|

市場調查報告書

商品編碼

1689681

一次性包裝:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)Single-use Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

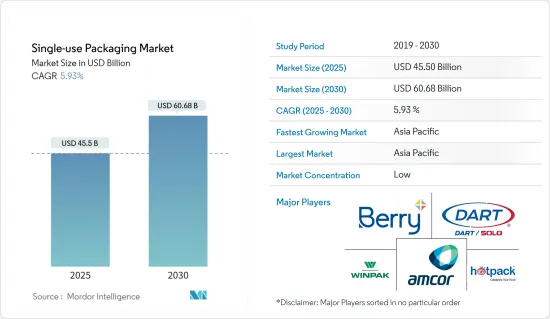

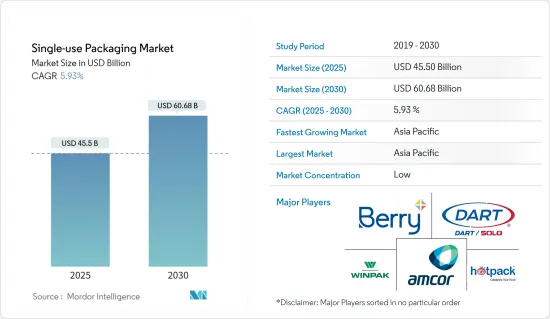

一次性包裝市場規模預計在 2025 年為 455 億美元,預計到 2030 年將達到 606.8 億美元,預測期內(2025-2030 年)的複合年成長率為 5.93%。

關鍵亮點

- 由於都市化、繁忙的生活方式以及食品和飲料需求,一次性塑膠包裝的需求量很大,推動了該行業的發展。食品和飲料消費量的增加以及網上食品宅配的普及也推動了一次性包裝的需求。一次性塑膠包裝因其強度、多功能性、價格實惠和透明度而受到各行各業的歡迎。

- 消費者購買行為的改變以及靈活、經濟高效且易於使用的包裝的興起正在推動一次性包裝市場的發展。使用一次性食品包裝對於預防食源性疾病至關重要,透過使用一次性產品可以消除污染和疾病傳播的風險。一次性產品的例子可以在各種食品和飲料場所找到,包括速食店、外帶餐廳和餐飲設施。在現代,大多數終端用戶工業集團都採用了一次性紙質和塑膠飲水杯、飲料蓋、吸管和瓶子的設計,這些都是日常生活中必不可少的。

- 中國和印度等新興國家的電子商務興起預計將增加一次性包裝的需求。此外,預計市場包裝需求將受到不斷變化的現代生活方式以及不斷擴大的食品和飲料行業、居家醫療行業、醫療行業和個人護理行業成長的影響,並受到新興電子商務市場發展的影響,從而推動一次性包裝市場的需求。

- 此外,隨著雲端廚房新需求的出現,食品產業最近經歷了重大轉型。近年來,雲端廚房越來越受歡迎。隨著雲端廚房概念越來越被消費者接受,尤其是在後疫情時代,隨著餐廳採用線上送餐和用戶需求驅動,外帶和外送服務將出現轉變。

- 全球範圍內塑膠材料的廣泛使用對環境構成了越來越大的威脅,各國政府和全球監管機構正在採取措施解決這個問題。為了解決這個問題,印度等新興國家已經禁止生產、進口、儲存、分銷、銷售和使用經鑑定的實際用途不大、容易被亂丟垃圾的一次性塑膠製品。禁止攜帶的物品清單包括帶有塑膠棒的耳機、塑膠氣球棒、塑膠旗、糖果棒、冰淇淋棒、裝飾保溫巧克力、塑膠盤子、杯子、玻璃杯、刀叉餐具、叉子和攪拌器。湯匙、刀子、吸管、托盤、糖果零食周圍的包裝膜、邀請函、香菸盒、塑膠或 PVC 橫幅等,小於 100 微米;

- 同時,俄羅斯與烏克蘭的戰爭導致多個國家遭受經濟制裁,大宗商品價格上漲,供應鏈中斷,全球多個市場受到影響。一些中東國家高度依賴糧食和能源進口,特別容易受到烏克蘭危機造成的經濟衝擊。俄烏戰爭導致多個生產國原料和能源成本增加,導致大宗商品價格上漲、供應鏈中斷,許多市場受到影響。據戰略與國際研究實驗室稱,戰爭限制了烏克蘭和俄羅斯的糧食出口,導致這些商品的價格上漲。包裝材料和物品成本的上升正在降低整個供應鏈的利潤。

