|

市場調查報告書

商品編碼

1910620

光調變器:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Optical Modulators - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

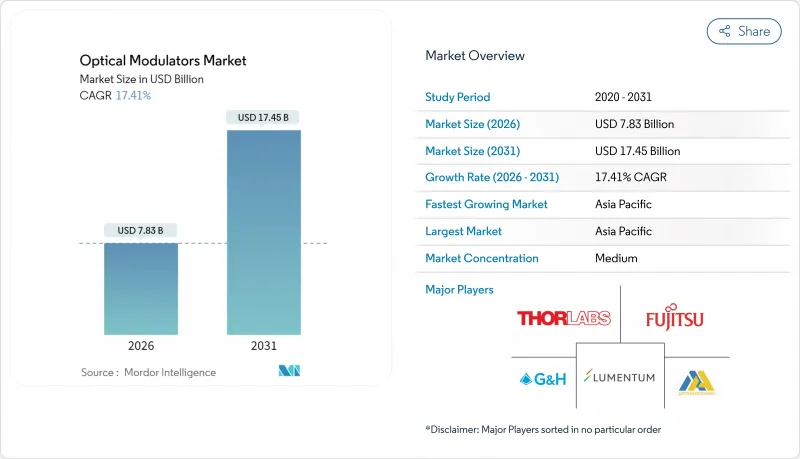

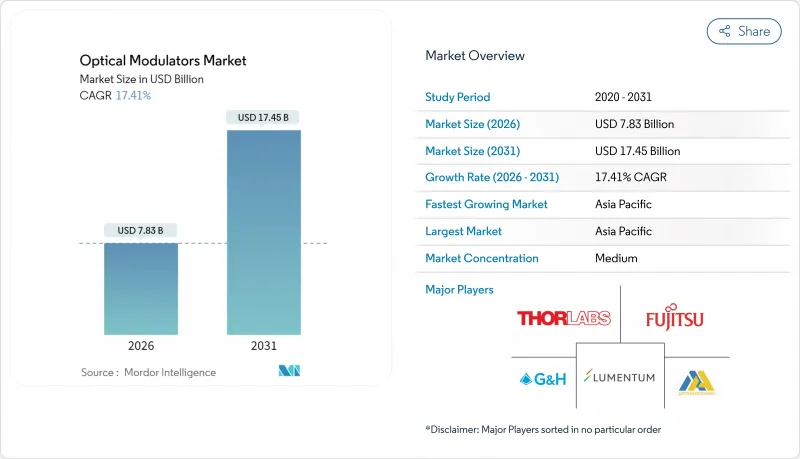

預計光調變器市場將從 2025 年的 66.7 億美元成長到 2026 年的 78.3 億美元,到 2031 年將達到 174.5 億美元,2026 年至 2031 年的複合年成長率為 17.41%。

這種成長軌跡反映了800G和1.6T光纖通訊、超大規模資料中心部署以及早期量子運算網路等領域對頻寬,所有這些都依賴於速度日益加快的光電元件。供應商正在優先考慮相位穩定性和低驅動電壓設計,以滿足共封裝光學元件的熱設計要求。同時,薄膜鈮酸鋰和矽光電領域的材料創新正在改變成本結構。隨著交換器ASIC供應商對能夠達到100Gbps及以上速率的光引擎的需求,整合式調變器晶片正從利基市場走向主流市場。同時,新興經濟體的政策制定者繼續為5G回程傳輸和光纖到府(FTTH)分配頻寬和補貼,從而支援50-100Gbps範圍內的大規模部署。

