|

市場調查報告書

商品編碼

1687838

生質塑膠包裝:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Bioplastics Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

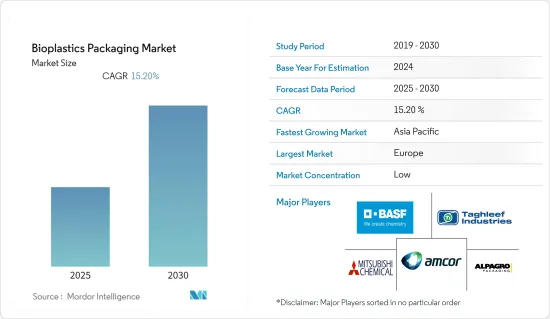

預計預測期內生質塑膠包裝市場的複合年成長率將達到 15.2%。

主要亮點

- 氣候變遷和未來化石資源稀缺等總體問題加速了對更好的塑膠包裝概念的探索。政府對傳統塑膠使用的嚴格限制正在推動對生質塑膠的需求。生質塑膠有可能避免石油基塑膠包裝對環境的影響。

- 生質塑膠是由生質能(植物、樹木、廢棄物)等各種生物分解性材料組合而成的塑膠材料。利用這些材料有助於減少對基於石化燃料的塑膠包裝的依賴,並最終增加綠色產品的使用,支持永續性和環境保護。

- 此外,世界各國政府正在透過實施法規來減少環境廢棄物並改善廢棄物管理流程,以應對對包裝廢棄物(特別是塑膠包裝廢棄物)的擔憂。世界各地政府都在向人們施壓,要求他們使用傳統塑膠,這幫助生質塑膠成為包裝行業的穩定替代品。

- 印度等嚴重依賴一次性塑膠的新興國家正在推出嚴格的法律,禁止使用一次性塑膠。例如,環境部於 2021 年 8 月宣布,將從 2022 年 7 月 1 日起禁止使用一次性塑膠製品。在印度,預計所研究的市場將根據《2021 年塑膠廢棄物管理修正規則》規定的國家目標實現顯著成長。

- 根據歐洲生質塑膠協會預測,全球生質塑膠產能將從2020年的211萬噸增加到2025年的270萬噸左右。據該協會預測,2020年將生產1,227噸生物分解性生質塑膠和884噸生物基非生物分解生質塑膠。

- 此外,預計在預測期內,政府和監管機構為促進生質塑膠的使用而採取的舉措將推動市場成長。例如,日本宣布增加植物來源生質塑膠的新政策,以應對海洋塑膠廢棄物。

- 在新冠疫情期間,生質塑膠包裝市場的成長受到嚴重阻礙。在疫情爆發之前,供應鏈中斷、原物料價格上漲和停工已經對成長型市場產生了重大影響。

此外,新冠疫情期間消費行為的變化使得人們有必要採取行動,並採用生質塑膠作為一次性食品包裝。預計聚乳酸 (PLA) 將在預測期內在所研究的市場中實現顯著成長,因為它具有高生產率、可與石油基熱塑性塑膠相媲美的性能以及碳中性的生命週期。此外,俄烏戰爭影響了整個包裝生態系統。

生質塑膠包裝市場的趨勢

硬包裝佔據市場主導地位

- 硬質生質塑膠用於化妝品包裝,例如粉餅、口紅、乳霜和飲料瓶。廣泛的應用正在擴大需求範圍。本部分使用生物基 PE、PLA 和生物基 PET 等材料。

- 根據FEA統計,德國每年排放近628萬噸塑膠廢棄物,而全球整體塑膠垃圾約4億噸。一般來說,寶特瓶大約需要500到1000年才能分解。這些統計數據表明,瓶子、管子、杯子、刀叉餐具和泡殼包裝等硬質包裝產品需要生質塑膠,這可以大大減少分解時間。

- 在日益增強的環保意識的推動下,Vittel、可口可樂、亨氏和 Volvic 等知名品牌已開始使用生物基 PET 製造各種尺寸的瓶子,用於盛裝氣泡飲料和其他非氣態液體和溶液。強生和寶潔等許多公司都在其部分化妝品的包裝中使用生物基聚乙烯。

