturing technologies have developed gradually and are expected to continue to expand steadily.

- Moreover, according to ITA, India has set determined renewable energy goals for the long and medium term. The nation expects to develop 175 GW of renewable power capacity in 2023 and 500 GW by 2030.

- Furthermore, the government assigned INR 173.45 crore (USD 20.93 million) to the Department of Chemicals and Petrochemicals in the Union Budget 2023-24. The Indian government's investment in the oil and gas industry is increasing the country's need for engineering services.

- Overall, the market for engineering services is expected to rise in the future as a result of several factors, including a robust and diverse economy, a trained workforce, a rise in government initiatives, infrastructure investment, and globalization.

Engineering Services Industry Overview

The global engineering services market is highly fragmented, with local and multinational firms having decades of business expertise and competing for market share. Some of the major players in the market are AECOM Engineering Company, Bechtel Corporation, Kiewit Corporation, WSP Global Inc., and STRABAG SE, among others. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their service offerings and gain a sustainable competitive advantage.

First Student, a provider of student transportation services in North America, chose Bechtel Corporation in March 2023 to continue its electrification efforts. The partnership is focused on more EV deployments in the future, with Bechtel providing engineering, procurement, and construction services. The company has been receiving various contracts to cater to its growing customer base.

May 2023: KSB and KSB SupremeServ North America announced the introduction of a new engineering services division strategically prepared to meet business growth demand. The new group contains product development, application engineering, automation and digitization, consultancy, spare parts, technical documentation, technical training, licenses, and warranty management.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Stakeholder Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Evolution of Industrial IoT

- 5.1.2 Increasing Civil Engineering Services Due to Rapid Urbanization Throughout the Region to Drive the Overall Market

- 5.2 Market Restraints

- 5.2.1 Political Problems and Lack of Skilled Professionals

- 5.3 Impact of COVID-19 in Supply Chain Distribution of Engineering Services

6 KEY TECHNOLOGY INVESTMENTS

- 6.1 Cloud Technology

- 6.2 Artificial Intelligence

- 6.3 Cyber Security

- 6.4 Digital Services

7 MARKET SEGMENTATION

- 7.1 By Engineering Disciplines

- 7.1.1 Civil

- 7.1.2 Mechanical

- 7.1.3 Electrical

- 7.1.4 Piping and Structural

- 7.2 By Delivery Model

- 7.2.1 Offshore

- 7.2.2 Onsite

- 7.3 By Services

- 7.3.1 Product Engineering

- 7.3.2 Process Engineering

- 7.3.3 Automation Related Services

- 7.3.4 Asset Management Related Services

- 7.4 By Industries

- 7.4.1 Aerospace and Defense

- 7.4.2 Automotive

- 7.4.3 Chemical and Petrochemical

- 7.4.4 Electric Power Generation

- 7.4.5 Municipal Utility Projects

- 7.4.6 Mining

- 7.4.7 Oil and Gas

- 7.4.8 Pharmaceuticals

- 7.4.9 Transportation

- 7.4.10 Telecommunications

- 7.4.11 Nuclear Projects

- 7.4.12 Other Industries

- 7.5 By Geography

- 7.5.1 North America

- 7.5.1.1 United States

- 7.5.1.2 Canada

- 7.5.2 Europe

- 7.5.2.1 Germany

- 7.5.2.2 United Kingdom

- 7.5.2.3 France

- 7.5.2.4 Spain

- 7.5.2.5 Rest of Europe

- 7.5.3 Asia-Pacific

- 7.5.3.1 China

- 7.5.3.2 Japan

- 7.5.3.3 India

- 7.5.3.4 Rest of Asia-Pacific

- 7.5.4 Latin America

- 7.5.4.1 Brazil

- 7.5.4.2 Argentina

- 7.5.4.3 Rest of Latin America

- 7.5.5 Middle East and Africa

- 7.5.5.1 United Arab Emirates

- 7.5.5.2 Saudi Arabia

- 7.5.5.3 South Africa

- 7.5.5.4 Rest of Middle East and Africa

- 7.5.1 North America

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 AECOM Engineering company

- 8.1.2 Bechtel Corporation

- 8.1.3 Kiewit Corporation

- 8.1.4 WSP Global Inc

- 8.1.5 STRABAG SE

- 8.1.6 NV5 Global, Inc.

- 8.1.7 Barton Malow

- 8.1.8 Gilbane Building Company

- 8.1.9 Jones Lang LaSalle Incorporated

- 8.1.10 Balfour Beatty Inc.

- 8.1.11 Brasfield & Gorrie LLC

- 8.1.12 Nearby Engineers

- 8.1.13 RMF Engineering Inc.