|

市場調查報告書

商品編碼

1687874

全球汽車物流-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Global Automotive Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

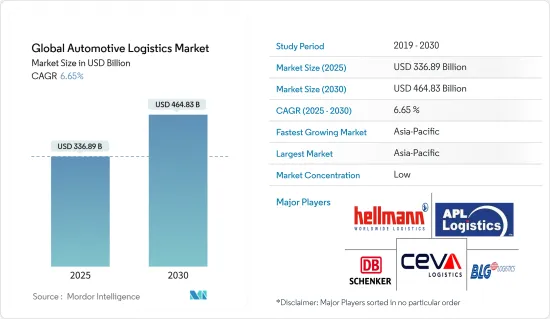

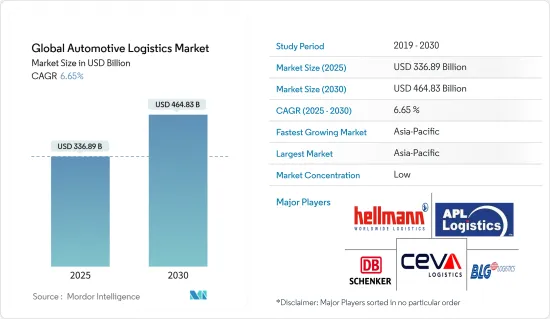

2025 年全球汽車物流市場規模估計為 3,368.9 億美元,預計到 2030 年將達到 4,648.3 億美元,預測期內(2025-2030 年)的複合年成長率為 6.65%。

關鍵亮點

- 受全球汽車產量和銷量不斷成長的推動,全球汽車物流市場正在經歷顯著成長。這種擴張主要歸因於新興市場的需求不斷成長、汽車行業的技術進步以及電子商務的激增。預測顯示,在汽車製造全球化、向電動和自動駕駛汽車的轉變以及全球供應鏈的持續演變的支持下,汽車產業將呈現穩定的成長軌跡。

- 汽車物流市場的成長與整個汽車產業的健康密切相關。隨著汽車產量和銷售量的增加,對高效物流解決方案的需求也隨之成長。新興市場在這一擴張中發揮關鍵作用,為物流供應商提供了新的機會。技術進步不僅增強了車輛的性能,而且還改變了物流業務,使其更有效率、更安全。向電動和自動駕駛汽車的轉變正在帶來新的物流挑戰和機會,尤其是在處理專用零件和電池方面。此外,對永續性的關注正在鼓勵公司採用更環保的物流實踐,這也將節省成本並提高品牌聲譽。

- 儘管如此,亞洲國家在汽車零件進口方面仍佔據主導地位,佔63%,其次是歐洲(27%)和北美(9%)。來自歐洲的進口量增加了 8%,來自北美的進口量增加了 2.5%,而來自亞洲的進口量則增加了 2%。此外,專注於售後服務和產品的售後市場部分在2024會計年度上半年大幅成長了7.5%,達到55億美元。

- 印度汽車零件製造商在 2024 會計年度上半年的收益為 361 億美元,主要受到汽車目標商標產品製造商 (OEM ) 強勁需求的推動。預計OEM需求的激增將成為汽車零件物流市場的主要動力。

- 物聯網、人工智慧和區塊鏈等技術的採用正在徹底改變供應鏈視覺性、最佳化營運並提高安全性和效率。例如,2023年5月,韓國貿易、工業和能源部承諾投入超過14兆韓元(110億美元),與當地汽車製造商合作,加強國內汽車供應鏈,促進出口,並促進向下一代技術的過渡。

- 向電動車 (EV) 的轉變和自動駕駛汽車的興起正在重塑物流,並需要對零件和電池進行專門處理。同時,人們也越來越重視物流的環境永續性。越來越多的公司採用環保做法,例如最佳化運輸路線、使用節能車輛和採用永續包裝解決方案。