全球光調變器市場趨勢與洞察

加大對光纖通訊基礎設施的投資

隨著雲端服務供應商追求更低的每位元成本,創紀錄的人工智慧叢集建設將推動800G收發器出貨量在2024年突破2,000萬台。從400G到800G的過渡,以及早期1.6T技術演示(例如Ciena使用224G SerDes進行的1.6T連貫光演示),都將要求調變器在不超出功耗預算的情況下實現100Gbaud符號速率。線性可插拔光學模組市場預計將從2024年的50億美元加倍,到2026年超過100億美元,這將加速對緊湊型、低Vπ架構的近期需求。共封裝光學模組的熱設計裕度正在縮小,這使得整合供應商可以透過在同一基板共同最佳化驅動IC和調製器波導管來獲得優勢。隨著 51T 和 102T 光纖交換 ASIC藍圖的逐步完善,光引擎的搭載率將會加快,進一步增強對近期複合年成長率的正面驅動作用。

加速在新興國家部署 5G 和 FTTH 技術

印度推出5G服務後,每月光纖安裝量激增至101,550公里,是5G推出前的六倍。這顯示「基地台光纖覆蓋率達到70%」等政策目標能夠直接轉換為對光元件的實際需求。由於每個小型基地台至少需要一條25G或50G光纖去程傳輸鏈路,因此預計成本和溫度最佳化的調變器訂單量將大幅成長。中國雲端營運商已打造出一個價值20-30億美元的國內收發器市場(預計到2024年),這進一步強化了區域採購週期,並帶動了調製器製造工廠的發展。能夠在各種環境條件下對其設備進行認證的供應商,在公共電信競標中獲得了優先供應商地位,從而提升了其中期成長前景。

超過 100 Gbaud 後,設計複雜性和溫度控管限制將會增加。

將符號速率提升至 100 Gb/s 以上會增加熱負載,並對微波和光訊號之間的速度匹配構成挑戰。麻省理工學院林肯實驗室的電感調諧電極能夠在保持 50 歐姆電阻的同時實現超過 100 GHz 的頻寬,但將這些創新整合到可量產的模組中仍然面臨挑戰。特殊的基板和液態金屬導熱通孔會增加組件成本並延長認證週期,從而限制近期供應多樣性並減緩複合年成長率。

細分市場分析

相位調製器作為連貫檢測的基礎技術,預計到2025年將佔據光調變器市場37.65%的佔有率。然而,整合式調變器晶片將以18.05%的最高複合年成長率成長,因為共封裝光學元件採用單一基板設計,從而降低了功耗和延遲。隨著Tower Semiconductor等晶圓代工廠對400Gbit/通道單元進行認證,整合晶片相關的光調變器市場規模正在不斷擴大。

成熟的振幅和偏振裝置將繼續用於直接檢測和感測應用。類比調製器將在無線光纖傳輸(ROF) 這一細分領域保持其地位,在該領域,線性度比速度更為重要。晶圓級測試的普及正在降低平均售價 (ASP),這吸引了掌握光子電子協同設計技術的新進者。

由於鈮酸鋰具有優異的電光係數和溫度穩定性,其市佔率維持在43.55%。然而,隨著CMOS晶圓廠實現大規模生產並降低成本,矽光子光電正以18.25%的複合年成長率快速成長。受矽光電驅動的光調變器市場正在擴張,因為大型雲端服務買家需要從單一供應商獲得端到端的光子積體電路。磷化銦在整合雷射至關重要的領域保持著一定的市場佔有率,而電光聚合物則在100 GHz以上的微波光電佔據一席之地,儘管可靠性方面仍存在挑戰。

區域分析

截至2025年,亞太地區佔了38.35%的光調變器市場佔有率,主要得益於中國垂直整合的收發器生態系統以及印度大力推進基地台光纖化。該地區深厚的製造業基礎使得物料清單(BOM)成本保持在較低水平,從而能夠快速部署到5G和光纖到戶(FTTH)網路中。政府補貼計劃和在地採購政策進一步鞏固了該地區的製造業基礎。北美市場雖然已經成熟,但其創新主導的需求正在成長,超大規模營運商和國防主要企業正在採用尖端的薄膜鈮酸鋰(LiNbO3)和矽光電來支援人工智慧架構和量子研究。在歐洲,都會區網路持續穩定升級,而汽車LiDAR和工業感測技術正在為模擬調製器和偏振調製器開闢新的市場。與新興經濟體以銷售主導成長不同,這些成熟地區的光調變器市場規模成長主要由技術更新所驅動。

