|

市場調查報告書

商品編碼

1687929

飯店物業管理軟體 (PMS):市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Hospitality Property Management Software (PMS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

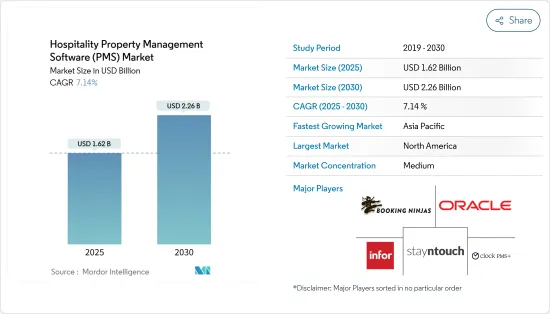

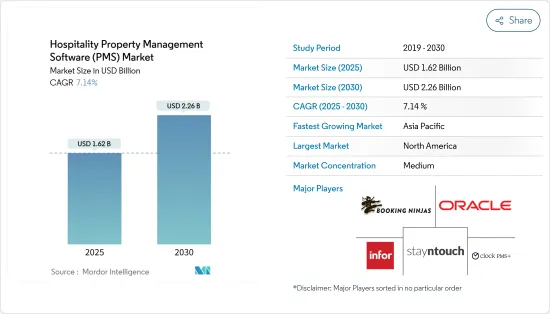

飯店物業管理軟體市場規模預計在 2025 年為 16.2 億美元,預計到 2030 年將達到 22.6 億美元,預測期內(2025-2030 年)的複合年成長率為 7.14%。

由於旅遊業擴張、酒店業快速數位轉型、商業房地產市場成長、業務效率需求不斷增加以及技術進步等因素,飯店物業管理軟體市場正在經歷強勁成長。物業管理軟體 (PMS) 的採用率正在不斷提高,因為它能夠最佳化營運、增強客人體驗並跟上不斷發展的行業趨勢和技術創新。

主要亮點

- 隨著可支配收入的增加,人們在假期和休閒上的支出越來越多,增加了旅遊住宿設施的需求。這一趨勢因其經濟優勢而推動著全球中小型酒店的成長。因此,飯店物業管理軟體 (PMS) 供應商正在抓住機會擴大針對這些小型飯店的軟體產品。

- 雲端運算的進步、對業務效率的關注以及對改善客戶體驗的不斷成長的需求是塑造市場的關鍵促進因素。值得注意的是,越來越多的中小型飯店 (SMH) 開始採用這些系統,推動了市場對經濟高效、擴充性且易於使用的解決方案的需求不斷成長。

- 隨著業務最佳化和客戶維繫在新興市場中越來越受到重視,飯店物業管理系統 (PMS) 市場正在經歷重大變革時期。這種轉變是由對精簡營運、改善客戶體驗和穩定產生收入的需求不斷成長所推動的。

- 與現有系統的整合挑戰是飯店業採用現代物業管理軟體(PMS)的主要障礙。這些挑戰在老牌和中端酒店中尤其普遍,因為舊有系統為主,從而造成了業務瓶頸、增加了成本並減緩了市場滲透率。

- 亞太地區和拉丁美洲國家經濟的快速成長刺激了對新酒店和度假村的投資,從而產生了對具有成本效益、擴充性的酒店物業管理軟體 (PMS) 的需求。印度、中國、印尼、越南和巴西等國家的國內和國際旅遊業正在蓬勃發展。這種成長主要歸因於可支配收入的增加、基礎設施的加強以及政府在旅遊和酒店業採取的積極舉措。

飯店物業管理軟體 (PMS) 市場趨勢

大型企業預計將佔據主要市場佔有率

- 國際連鎖飯店和豪華度假村正在推動飯店物業管理系統 (PMS) 市場的強勁成長。這些領先的公司在多個地點進行大規模營運,依靠先進的 PMS 解決方案來簡化流程、增強客戶體驗並保持競爭優勢。對尖端PMS技術的大量投資是推動市場擴張的關鍵因素。

- 在多個地區擁有物業的大型連鎖飯店受益於集中式物業管理系統 (PMS)。該系統不僅確保一致的服務品質和操作程序,而且還標準化了各個設施之間的流程。這種一致性為客人提供了一致的品牌體驗。此外,集中式資料管理簡化了資源分配,有助於降低營運成本。