- 隨著物流技術的不斷創新,它將使供應鏈更有效率、透明和更具適應性。特別是亞太地區快速成長的市場預計將對全球汽車物流市場的擴張做出重大貢獻。此外,向線上汽車銷售的轉變以及對客戶體驗的重視正在重塑物流策略和營運。

汽車物流市場的全球趨勢

特定服務運輸服務未來將佔據最大市場佔有率

- 車輛主要透過公路、鐵路、海運和空運運輸。由於即時追蹤、RFID 技術和物聯網設備等技術的進步,提高了供應鏈的可視性,預計道路產業將在全球市場上實現成長。

- 特別是在歐洲,低成本和智慧交通系統的引入正在刺激公路產業的發展。這些系統將促進先進的連接、車隊行駛並為自動駕駛鋪平道路。同時,在高效能港口服務和優質基礎設施興起的推動下,海運業可望大幅成長,進而降低企業、托運人和消費者的成本。

- 2023年12月,中國知名第三方汽車物流公司長久物流採取引人注目的舉措,承接上汽通用五菱的跨國道路運輸。約500車陸續從柳州工廠出發,經中國新疆維吾爾自治區喀什口岸駛往烏茲別克塔什幹。這種跨境道路運輸因其速度快、成本效益高和靈活性而受到重視。在上汽通用五菱柳州工廠,長久物流團隊精心將一輛五菱乘用車裝載到開往烏茲別克的雙層汽車運輸拖車上。隨著這項發展,亞太地區汽車物流市場將享有更大的跨境連通性和營運效率。

- 2023年5月,CEVA物流了橫跨中國-吉爾吉斯斯坦-烏茲別克斯坦和中國-巴基斯坦走廊的新國際道路運輸(TIR)路線,成為頭條新聞。這些航線旨在加強貿易並造福該地區,並舉行了剪綵儀式。這支由六輛卡車組成的車隊滿載著工業零件、汽車零件和消費品,從中國西部的喀什出發,進入吉爾吉斯斯坦,行駛約1100公里,抵達烏茲別克的撒馬爾罕。該舉措將開闢新的貿易路線並促進物流業務,從而顯著增強亞太汽車物流市場。

- 鐵路客運2023會計年度1-3月汽車運輸量較上年同期增加33%,達到約2.7萬輛。

- 中央鐵路公司報告稱,2023 會計年度第一季火車車輛負載容量與 2022 會計年度同期相比大幅增加了 33%。

- 馬恆達、塔塔汽車和馬魯蒂烏迪奧格等主要汽車製造商一直依賴鐵路服務來滿足其車輛運輸需求。

- 2023 年 6 月,DMN 物流採取策略性措施收購 JLL 汽車分銷,彰顯其致力於加強電動車 (EV) 和通用汽車物流業務的決心。 JLL 汽車分銷公司總部位於阿爾維徹奇,成立於 2010 年,是一家家族企業,專門提供精品和電動汽車運輸服務,為 Inchcape、Autorola、奧迪和其他主要經銷商集團和品牌等客戶提供服務。

- 此外,JLL 汽車分銷還為企業客戶和經銷商提供送貨和車輛運輸服務以及客戶交接服務。 DMN 物流與 JLL 的董事總經理進行了討論,最終達成了全面收購。此次收購充分利用了中國新興OEM對打入英國汽車物流市場日益成長的興趣。

亞太地區可望維持市場佔有率

- 亞太地區包括中國、日本、印度和韓國,是世界汽車強國。汽車產銷量的激增、汽車出口的良好趨勢以及消費者對新車和二手車的需求不斷成長,推動了市場的快速擴張。

- 電子商務的出現和網上汽車銷售的快速成長正在重塑汽車物流。這種轉變凸顯了精簡物流網路和創新最後一哩路交付解決方案的必要性。此外,人們對電動車日益成長的興趣不僅改變了汽車產業,也徹底改變了物流。這包括專用零件和電池的複雜運輸要求,為新穎的物流解決方案鋪平了道路。

