|

市場調查報告書

商品編碼

1687970

功能安全-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Functional Safety - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

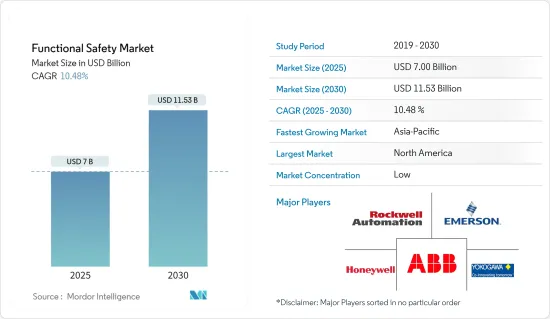

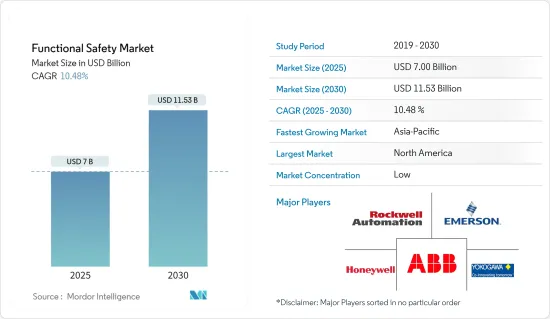

功能安全市場規模預計在 2025 年為 70 億美元,預計到 2030 年將達到 115.3 億美元,預測期內(2025-2030 年)的複合年成長率為 10.48%。

關鍵亮點

- 市場成長的動力來自於各行各業對功能安全系統的日益採用以及工業安全標準的不斷提高。石油和天然氣設施容易發生事故,對社會和環境造成不利影響。包括緊急關閉系統在內的功能安全措施可以顯著降低石油和天然氣設施災難的風險。

- 此外,連網型設備的使用日益增多以及使用無線(OTA)快速安裝軟體解決方案預計也將推動對功能安全系統的需求。工業革命 4.0 正在推動對可靠的安全系統的需求,以保護個人和財產。預計在預測期內,以下因素將有助於市場收益成長:

- 功能安全系統和資料為中心的方法的採用為各行各業的公司提供了必要的能力,可以自動防止危險故障,並在發生此類故障時實現控制。它還列出了人類無法複製的設施。

- 功能安全系統正在推動全球市場的需求,但這些系統日益複雜,以及高昂的維護成本和初始系統建設成本,正在降低對功能安全系統技術的投資動力並減緩市場滲透。

功能安全市場趨勢

汽車是成長最快的終端用戶領域

- 功能安全已成為各行各業的首要任務,尤其是隨著技術進步和自動化設備的不斷增強。自動化在包括服務在內的廣泛應用中發揮著越來越重要的作用。在醫療保健和建築等領域,必須確保故障設備、機器人和自動化的設計能夠防止事故發生並消除不良後果。

- 多年來,汽車行業經歷了各種變化,將技術進步融入多種類型的車輛中。以前,汽車基本上都是機械的,只有基本的電氣系統來為前燈和火星塞。隨著技術的進步,汽車現在配備了先進的安全功能,例如安全氣囊展開系統。

- 越來越多的感測器相關功能促使工程師開發更精確的感測器以適應汽車應用。由於這些趨勢,預計工業領域對功能安全的採用將會增加。這使汽車製造商能夠更快地響應市場需求,減少製造停機時間,提高供應鏈效率並擴大生產力。

- 配備汽車電控系統(ECU)的現代汽車的廣泛使用帶來了對先進安全措施的需求。功能安全流程對於 ECU 軟體的開發過程至關重要。為了減少軟體和硬體故障造成的風險和損害,汽車功能安全方案有助於診斷故障(電氣和電子)並確定要採取的措施和程序。

- 電氣化和自動化是汽車領域的兩個主要趨勢。電動車在工業中的出現對感測器的長期需求產生了巨大影響。更多的電動車意味著對感測器的需求更多,這意味著需要更多的電池監控、各種定位和檢測汽車內運動部件的感測器。

- 汽車產業是全球自動化製造設備使用量最大的產業之一。 2022年,豐田位居全球最大汽車品牌榜首,市場佔有率約11.5%。每個汽車製造商的生產設施都實現了自動化以保持高效。電動車(EV)取代傳統汽車的趨勢日益成長,預計將進一步增加汽車產業的需求。