其他福利:

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 加大對光纖通訊基礎設施的投資

- 超大規模資料中心擴展和 800G/1.6T光纖通訊藍圖

- 加速在新興國家部署 5G 和 FTTH 技術

- 城域/長途連結向 400G 以上連貫光纖通訊傳輸的過渡

- 絕緣體上鈮酸鋰(LNOI)調製器的商業化

- 量子光電和低溫互連需求

- 市場限制

- 高於 100 Gbaud 時,設計複雜性和溫度控管限制會增加。

- InP/LiNbO3晶片和極化製程的高昂組件成本

- 高速光電領域技術純熟勞工短缺

- 上游鋰礦供應鏈的集中風險

- 產業供應鏈分析

- 監管環境

- 宏觀經濟因素的影響

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依產品類型

- 幅度調製器

- 偏振調製器

- 相位調製器

- 類比調製器

- 整合(SiPh/InP/LNOI)調製器晶片

- 透過 Material Platform

- 鈮酸鋰(LiNbO3)

- 磷化銦(InP)

- 矽光電(SiPh)

- 電光聚合物

- 其他

- 按數據速率等級

- 25 Gbps 或更低

- 25~50 Gbps

- 50~100 Gbps

- 超過 100 Gbps

- 透過使用

- 光纖通訊

- 資料中心互連

- 5G去程傳輸/回程傳輸

- 海底電纜

- 城市/長途路線

- 光纖感測器

- 工業和結構健康

- 石油和天然氣監測

- 太空與國防

- 測試和測量設備

- 關於量子計算和低溫技術的鏈接

- 光纖通訊

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 東南亞

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 中東

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Lumentum Holdings Inc.

- Fujitsu Optical Components Ltd.

- Thorlabs Inc.

- Hamamatsu Photonics KK

- Lightwave Logic Inc.

- Gooch and Housego PLC

- APE Angewandte Physik and Elektronik GmbH

- AA Opto-Electronic SAS

- Conoptics Inc.

- L3Harris Technologies Inc.

- AMS Technologies AG

- Sumitomo Electric Device Innovations USA Inc.

- iXblue Photonics(Exail)

- Ciena Corporation

- Civicom Photonics

- HyperLight Corp.

- Keysight Technologies Inc.

- ThinkPhotonics Ltd.

- Optilab LLC

- Mellanox Technologies(NVIDIA Photonics)

第7章 市場機會與未來展望

The optical modulators market is expected to grow from USD 6.67 billion in 2025 to USD 7.83 billion in 2026 and is forecast to reach USD 17.45 billion by 2031 at 17.41% CAGR over 2026-2031.

This trajectory reflects accelerating bandwidth demand from 800 G and 1.6 T optics, hyperscale data-center rollouts, and early quantum-computing networks that all rely on ever-faster electro-optic components. Vendors are prioritizing phase-stable, low-drive-voltage designs to meet thermal budgets inside co-packaged optics, while material innovation in thin-film lithium niobate and silicon photonics is reshaping cost structures. Integrated modulator chips are moving from niche to mainstream as switch ASIC vendors mandate optical engines optimized for 100 Gbaud and above. Meanwhile, policymakers in emerging economies keep allocating spectrum and subsidies for 5G backhaul and fiber-to-the-home, sustaining large-volume deployments in the 50-100 Gbps class.

Global Optical Modulators Market Trends and Insights

Rising investments in optical-fiber communication infrastructure

Record AI cluster build-outs lifted 800 G transceiver shipments past 20 million units in 2024 as cloud providers chased lower cost-per-bit metrics. The pivot from 400 G to 800 G, and early 1.6 T proof-points such as Ciena's 1.6 T coherent-lite demo using 224 G SerDes, compel modulators to hit 100 Gbaud symbol rates without breaking power budgets. Linear pluggable optics are doubling from USD 5 billion in 2024 to more than USD 10 billion by 2026, amplifying short-term demand for compact, low-Vπ architectures. Thermal design margins tighten inside co-packaged optics, rewarding integrated suppliers that can co-optimize driver ICs and modulator waveguides on the same substrate. As switch ASIC roadmaps lock in 51 T and 102 T fabrics, optical-engine attach rates accelerate, reinforcing the driver's positive impact on near-term CAGR.

