|

市場調查報告書

商品編碼

1687890

雷射焊接機:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Laser Welding Machines - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

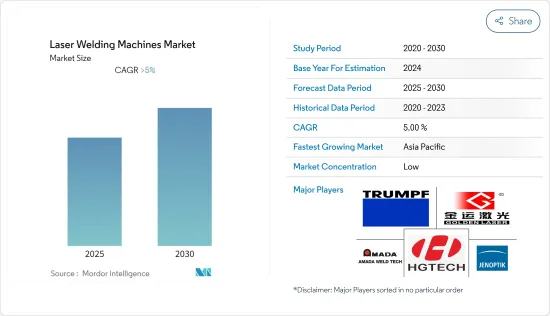

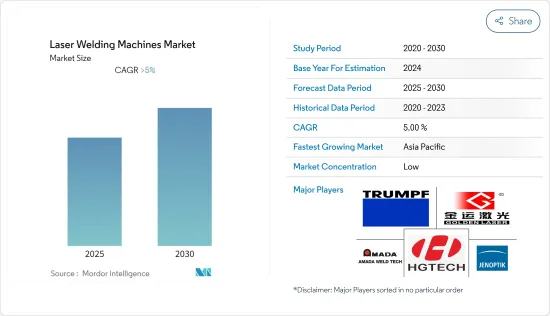

預測期內,雷射焊接機市場預計將以超過 5% 的複合年成長率成長

關鍵亮點

- 事實證明,COVID-19 疫情對各種企業都造成了極其嚴重的衝擊,迫使世界各國政府實施嚴格的封鎖措施,並強制要求保持社交距離,以遏制病毒的傳播。受新冠疫情影響,各國不得不暫停彼此間的焊接作業,嚴重影響了貨物供應,導致供應鏈中斷。市場成長主要受到全球汽車、醫療和電子等多個終端用戶產業需求不斷成長的推動。

- 北美和歐洲等已開發地區比其他新興經濟體更早將雷射焊接技術應用於許多應用。由於自動化趨勢的上升和焊接技術的不斷進步等因素,這些新興市場預計將極大地推動市場發展。

- 如今,雷射焊接已應用於許多不同的領域,從醫療設備中的高精度微焊接到醫療珠寶行業的小規模手工焊接,從模具和工具製造和修理到汽車和重工業領域的全自動雷射焊接。

- 此外,對金屬製品的需求不斷增加、重型工業設備的發展、日益先進的製造流程以及最新技術的採用也在推動市場的發展。此外,一些地區缺乏熟練勞動力,也增加了對自動化設備的需求。

雷射焊接機市場趨勢

汽車產業需求增加

過去幾年,雷射在汽車製造的應用呈指數級成長。儘管雷射最初主要用於切割應用,但其在焊接領域的應用已顯著成長。

零件製造中的雷射應用涵蓋引擎零件、傳動零件、交流發電機、螺線管、燃油噴射器、燃油濾清器等。提高生產率、縮短週期時間在現代工業生產中扮演越來越重要的角色。特別是在汽車行業,每輛車的雷射焊縫總長度可能超過 50 米,因此高焊接速度對於最大限度地縮短加工時間至關重要。與傳統焊接相比,雷射焊接還可以實現熱傳導焊接和深熔焊接。

據業內人士透露,全球輕型汽車產量令人印象深刻,未來將持續成長。就產量而言,預計亞太地區將創下最高成長率,其次是北美。預計這種情況將產生對雷射焊接機和其他與汽車製造過程相關的機械的需求。