- 這些產品含有大量生物基材料,可與傳統 PE 和 PET 的合適再生材料混合,從而提高資源效率並減少碳排放。

隨著生質塑膠越來越受到人們的歡迎,已開發國家正投入大量資金進行研發,許多生質塑膠應用技術也不斷被發現。例如,2021年7月,布朗大學的學生開發了Fouette,這是一種生質塑膠杯,可以取代Solo Cup。一次性杯子由 6 號塑膠製成,其化學成分與發泡聚苯乙烯相同,對環境有害。

歐洲佔很大佔有率

- 歐盟正在努力實現2050年淨零排放目標,並透過實施歐洲綠色新政來應對日益嚴重的環境和永續性危機。向更永續的社會傾斜與歐洲經濟中塑膠的生產、使用和處理息息相關。

- 歐洲正在加強其作為整個生質塑膠產業中心的地位,並且是世界上最大的研發市場。目前,近四分之一的生質塑膠產能來自歐洲。

- 此外,該地區的消費者越來越意識到塑膠和不可生物分解性的包裝對環境的影響。該地區對環保包裝(包括生質塑膠包裝)的需求日益成長。

- 該地區的政府和其他監管機構正在擴大想出辦法來推廣和鼓勵在包裝中使用生質塑膠。

新興的生質塑膠產業不僅有助於實現更永續的未來,而且還有潛力在未來幾十年為歐洲帶來巨大的經濟效益。根據EuropaBio進行的市場分析,歐洲生質塑膠產業有潛力快速創造就業成長,其中很大一部分將有利於農村發展。

生質塑膠包裝產業概況

全球生質塑膠包裝市場由幾家領先的公司組成。在這個市場中佔有較大佔有率的大公司正致力於擴大基本客群,無論其地區或最終用戶行業如何。這些公司正在利用策略合作措施來增加市場佔有率和盈利。市場上的一些主要企業包括BASF SE、Taghleef Industries Group、Alpagro Packaging 和 Amcor Ltd.。市場近期趨勢包括:

2022年7月,Taghleef Industries與阿拉伯聯合大公國環境集團合作,致力於中東地區的環境保護與永續社區發展。 EEG 是一群專業人士,他們透過教育、行動計劃和社區參與共同致力於保護環境。

2022 年 7 月,TerratecBD 的產品組合增加了 Green Dot Bioplastics 的應用,Green Dot Bioplastics 是一家開發和製造用於創造性和永續最終用途的生質塑膠材料的公司。薄膜擠出、熱成型和射出成型的更多使用符合 Green Dot 生物塑膠的目標,即實現更快的生物分解性,同時滿足品牌所有者和客戶日益成長的永續性需求。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 政府嚴格限制使用傳統塑膠

- 綠色產品、永續性和環保意識不斷增強

- 市場挑戰

- 生質塑膠生產成本高且供不應求

第6章市場區隔

- 依材料類型

- 生物PET

- 生物聚乙烯

- 生物聚醯胺

- 其他生物基/非生物分解材料

- 澱粉混合物

- PLA

- PBAT

- PHA

- 其他生物分解性材料

- 依產品類型

- 硬質塑膠包裝(瓶子、托盤、管子、蓋子、杯子、刀叉餐具、泡殼包裝)非生物分解的生物聚合物

- 軟包裝(袋、薄膜、標籤等)

- 按最終用戶產業

- 食物

- 飲料

- 製藥

- 個人護理

- 其他最終用戶應用程式

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章競爭格局

- 公司簡介

- Taghleef Industries Group

- BASF SE

- Mitsubishi Chemicals Corporation

- Alpagro Packaging

- Biome Bioplastics Limited

- FKuR Ploymers GmbH

- Raepak Ltd.

- COMPOSTPACK SAS

- Eastman Chemical Company

- Element Packaging Ltd

- Treemera GmbH

- Plasto Manufacturing Company

- Arkema SA

- Tipa-corp Ltd.

- Minima Technology

- Mondi PLC

- Amcor Limited

- Plastic Suppliers Inc.

- Biogreen Packaging Pvt. Ltd.