一次性包裝市場的趨勢

食品和飲料領域的需求不斷成長

- 線上食品配送平台和行動應用程式的興起正在刺激一次性包裝產品(尤其是容器)的成長。過去幾年,食品和飲料行業取得了顯著成長,獨立餐廳透過食品和飲料聚合應用程式接受線上訂單以及電子商務交易。

- 此外,已開發國家快節奏的生活方式使得一次性食品服務包裝成為速食店的必需品。越來越多的人開始選擇速食,因為他們沒有時間在家做飯。一次性包裝使餐廳能夠安全、經濟地分離和包裝食物,同時提供一種快速簡便的方式將餐點送到顧客手中。

- 每個 QSR 每天都會使用各種一次性食品包裝,包括一次性紙杯、紙吸管、漢堡盒、炸薯條容器等。它們也用於保護菜單、保持菜單清潔和適當的溫度,並在菜單上印上品牌顏色和標誌。由於居民消費能力強,速食店市場日益擴大。在印度、加拿大、德國和法國等國家,在餐廳用餐被廣泛視為慶祝特殊場合和與家人共度歡樂的一種方式。同時,著名咖啡連鎖店星巴克正在全球增加門市數量,以滿足人們在戶外享用零食和咖啡的需求。該公司在全球擁有 35,711 家門市,較一年前的 33,833 家門市有所成長。

- 袋子在食品和飲料行業也有廣泛的應用。外出用餐正變得越來越普遍,包裝在確保方便食用食物方面發揮關鍵作用。宅配和外帶食品是快速成長的趨勢。這就是為什麼塑膠購物袋已成為餐廳、咖啡館和食品服務連鎖店用來為顧客提供食物和便利的關鍵元素。

- 此外,食品領域一次性紙板包裝的成長歸因於紙板包裝的優異的操作性能。紙板包裝可以安全地與食物接觸,可以在很寬的溫度範圍內使用,並能在較長時間內保持其有機特性。瓦楞紙箱和紙盒廣泛用於運送完好的食品,如披薩、麥片、零食餅乾等。它可用於包裝需要緩衝、強度、透氣、防潮和保護的食品和非常新鮮的水果和蔬菜,每次您都會得到一個乾淨、嶄新的盒子。

- 此外,隨著人們越來越精通技術並優先考慮服務的便利性和速度,多個線上食品訂購入口網站應運而生,大大擴展了餐廳和餐飲服務網點的覆蓋範圍。對國內品牌的偏好和咖啡文化的成長也有助於塑造該國的餐飲市場。預計此類案例將導致塑膠容器、杯子和瓦楞紙箱等一次性包裝的使用量增加。

亞太地區預計將佔據主要市場佔有率

- 由於擁有眾多最終用戶行業協會,該地區是一次性包裝市場的主要投資者和採用者之一。盒裝午餐的成長趨勢、餐廳和超級市場數量的增加以及瓶裝水和飲料消費量的增加是該地區市場成長的主要驅動力。

- 在印度,不斷擴張的經濟、不斷壯大的中階、不斷變化的生活方式以及不斷成長的人口正在推動一次性包裝的需求。印度品牌資產基金會預測,到 2026 年,該國的電子商務市場規模將達到 2,000 億美元。網路和智慧型手機的興起也推動了該地區的大部分包裝需求。

- 由於食品和飲料領域的需求不斷增加以及新參與者的進入,印度的食品和飲料用紙和紙板包裝正在興起。 Zomato、Swiggy等外宅配服務公司的進入和快速成長,帶動了包裝食品和飲料消費量的增加。

- 此外,盒裝午餐的日益普及、餐廳和超級市場的興起以及瓶裝水和飲料消費量的增加都是中國市場成長的主要驅動力。

- 技術的進步和終端用戶行業包裝應用數量的增加是推動中國市場成長的主要因素。人口正在成長,這意味著人均包裝量增加。這是消費行為趨勢推動的,例如便利產品的使用增加以及一次性包裝產品作為其他包裝材料的替代品的使用增加。

