|

市場調查報告書

商品編碼

1687832

MEMS 感測器 -市場佔有率分析、行業趨勢與統計、成長預測(2025-2030 年)MEMS Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

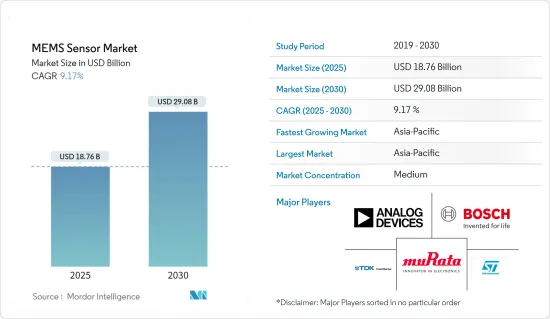

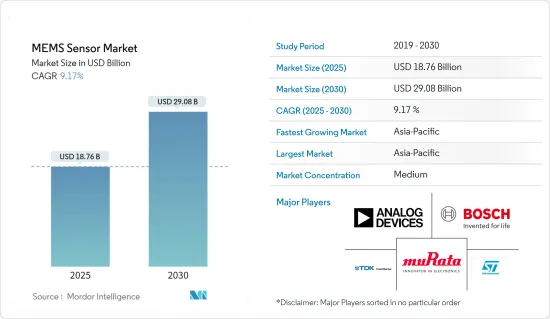

預計2025年MEMS感測器市場規模為187.6億美元,到2030年預計將達到290.8億美元,預測期內(2025-2030年)的複合年成長率為9.17%。

半導體領域物聯網的日益普及、對智慧家電和穿戴式裝置的需求不斷成長以及工業和住宅自動化應用的日益普及是影響研究市場成長的關鍵因素。

主要亮點

- MEMS 感測器具有多種優勢,包括準確性、可靠性和電子小型化。因此,MEMS 感測器近年來廣受歡迎。微型消費性設備,包括物聯網連網型設備和穿戴式設備,是 MEMS 感測器的新興應用。

- 根據IFR預測,未來幾年,全球工廠運作的工業機器人數量預計將達到51.8萬台,這意味著全球機器人使用量將大幅增加。工業機器人市場的積極成長軌跡預計將在同一時期推動對 MEMS 感測器的需求。

- 此外,可支配收入的增加、5G的出現以及通訊基礎設施的發展等因素正在推動智慧型手機需求的激增。例如,根據愛立信預測,未來幾年全球智慧型手機用戶數量將達到76.9億。

- 此外,由於壓力感測器在生物醫學、汽車電子、小家電、穿戴式和健身電子等眾多應用領域的應用,預計將實現最快的成長率。其他 MEMS 感測器,如麥克風、超音波MEMS 感測器、環境感測器和微測輻射熱計,預計也將佔據市場研究的很大佔有率。

- 波士頓半導體設備公司 (BSE) 是一家美國半導體測試處理公司,最近訂單汽車客戶的重複訂單,要求購買多台 Zeus Gravity 測試處理機,用於 MEMS 高功率和壓力 IC 測試應用。 Zeus 處理器具有靈活的 MEMS 壓力感測測試單元範圍,並在生產處理器中提供高電壓水平,用於測試 IGBT、MOSFET、閘極驅動器、GaN 和 SiC 功率半導體。

- 此外,市場成長面臨的挑戰還包括由於介面設計考量而導致的 MEMS 感測器實施成本上升,以及 MEMS 製造流程缺乏標準化。毫無疑問,MEMS的標準化程度不如傳統半導體製程和模型環境那麼先進。然而,標準化程序應該在未來幾年內到位,使得這些挑戰的影響在未來幾年內越來越不明顯。

- COVID-19 疫情導致某些類型的 MEMS 感測器的需求激增。例如,由於需要非接觸式監測人體溫度,對溫度槍和熱成像儀中使用的熱電堆和微測輻射熱計的需求增加。此外,用於檢測 COVID-19 的即時聚合酵素鏈鎖反應(PCR) 診斷測試和用於 DNA序列測定的微流體在市場上也具有重要意義。