成長最快的市場—亞太地區

分析稱,預測期內亞太地區預計成長速度將快於其他地區。該地區擁有最多的製造工廠,引進雷射焊接機對於提高生產率至關重要。

由於中國擁有龐大的製造業,預計將成為該地區的主要參與者。此外,汽車產業是中國的重點產業之一,中國仍是全球最大的汽車市場。

縱觀東南亞國協,製造業是該地區成長要素之一。該地區經濟營運成本低,吸引了許多來自大型製造地的企業。

近年來,中國工資上漲,監管趨嚴,導致製造業向高附加價值方向轉變,導致營運成本上升。為了取代中國曾經扮演的角色,企業正在轉向東協地區附加價值較低的生產網路,這些網路已基本融入全球製造業價值鏈。分析認為,焊機生產企業應聚焦成長市場,服務新興製造業,調整分銷管道,提高銷售量。

雷射焊接機產業概況

雷射焊接機市場高度分散,大量參與企業佔據市場佔有率,其中包括大型全球參與企業和中小型本地企業。對主要國家製造業基地的分析表明,許多跨國公司在主要國家都有業務。對主要企業的詳細分析包括公司概況、財務狀況、產品供應、最新發展等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查結果

- 調查前提

- 研究範圍

第2章調查方法

- 分析方法

- 研究階段

第3章執行摘要

第4章 市場概述

- 當前市場狀況

- 市場動態

- 驅動程式

- 限制因素

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

- 全球製造業(概況、趨勢、研發、關鍵統計等)

- 政府針對製造業的主要法規和舉措

- 焊接行業概況(概述、關鍵指標、發展等)

- 技術簡介(例如機器人技術)

- 3D列印與積層製造洞察

- 雷射塑膠焊接聚光燈

第5章市場區隔

- 依技術

- 纖維

- Co2

- 固態

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第6章競爭格局

- 公司簡介

- TRUMPF Group

- The Emerson Electric Co

- Wuhan Golden Laser Co

- Jenoptik AG

- Huagong Laser Engineering Co.,Ltd

- LaserStar Technologies Corporation

- Shenzhen HeroLaser Equipment Co.,Ltd

- IPG Photonics Corporation

- Amada Miyachi

- EMAG GmbH & Co. KG

- FANUC Robotics

- LASAG

第7章:市場的未來

第 8 章 附錄

- GDP分佈(依活動)- 主要國家

- 資本流動洞察 – 主要國家

- 經濟統計資料-製造業對經濟的貢獻(主要國家)

- 全球製造業統計數據

The Laser Welding Machines Market is expected to register a CAGR of greater than 5% during the forecast period.

Key Highlights

- The COVID-19 outbreak proved very drastic for a variety of businesses and forced governments across the globe to implement strict lockdowns and led to social distancing being made mandatory to contain the spread of the virus, which disrupted the supply chain and halted welding activities across the world. As a consequence of the COVID-19 epidemic, countries were left with no alternative but to temporarily halt their welding operations with one another, which significantly impacted the supply of commodities, consequently producing a disruption in the supply chain. The growth of the market is majorly driven by the increasing demand from several end-user industries such as automotive, medical, electronics, etc., across the world.

- Developed regions like North America and Europe adopted laser welding techniques long back for many applications when compared to other developing economies. These developed regions are expected to fuel the growth of the market significantly owing to factors such as the rising trend of automation, and continuous advancements in welding technology.

- Currently, laser welding is used in numerous different fields, ranging from highly precise micro-welding of medical devices to small-scale manual welding in the medical and jewelry industries, from the manufacture and repair of dies and tools to fully automated laser welding in the automotive and heavy manufacturing sectors.

- Furthermore, the market is also driven by the growing demand for fabricated metal products, development of heavy industrial equipment, advancement in the manufacturing processes, and adoption of latest technologies. Additionally, the demand for automated equipment is also increasing due to the shortage of skilled personnel in some of the regions studied

Laser Welding Machines Market Trends

Increasing Demand from the Automotive Industry

The use of laser in automotive manufacturing has increased intensely over recent years. Although the lasers are initially developed mainly to cutting applications, a significant and growing proportion of lasers is being applied to welding.

The application of lasers in the manufacture of components covers engine parts, transmission parts, alternators, solenoids, fuel injectors, fuel filters, etc. Improved productivity and reduction of cycle time play an increasing role in current industrial manufacturing. Especially within the automotive industry, where the total length of laser welded seams can add up to more than 50 meters per car, it is important to minimize processing time by means of high welding speeds. Compared to conventional welding, laser welding allows for heat conduction welding and deep penetration welding, as well.

According to industry sources, global light vehicle production units have been remarkable and it only continues to grow. APAC is expected to register the highest growth rates in terms of production volumes followed by North America. This scenario is expected to create demand for the laser welding machines and other related machines associated with the automotive manufacturing process.

Fastest Growing Market- Asia-Pacific Region

As per the analysis, Asia-Pacific (APAC) is estimated to grow faster than other regions during the forecast period. The region has the highest number of manufacturing plants where the adoption of laser welding machines, which focus on improved productivity is essential.

China is expected to be the major country in the region owing to its vast manufacturing sector. Additionally, automotive is one of China's pillar industries, and it continues to be the largest vehicle market in the world.

Coming to ASEAN countries, the manufacturing sector has been one of ASEAN's key economic growth drivers. Economies in this region have low operating costs, which attract many businesses from larger manufacturing bases.

In recent times, China has seen rising wages and tighter regulations, which has led to an increase in operating costs as it shifts towards higher-value manufacturing. In order to replace the role that PRC once played, companies are looking to the ASEAN region for lower-value production networks which have also been largely integrated into global manufacturing value chains. As per the analysis, welding machine manufacturers should align their distribution channels to focus on the growing markets by serving the emerging manufacturing sectors to increase their sales.

Laser Welding Machines Industry Overview

The laser welding machines market is fairly fragmented in nature with the presence of large global players and small and medium sized local players with quite a few players who occupy the market share. When analyzing major countries' manufacturing establishments, it is revealed that many of the global companies have footprint in the major countries. Detailed analysis of major companies, which include company overview, financials, products offerings, recent developments, etc. are covered in the report.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Current Market Scenario

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.2 Restraints

- 4.3 Industry Attractiveness- Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Industry Value Chain Analysis

- 4.5 Global Manufacturing Sector (Overview, Trends, R&D, Key Statistics, etc.)

- 4.6 Key Government Regulations and Initiatives for Manufacturing Sector

- 4.7 Welding Industry Snapshot (Overview, Key Metrics, Developments, etc.)

- 4.8 Technology Snapshot (Robotics, etc.)

- 4.9 Insights on 3D Printing and Additive Manufacturing

- 4.10 Spotlight on Laser Plastic Welding

5 MARKET SEGMENTATION

- 5.1 By Technology

- 5.1.1 Fiber

- 5.1.2 Co2

- 5.1.3 Solid-State

- 5.1.4 Others

- 5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 Latin America

- 5.2.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Overview (Market Concentration, Major Players)

- 6.2 Company Profiles

- 6.2.1 TRUMPF Group

- 6.2.2 The Emerson Electric Co

- 6.2.3 Wuhan Golden Laser Co

- 6.2.4 Jenoptik AG

- 6.2.5 Huagong Laser Engineering Co.,Ltd

- 6.2.6 LaserStar Technologies Corporation

- 6.2.7 Shenzhen HeroLaser Equipment Co.,Ltd

- 6.2.8 IPG Photonics Corporation

- 6.2.9 Amada Miyachi

- 6.2.10 EMAG GmbH & Co. KG

- 6.2.11 FANUC Robotics

- 6.2.12 LASAG

7 FUTURE OF THE MARKET

8 APPENDIX

- 8.1 GDP Distribution, by Activity-Key Countries

- 8.2 Insights on Capital Flows-Key Countries

- 8.3 Economic Statistics-Manufacturing Sector, Contribution to Economy (Key Countries)

- 8.4 Global Manufacturing Industry Statistics