- Tetra Pak International SA

第8章投資分析

第9章:市場的未來

The Bioplastics Packaging Market is expected to register a CAGR of 15.2% during the forecast period.

Key Highlights

- The overarching issue of climate change and the future scarcity of fossil resources accelerated the search for better plastic packaging concepts. Stringent government regulations against the use of conventional plastics have propelled the demand for bioplastics. Bioplastics have the potential to bypass the environmental impacts of petroleum-based plastic packaging.

- Bioplastics are plastic materials created by combining various biodegradable materials, such as biomass (plants, trees, and waste).Such materials can be utilized to reduce the dependence on fossil fuel-based plastic packaging, eventually increasing the use of green products and boosting sustainability and an inclination toward environmental protection.

- Also, governments worldwide are responding to concerns regarding packaging waste, especially plastic packaging waste, and are implementing regulations to minimize environmental waste and improve waste management processes. In all parts of the world, governments are putting more pressure on people to use traditional plastics, which is helping bioplastic grow as a stable alternative in the packaging industry.

- Emerging economies, like India, which are heavily dependent on single-use plastics, are witnessing the rigorous roll-out of legislation that bans the use of single-use plastics. For example, the environment ministry announced in August 2021 that single-use plastic items would be banned beginning July 1, 2022.The country is anticipated to witness heavy developments in the market studied to align the country's goals laid out in the Plastic Waste Management Amendment Rules, 2021.

- According to European Bioplastics (Association of Bioplastics), global bioplastics production capacity is set to increase from 2.11 million metric tons in 2020 to approximately 2.7 million metric tons in 2025. In 2020, the organization said, 1,227 metric tons of biodegradable bioplastics and 884 metric tons of bio-based non-biodegradable bioplastics were made.

- Furthermore, rising government and regulatory initiatives to promote bioplastics usage are expected to drive market growth over the forecast period.For instance, Japan unveiled a new policy to increase plant-based bioplastics to tackle marine plastic waste. in a move that would see the country recycle 100% of newly produced plastics by 2035 and promote bioplastics from plant-based sources.

- Amid the COVID-19 pandemic, the growth of the bioplastics packaging market has been severely stunted. The supply chain disruption, price hike of the raw material, and lockdowns had heavily impacted the growing market before the pandemic hit.

Moreover, changes in consumer behavior during the COVID-19 pandemic required actions concerning the adoption of bioplastics for single-use food packaging. Polylactide (PLA) was anticipated to witness significant growth due to its high production viability, performance comparable to petroleum-based thermoplastics, and carbon-neutral life cycle in the market studied over the forecast period. Further, the Russia-Ukraine war had an impact on the overall packaging ecosystem.

Bioplastic Packaging Market Trends

Rigid Packaging to Hold Dominant Position in the Market

- Rigid bioplastics are used for the packaging of cosmetics such as compact powders, lipsticks, creams, and beverage bottles. A broad application base increases the scope for demand. Materials such as bio-based PE, PLA, or bio-based PET are used in the section.

- According to statistics from the FEA, Germany produces almost 6.28 million tons of plastic waste each year, and globally, the figure is about 400 million tons. In general, a plastic bottle takes approximately 500 to 1,000 years to decompose. Such stats showcase the need for bioplastics in rigid packaging products, such as bottles, tubes, cups, cutlery, blister packaging, etc., which could significantly reduce the decomposition time.

- In the context of rising environmental awareness, several well-known brands, such as Vittel, Coca-Cola, Heinz, and Volvic, have started using bio-based PET for making bottles of all sizes that contain sparkling drinks and other non-gaseous fluids and solutions. A significant number of companies like Johnson & Johnson and Procter & Gamble rely on bio-based PE to package several cosmetic products.

- Because these products contain a large amount of bio-based materials and can be mixed with suitable recyclates from traditional PE and PET, resource efficiency has increased and carbon dioxide emissions have gone down.

Given the growing popularity of bio-plastics, numerous bioplastics application technologies are being discovered in developed countries with significant research and development funding. For instance, in July 2021, Brown University students developed a bioplastic "Fette" cup to replace solo cups. The solo cups are made from number six plastic, which is chemically identical to Styrofoam and toxic for the environment.

