|

市場調查報告書

商品編碼

1687855

印度瓷磚:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)India Ceramic Tiles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

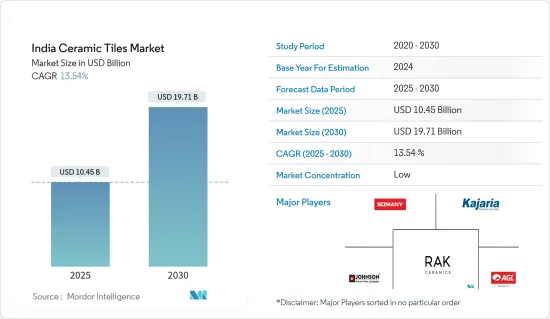

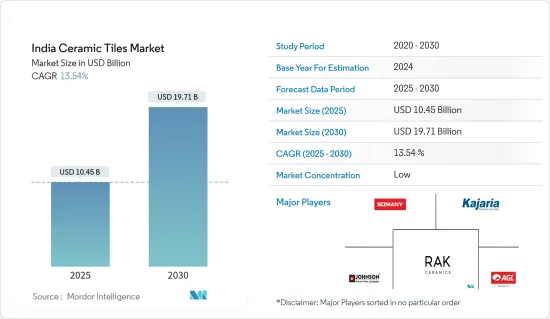

印度瓷磚市場規模預計在 2025 年為 104.5 億美元,預計到 2030 年將達到 197.1 億美元,預測期內(2025-2030 年)的複合年成長率為 13.54%。

近年來,印度瓷磚市場穩步成長。新冠病毒疫情已導致約1,000萬農民工返回祖國。勞動力短缺迫使瓷磚製造商必須快速完成計劃。印度對瓷磚的需求增加可歸因於幾個因素。政府措施帶動房地產產業快速成長,住宅產業也呈現強勁成長動能。印度的可支配收入也在增加,人們正在尋找美化生活和工作場所的方法。 RERA 讓房地產行業更加透明和流程化。在浴室配件和無菌瓷磚方面,對新型非接觸式和衛生導向產品的需求很可能在不久的將來成為市場焦點。一些政府計劃可能會促進印度房地產市場的發展。

RERA也將對陶瓷產業產生直接影響。預計未來幾年印度住宅瓷磚市場將活性化的翻新活動。人們花費大量金錢來升級他們的牆壁和地板。預計這將成為未來幾年推動住宅住宅對陶瓷產品需求的關鍵因素之一。

印度瓷磚市場的趨勢

都市化加速推動市場

印度正經歷快速都市化,今年城鎮人口已佔總人口的相當一部分。印度都市化的快速發展,主要得益於城市擴張和大規模人口遷移。該國已對城市各個領域進行了投資,包括住宅、道路網路、城市交通、供水、電力基礎設施、智慧城市和城市管理計劃。這種都市化趨勢刺激了住宅和商業建築市場的需求,從而推動了印度瓷磚行業的成長。印度的城市人口不僅在絕對數量上不斷成長,這得益於蓬勃發展的中產階級和穩定的民主制度,而且還有不斷湧入的移民,這可能導致新城市的出現。

印度房地產投資增加推動市場

儘管面臨經濟危機,房地產投資仍盈利豐厚,並持續帶來正回報。投資激增刺激了印度住宅需求的成長,佔該國瓷磚總需求的 70%。房地產投資信託基金(REIT)提供了更廣泛的房地產領域投資機會,吸引了機構和個人投資者。 REIT 提供了一個有吸引力的提案:一種無需擁有房產即可投資房地產的方式,這對於尋求多元化投資的投資者來說尤其有吸引力。此外,印度中階可支配收入的快速成長也鼓勵開發商和投資者進入新興市場。

印度磁磚市場概況

該報告重點關注分散的印度瓷磚市場的主要全球參與企業。目前,少數幾家大公司佔據著很大的市場佔有率。然而,隨著技術進步和產品演進,中小企業的影響力正在擴大。他們透過贏得新合約和進入尚未開發的市場來實現這一目標。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察與動態

- 市場概覽

- 市場促進因素

- 房地產產業為市場注入活力

- 生活方式的改變和可支配收入的增加將推動市場成長

- 市場限制

- 原料高成本

- 技術純熟勞工短缺

- 市場機會

- 技術進步推動該產業

- 波特五力分析

- 買家/消費者的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 工業供應鏈/價值鏈分析

- 洞察近期市場趨勢

- 洞察市場技術趨勢

- 新冠疫情對市場的影響(新冠疫情後 vs 新冠疫情前)

第5章市場區隔

- 產品

- 釉藥

- 瓷

- 無刮痕

- 其他

- 應用

- 地磚

- 牆磚

- 其他

- 建築類型

- 新建築

- 更換和翻新

- 最終用戶

- 住宅

- 商業的

第6章競爭格局

- 市場集中度概覽

- 公司簡介

- Asian Granito India Limited

- Kajaria Ceramics Limited

- Nitco Limited

- Orient Bell Limited

- Varmora Granito Private Limited

- RAK Ceramics

- Somany Ceramics Limited

- Murudeshwar Ceramics Limited

- H & R Johnson (India) Limited(Prism Johnson)

- Simpolo Vitrified Private Limited*

第7章:市場的未來

第8章 免責聲明

The India Ceramic Tiles Market size is estimated at USD 10.45 billion in 2025, and is expected to reach USD 19.71 billion by 2030, at a CAGR of 13.54% during the forecast period (2025-2030).