預計北美將佔據較大的市場佔有率

- 美國是世界上最大的功能安全系統市場之一。該國以其創新能力而聞名,並處於第四次工業革命新興技術重大發展的前沿。美國新發現的頁岩資源和不斷增加的石油和天然氣計劃也是市場潛力的指標。美國是霍尼韋爾國際公司、羅克韋爾自動化公司、班納工程公司和通用電氣等主要供應商的所在地。

- 政府也致力於提高能源生產能力,並正在投資此類計劃。例如,美國能源局(DOE)於2022年10月宣布,愛達荷國家實驗室(INL)將獲得總統通膨削減法案提供的1.5億美元貸款,用於實現基礎設施現代化和推進核能研發。這筆資金將支持 INL 先進測試反應器 (ATR) 和材料燃料綜合體 (MFC) 的近十幾個計劃,這兩個項目都已運作50 多年,在為政府機構、公司和全球合作開發核能技術方面發揮關鍵作用。核能約佔全國電力產量的5%,佔全國清潔能源總產量的50%,對於實現拜登總統到2035年實現100%清潔電力的目標至關重要。

- 此外,2022 年 10 月,美國能源局(DOE) 宣布透過三個融資機會提供超過 2,800 萬美元的資金,用於支持推進和維持水力發電作為重要清潔能源的研究和開發舉措。

- 《兩黨基礎設施法案》將為擴大低負載水力發電和抽水蓄能、建設新的抽水蓄能設施、現代化水力發電廠群、永續性和環境影響等問題提供有影響力的聲音的交流,並提供資金支持。對發電工程的此類投資必將增加該國對功能安全設備的需求。

- 根據加拿大政府統計,加拿大製造業約佔GDP的1,740億加元,佔GDP總量的10%以上。製造業是研發投入最大的產業,並且正在採用新技術,因此市場預計將擴大。

功能安全產業概覽

功能安全市場的特點是幾家知名的全球公司在激烈的市場競爭中競爭。該市場的一些主要競爭對手包括羅克韋爾自動化公司、艾默生電氣公司和霍尼韋爾國際公司。這些市場參與企業正在積極努力透過包括產品創新在內的各種策略來加強競爭力。因此,預計市場競爭對手之間的競爭仍將保持激烈。

2022年10月,艾默生邁出重大一步,宣布推出PlantWeb數位生態系統。這個創新的生態系統匯集了由工業人工智慧驅動的 AspenTech 資產最佳化軟體產品組合。這項策略舉措使艾默生成為擁有最全面數位轉型產品組合的產業領導者。

2022年9月,橫河電機株式會社收購了Votiva Singapore Pte Ltd,這是一家東南亞著名的IT顧問公司,專門從事業務線規劃(ERP)和客戶關係管理(CRM)軟體的部署。橫河馬達依靠 ERP 系統作為解決方案的核心組件,旨在幫助其製造客戶實現智慧製造和數位轉型 (DX)。此次收購將使橫河電機擴大其在東南亞的地理覆蓋範圍,並加強其在該地區的ERP解決方案諮詢、實施和技術支援服務。透過此次收購,Votiva Singapore Pte Ltd 將更名為 Yokogawa Votiva Solutions,從而增強橫河在東南亞市場的地位和影響力。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 工業影響評估

第5章市場動態

- 市場促進因素

- 不斷提高的工業安全標準

- 功能安全系統在工業領域的應用日益廣泛

- 市場限制

- 複雜性、高初始成本和維護成本

第6章市場區隔

- 設備類型

- 安全感應器

- 安全控制器/模組/繼電器

- 安全開關

- 可程式安全系統

- 緊急停止裝置

- 最終控制元件(閥門、致動器)

- 其他

- 安全系統

- 燃燒器管理系統(BMS)

- 渦輪機械控制(TMC)系統

- 高完整性壓力保護系統 (HIPPS)

- 火災和氣體監控系統

- 緊急關閉系統(ESD)

- 監控、控制和資料採集 (SCADA) 系統

- 分散式控制系統(DCS)

- 最終用戶產業

- 石油和天然氣

- 發電

- 飲食

- 製藥

- 車

- 其他

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 拉丁美洲

- 中東和非洲

- 北美洲

第7章競爭格局

- 公司簡介

- Rockwell Automation Inc.

- Emerson Electric Company

- Honeywell International Inc.

- Yokogawa Electric Corporation

- ABB Ltd

- Schneider Electric SE

- Siemens AG

- General Electric Company

- Omron Corporation

- SICK AG

- Panasonic Industry Europe GmbH(Panasonic Corporation)

- Pepperl+Fuchs

- Banner Engineering Corporation

第8章投資分析

第9章:市場的未來

The Functional Safety Market size is estimated at USD 7.00 billion in 2025, and is expected to reach USD 11.53 billion by 2030, at a CAGR of 10.48% during the forecast period (2025-2030).

Key Highlights

- The increasing adoption of functional safety systems in a wide range of industries and the growing industrial safety standards are the factors driving the market growth. Oil and gas facilities are prone to accidents that can negatively impact society and the environment. Functional safety measures, including emergency shutdown systems, can significantly minimize the risk of disasters in oil and gas facilities.

- The increasing use of connected devices and the rapid installation of software solutions using over-the-air (OTA) are also expected to drive the demand for functional safety systems. Industrial Revolution 4.0 has increased the need for reliable security systems to protect individuals and property. These are the factors anticipated to contribute to the market's revenue growth during the forecast period.

- The adoption of functional safety systems and a datacentric approach provides enterprises in a wide range of industries with the required functionality that enables automatic prevention of dangerous failures and control in instances of such occurrences. They also offer facilities that humans cannot mimic.

- Although functional safety systems are driving the demand for the market across the world, the increasing complexity of these systems, coupled with high maintenance costs and the high initial cost of setting up these systems, is dissuading enterprises from investing in functional safety systems technology, thus leading to slow market penetration.

Functional Safety Market Trends

Automotive to be the Fastest-growing End-user Sector

- Functional safety must be a top priority across various industries, especially with the advancements in technology and the continuous enhancements in automation equipment. Automation is assuming an increasingly crucial role in a wide array of applications, including services. It is imperative to ensure that malfunctioning equipment, robotics, and automation in sectors like medical and construction are designed to prevent accidents and eliminate any undesirable consequences.

- The automotive industry has undergone various changes over the past few years, integrating technological advancements into multiple types of vehicles. Previously, cars were mechanical, mostly with basic electrical systems that offered power for headlights and spark plugs. As technology progressed, vehicles were now equipped with advanced safety purposes, such as airbag deployment systems.

- The increase in these sensor-dependent features has driven engineers to develop more accurate sensors with automotive applications in mind. The industry's adoption of functional safety is predicted to increase due to these trends. It will enable automakers to react faster to market requirements, reduce manufacturing downtimes, enhance supply chains' efficiency, and expand productivity.

- The widespread use of modern vehicles powered by automotive electronic control units (ECU) has necessitated sophisticated safety measures. The process of functional safety has grown to be crucial to the process of developing ECU software. To reduce risks and damage in software or hardware failures, functional safety schemes for automobiles help diagnose malfunctions (electric and electronic) and specify the actions and procedures to be used.

- Electrification and automation are the two significant trends in the automotive sector. The emergence of electric vehicles in the industry has dramatically impacted the demand for sensors in the long term. More electric cars mean increased demand for sensors and a rise in sensors for applications, such as battery monitoring, various positioning, and detection of moving parts of automobiles.

- The automotive industry is among the prominent sectors that hold a significant share of the world's automated manufacturing facilities. In 2022, the ranking of the world's largest car brands was topped by Toyota, with a maarket share of around 11.5 percent. The production facilities of various automakers are automated to maintain efficiency. The growing trend of replacing conventional vehicles with electric vehicles (EVs) is expected to augment the automotive industry's demand further.

North America Expected to Hold Significant Market Share

- The United States is one of the largest markets for functional safety systems globally. The country is renowned for its innovation capabilities and is at the forefront of significant developments surrounding the emerging technologies of the 4th Industrial Revolution. Newfound shale resources in the United States and an increasing number of oil and gas projects are additional indicators of market potential. Prominent vendors such as Honeywell International, Rockwell Automation, Banner Engineering Corp, and General Electric are headquartered in the country.

- The government is also focusing on increasing its energy generation capacity and is investing in such projects. For instance, in October 2022, the US Department of Energy (DOE) announced that the Idaho National Laboratory (INL) would receive USD 150 million in financing from the President's Inflation Reduction Act to modernize its infrastructure and advance nuclear energy research and development. The funding will help almost a dozen projects at INL's Advanced Test Reactor (ATR) and Materials Fuels Complex (MFC), both of which have been in operation for more than 50 years and play a critical role in developing nuclear technologies for governmental organizations, business, and global collaborations. With nuclear energy accounting for approximately 5% of domestic electricity production and 50% of all domestic clean energy production, it is essential to achieving President Biden's target of 100% clean electricity by 2035.