- 2024 年 3 月,雲端基礎飯店技術供應商 Hotelogix 宣布印度 Suba 飯店集團採用了其多飯店管理系統。利用 Hotelogix 平台,Suba Group 旨在實現其所有物業流程的自動化和簡化、集中營運並提高成長、收益和客戶滿意度。同樣,克拉克酒店及度假村 (Clarks Hotels and Resorts) 於 2024 年 9 月採用了 Hotelogix 的多物業管理系統。該平台將使克拉克酒店及度假村能夠集中監督其所有物業,專注於提升賓客體驗並推動收益成長。

- 先進的 PMS 平台配備了強大的分析工具,可以了解市場趨勢、客戶偏好和營運績效。這使得相關人員能夠做出明智的、資料主導的決策。利用資料分析,飯店可以微調其定價策略,從而提高每間可用客房收入 (RevPAR)。

- 例如,STR 報告稱,截至 2024 年 12 月 14 日當週,美國酒店業 RevPAR 成長了 18.2%。此外,飯店擴大採用環保做法和綠色舉措來減少碳排放。隨著資料分析和個人化重新定義客戶體驗,酒店業正在經歷變革時期。

- 隨著全球酒店和旅遊業的擴張,酒店物業管理軟體(PMS)(HPMS)供應商正在抓住機會。透過採用 HPMS,從飯店和度假村到度假租賃和服務式公寓的各類營業單位都可以簡化日常業務並提高生產力和客戶滿意度。

- 例如,根據世界旅遊組織(聯合國旅遊部)的資料,全球各地區的國際觀光人數與前一年相比都有所增加。在歐洲,國際觀光人數從 2022 年的 6.0945 億增加到 2023 年的 7.0744 億。同樣,在中東,國際觀光人數從 2022 年的 6,798 萬人增加到 2023 年的 9,347 萬人。

預計北美將佔據較大的市場佔有率

- 技術進步和不斷變化的消費者期望正在推動美國酒店物業管理系統 (PMS) 市場大幅成長。美國酒店業正處於領先地位,迅速採用這些技術創新來提高業務效率並增強客人體驗。透過將人工智慧 (AI)、機器學習和物聯網 (IoT) 設備整合到 PMS 解決方案中,飯店不僅可以實現業務自動化和簡化業務,還可以為住宿提供個人化服務。

- 科技公司 SiteMinder 發現,78% 的旅客願意接受人工智慧在住宿旅行中發揮作用。這些受訪者對 2025 年人工智慧將參與規劃、預訂和飯店住宿領域表示樂觀。另一方面,截至 2024 年 8 月,美國飯店巨頭 Nobu Hotels 正在加強其人工智慧主導的基礎設施。該基礎設施植根於零信任原則,正在透過惠普企業的全面 HPE Aruba 網路解決方案進行升級。升級後的網路目前為全球各地的精選 Nobu 飯店提供高度安全的連線。

- 從精品酒店到大型連鎖飯店,飯店擴大採用雲端基礎的解決方案和人工智慧 (AI) 來提高業務效率並提供個人化賓客體驗。這些雲端基礎的物業管理系統 (PMS) 不僅可以輕鬆擴展以滿足飯店的多樣化需求,而且還減少了對內部硬體的依賴。這一轉變將大大節省資本支出。此外,飯店員工可以從任何地方存取 PMS,從而享受更大的靈活性和應對力。

- 例如,2024 年 10 月,雲端基礎的飯店物業管理系統 (PMS) 和以客人為中心的技術的供應商 StayTouch 與 Cobbleston Hotels 建立了夥伴關係。 Cobblestone 是一家快速擴張的飯店專利權,在 29 個州擁有超過 140 家飯店。 StayTouch 利用先進自動化技術的強大功能,實現了在 Cobblestone 整個產品組合中快速部署雲端 PMS。

- 在加拿大,酒店物業管理系統 (PMS) 市場在技術創新和旅遊業蓬勃發展的推動下正在經歷快速成長。對於加拿大的飯店來說,與線上旅行社 (OTA) 和全球分銷系統 (GDS) 平台的無縫整合對於提高線上可見度和簡化預訂流程至關重要。與這些平台即時同步的 PMS 解決方案不僅可以防止超額預訂,還可以確保尖峰時段的運轉率,讓您在加拿大酒店業中佔據優勢。

- 根據 CoStar Group, Inc. 2024 年 6 月的資料,受平均每日房價 (ADR) 上升的推動,加拿大酒店業繼續蓬勃發展。具體而言,加拿大飯店運轉率將增加0.5個百分點,到2024年達到74.5%。 ADR為231.04加元,較2023年上漲3.7%。隨著經濟前景樂觀,飯店擴大轉向先進的物業管理系統(PMS)解決方案。這種樂觀情緒不僅推動了業務擴張計劃,而且增加了對高度擴充性的PMS 平台的需求。此外,經濟信心的增強為採用提升客戶體驗的 PMS 功能鋪平了道路。

飯店物業管理軟體 (PMS) 產業概覽

飯店物業管理軟體(PMS)市場較為分散,各家公司在區域範圍內爭奪市場佔有率。

提供整合產品的領先供應商有望獲得更高的解決方案採用率,因為它們在價值鏈中佔有一席之地,並且可以降低風險。

此外,由於市場滲透率和提供先進產品的能力,競爭對手之間的敵意預計將繼續加劇。由於市場是需求主導的,創新在產品差異化中起著關鍵作用,因此對創新的需求很高,以獲得競爭優勢。

Oracle Hospitality、Sabre 和 Agilysys 等全球參與者正在與新興參與企業一起在市場上競爭。 Cloudbeds、Mews 和 Guestline 等雲端基礎的PMS 供應商正在透過提供具有成本效益、靈活性和擴充性的解決方案來顛覆 Oracle Hospitality 等傳統領導者的市場格局。從舊有系統向SaaS的轉變降低了進入門檻並加劇了市場競爭。

此外,飯店物業管理軟體市場的併購活動加劇了競爭對手之間的競爭。

整體而言,市場競爭程度較高,預計在市場預測期內競爭程度還會增加。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 主要經濟趨勢分析

第5章 市場動態

- 市場促進因素

- 中小型飯店正在不斷擴大採用

- 注重業務最佳化和客戶維繫推動新市場成長

- 市場挑戰

- 與現有解決方案整合的挑戰

第6章 市場細分

- 按部署

- 本地

- 雲

- 按房產大小

- 中小型企業

- 大型企業

- 按房產類型

- 飯店和度假村

- 汽車旅館和旅館

- 寄宿家庭

- 飯店式公寓

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 亞洲

- 中國

- 日本

- 印度

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Oracle Corporation

- Booking Ninjas

- Clock Software Ltd.

- Infor Equity Holdings LLC

- Stayntouch, Inc.

- Planet

- Mews Systems

- Maestro PMS

- Springler-Miller Systems

- Guestline Limited

- Cloudbeds

- Amadeus Hospitality

- Agilysys NV LLC

- innRoad Hotel Management Software

- AppFolio, Inc.

第8章投資分析

第9章:市場的未來

The Hospitality Property Management Software Market size is estimated at USD 1.62 billion in 2025, and is expected to reach USD 2.26 billion by 2030, at a CAGR of 7.14% during the forecast period (2025-2030).

The hospitality management software market is experiencing robust growth, driven by factors such as the expansion of the tourism industry, rapid digital transformation within the hospitality sector, growth in the commercial real estate market, increasing demand for operational efficiency, and advancements in technology. The adoption of Property Management Software (PMS) continues to rise due to its ability to optimize operations, enhance guest experiences, and align with evolving industry trends and technological innovations.

Key Highlights

- As disposable incomes rise, people are increasingly spending on vacations and leisure activities, driving up demand for tourist accommodations. This trend is bolstering the growth of small and medium hotels globally, owing to their economic advantages. Consequently, hospitality property management software vendors are seizing the opportunity, broadening their software offerings tailored for these smaller hotels.

- Advancements in cloud computing, a heightened emphasis on operational efficiency, and an escalating demand for enhanced guest experiences have been pivotal in shaping the market studied. Notably, small and medium-sized hotels (SMHs) have increasingly adopted these systems, fueling market growth as they seek cost-effective, scalable, and user-friendly solutions.

- As new and emerging markets increasingly prioritize business optimization and customer retention, the hotel Property Management System (PMS) market is undergoing a significant transformation. This evolution is fueled by a rising demand for streamlined operations, improved guest experiences, and consistent revenue generation.

- Integration challenges with existing systems significantly hinder the adoption of modern Property Management Software (PMS) in the hospitality industry. These challenges, especially pronounced in established and mid-tier hotels dominated by legacy systems, create operational bottlenecks, inflate costs, and decelerate market penetration.

- Rapid economic growth in countries in regions such as Asia Pacific and Latin America is fueling investments in new hotels and resorts, driving the demand for cost-effective and scalable hospitality property management software. Countries such as India, China, Indonesia, Vietnam, and Brazil are experiencing a boom in both domestic and international tourism. This surge is largely attributed to rising disposable incomes, enhanced infrastructure, and proactive government initiatives in the travel and hospitality sectors.

Hospitality Property Management Software (PMS) Market Trends

Large Enterprises Segment is Expected to Hold Significant Market Share

- International hotel chains and luxury resorts are driving the robust growth of the Hotel Property Management System (PMS) market. These major players, managing vast operations across multiple locations, rely on advanced PMS solutions to streamline processes, elevate guest experiences, and stay ahead of the competition. Their hefty investments in cutting-edge PMS technologies are a key factor fueling the market's expansion.

- Large hotel chains, with properties spanning diverse regions, benefit from a centralized Property Management System (PMS). This system not only ensures consistent service quality and operational procedures but also standardizes processes across all properties. Such uniformity fosters a cohesive brand experience for guests. Moreover, centralized data management streamlines resource allocation, leading to reduced operational costs.

- In March 2024, Hotelogix, a cloud-based hospitality technology provider, announced that India's Suba Group of Hotels had adopted its multi-property management system. With Hotelogix's platform, Suba Group aims to automate and streamline processes across its properties, ensuring centralized control over operations to boost growth, revenue, and guest satisfaction. In a similar move, in September 2024, The Clarks Hotels & Resorts adopted Hotelogix's multi-property management system in September 2024. This platform will grant The Clarks centralized oversight of all its properties, focusing on enhancing guest experiences and driving revenue growth.

- Advanced PMS platforms equip users with powerful analytics tools, shedding light on market trends, customer preferences, and operational performance. This empowers stakeholders to make informed, data-driven decisions. By leveraging data analysis, hotels can fine-tune their pricing strategies, leading to heightened revenue per available room (RevPAR).

- For instance, STR reported an impressive 18.2% surge in the U.S. hotel industry RevPAR for the week ending December 14, 2024. Furthermore, hotels are increasingly embracing eco-friendly practices and green initiatives to mitigate their carbon footprint. The hospitality sector is undergoing a transformation, with data analytics and personalization reshaping guest experiences.

- As the global hospitality and tourism sector expands, vendors of hospitality property management software (HPMS) are seizing the opportunity. By adopting HPMS, entities ranging from hotels and resorts to homestays and service apartments can streamline daily operations, boosting both productivity and customer satisfaction.

- For instance, according to the data from the World Tourism Organization (UN Tourism), the number of international tourist arrivals worldwide increased in each region compared to the previous year. In Europe, the number of international tourist arrivals increased from 609.45 million in 2022 to 707.44 million in 2023. Similarly, in the Middle East, the number of international tourist arrivals rose to 93.47 million in 2023 from 67.98 million in 2022.

North America is Expected to Hold Significant Market Share

- Technological advancements and changing consumer expectations are fueling significant growth in the U.S. Hotel Property Management System (PMS) market. Leading the charge, the U.S. hospitality sector is swiftly adopting these innovations, aiming to boost operational efficiency and elevate guest experiences. By integrating artificial intelligence (AI), machine learning, and Internet of Things (IoT) devices into their PMS solutions, hotels are not only automating tasks and streamlining operations but also personalized services for their guests.

- SiteMinder, a technology firm, found that 78% of travelers are receptive to AI's role in their accommodation journey. These respondents expressed their openness to AI's involvement in planning, booking, and hotel stays by 2025. In another development, as of August 2024, Nobu Hotels, a US-based hospitality giant, is enhancing its AI-driven infrastructure. This infrastructure, rooted in Zero Trust principles, is being upgraded with a comprehensive HPE Aruba Networking solution from Hewlett Packard Enterprise. The revamped network now provides advanced secure connectivity at select Nobu properties globally.

- Hotels, from boutique establishments to large chains, are increasingly turning to cloud-based solutions and artificial intelligence (AI) to boost operational efficiency and personalize guest experiences. These cloud-based Property Management Systems (PMS) not only scale effortlessly to meet diverse hotel needs but also diminish reliance on on-premises hardware. This shift translates to significant savings in capital expenditures. Moreover, with the ability to access the PMS from any location, hotel staff enjoy heightened flexibility and responsiveness.

- For instance, in October 2024, Stayntouch, a provider of cloud-based hotel property management systems (PMS) and guest-centric technologies, forged a partnership with Cobblestone Hotels. Cobblestone, a rapidly expanding hotel franchise, boasts over 140 properties spread across 29 states. In a remarkable feat, Stayntouch swiftly rolled out its cloud PMS throughout Cobblestone's portfolio, harnessing the power of advanced automation technology.

- In Canada, the Hotel Property Management System (PMS) market is witnessing a surge fueled by tech innovations and a thriving tourism sector. For Canadian hotels, integrating seamlessly with Online Travel Agencies (OTAs) and Global Distribution System (GDS) platforms is vital to bolster their online visibility and streamline bookings. PMS solutions that provide real-time sync with these platforms not only avert overbooking but also guarantee peak room occupancy, positioning them favorably within the Canadian hotel landscape.

- CoStar Group, Inc.'s June 2024 data reveals that Canada's hotel industry continues to thrive, buoyed by rising average daily rates (ADR). Specifically, hotel occupancy in Canada ticked up by 0.5%, reaching 74.5% in 2024. The ADR stood at CAD 231.04, reflecting a 3.7% uptick from 2023. With a positive economic outlook, hotels are increasingly turning to advanced Property Management System (PMS) solutions. This optimism not only fuels expansion plans but also heightens the demand for scalable PMS platforms. Moreover, bolstered financial confidence paves the way for adopting PMS features that elevate guest experiences.

Hospitality Property Management Software (PMS) Industry Overview

The hospitality property management software market is fragmented, and various companies compete on a regional scale to gain market share.

Major vendors that offer integrated products are expected to command a higher share of the adoption for their solutions due to the spread of their presence over the value chain and the ability to mitigate the risk.

Additionally, owing to the market penetration and ability to offer advanced products, the intensity of competitive rivalry is expected to continue to be high. As the market is demand-driven, innovation plays a vital role in product differentiation, resulting in high demand for innovation to gain competitive advantages.

Global players like Oracle Hospitality, Sabre, and Agilysys compete in the market alongside emerging entrants. Cloud-based PMS providers such as Cloudbeds, Mews, and Guestline have disrupted traditional leaders like Oracle Hospitality by delivering cost-efficient, flexible, and scalable solutions. The shift from legacy systems to SaaS has lowered entry barriers, intensifying competition in the market.

Further, the mergers and acquisition activities in the hospitality property management software market are intensifying the competitive rivalry.

Overall, the degree of competition in the market is considered high and expected to grow over the forecast period of the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Analysis of Key Economic Trends

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption from Small and Medium-scale Hotels

- 5.1.2 Stronger Emphasis on Business Optimization and Customer Retention to Drive Growth in New Markets

- 5.2 Market Challenges

- 5.2.1 Integration Challenges with Existing Solutions

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 On-premise

- 6.1.2 Cloud

- 6.2 By Property Size

- 6.2.1 Small and Medium Enterprises

- 6.2.2 Large Enterprises

- 6.3 By Property Type

- 6.3.1 Hotels and Resorts

- 6.3.2 Motels and Lodges

- 6.3.3 Homestay Accommodations

- 6.3.4 Service Apartments

- 6.3.5 Other Property Types

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Italy

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Oracle Corporation

- 7.1.2 Booking Ninjas

- 7.1.3 Clock Software Ltd.

- 7.1.4 Infor Equity Holdings LLC

- 7.1.5 Stayntouch, Inc.

- 7.1.6 Planet

- 7.1.7 Mews Systems

- 7.1.8 Maestro PMS

- 7.1.9 Springler-Miller Systems

- 7.1.10 Guestline Limited

- 7.1.11 Cloudbeds

- 7.1.12 Amadeus Hospitality

- 7.1.13 Agilysys NV LLC

- 7.1.14 innRoad Hotel Management Software

- 7.1.15 AppFolio, Inc.