- 例如,2023年,中國汽車出口強勁。光是2023年12月,中國就售出了49.9萬輛汽車。根據中國工業協會的資料,2023年中國汽車出口創下新紀錄,飆漲57.9%,達491萬輛。這一成長主要得益於新能源汽車出口的大幅成長,出口量激增 77.6%,超過 120 萬輛。其中,純電動汽車出口成長80.9%,混合動力汽車成長47.8%。

- 中國汽車整體市場銷量與前一年同期比較增12%,突破3,000萬輛大關。產量同樣令人印象深刻,突破3000萬輛,比2022年成長11.6%。新能源汽車發揮了重要作用,產銷分別達到958萬輛和949萬輛,年比大幅增加35.8%和與前一年同期比較%。值得注意的是,到 2023 年,新能源汽車將佔據 31.6% 的市場佔有率。汽車出口和新能源汽車產量的成長極大地推動了亞太汽車物流市場的發展,促進了對高效運輸和配送解決方案的需求。

- 汽車產業是日本經濟的重要組成部分。豐田、本田、日產等全球大型公司不僅引領國內市場,在全球也佔有重要地位。值得注意的是,汽車出口(主要是轎車)佔日本出口總額的很大一部分,凸顯了該產業在經濟狀況中所扮演的關鍵角色。根據日本海關的資料,2023年日本乘用車出口總量約527萬輛,與前一年同期比較增加20%。這些出口額約為15.54兆日圓(1056.7億美元)。展望2024年,日本汽車工業協會報告稱,日本1月汽車出口量為295,133輛。其中,乘用車263981輛,貨車22755輛,客車8397輛。高出口量需要先進的物流解決方案來管理車輛的有效運輸,從而加強該地區的汽車物流市場。

- 印度是全球第三大汽車市場,汽車業對該國GDP的貢獻率為7.1%。最近的一份報告也強調,該國在過去 14 年減少了 33% 的溫室氣體排放。

- 在汽車產業經歷重大轉型的同時,印度依然堅定地履行《聯合國氣候變遷公約》(UNFCCC)的承諾。依照全球永續性目標,我們的目標是到 2030 年將排放強度在 2005 年的基礎上降低 45%。這項承諾加上汽車產業的成長,推動了對支持高效汽車和零件分銷的創新物流解決方案的需求,從而進一步推動亞太汽車物流市場的發展。

全球汽車物流產業概覽

汽車物流市場較為分散,有大型全球參與企業、中小型本地參與企業以及少數佔據市場佔有率的少數參與企業。大多數全球物流參與企業都設有汽車物流部門來滿足市場需求。此外,本地參與企業在庫存處理、服務提供、處理產品和技術方面的能力也日益增強。

市場上的第三方物流(3PL)服務供應商正在根據其可靠性和供應鏈能力展開激烈競爭。每家公司都試圖透過提供高附加價值的服務來實現其服務的差異化。電子商務銷售的興起為物流公司在速度、配送等方面創造了機會和挑戰。

擁有大量資產和資本資源的全球公司可以投資先進的技術和物流中心,以從上述場景中獲益。同時,地區和本地參與企業正在提出更好的行業解決方案來滿足製造商、零售商和經銷商的需求。該行業的一些主要參與者包括 Hellmann Worldwide Logistics、APL Logistics、BLG Logistics Group、CEVA Logistics 和 DB Schenker。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查結果

- 調查前提

- 研究範圍

第2章調查方法

- 分析方法

- 研究階段

第3章執行摘要

第4章 市場洞察

- 當前市場狀況

- 產業價值鏈分析

- 政府法規和舉措

- 全球物流業(概況、LPI 評分、主要貨運統計等)

- 聚焦全球汽車產業(概況、發展趨勢、統計等)

- 聚焦-電子商務對傳統汽車物流供應鏈的衝擊

- 逆向物流的回顧與說明(概述、與正向物流的比較問題等)