- 此外,醫院加護病房(ICU)的人工呼吸器壓力和流量計的需求也在增加。因此,這場疫情凸顯了擁有強大醫療保健基礎設施的重要性,預計隨後該行業的開放將在預測期內推動市場需求。

MEMS感測器市場趨勢

汽車產業預計將推動市場成長

- MEMS感測器應用於汽車工業和智慧汽車。預計MEMS感測器的開發將集中在汽車產業。廣泛應用於引擎防鎖死煞車系統(ABS)、電子穩定程式(ESP)、電子控制懸吊(ECS)、電子手煞車(EPB)、坡道啟動輔助(HAS)、輪胎壓力監測(EPMS)、汽車引擎穩定、角度測量、心率偵測、自我調整導航系統等。

- 對車輛安全和保障的需求不斷增加是市場成長的主要因素之一。根據世界衛生組織統計,每年有超過135萬人死於道路交通事故。 MEMS感測器在改善汽車安全性能方面發揮著至關重要的作用,從而成為市場成長的催化劑。

- OMRON發布了用於機械臂的全新系列FH-SMD視覺感測器。透過為機器人配備這些功能,它可以識別三種尺寸的隨機(批量)汽車零件,這對於傳統機器人來說很難做到,並提高生產率,從而實現節省空間、檢查和拾取放置。

- 例如,塔塔汽車於 2022 年 4 月宣布了計劃,將在未來五年為其乘用車業務融資 24,000 億印度盧比(30.8 億美元)。此外,2022年3月,中國上汽集團旗下名爵汽車宣布,計畫將在印度的保密投資擴大3.5億美元至5億美元,以滿足包括電動車擴張在內的未來融資需求。此類車輛的發展可能會進一步促進所研究市場的成長。

- 此外,隨著新能源汽車、無人駕駛汽車等新型智慧汽車市場的發展,MEMS感測器未來很可能在汽車感測器市場佔據更大的佔有率。最近,InvenSense 在 CES 上展示了其豐富的創新 MEMS 感測器技術。例如用於 ADAS 和自動駕駛系統的 IMU IAM-20685 高性能汽車 6 軸運動追蹤感測器平台,以及用於家庭、工業、汽車、醫療保健和其他應用中的直接和精確的 CO2 檢測的微型、超低功耗 MEMS 平台 TCE-11101。

亞太地區預計將佔據主要市場佔有率

- 由於印度、日本和中國經濟的成長,以及家用電子電器和汽車產業的成長,亞太地區預計將成為 MEMS 感測器的最大市場。據思科稱,預計今年亞太地區穿戴式裝置銷量約 3.11 億台,北美地區約 4.39 億台。這進一步推動了該地區對 MEMS 感測器的需求。

- 近年來,受汽車和消費市場成長以及智慧型手機、平板電腦、無人機和其他微型系統和半導體產品出口的推動,中國 MEMS 感測器的使用量大幅增加。多種MEMS感測器,包括加速計、陀螺儀、壓力感測器和射頻(RF)濾波器,都進口到中國進行產品組裝。

- 此外,中國政府將汽車產業(包括汽車零件產業)視為其重點產業之一。中央政府預計未來幾年中國汽車產量將達3,500萬輛。因此,汽車產業有望成為中國MEMS感測器的突出應用領域之一。

- 根據印度品牌股權基金會(IBEF)的數據,印度家用電器和家用電子電器(ACE)市場今年的複合年成長率為 9%,達到 3.15 兆印度盧比(約 483.7 億美元)。政府已採取多項舉措推廣該產品,包括《2019 年國家電子產品政策》,該政策旨在促進國內電子產品製造業和出口完整價值鏈,以在未來幾年實現約 4,000 億美元的營業額。預計此類地方政府舉措將增強所研究的市場。

- 印度汽車產業在經濟和人口方面都具有良好的成長條件,能夠刺激國內興趣和出口潛力。作為「印度製造」計畫的一部分,印度政府旨在將汽車製造業作為該計畫的關鍵驅動力。正如《2016-26 年汽車使命計畫》(AMP)所強調的,該計畫預計在未來幾年內將乘用車市場擴大到 940 萬輛。預計這一因素將推動該地區汽車產業對 MEMS 感測器的採用。