- Furthermore, in October 2022, the United States Department of Energy (DOE) announced more than USD 28 million across three funding opportunities to support research and development initiatives that promote and sustain hydropower as a crucial source of clean energy.

- The expansion of low-impact hydropower and pumped storage hydropower, the construction of new pumped storage hydropower facilities, and engagement with influential voices on issues like hydropower fleet modernization, sustainability, and environmental impacts will all be supported by funding provided by Bipartisan Infrastructure Law. Such initiatives of power-generating project investments certainly increase the demand for functional safety devices in the country.

- According to the Government of Canada, the Canadian manufacturing industry accounts for approximately CAD 174 billion of its GDP, representing more than 10% of the country's total GDP. The manufacturing sector is the largest investor in R&D and implements new technologies that are expected to create scope for the market.

Functional Safety Industry Overview

The functional safety market is characterized by several prominent global players competing in a fairly competitive landscape. Key contenders in this market include Rockwell Automation Inc., Emerson Electric Company, and Honeywell International Inc. These market players are actively working on enhancing their competitive edge through various strategies, including product innovation. As a result, the competitive rivalry within the market is anticipated to remain intense.

In October 2022, Emerson made a significant move by launching its PlantWeb digital ecosystem. This innovative ecosystem integrates the AspenTech portfolio of asset-optimizing software, which harnesses the power of industrial artificial intelligence. This strategic move positions Emerson as a leader in the industry, offering one of the most comprehensive digital transformation portfolios available.

In September 2022, Yokogawa Electric Corporation acquired Votiva Singapore Pte Ltd, a prominent Southeast Asian IT consultancy specializing in the deployment of enterprise resource planning (ERP) and customer relationship management (CRM) software. Yokogawa relies on ERP systems as a core component of its solutions designed to support smart manufacturing and digital transformation (DX) for customers in the manufacturing industry. With this acquisition, Yokogawa gains the ability to expand its geographic reach in Southeast Asia, offering enhanced consulting, implementation, and technical support services for ERP solutions in the region. As a result of this transaction, Votiva Singapore Pte Ltd will be rebranded as Yokogawa Votiva Solutions, solidifying Yokogawa's presence and influence in the Southeast Asian market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Standards of Industrial Safety

- 5.1.2 Increasing Adoption of Functional Safety Systems in Industries

- 5.2 Market Restraints

- 5.2.1 Increasing Complexity, High Initial Costs and Maintenance Costs

6 MARKET SEGMENTATION

- 6.1 Device Type

- 6.1.1 Safety Sensors

- 6.1.2 Safety Controllers/Modules/Relays

- 6.1.3 Safety Switches

- 6.1.4 Programmable Safety Systems

- 6.1.5 Emergency Stop Devices

- 6.1.6 Final Control Elements (Valves, Actuators)

- 6.1.7 Other Device Types

- 6.2 Safety Systems

- 6.2.1 Burner Management Systems (BMS)

- 6.2.2 Turbomachinery Control (TMC) Systems

- 6.2.3 High-Integrity Pressure Protection Systems (HIPPS)

- 6.2.4 Fire and Gas Monitoring Control Systems

- 6.2.5 Emergency Shutdown Systems (ESD)

- 6.2.6 Supervisory Control and Data Acquisition (SCADA) Systems

- 6.2.7 Distributed Control Systems (DCS)

- 6.3 End-user Industry

- 6.3.1 Oil and Gas

- 6.3.2 Power Generation

- 6.3.3 Food and Beverage

- 6.3.4 Pharmaceutical

- 6.3.5 Automotive

- 6.3.6 Other End-user Industries

- 6.4 Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Rockwell Automation Inc.

- 7.1.2 Emerson Electric Company

- 7.1.3 Honeywell International Inc.

- 7.1.4 Yokogawa Electric Corporation

- 7.1.5 ABB Ltd

- 7.1.6 Schneider Electric SE

- 7.1.7 Siemens AG

- 7.1.8 General Electric Company

- 7.1.9 Omron Corporation

- 7.1.10 SICK AG

- 7.1.11 Panasonic Industry Europe GmbH (Panasonic Corporation)

- 7.1.12 Pepperl+Fuchs

- 7.1.13 Banner Engineering Corporation