- 深入了解汽車售後市場及其物流活動

- 物流與綜合物流需求聚焦

- 地緣政治與疫情將如何影響市場

第5章市場動態

- 市場促進因素

- 汽車產銷售成長

- 電子商務與全通路物流

- 市場限制

- 供應鏈中斷

- 基礎設施限制

- 市場機會

- 技術創新

- 投資永續性計劃

- 產業吸引力-波特五力分析

- 買家/消費者的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第6章市場區隔

- 按服務

- 運輸

- 倉儲、配送和庫存管理

- 其他

- 按類型

- 整車

- 汽車零件

- 其他

- 按地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 德國

- 義大利

- 俄羅斯

- 法國

- 其他歐洲國家

- 拉丁美洲

- 巴西

- 阿根廷

- 其他拉丁美洲

- 中東和非洲

- 南非

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 其他中東和非洲地區

- 亞太地區

第7章競爭格局

- 公司簡介

- Hellmann Worldwide Logistics SE & Co. KG

- APL Logistics Ltd

- BLG Logistics Group AG & Co. KG

- CEVA Logistics

- DB Schenker

- DHL Group

- GEFCO SA

- Kerry Logistics Network Ltd

- Kuehne+Nagel International AG

- Penske Logistics Inc.

- Ryder System Inc.

- DSV Panalpina AS

- Expeditors

- Panalpina

- XPO Logistics Inc.

- Tiba Group

- Bollore Logistics

- CFR Rinkens*

- 其他公司

第8章:市場的未來

第9章 附錄

- GDP 分佈(依活動 - 主要國家)

- 資本流動洞察 – 主要國家

- 經濟統計-運輸和倉儲業對經濟的貢獻(主要國家)

- 全球汽車產業統計數據

The Global Automotive Logistics Market size is estimated at USD 336.89 billion in 2025, and is expected to reach USD 464.83 billion by 2030, at a CAGR of 6.65% during the forecast period (2025-2030).

Key Highlights

- The global automotive logistics market is witnessing substantial growth, propelled by increased vehicle production and sales worldwide. This expansion is primarily fueled by heightened demand in emerging markets, technological advancements in the automotive sector, and the surge of e-commerce. Projections indicate a steady growth trajectory, underpinned by the globalization of automotive manufacturing, the pivot towards electric and autonomous vehicles, and the continual evolution of global supply chains.

- The automotive logistics market's growth is closely tied to the overall health of the automotive industry. As vehicle production and sales rise, the demand for efficient logistics solutions increases. Emerging markets are playing a crucial role in this expansion, offering new opportunities for logistics providers. Technological advancements are not only enhancing vehicle features but also transforming logistics operations, making them more efficient and secure. The shift towards electric and autonomous vehicles is creating new logistics challenges and opportunities, particularly in the handling of specialized components and batteries. Additionally, the emphasis on sustainability is driving companies to adopt greener logistics practices, which can also lead to cost savings and improved brand reputation.

- Despite this, Asian nations retained their dominance in auto components imports, accounting for 63%, with Europe at 27% and North America at 9%. While imports from Europe and North America saw modest growth rates of 8% and 2.5% respectively, those from Asia increased by a more conservative 2%. Furthermore, the aftermarket segment, focusing on post-sales services and products, saw a notable 7.5% expansion, reaching USD 5.5 billion in H1 FY24.

- India's auto parts manufacturers raked in a revenue of USD 36.1 billion in the first half of the 2024 fiscal year, largely driven by robust demand from automotive original equipment manufacturers (OEMs). This surge in demand from OEMs is poised to be a key driver for the auto components logistics market.

- Technological adoptions, such as IoT, AI, and blockchain, are revolutionizing supply chain visibility, operational optimization, and enhancing security and efficiency. For instance, in May 2023, South Korea's Ministry of Trade, Industry, and Energy, in collaboration with local automakers, pledged over KRW 14 trillion (USD 11 billion) to fortify the nation's automotive supply chain, boost exports, and facilitate the transition to next-gen technologies.