- 此外,日本MinbearMitsumi株式會社近日宣布,其子公司三美電機株式會社已與Omron Corporation達成協議,三美電機將收購OMRON位於野洲工廠的半導體和MEMS製造設施,作為其MEMS產品開發職能。透過收購MEMS感測器業務,三美將加強其感測器業務,這是其最重要的業務之一。

MEMS感測器產業概況

MEMS 感測器市場競爭相對激烈,擁有多家大型企業。就市場佔有率而言,目前一些關鍵參與者佔據了相當大的市場佔有率,包括意法半導體 (STMicroelectronics NV)、Invensense Inc.(TDK Corporation)、Bosch Sensortec GmbH(Robert Bosch GmbH)、Analog Devices Inc. 和村田製作所 (Murata Manufacturing Co.)。此外,這些公司正在不斷創新其產品,以提高市場佔有率和盈利。

- 2022 年 4 月:Bosch Sensatec 推出首款電容式氣壓感知器 BMP581。這款節能氣壓感測器是一款高精度高度追蹤 IC,可為室內定位、地板偵測和導航應用提供準確的位置資訊。此感測器支援多種通訊介面,包括I2C、I3C和SPI數位串行介面。它體積小、功耗低,非常適合智慧穿戴裝置、可聽設備和物聯網應用。

- 2022 年 1 月:TDK 推出其最新的具有 SoundWire 功能 MEMS 麥克風。全新 T5828 MEMS(微電子機械系統)麥克風符合 MIPI SoundWire通訊協定。它具有 68dBA SNR(信噪比)的聲學活動偵測元件和始終開啟的超低功耗模式。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 汽車產業越來越重視安全

- 自動化和工業4.0的出現

- 市場挑戰

- 多種介面設計複雜性推高了 MEMS 感測器的整體成本

- MEMS 缺乏標準化製造程序

第6章市場區隔

- 按類型

- 壓力感測器

- 慣性感測器

- 其他類型

- 按最終用戶產業

- 車

- 衛生保健

- 家電

- 工業的

- 航太與國防

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 世界其他地區

- 北美洲

第7章競爭格局

- 公司簡介

- STMicroelectronics NV

- InvenSense Inc.(TDK Corp.)

- Bosch Sensortec GmbH(Robert Bosch GmbH)

- Analog Devices Inc.

- Murata Manufacturing Co. Ltd

- Kionix Inc.(ROHM Co Ltd)

- Infineon Technologies AG

- Freescale Semiconductors Ltd(NXP Semiconductors NV)

- Panasonic Corporation

- Omron Corporation

- First Sensor AG(TE Connectivity)

第8章投資分析

第9章:市場的未來

The MEMS Sensor Market size is estimated at USD 18.76 billion in 2025, and is expected to reach USD 29.08 billion by 2030, at a CAGR of 9.17% during the forecast period (2025-2030).

The rising popularity of IoT in semiconductors, the growing need for smart consumer electronics and wearable devices, and the enhanced adoption of automation in industries and residences are some significant factors influencing the growth of the studied market.

Key Highlights

- MEMS sensors deliver multiple advantages, such as accuracy, reliability, and the prospect of making smaller electronic devices. As a result, they have gained considerable traction in the past few years. Miniaturized consumer devices, such as IoT-connected devices and wearables, are emerging applications of MEMS sensors in the market.

- According to the IFR forecasts, global adoption is expected to increase significantly to 518,000 industrial robots operational across factories all around the globe in the next few years. The positive growth trajectory of the industrial robots market is expected to drive the demand for MEMS sensors during the same period.

- Moreover, the demand for smartphones has been witnessing an upsurge owing to several factors increasing disposable income, the advent of 5G, and the development of telecom infrastructure. For instance, according to Ericsson, worldwide smartphone subscriptions are expected to reach 7,690 million in the next few years.

- Furthermore, pressure sensors are anticipated to witness the fastest growth rate as they are used in numerous application areas, such as biomedicine, automotive electronics, small home appliances, and wearable and fitness electronics. Other MEMS sensors, such as microphones and ultrasonic MEMS sensors, environmental sensors, and microbolometers, are expected to hold a significant share of the market studied.