- 由於醫療保健行業中非專利注射藥物的使用日益增多,一次性玻璃包裝的需求也在不斷成長。藥用玻璃包裝可容納多種藥物類型,包括注射劑和非注射劑。藥用玻璃包裝的關鍵特性之一是其高化學耐久性,可確保最大程度的產品可靠性。

- 印度在全球醫藥市場佔有重要地位,隨著市場規模的擴大,印度對一次性玻璃包裝的需求預計會增加。根據印度品牌資產基金會網站發佈的資料,印度是全球最大的學名藥供應國,佔全球供應量的20%,並滿足全球60%以上的疫苗需求。印度製藥業的全球整體價值為 420 億美元。

- 此外,日本是製藥業發展最快的國家之一,並一直致力於不同類型包裝的不斷創新。日本政府也透過放鬆對國際投資的管制促進了這一成長,從而推動了日本包裝市場的發展。

一次性包裝行業概況

一次性包裝市場由 Ardagh Group SA、Amcor Group GmbH、Winpak Limited 等多家全球和地區參與者組成,高度細分,在競爭激烈的市場空間中佔據主導地位。該市場的特徵是產品差異化程度低、產品擴散程度高、競爭激烈。

2023 年 2 月針對糖漿和液體藥物的製藥和草藥市場,Berry Global Healthcare 正在開發完整的捆綁解決方案,以幫助其客戶滿足對兒科安全 (CRC) 和防篡改 (TE) 包裝日益成長的需求。 Berry Healthcare 的新型防篡改和兒童防護功能有七種款式和各種設計的 28 毫米頸部寶特瓶,容量從 20 毫升到 1,000 毫升不等。

2022 年 11 月,重要的一次性包裝公司 HotpackGlobal 在卡達開設了一家製造工廠。這座最先進的製造廠專門用於生產各種熱包裝紙製品,包括折疊式紙盒、瓦楞紙盒、紙袋和杯子。該工廠位於杜哈新工業區。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

- COVID-19 工業影響評估

第5章市場動態

- 市場促進因素

- 開發中國家電子商務的興起

- 線上食品宅配服務需求不斷成長

- 市場問題

- 全球一次性塑膠包裝產品使用法規

第6章市場區隔

- 依材料類型

- 紙和紙板

- 塑膠

- 玻璃

- 其他材料(金屬、木材)

- 按最終用戶產業

- 食物

- 飲料

- 個人護理

- 製藥

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 北美洲

第7章競爭格局

- 公司簡介

- Novolex

- Pactiv LLC

- Dart Container Corporation

- Winpak Ltd.

- Berry Global Inc

- Amcor Group GmbH

- Huhtamaki Oyj

- Hotpack Packaging Industries LLC

- Graphic Packaging International, LLC

- Transcontinental Inc.

第8章投資分析

第9章:市場的未來

The Single-use Packaging Market size is estimated at USD 45.50 billion in 2025, and is expected to reach USD 60.68 billion by 2030, at a CAGR of 5.93% during the forecast period (2025-2030).

Key Highlights

- Single-use plastic packaging is in high demand because of urbanization, busy lifestyles, and the need for food and beverage drives the industry. The increase in the consumption of food and drink and the popularity of online food delivery are also driving the demand for single-use packaging. Due to its strength, versatility, affordability, and transparency, single-use plastic packaging has gained popularity across different industries.

- The changing consumer buying behavior and the increasing prevalence of flexible, cost-effective, and user-friendly packaging drive the market for single-use packaging. Using single-use food packaging is essential in preventing foodborne illness by eliminating the risk of contamination and transmission of diseases by using products intended to be used only once. Examples of single-use products can be found in various eateries, such as fast-food joints, takeaway restaurants, and catering facilities. In the modern era, most end-user industry organizations adopt designs essential for everyday life, such as single-use paper and plastic beverage cups, beverage lids, and straws and bottles.

- The emergence of e-commerce in developing countries such as China and India is expected to increase the demand for disposable packaging. Additionally, the need for packaging in the market is expected to be influenced by the growth of modern lifestyle changes and the expansion of the food and beverages industry, the home care industry, the healthcare industry, and the personal care industry impacted by the development of new e-commerce markets which drive the demand of Single-use packaging market.

- Further, the food industry has significantly transformed recently, with a new demand for cloud kitchens emerging. Cloud kitchens have seen a surge in popularity in recent years, as the concept of cloud kitchens has become increasingly accepted by consumers, particularly in the post-pandemic, when restaurants adopt online food delivery, and the transition occurs to takeout and delivery services due to user demand.

- The widespread use of plastic materials worldwide has posed a considerable threat to the environment, and governments and global regulatory bodies are taking steps to address this issue. To address this issue, developing countries such as India have banned the production, import, storage, distribution, sale, and use of identified single-use plastic products, which are of low utility and have a high littering potential. The list of prohibited items includes earbuds containing plastic sticks, plastic sticks for balloons, plastic flags, candy sticks, ice-cream sticks, thermocol for decoration, plastic plates, cups, glasses, cutlery, forks, and stirrers. Spoons, knives, straws, trays, wrapping or packing films surrounding sweet boxes, invitation cards, cigarette packets, and plastic or PVC banners, all smaller than 100 microns;

- Meanwhile, the war between Russia and Ukraine has resulted in economic sanctions against several countries, high commodity prices, supply chain disruptions, and impacts on many markets worldwide. Some Middle Eastern nations are very reliant on imports of food and energy, making them particularly susceptible to economic shocks brought on by the Ukraine crisis. The war between Russia and Ukraine has made raw material prices and energy costs rise in several countries with production facilities, high commodity prices, supply chain disruptions, and impacts on many markets. According to the Center for Strategic and International Studies, the war restricted food exports from Ukraine and Russia and increased the prices of these commodities. The rising cost of packaging materials and items has resulted in a decline in profit across the supply chain.

Single Use Packaging Market Trends

Growing Demand for Food and beverage segment

- The rise of online food delivery platforms and mobile applications has stimulated the growth of disposable packaging products, particularly containers. In the food and beverage sector, e-commerce transactions for standalone restaurants accepting orders online or through food aggregator applications have witnessed remarkable growth in the last few years.

- Moreover, the Fast-paced life in developed countries has made single-use foodservice packaging in quick-service restaurants necessary. More individuals rely on fast food as they have less time to prepare meals at home. Single-use packaging enables restaurants to package food sensibly, securely, and economically while providing customers with a quick and easy way to transfer meals.

- Every QSR utilizes a variety of single-use food packaging daily, including disposable paper cups, paper straws, burger boxes, and fry containers. It also uses them to protect menu items and keep them clean, at the right temperature, and imprinted with the brand's colors and logo. The quick restaurant market is multiplying daily because of the inhabitants' considerable spending power. In countries like India, Canada, Germany, and France, eating in restaurants is now widely recognized as the place to celebrate special occasions and have fun with the family. In this context, Starbucks, a famous coffee chain, has increased its stores worldwide due to demand for outside snacking and coffee. The company has 35,711 stores worldwide, which has risen from 33,833 stores the previous year.

- Bags are also widely used in the food and beverage industry. Eating on the go is rapidly becoming a norm, and packaging plays a crucial role in ensuring that the food served is consumed conveniently. Home delivery and takeaway food are the trends that witnessed rapid growth. Thus, plastic bags are a vital element used by restaurants, cafes, and food service chains to deliver food and convenience to customers.

- In addition, the growth of single-use paperboard packaging in the food sector is attributed to the superior operational characteristics of paperboard packaging, which is safe for food contact and can be used over a wide range of temperatures, maintaining organoleptic properties for a more extended period. Corrugated boxes and cartons are extensively utilized for delivering food products, such as pizzas, cereals, and snack crackers, in mint condition. They offer a clean new box each time, which can be used to pack foodstuffs and exceedingly fresh produce that needs cushioning, strength, ventilation, moisture resistance, and protection.

- Moreover, as people become more tech-savvy and value convenience and service speed, multiple online food ordering portals have emerged, significantly increasing restaurants and food service outlets' reach. An inclination toward home-grown brands and a growing cafe culture also play a role in shaping the restaurant market in the country. Such instances are expected to augment single-use packaging such as plastic containers, cups, corrugated boxes, etc.

Asia-Pacific Expected to Hold a Significant Market Share

- The region is one of the major investors and adopters of the single-use packaging market, owing to many end-user industry organizations. The growing trend of packed meals, the increasing number of restaurants and supermarkets, and increasing bottled water and beverage consumption are significant driving factors of the regional market growth.

- The need for single-use packaging is developing in India due to the country's expanding economy, growing middle class, changing lifestyles, and increasing population. The India Brand Equity Foundation predicts that by 2026, the country's e-commerce market will reach USD 200 billion. The boom in internet and smartphone use is also driving the majority of the packaging demand in the region.

- With increased demand and new companies in the food and beverage space, India has seen a rise in the paper and paperboard packaging of food and beverages. The entry and meteoric rise of food delivery service companies such as Zomato and Swiggy have increased the consumption of food and beverage packaging.

- Furthermore, in China, the growing trend of packed meals, the increasing number of restaurants and supermarkets, and increasing bottled water and beverage consumption are significant driving factors of the country's market growth.

- The increasing technological advancements and end-user industry packaging applications are the significant factors driving the growth in the Chinese market. The population is growing, and packaging per person is increasing. It is due to consumer behavior trends, such as the growth in the use of convenience products and the increasing use of single-use packaging products as substitutes for other packaging materials.

- Single-use glass packaging has been growing due to the increasing usage of generic injectable drugs in the healthcare industry. Pharmaceutical glass packaging is available in various drug types, such as injectable and non-injectable. The significant property of pharmaceutical glass packaging has high chemical durable properties, which maximizes the reliability of the products.

- The demand for single-use glass packaging in India is expected to multiply as India is a prominent and expanding player in the global medicines market. According to data published on the India Brand Equity Foundation website, India is the world's largest provider of generic pharmaceuticals, accounting for 20% of the worldwide supply and meeting over 60% of global vaccine demand. The Indian pharmaceutical industry is .valued at USD 42 billion globally.

- Furthermore, Japan is one of the fastest-growing pharmaceutical industries, constantly focusing on continuous innovation in different types of packaging. The Government of Japan also contributes to this growth through deregulations for international companies to invest, thereby driving the country's packaging market.

Single Use Packaging Industry Overview

The majorly fragmented single-use packaging market, comprising several global and regional players like Ardagh Group SA, Amcor Group GmbH, Winpak Limited, and more, is vying for attention in a contested market space. This market is characterized by low product differentiation, growing levels of product penetration, and high levels of competition.

In February 2023, For the pharmaceutical and herbal market for syrup and liquid medications, Berry Global Healthcare is developing a complete bundle solution to assist customers in capitalizing on the rising demand for child-resistant (CRC) and tamper-evident (TE) packaging. The new Berry Healthcare tamper-evident and child-resistant features have seven variations of 28mm neck PET bottles ranging from 20ml to 1,000ml and various designs.

In November 2022, HotpackGlobal, a significant disposable packaging company, opened a manufacturing facility in Qatar. The cutting-edge manufacturing facility is a specialized factory that will create a wide range of Hotpack's paper products, including folding and corrugated cartons, paper bags, and cups. It is situated in Doha's new industrial region.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industrial Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rise of E-commerce in Developing Nations

- 5.1.2 Growing Demand for Online Food Delivery Services

- 5.2 Market Challenges

- 5.2.1 Regulations Against the Usage of Single-use Plastic Packaging Products Globally

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Paper and Paperboard

- 6.1.2 Plastic

- 6.1.3 Glass

- 6.1.4 Other Material Types (Metals and Wood)

- 6.2 By End-user Industry

- 6.2.1 Food

- 6.2.2 Beverage

- 6.2.3 Personal Care

- 6.2.4 Pharmaceutical

- 6.2.5 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 South Korea

- 6.3.3.5 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 Rest of Latin America

- 6.3.5 Middle East and Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 South Africa

- 6.3.5.4 Rest of Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Novolex

- 7.1.2 Pactiv LLC

- 7.1.3 Dart Container Corporation

- 7.1.4 Winpak Ltd.

- 7.1.5 Berry Global Inc

- 7.1.6 Amcor Group GmbH

- 7.1.7 Huhtamaki Oyj

- 7.1.8 Hotpack Packaging Industries LLC

- 7.1.9 Graphic Packaging International, LLC

- 7.1.10 Transcontinental Inc.