Europe Holds a Significant Market Share

- The European Union (EU) is working towards the 2050 net-zero emissions goal and tackling the increasing environmental and sustainability crises by implementing the European Green Deal. The inclination towards a more sustainable society is intertwined with the European economy's production, use, and disposal of plastic.

- Europe strengthened its position as a central hub for the entire bioplastics industry and ranked foremost in the field of research and development, having this industry's largest market worldwide. By now, nearly one-fourth of the overall bioplastics production capacity is located in Europe.

- Furthermore, consumers in the region are increasingly becoming aware of the effects of plastic and non-biodegradable packaging on the environment. The demand for green packaging, including bioplastic packaging, is on the rise in the region.

- Governments and other regulatory bodies in the region are coming up with more and more ways to promote and incentivize the use of bioplastics for packaging.

Aside from its contributions to a more sustainable future, the emerging bioplastics industry has the potential to have a massive economic impact in Europe over the next few decades. According to a market analysis conducted by EuropaBio, the European bioplastics industry could realize steep employment growth, most of which will positively affect the development of rural areas.

Bioplastic Packaging Industry Overview

The Global Bioplastics Packaging market consists of several major players. The major players with a prominent share in the market are focusing on expanding their customer base across the regions and their end-user industry base. These companies are leveraging strategic collaborative initiatives to increase their market share and profitability. Some of the major players operating in the market include BASF SE, Taghleef Industries Group, Alpagro Packaging, and Amcor Ltd. Some of the recent developments in the market are:

In July 2022, Taghleef Industries collaborated with the Emirates Environmental Group to protect the environment and develop a sustainable community within the Middle East. EEG is a group of professionals who work together to protect the environment through education, action programs, and involvement in the community.

In July 2022, applications were added to the Terratek BD portfolio by Green Dot Bioplastics, a developer and producer of bioplastic materials for creative, sustainable end uses. The increased selection for film extrusion, thermoforming, and injection molding is consistent with Green Dot Bioplastics' objective to address rising sustainability demands from brand owners and customers while achieving faster rates of biodegradability.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Stringent Government Regulations against the Use of Conventional Plastics

- 5.1.2 Increased Usage of Green Products, Sustainability, and Inclination toward Environment Protection

- 5.2 Market Challenges

- 5.2.1 High Production Cost and Lack of Supply of Bio-plastics

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 BIO - PET

- 6.1.2 BIO - PE

- 6.1.3 BIO - PA

- 6.1.4 Other Bio-Based/Non-Biodegradable Materials

- 6.1.5 Starch Blends

- 6.1.6 PLA

- 6.1.7 PBAT

- 6.1.8 PHA

- 6.1.9 Other Biodegradable Materials

- 6.2 By Product Type

- 6.2.1 Rigid Plastic Packaging (Bottle, Tray, Tubes, Caps, Cups, Cutlery, Blister Packaging) Non-biodegradable Biopolymers

- 6.2.2 Flexible Packaging (Pouch, Film, Labels, and Others)

- 6.3 By End-user Industries

- 6.3.1 Food

- 6.3.2 Beverage

- 6.3.3 Pharmaceuticals

- 6.3.4 Personal Care & Household Care

- 6.3.5 Other End-user Applications

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Taghleef Industries Group

- 7.1.2 BASF SE

- 7.1.3 Mitsubishi Chemicals Corporation

- 7.1.4 Alpagro Packaging

- 7.1.5 Biome Bioplastics Limited

- 7.1.6 FKuR Ploymers GmbH

- 7.1.7 Raepak Ltd.

- 7.1.8 COMPOSTPACK SAS

- 7.1.9 Eastman Chemical Company

- 7.1.10 Element Packaging Ltd

- 7.1.11 Treemera GmbH

- 7.1.12 Plasto Manufacturing Company

- 7.1.13 Arkema SA

- 7.1.14 Tipa-corp Ltd.

- 7.1.15 Minima Technology

- 7.1.16 Mondi PLC

- 7.1.17 Amcor Limited

- 7.1.18 Plastic Suppliers Inc.

- 7.1.19 Biogreen Packaging Pvt. Ltd.

- 7.1.20 Tetra Pak International SA