- The US-based Boston Semi Equipment (BSE), a semiconductor test handler company, recently received repeat orders from automotive customers for multiple Zeus gravity test handlers configured for MEMS high-power and pressure IC testing applications. Zeus handlers have a flexible range for MEMS pressure sensing test cells and offer high voltage levels in a production handler for testing IGBT, MOSFET, gate drivers, GaN, and SiC power semiconductors.

- In addition, the factors challenging the market's growth include the increase in the cost of MEMS sensors implementation due to interface design considerations and the lack of a standardized fabrication process of MEMS. The standardization in MEMS is undoubtedly less advanced than it is for conventional semiconductor processes and model environments. However, the standard procedure is bound to happen in the next few years, making the impact of the challenge gradually low in the next few years.

- Due to the COVID-19 pandemic, certain types of MEMS sensors significantly spiked in demand. For instance, the demand for thermopiles and microbolometers used in temperature guns and thermal cameras increased because of the need for contactless monitoring of people's temperatures. Moreover, real-time polymerase chain reaction (PCR) diagnostic tests for detecting COVID-19 and microfluidics for DNA sequencing gained substantial market relevance.

- Furthermore, pressure and flowmeters in ventilators grew because of hospital intensive care units (ICUs). Therefore, the pandemic highlighted the criticality of having a robust healthcare infrastructure, and the industry's subsequent developments are expected to propel market demand over the forecast period.

MEMS Sensor Market Trends

Automotive Sector Expected to Drive the Market Growth

- MEMS sensors are used in the automobile industry and intelligent automobiles. MEMS sensor development is expected to focus on the automotive industry. It is widely used in engine e(ABS), electronic stability program (ESP), electronic control suspension (ECS), electric hand brake (EPB), slope starter auxiliary (HAS), tire pressure monitoring (EPMS), car engine stabilization, angle measure, and heartbeat detection, as well as adaptive navigation systems.

- The increasing demand for safety and security in automobiles is one of the main factors that play a vital role in the market's growth. According to the WHO, more than 1.35 million people yearly are killed in road accidents. MEMS sensors play a critical role in improving the safety features of vehicles and act as a catalyst for the market's growth.

- OMRON has newly released the FH-SMD Vision Sensor series for robot arms, which can be used for fast detection for humans and flexibility for auto-selection of the compartment. These can be mounted on a robot to recognize random (bulk) automotive parts in three sizes that are hard to use with conventional robots and improve productivity, thereby saving space, inspection, and pick and place.

- For instance, in April 2022, Tata Motors announced projects to finance INR 24,000 crores (USD 3.08 billion) in its passenger motorcar business over the next five years. Furthermore, in March 2022, MG Motors, owned by China's SAIC Motor Corp., declared plans to expand USD 350-500 million in confidential equity in India to fund its future requirements, including EV expansion. Such developments in automobiles will further drive the studied market growth.

- Furthermore, with the development of new intelligent vehicles, such as new energy vehicles and driverless vehicles, MEMS sensors may occupy a more significant share of the automotive sensor market in the future. Recently, InvenSense presented its vast portfolio of innovative MEMS sensor technologies at CES. For instance, it released the IMU IAM-20685 high-performance automotive 6-Axis MotionTracking sensor platform for ADAS and autonomous systems and TCE-11101, a miniaturized ultra-low-power MEMS platform for direct and accurate detection of CO2 in home, industrial, automotive, healthcare, and other applications.

Asia-Pacific Expected to Hold Significant Market Share

- Asia-Pacific is anticipated to be the most extensive market for MEMS sensors due to economies, such as India, Japan, and China, along with the increasing growth of the consumer electronics and automobile segments. According to Cisco, this year, around 311 million and 439 million wearable device units are expected to be sold in Asia-Pacific and North America, respectively. This is further driving the demand for MEMS sensors in the region.

- China has witnessed a significant increase in the usage of MEMS sensors in the past couple of years due to the rise in its automotive and consumer markets and the export of smartphones, tablets, drones, and other microsystem and semiconductor-enabled products. Multiple MEMS sensors, such as accelerometers, gyroscopes, pressure sensors, and radio frequency (RF) filters, have been imported into China for product assembly.