- The transition to electric vehicles (EVs) and the rise of autonomous vehicles are reshaping logistics, necessitating specialized handling of components and batteries. Simultaneously, there's a growing emphasis on environmental sustainability in logistics. Companies are increasingly adopting green practices, including optimizing transportation routes, using energy-efficient vehicles, and embracing sustainable packaging solutions.

- As logistics technology continues to innovate, it's poised to further enhance supply chain efficiency, transparency, and adaptability. The burgeoning markets, especially in the Asia-Pacific region, are set to be significant contributors to the global automotive logistics market's expansion. Moreover, the shift towards online vehicle sales and an amplified focus on customer experience are reshaping logistics strategies and operations.

Global Automotive Logistics Market Trends

By Service Transportation Service Occupies the Largest Market Share in the Future

- Automotive vehicles primarily utilize roadways, railways, maritime, and airways for transportation. The roadways segment is poised for global market growth, driven by advancements like real-time tracking, RFID technology, and IoT devices, enhancing supply chain visibility.

- Low costs and the adoption of intelligent transport systems, particularly in Europe, are fueling the roadways segment. These systems facilitate high-level connectivity, platooning, and pave the way for automated driving. Meanwhile, the maritime segment is set for significant growth, attributed to the rise of high-performing port services and quality infrastructure, which reduce costs for operators, shippers, and consumers.

- In a notable move in December 2023, Changjiu Logistics, a prominent third-party automotive logistics firm in China, took on SAIC-GM-Wuling's cross-border road transport. The journey saw nearly 500 vehicles leaving sequentially from Liuzhou plant, traveling from Kashgar port in Xinjiang, China, to Tashkent, Uzbekistan. This cross-border road transport is lauded for its speed, cost-efficiency, and flexibility. Changjiu Logistics' team meticulously handled operations at SAIC-GM-Wuling's Liuzhou plant, loading Wuling passenger cars onto double-deck car carrier trailers destined for Uzbekistan. This development boosts the automotive logistics market in the Asia-Pacific region by enhancing cross-border connectivity and operational efficiency.

- CEVA Logistics made headlines in May 2023 with the launch of new international road transport (TIR) routes spanning China-Kyrgyzstan-Uzbekistan and China-Pakistan corridors. These routes, aimed at bolstering trade and reaping regional benefits, were inaugurated with a ribbon-cutting ceremony. The convoy, comprising six trucks laden with industrial components, auto parts, and consumer goods, set off from Kashgar in western China, crossed into Kyrgyzstan, and successfully reached Samarkand in Uzbekistan after a journey of about 1,100 kilometers. This initiative significantly enhances the automotive logistics market in the Asia-Pacific region by opening new trade routes and facilitating smoother logistics operations.

- Central Railway saw a commendable 33% surge in car transportation, moving around 27,000 cars in the first three months of FY 2023, compared to the same period in FY 2022.

- Central Railway reported a significant uptick of 33% in car loading via trains in the first quarter of FY 2023, compared to the corresponding period in FY 2022.

- Leading automobile manufacturers like Mahindra & Mahindra, Tata Motors, and Maruti Udyog have been relying on railway services for their vehicle transportation needs.

- In a strategic move in June 2023, DMN Logistics acquired JLL Vehicle Distribution, emphasizing its commitment to bolstering its electric vehicle (EV) and general vehicle logistics operations. JLL Vehicle Distribution, based in Alvechurch and founded in 2010 as a family business, specializes in boutique and EV transport services, catering to clients like Inchcape, Autorola, and Audi, as well as other major dealer groups and brands.

- Besides, JLL Vehicle Distribution offers delivery and vehicle transfer services to corporate clients, dealers, and handles customer handovers. DMN Logistics initiated discussions with JLL's managing director, eventually culminating in a full acquisition. The acquisition is poised to capitalize on the growing interest from emerging Chinese OEMs eyeing expansion into the UK's vehicle logistics market.

Asia-Pacific is Poised to Maintain its Dominance in Market Share

- The Asia-Pacific region, encompassing countries like China, Japan, India, and South Korea, stands out as a global automotive powerhouse. This market's rapid expansion is fueled by surging vehicle production and sales, a buoyant trend in automotive exports, and an escalating appetite for both new and pre-owned vehicles among consumers.

- The advent of e-commerce and the surge in online vehicle sales are reshaping automotive logistics. This shift underscores the need for streamlined distribution networks and innovative last-mile delivery solutions. Additionally, the mounting interest in electric vehicles is not just transforming the automotive landscape but also revolutionizing logistics. This includes the intricate transportation requirements for specialized components and batteries, paving the way for novel logistics solutions.

- For example, in 2023, China's automotive exports painted a robust picture. In December 2023 alone, China shipped out a staggering 499,000 automobiles. Data from the China Association of Automobile Manufacturers (CAAM) revealed that China's auto exports hit a milestone in 2023, surging by 57.9% to a record 4.91 million vehicles. This surge was largely driven by a remarkable uptick in new energy vehicle (NEV) exports, which leaped by 77.6% to over 1.2 million units. Specifically, pure electric vehicle exports soared by 80.9%, while hybrid variants saw a 47.8% uptick.

- The broader auto market in China saw a 12% year-on-year sales increase, crossing the 30 million mark. Production figures were equally impressive, surpassing 30 million units, marking an 11.6% rise from 2022. NEVs played a significant role, with production and sales exceeding 9.58 million and 9.49 million units, respectively, marking a robust 35.8% and 37.9% year-on-year surge. Notably, NEVs captured a market share of 31.6% in 2023. This growth in automotive exports and NEV production significantly boosts the automotive logistics market in the Asia-Pacific region, driving demand for efficient transportation and distribution solutions.

- Japan's automotive sector is a cornerstone of its economy. Global giants like Toyota, Honda, and Nissan not only lead the domestic market but also command a significant presence worldwide. Notably, automotive exports, predominantly automobiles, make up a substantial portion of Japan's total exports, underscoring the sector's pivotal role in the nation's economic landscape. Data from Japan Customs for 2023 highlights that Japan exported around 5.27 million passenger cars, marking a robust 20% increase from the previous year. These exports were valued at approximately 15.54 trillion Japanese yen (USD 105.67 billion). Moving into 2024, January saw Japan exporting 295,133 motor vehicles, as reported by the Japan Automobile Manufacturers Association. The breakdown includes 263,981 passenger cars, 22,755 trucks, and 8,397 buses. The substantial volume of exports necessitates advanced logistics solutions to manage the efficient movement of vehicles, thereby enhancing the automotive logistics market in the region.

- India, the world's third-largest automotive market, sees its automotive sector contributing a notable 7.1% to the nation's GDP. Recent reports also highlight a commendable 33% reduction in the country's greenhouse gas emissions over the past 14 years.

- Amidst a sweeping transformation in the automotive landscape, India is steadfast in its commitment to the United Nations Convention on Climate Change (UNFCCC). The nation aims to slash emissions intensity by 45% from 2005 levels by 2030, aligning with global sustainability goals. This commitment, coupled with the growth of the automotive sector, drives the need for innovative logistics solutions to support the efficient distribution of vehicles and components, further boosting the automotive logistics market in the Asia-Pacific region.

Global Automotive Logistics Industry Overview

The automotive logistics market is fragmented in nature, with large global players, small- and medium-sized local players, and few players who occupy the market share. Most global logistics players have an automotive logistics division to meet the market needs and demand. Additionally, local players are increasingly enhancing their capabilities in terms of inventory handling, service offerings, products handled, and technology.

The third-party logistics (3PL) service providers in the market compete intensely based on reliability and supply chain capacity. By offering value-added services, companies would differentiate their service offerings. The growing e-commerce sales are creating opportunities and challenges for logistics firms in terms of speed, delivery, etc.

Global companies with high assets and capital can invest in advanced technology and distribution centers and benefit from the scenario mentioned above. On the other hand, regional and local players are coming up with better sector solutions to support the needs of manufacturers, retailers, as well as dealers. This industry's major players include Hellmann Worldwide Logistics, APL Logistics, BLG Logistics Group, CEVA Logistics, and DB Schenker.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Industry Value Chain Analysis

- 4.3 Government Regulations and Initiatives

- 4.4 Global Logistics Sector (Overview, LPI Scores, Key Freight Statistics, etc.)

- 4.5 Focus on the Global Automotive Industry (Overview, Development and Trends, Statistics, etc.)

- 4.6 Spotlight - Effect of E-commerce on Traditional Automotive Logistics Supply Chain

- 4.7 Review and Commentary on Reverse Logistics (Overview, Challenges in Comparison with Forwards Logistics, etc.)

- 4.8 Insights on Automotive Aftermarket and its Logistics Activities

- 4.9 Spotlight on the Demand for Contract Logistics and Integrated Logistics

- 4.10 Impact of Geopolitics and Pandemic on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Vehicle Production and Sales

- 5.1.2 E-commerce and Omnichannel Distribution

- 5.2 Market Restraints

- 5.2.1 Supply Chain Disruptions

- 5.2.2 Infrastructure Limitations

- 5.3 Market Opportunities

- 5.3.1 Technological Innovations

- 5.3.2 Investing in Sustainability Initiatives

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Powers of Buyers/Consumers

- 5.4.2 Bargaining Power of Suppliers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Service

- 6.1.1 Transportation

- 6.1.2 Warehousing, Distribution, and Inventory Management

- 6.1.3 Other Services

- 6.2 By Type

- 6.2.1 Finished Vehicle

- 6.2.2 Auto Components

- 6.2.3 Other Types

- 6.3 Geography

- 6.3.1 Asia-Pacific

- 6.3.1.1 China

- 6.3.1.2 Japan

- 6.3.1.3 India

- 6.3.1.4 South Korea

- 6.3.1.5 Rest of Asia-Pacific

- 6.3.2 North America

- 6.3.2.1 United States

- 6.3.2.2 Canada

- 6.3.2.3 Mexico

- 6.3.3 Europe

- 6.3.3.1 United Kingdom

- 6.3.3.2 Germany

- 6.3.3.3 Italy

- 6.3.3.4 Russia

- 6.3.3.5 France

- 6.3.3.6 Rest of Europe

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Argentina

- 6.3.4.3 Rest of Latin America

- 6.3.5 Middle East & Africa

- 6.3.5.1 South Africa

- 6.3.5.2 United Arab Emirates

- 6.3.5.3 Saudi Arabia

- 6.3.5.4 Rest of Middle East & Africa

- 6.3.1 Asia-Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Overview (Market Concentration and Major Players)

- 7.2 Company Profiles

- 7.2.1 Hellmann Worldwide Logistics SE & Co. KG

- 7.2.2 APL Logistics Ltd

- 7.2.3 BLG Logistics Group AG & Co. KG

- 7.2.4 CEVA Logistics

- 7.2.5 DB Schenker

- 7.2.6 DHL Group

- 7.2.7 GEFCO SA

- 7.2.8 Kerry Logistics Network Ltd

- 7.2.9 Kuehne + Nagel International AG

- 7.2.10 Penske Logistics Inc.

- 7.2.11 Ryder System Inc.

- 7.2.12 DSV Panalpina AS

- 7.2.13 Expeditors

- 7.2.14 Panalpina

- 7.2.15 XPO Logistics Inc.

- 7.2.16 Tiba Group

- 7.2.17 Bollore Logistics

- 7.2.18 CFR Rinkens*

- 7.3 Other Companies

8 FUTURE OF THE MARKET

9 APPENDIX

- 9.1 GDP Distribution (by Activity - Key Countries)

- 9.2 Insights on Capital Flows - Key Countries

- 9.3 Economic Statistics - Transport and Storage Sector, Contribution to Economy (Key Countries)

- 9.4 Global Automotive Industry Statistics