Accelerated 5G and FTTH rollout in emerging economies

India's monthly fiber deployment spiked to 101,550 km after 5G launch, six times the pre-5G run-rate, underlining how policy targets such as 70% tower fiberization translate into real optical component pull-through. Each small cell needs at least one 25 G or 50 G optical fronthaul link, so modulators tuned for cost and temperature resilience see large-volume orders. Chinese cloud operators generated a USD 2-3 billion domestic transceiver market in 2024, reinforcing regional procurement cycles that ripple through modulator fabs. Vendors able to qualify devices under wide environmental ranges win preferred-supplier status in public-telecom tenders, elevating medium-term growth prospects.

Design complexity and thermal-management limits above 100 Gbaud

Pushing symbol rates past 100 Gbaud inflates thermal load and challenges velocity matching between microwave and optical signals. MIT Lincoln Laboratory's inductance-tuned electrodes stretch bandwidth beyond 100 GHz while holding 50-ohm impedance, but packaging such innovations into manufacturable modules remains difficult. Exotic substrates and liquid-metal thermal vias raise BOM and lengthen qualification cycles, limiting short-term supply diversity and depressing CAGR.

Other drivers and restraints analyzed in the detailed report include:

- Move to coherent optics >= 400 G on metro/long-haul links

- Commercialization of lithium-niobate-on-insulator (LNOI) modulators

- High BOM cost of InP/LiNbO3 wafers and poling processes

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Phase modulators owned 37.65% of the optical modulators market share in 2025 as they remain fundamental for coherent detection. Integrated modulator chips, however, will post the strongest 18.05% CAGR because co-packaged optics depends on single-substrate designs that trim power and latency. The optical modulators market size tied to integrated chips expands as foundries like Tower Semiconductor qualify 400 G-per-lane units.

Established amplitude and polarization devices continue serving direct-detection and sensing. Analog modulators keep niche radio-over-fiber footholds where linearity trumps speed. The shift toward wafer-level test drives ASP reduction, inviting new entrants that master photonic-electronic co-design.

Lithium niobate held a 43.55% share thanks to its superior electro-optic coefficient and temperature stability. Yet silicon photonics is accelerating at 18.25% CAGR because CMOS fabs unlock high-volume, low-cost runs. The optical modulators market size attributable to silicon photonics rises as large cloud buyers demand single-supplier photonic ICs end-to-end. Indium phosphide retains a foothold where integrated lasers are mandatory, while electro-optic polymers address >100 GHz microwave photonics, though reliability hurdles persist.

The Optical Modulators Market Report is Segmented by Product Type (Amplitude Modulators, Polarization Modulators, and More), Material Platform (Lithium Niobate, Indium Phosphide, and More), Data-Rate Class (Less Than or Equal To 25 Gbps, 25 - 50 Gbps, and More), Application (Optical Communication, Fiber-Optic Sensors, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific accounted for 38.35% of the optical modulators market share in 2025, fueled by China's vertically integrated transceiver ecosystem and India's sprint to fiberize towers. Regional manufacturing depth keeps BOM low, allowing rapid deployment across 5G and FTTH footprints. Government subsidy programs and local sourcing mandates further anchor production. North America shows mature but innovation-led demand, with hyperscale operators and defense primes adopting cutting-edge thin-film LiNbO3 and silicon photonics to support AI fabrics and quantum research. Europe maintains steady upgrades in metro networks while automotive LiDAR and industrial sensing open adjacencies for analog and polarization modulators. The optical modulators market size in these mature regions grows via technology refresh, contrasting with volume-driven expansion in emerging economies.

- Lumentum Holdings Inc.

- Fujitsu Optical Components Ltd.

- Thorlabs Inc.