- Moreover, the Chinese administration also views its automotive industry, including the auto parts sector, as one of the major industries. The Central Government expects China's automobile output to reach 35 million units in the next few years. This is posed to make the automotive sector one of the prominent uses of MEMS sensors in China.

- According to the India Brand Equity Foundation (IBEF), the Indian appliances and consumer electronics (ACE) market has registered a CAGR of 9% to achieve INR 3.15 trillion (USD 48.37 billion) this year. The government has taken several initiatives to propel this product, including the National Policy on Electronics 2019, which aims to promote domestic electronic manufacturing and export a complete value chain to achieve a turnover of approximately USD 400 billion in the next few years. Such regional government initiatives are estimated to bolster the studied market.

- The Indian automotive industry is well-positioned for growth economically and demographically, serving domestic interest and export possibilities, which will rise shortly. As a part of the Make in India scheme, the Government of India aims to make automobile fabricating the main driver for the initiative. The system is poised to make the passenger vehicles market rise to 9.4 million units in the next few years, as underlined in the 2016-26 Auto Mission Plan (AMP). This factor is expected to raise the adoption of MEMS sensors in the region's automotive sector.

- Furthermore, Minbea Mitsumi Inc., based in Japan, recently announced that Mitsumi Electric Co. Ltd, a company subsidiary, has reached an agreement with Omron Corporation to acquire the semiconductor and MEMS Manufacturing plant as the MEMS product development function at OMRON's Yasu facility through MITSUMI. Acquiring the MEMS sensor business will strengthen Mitsumi's sensor business, which is one of its most important.

MEMS Sensor Industry Overview

The MEMS sensors market is relatively competitive and consists of numerous significant players. In terms of market share, a few crucial players, such as STMicroelectronics NV, Invensense Inc. (TDK Corp), Bosch Sensortec GmbH (Robert Bosch GmbH), Analog Devices Inc., and Murata Manufacturing Co. Ltd, currently hold a significant market share. Additionally, these companies continuously innovate their products to increase their market share and profitability.

- April 2022: Bosch Sensortec released its first capacitive barometric pressure sensor, the BMP581. The energy-efficient barometric is a highly accurate altitude-tracking IC that can provide precise location information for indoor localization, floor detection, and navigation applications. The sensor supports multiple communication interfaces, including I2C, I3C, and SPI digital serial interfaces. Its small size and low power consumption create it ideal for smart wearables, hearables, and IoT applications.

- January 2022: TDK introduced the most recent MEMS microphone with SoundWire functionality. The new T5828 MEMS (micro-electromechanical system) microphone complies with the MIPI SoundWire protocol. It includes 68dBA SNR (signal-to-noise ratio) and acoustic activity detect elements with always-on ultra-low power mode.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Safety Concerns in the Automotive Industry

- 5.1.2 Emergence of Automation and Industry 4.0

- 5.2 Market Challenges

- 5.2.1 Increase in Overall Cost of MEMS Sensors due to Multiple Interface Design Complexity

- 5.2.2 Lack of Standardized Fabrication Process for MEMS

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Pressure Sensors

- 6.1.2 Inertial Sensors

- 6.1.3 Other Types

- 6.2 By End-user Industry

- 6.2.1 Automotive

- 6.2.2 Healthcare

- 6.2.3 Consumer Electronics

- 6.2.4 Industrial

- 6.2.5 Aerospace and Defense

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.2.5 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 South Korea

- 6.3.3.5 Rest of the Asia-Pacific

- 6.3.4 Rest of the World

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 STMicroelectronics NV

- 7.1.2 InvenSense Inc. (TDK Corp.)

- 7.1.3 Bosch Sensortec GmbH (Robert Bosch GmbH)

- 7.1.4 Analog Devices Inc.

- 7.1.5 Murata Manufacturing Co. Ltd

- 7.1.6 Kionix Inc. (ROHM Co Ltd)

- 7.1.7 Infineon Technologies AG

- 7.1.8 Freescale Semiconductors Ltd (NXP Semiconductors NV)

- 7.1.9 Panasonic Corporation

- 7.1.10 Omron Corporation

- 7.1.11 First Sensor AG (TE Connectivity)