In recent years, the Indian ceramic tiles market has been growing steadily. Due to the lockdown due to the coronavirus outbreak, around 10 million immigrant workers returned to their home country. This shortage of labor forced ceramic tile manufacturers to complete projects promptly. The increasing demand for ceramic tiles in India can be attributed to several factors. The real estate sector is growing rapidly due to government policies, and the housing sector is also seeing strong growth. The disposable income of India is also increasing, and people are looking for ways to beautify their living and workspaces. RERA has made the real estate industry more transparent and process-oriented. The demand for new touchless or hygiene-oriented products in bathroom ware and germ-free tiles may be at the forefront of the market in the near future. Several government schemes are likely to boost the Indian real estate market.

RERA also has a direct impact on the ceramic industry. Over the next few years, remodeling activity is expected to increase in India's residential ceramic tiles market segment. People are spending huge amounts of money to upgrade their walls and flooring. This will be one of the key factors driving demand for ceramic products in the residential segment of the residential market over the next few years.

India Ceramic Tiles Market Trends

Growing Urbanization is Driving the Market

India has witnessed rapid urbanization, with the urban population accounting for a significant share of the population in the current year. The surge in urbanization in India is primarily attributed to city expansions and significant migration. The country has channeled investments into various urban sectors, including housing, road networks, urban transport, water supply, power infrastructure, smart cities, and urban management initiatives. This urbanization wave has notably spurred demand in residential and commercial construction markets, propelling growth in the Indian ceramic tiles sector. India's urban population is not only witnessing absolute growth, buoyed by a burgeoning middle class and a stable democracy, but also witnessing a consistent influx of migrants, potentially leading to the emergence of new cities.

Rising Investments in Real Estate in India is Driving the Market

Despite the economic crash, real estate investments have maintained their reputation for profitability, consistently yielding positive returns. This investment surge has correspondingly fueled a heightened demand for housing in India, which accounts for 70% of the country's total tile demand. Real Estate Investment Trusts (REITs) have broadened investment opportunities in the real estate sector, luring in both institutional and retail investors. REITs offer an enticing proposition: the chance to invest in real estate sans property ownership, making them particularly appealing to diversification-minded investors. Moreover, the burgeoning disposable income of India's middle class has enticed developers and investors to tap into this expanding market.

India Ceramic Tiles Market Overview

The report focuses on key global players in India's fragmented ceramic tiles market. Presently, a handful of major players hold significant market shares. Yet, as technology advances and products evolve, mid-sized and smaller firms expand their footprints. They achieve this by securing fresh contracts and exploring untapped markets.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Real Estate Sector Booming the Market

- 4.2.2 Changing Lifestyles and Rising Disposable Incomes Helping Growth of the Market

- 4.3 Market Restraints

- 4.3.1 High Cost of the Raw Material

- 4.3.2 Lack of Skilled Labour

- 4.4 Market Opportunities

- 4.4.1 Technological Advancement Driving the Sector

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Buyers/Consumers

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Industry Supply Chain/Value Chain Analysis

- 4.7 Insights on Recent Developments on the Market

- 4.8 Insights on Technological Trends in the Market

- 4.9 Impact of COVID-19 on the Market (Post and Pre-COVID-19)

5 MARKET SEGMENTATION

- 5.1 Product

- 5.1.1 Glazed

- 5.1.2 Porcelain

- 5.1.3 Scratch Free

- 5.1.4 Other Products

- 5.2 Application

- 5.2.1 Floor Tiles

- 5.2.2 Wall Tiles

- 5.2.3 Other Applications

- 5.3 Construction Type

- 5.3.1 New Construction

- 5.3.2 Replacement and Renovation

- 5.4 End-User

- 5.4.1 Residential

- 5.4.2 Commercial

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Asian Granito India Limited

- 6.2.2 Kajaria Ceramics Limited

- 6.2.3 Nitco Limited

- 6.2.4 Orient Bell Limited

- 6.2.5 Varmora Granito Private Limited

- 6.2.6 RAK Ceramics

- 6.2.7 Somany Ceramics Limited

- 6.2.8 Murudeshwar Ceramics Limited

- 6.2.9 H & R Johnson (India) Limited (Prism Johnson)

- 6.2.10 Simpolo Vitrified Private Limited*