- Hamamatsu Photonics K.K.

- Lightwave Logic Inc.

- Gooch and Housego PLC

- APE Angewandte Physik and Elektronik GmbH

- AA Opto-Electronic SAS

- Conoptics Inc.

- L3Harris Technologies Inc.

- AMS Technologies AG

- Sumitomo Electric Device Innovations USA Inc.

- iXblue Photonics (Exail)

- Ciena Corporation

- Civicom Photonics

- HyperLight Corp.

- Keysight Technologies Inc.

- ThinkPhotonics Ltd.

- Optilab LLC

- Mellanox Technologies (NVIDIA Photonics)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising investments in optical-fiber communication infrastructure

- 4.2.2 Hyperscale datacenter expansion and 800 G/1.6 T optics road-map

- 4.2.3 Accelerated 5 G and FTTH rollout in emerging economies

- 4.2.4 Move to coherent optics greater than or equal to?400 G on metro/long-haul links

- 4.2.5 Commercialisation of lithium-niobate-on-insulator (LNOI) modulators

- 4.2.6 Quantum photonics and cryogenic interconnect demand

- 4.3 Market Restraints

- 4.3.1 Design complexity and thermal-management limits above 100 Gbaud

- 4.3.2 High BOM cost of InP/LiNbO? wafers and poling processes

- 4.3.3 Skilled-labour shortage in high-speed photonics packaging

- 4.3.4 Upstream lithium-ore supply-chain concentration risk

- 4.4 Industry Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Impact of Macroeconomic Factors

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Amplitude Modulators

- 5.1.2 Polarization Modulators

- 5.1.3 Phase Modulators

- 5.1.4 Analog Modulators

- 5.1.5 Integrated (SiPh/InP/LNOI) Modulator Chips

- 5.2 By Material Platform

- 5.2.1 Lithium Niobate (LiNbO3)

- 5.2.2 Indium Phosphide (InP)

- 5.2.3 Silicon Photonics (SiPh)

- 5.2.4 Electro-optic Polymer

- 5.2.5 Others

- 5.3 By Data-Rate Class

- 5.3.1 Less than or Equal to 25 Gbps

- 5.3.2 25 - 50 Gbps

- 5.3.3 50 - 100 Gbps

- 5.3.4 Greater than 100 Gbps

- 5.4 By Application

- 5.4.1 Optical Communication

- 5.4.1.1 Datacentre Interconnect

- 5.4.1.2 5 G Fronthaul / Backhaul

- 5.4.1.3 Sub-sea Cables

- 5.4.1.4 Metro / Long-haul

- 5.4.2 Fiber-optic Sensors

- 5.4.2.1 Industrial and Structural Health

- 5.4.2.2 Oil and Gas Monitoring

- 5.4.3 Space and Defence

- 5.4.4 Test and Measurement Equipment

- 5.4.5 Quantum Computing and Cryogenic Links

- 5.4.1 Optical Communication

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 South-East Asia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Lumentum Holdings Inc.

- 6.4.2 Fujitsu Optical Components Ltd.

- 6.4.3 Thorlabs Inc.

- 6.4.4 Hamamatsu Photonics K.K.

- 6.4.5 Lightwave Logic Inc.

- 6.4.6 Gooch and Housego PLC

- 6.4.7 APE Angewandte Physik and Elektronik GmbH

- 6.4.8 AA Opto-Electronic SAS

- 6.4.9 Conoptics Inc.

- 6.4.10 L3Harris Technologies Inc.

- 6.4.11 AMS Technologies AG

- 6.4.12 Sumitomo Electric Device Innovations USA Inc.

- 6.4.13 iXblue Photonics (Exail)

- 6.4.14 Ciena Corporation

- 6.4.15 Civicom Photonics

- 6.4.16 HyperLight Corp.

- 6.4.17 Keysight Technologies Inc.

- 6.4.18 ThinkPhotonics Ltd.

- 6.4.19 Optilab LLC

- 6.4.20 Mellanox Technologies (NVIDIA Photonics)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment