|

市場調查報告書

商品編碼

1644458

美國一次性包裝:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)US Single Use Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

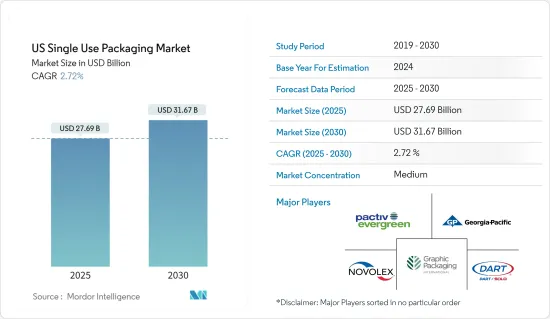

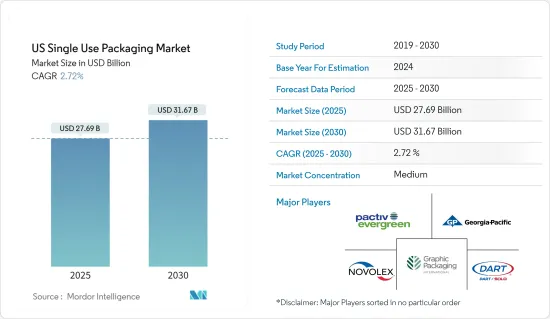

預計2025年美國一次性包裝市場規模為276.9億美元,到2030年預計將達到316.7億美元,預測期內(2025-2030年)的複合年成長率為2.72%。

由於一次性包裝的便利性和易於印刷,預計該國對一次性包裝的需求將會上升。現在一些企業要求使用一次性塑膠包裝,以避免交叉污染和疾病。一次性包裝市場擴張預計將加速。

關鍵亮點

- 對小型、便利包裝和強烈視覺衝擊力的需求日益成長,預計將在預測期內推動一次性包裝的成長。一次性包裝是指僅使用一次就被丟棄或回收的產品。例如塑膠袋、吸管、咖啡攪拌棒、汽水瓶和水瓶以及大多數食品包裝。

- 美國軟質塑膠包裝產業正在經歷健康成長,因為它已經針對其面臨的一些包裝挑戰實施了創新解決方案。據軟包裝協會(FPA)稱,品牌所有者擴大採用小袋、薄膜和袋子作為包裝解決方案,部分原因是美國消費者越來越接受這些產品。

- 醫藥產業正在推動國內一次性塑膠包裝市場的擴張。醫療設備、消耗品、注射器和藥品通常採用一次性塑膠包裝,以減少污染的機會並保護最終用戶的利益。此外,由於各種尺寸包裝產量不斷增加,以滿足對瓶裝水、軟性飲料、酒精飲料、即飲飲料和牛奶日益成長的需求,一次性塑膠飲料容器的市場預計將成長。

- 然而,一次性塑膠包裝的一個日益嚴重的問題包括廢棄物和處置管理。不當處置會帶來環境風險並增加塑膠廢棄物。這可能會阻礙該國的一次性塑膠包裝市場的發展。

- 美國電子商務發展顯著加速,部分原因是新冠疫情導致的封鎖。但2020年初疫情嚴重打擊了零售業。這些因素對美國零售業軟質塑膠包裝的使用產生了負面影響。不過,美國零售業在2020年下半年出現了大幅成長,推動了該地區一次性軟質塑膠包裝使用量的復甦。此外,俄烏戰爭正在影響整個包裝生態系統。

美國一次性包裝市場的趨勢

軟性、一次性塑膠包裝產品提供便利和實用性

- 根據Biologicaldiversity.org報道,美國人每年使用1000億個塑膠購物袋,生產這些塑膠袋需要1200萬桶(19.785億公升)石油。美國人平均每年使用365個塑膠購物袋。丹麥人平均每年使用四個塑膠購物袋。

- 此外,冠狀病毒的傳播暫時增加了一次性塑膠的採用,因為一次性塑膠具有阻隔性。主要用戶是餐廳、雜貨店和電子商務供應商。雜貨店的塑膠購物袋使用量正在激增。家庭垃圾量比疫情前高出50%,顯示需求增加。儘管如此,一旦各州恢復到接近正常的狀態,並實施新冠疫情之前的法規禁止使用一次性塑膠,這些包裝材料的流通預計就會減少。

- 當一次性包裝與快餐店(QSR)中的可重複使用的餐具進行比較時,一次性系統具有優勢,特別是在碳排放和淡水消費量方面。這是因為清洗、消毒和乾燥多次使用的餐具需要消耗能源和水。在基準情境下,與紙質一次性系統相比,聚丙烯基多用途系統排放的二氧化碳多 2.5 倍,使用的淡水多 3.6 倍。

- 因此,如果市場供應商推出可回收性更高的包裝或加入有助於分解的材料,一次性塑膠市場就可以實現永續發展。由於上述擔憂,新參與企業正在進入市場,推出生物基一次性塑膠產品。

- 據ITC稱,2021年塑膠廢棄物和廢料的進口額約為368,729,000美元,與前一年同期比較增58.28%,顯示將塑膠碎片轉化為一次性塑膠的需求增加。

醫療及製藥領域呈現顯著成長率

- 一次性包裝、塑膠包裝材料使用量的增加以及疫情期間對醫療產品和包裝的需求增加,導致全球塑膠廢棄物產生量大幅增加。出於衛生方面的考慮,主要需求之一是處理 RT-PCR 冠狀病毒檢測套組中的塑膠零件。

- 全球已禁止使用一次性塑膠,但由於擔心重複使用塑膠袋和容器會造成交叉污染,美國等國家已被迫在新冠肺炎疫情期間暫時廢除或推遲對一次性塑膠的禁令。此外,紐約州於2020年3月開始全面禁止使用塑膠購物袋,但受疫情影響,禁令於2020年5月被擱置。加州和奧勒岡州也暫停了塑膠袋禁令,康乃狄克州、德拉瓦、夏威夷州、新澤西州、新墨西哥州、奧勒岡州和華盛頓州均推遲了類似的禁令。

- 大多數 PPE 由聚氨酯 (PU)、聚丙烯 (PP)、聚碳酸酯 (PC)、低密度聚乙烯 (LDPE) 和聚氯乙烯(PVC) 等聚合物製成。 PS和LDPE很少被回收,而PET和HDPE被廣泛回收,PVC和PP通常不會被回收。

- 需要有效的材料來最好地滿足廣泛的醫療需求,同時也考慮到環境影響。然而,找到合適且價格合理的塑膠替代品,同時保持保護患者和員工所需的無菌和衛生,可能是一個挑戰。人口的成長給及時大規模運送醫療物資的能力帶來了額外的壓力。因此,一次性塑膠預計將繼續在醫療保健領域佔據較大佔有率。

- 據 CMS 稱,到 2028 年,人均醫療保健支出預計將超過 17,000 美元。醫療保健支出的增加可能會推動市場採用無菌產品,一次性包裝公司的數量將會增加,從而推動製藥業的顯著成長。

美國一次性包裝產業概況

美國一次性包裝市場適度整合,擁有幾個主要企業,包括 Dart Container Corporation、Georgia-Pacific LLC、Graphic Packaging International Inc 和 Novolex,以及一些新參與企業。公司不斷創新並建立戰略夥伴關係以保持市場佔有率。

2022年7月,喬治亞太平洋公司百老匯工廠獲得5億美元擴建投資。此項投資將顯著改善公司的消費用紙及毛巾零售業務。我們將建造一座採用熱風乾燥(TAD)技術的新造紙廠,並增加相關基礎設施和轉換工具。喬治亞太平洋公司的高階品牌將能夠發展,而且該公司的高階自有品牌產品以及其現有和未來客戶的產品都將透過這項變革得到支持。預計竣工日期為 2024 年

2022 年 4 月,Georgia-Pacific 將在喬治亞麥克多諾和賓夕法尼亞州約翰斯敦破土動工建立新工廠,生產其原創的可回收紙質填充信封。加上其鳳凰城地區工廠新增的第三條生產線,Georgia-Pacific 的生產能力提高了兩倍多,以滿足對更環保的電子商務包裝解決方案日益成長的需求。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 工業供應鏈分析

- 產業吸引力-波特五力模型

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 主要標準及法規

- COVID-19 市場影響評估

- 全球一次性包裝市場概覽

第5章 市場動態

- 市場促進因素

- 持續的輕量化趨勢和永續解決方案的使用(例如紙杯)

- 靈活的一次性包裝產品提供便利性和實用性

- 市場問題

- 嚴格的監管是一次性塑膠包裝產品成長的主要限制因素

- 一次性塑膠是一個日益嚴重的環境問題

第6章 市場細分

- 按材質

- 紙和紙板

- 塑膠

- 鋁

- 其他

- 按最終用戶產業

- 食物

- 飲料

- 醫療藥品

- 個人護理

- 其他

第7章 競爭格局

- 公司簡介

- Dart Container Corporation

- Georgia-Pacific LLC

- Graphic Packaging International Inc.

- Novolex

- Pactiv LLC

- Snapsil Corporation

- Berry Global Inc.

- Amcor Plc

- PPC Flexible Packaging LLC

- Fuling Plastic USA, Inc.

第8章投資分析

第9章:市場的未來

The US Single Use Packaging Market size is estimated at USD 27.69 billion in 2025, and is expected to reach USD 31.67 billion by 2030, at a CAGR of 2.72% during the forecast period (2025-2030).

The demand for single-use packaging in the country is anticipated to increase due to its high convenience and printability. Single-use plastic packaging is required by several businesses to avoid cross-contamination and disease. It will accelerate the expansion of the market for single-use packaging.

Key Highlights

- The increasing need for small and more convenient packaging and a strong visual impact is expected to contribute to the growth of single-use packaging over the forecast period. Single-use packaging is for products used only once before they are thrown away or recycled. These items are plastic bags, straws, coffee stirrers, soda and water bottles, and most food packaging.

- The United States' flexible plastic packaging industry is witnessing healthy growth as it implemented innovative solutions for the several packaging challenges it faced. According to the Flexible Packaging Association (FPA), brand owners are adopting pouches, films, and bags as a go-to packaging solution, partly due to rising acceptance by American consumers.

- The pharmaceutical industry is driving the expansion of single-use plastic packaging in the nation's market. Medical equipment, supplies, syringes, and medications are frequently packaged in single-use plastic since it decreases the possibility of contamination, protecting the end-users interests. Further, the market for single-use plastic beverage containers is predicted to expand due to the rising production of various package sizes to meet the growing demand for bottled water, soft drinks, alcoholic beverages, ready-to-drink beverages, and milk.

- However, growing issues with single-use plastic packaging include waste and disposal management. Environmental risks and a rise in plastic waste result from improper disposal. It will probably hamper the market for single-use plastic packaging in the country.

- The United States has witnessed a significant acceleration in e-commerce, driven by lockdowns imposed due to the outbreak of COVID-19. However, the pandemic made a dent in retail sales at the start of 2020. Such factors negatively impacted the usage of flexible plastic packaging in the US retail landscape in the respective months. However, the retail sector in the United States witnessed a significant surge in late 2020, which bounced back the usage of single-use flexible plastic packaging in the region. Further, the Russia-Ukraine war has an impact on the overall packaging ecosystem.

US Single Use Packaging Market Trends

Flexible Single-use Plastic Packaging Products Offering Increased Convenience and Utility

- According to Biologicaldiversity.org, American citizens use 100 billion plastic bags annually, which require 12 million barrels (1907.85 million liters) of oil to manufacture. Americans use an average of 365 plastic bags per person per year. People in Denmark use an average of four plastic bags per year.

- Moreover, the spread of coronavirus has temporarily increased the adoption of single-use plastic due to its barrier properties. The primary users are restaurants, grocery stores, and e-commerce vendors. Grocery stores have sharply increased plastic bag usage. Households are generating up to 50% more waste by volume than pre-pandemic, indicating increased demand. Still, as soon as the state achieves near-normal scenarios, the pre-covid established regulations to ban single-use plastics are expected to subside the circulation of these packaging materials.

- In comparing single-use packaging to reusable tableware in quick-service restaurants (QSR), single-use systems have their advantages, particularly in carbon emissions and freshwater consumption. These are due to the energy and water needed to wash, sanitize, and dry multi-use tableware. In the baseline scenario, the polypropylene-based multi-use system generated over 2.5 times more CO2 emissions and used 3.6 times the amount of freshwater than the paper-based single-use system.

- As a result, the market for single-use plastics might sustain if the vendors in the market introduce packaging with higher recycling rates or include materials that help in decomposition. The above concerns have led to the entry of new players in the market that are introducing bio-based single-use plastic products.

- According to the ITC, in 2021, the value of imports of plastic waste and scrap amounted to around USD 368.729 million, a 58.28% growth in imports from the previous year, indicating the demand for an increase in the transformation of plastic debris to single-use plastic.

Healthcare and Pharmaceutical Segment to Witness Significant Growth Rates

- The growing usage of single-use packaging, plastic-based packaging materials, and the increasing demand for medical products and packaging amid the pandemic has significantly spiked plastic waste generation worldwide. One primary need was disposing plastic-based parts of the coronavirus testing kits employing RT-PCR for hygienic concerns.

- Although single-use plastics are increasingly banned worldwide, concerns of cross-contamination by reusing plastic bags and containers have forced countries like the United States to temporarily revoke or defer bans on single-use plastics during the COVID-19 pandemic. Further, a statewide ban on plastic bags in New York initiated in March 2020 was put on hold in May 2020 owing to the pandemic. California and Oregon also suspended their bans on plastic bags, while Connecticut, Delaware, Hawaii, New Jersey, New Mexico, Oregon, Washington, etc., postponed similar prohibitions.

- The majority of PPEs are made up of polymers like polyurethane (PU), polypropylene (PP), polycarbonate (PC), low-density polyethylene (LDPE), and polyvinyl chloride (PVC). PS and LDPE are rarely recycled plastics; PET and HDPE are widely recycled, while PVC and PP are often not recycled.

- An effective material is needed to meet the vast healthcare needs best while considering its influence on the environment. However, maintaining the degree of sterility and sanitation necessary for protecting patients and employees while identifying appropriate and reasonably priced alternatives to plastic is difficult. The growing population puts extra strain on the ability to provide medical supplies on a large scale and on time. Thus, it is anticipated that single-use plastics will continue contributing significant shares in the healthcare sector.

- According to the CMS, national health expenditure per capita is expected to exceed USD 17,000 in 2028. The increase in the health expenditure values may drive the market by necessitating the adoption of sterilizing products increasing the number of single-use packaging companies to witness significant growth in the pharmaceutical sector.

US Single Use Packaging Industry Overview

The single-use packaging market in the United States is moderately consolidated, with new firms entering the market as well as the entry of a few dominant firms, including Dart Container Corporation, Georgia-Pacific LLC, Graphic Packaging International Inc, Novolex, and others. The firms keep innovating and entering strategic partnerships to retain their market share.

In July 2022, Georgia-Pacific's Broadway mill received an investment of USD 500 million for expansion. The expenditures will significantly improve the company's retail consumer tissue and towel business. Through-air-dried (TAD) technology is being used to construct a new paper mill and add related infrastructure and conversion tools. Georgia-Pacific's premium brands will be able to grow, and their premium private label products, as well as those of present and future clients, will be supported by the changes. 2024 is the projected completion date.

In April 2022, Georgia-Pacific constructed new facilities in McDonough, Georgia, and Jonestown, Pennsylvania, where they will manufacture an original, recyclable paper-padded envelope. Georgia-Pacific has more than tripled its capacity to help satisfy the rising demand for more environmentally friendly e-commerce packaging solutions when paired with the newly increased manufacturing capacity of a third production line at the company's factory in the Phoenix region.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter Five Forces

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Key Standards and Regulations

- 4.5 Assessment of Impact of COVID-19 on the Market

- 4.6 Overview of the Global Single-use Packaging Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Ongoing Trend Toward Lightweight and Use of Sustainable Solutions (such as Paper-based Cups)

- 5.1.2 Flexible Single-use Packaging Products Offering Increased Convenience and Utility

- 5.2 Market Challenges

- 5.2.1 Stringent Regulations as Major Impediment to the Growth of Single-use Plastic Packaging Products

- 5.2.2 Rising Environmental Concerns due to Single-use Plastic

6 Market Segmentation

- 6.1 By Material

- 6.1.1 Paper and Paperboard

- 6.1.2 Plastics

- 6.1.3 Aluminium

- 6.1.4 Other Materials

- 6.2 By End-user Industry

- 6.2.1 Food

- 6.2.2 Beverage

- 6.2.3 Healthcare and Pharmaceutical

- 6.2.4 Personal Care

- 6.2.5 Other End-user Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Dart Container Corporation

- 7.1.2 Georgia-Pacific LLC

- 7.1.3 Graphic Packaging International Inc.

- 7.1.4 Novolex

- 7.1.5 Pactiv LLC

- 7.1.6 Snapsil Corporation

- 7.1.7 Berry Global Inc.

- 7.1.8 Amcor Plc

- 7.1.9 PPC Flexible Packaging LLC

- 7.1.10 Fuling Plastic USA, Inc.