|

市場調查報告書

商品編碼

1721442

MEMS 感測器市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測MEMS Sensors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

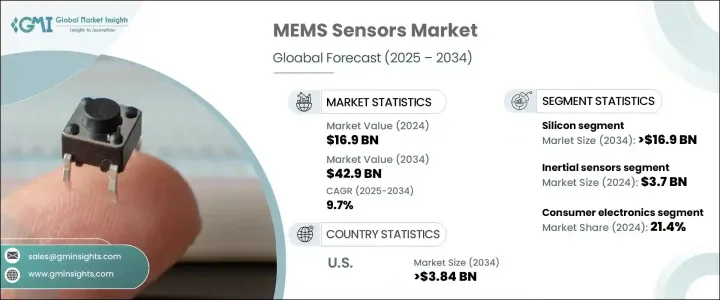

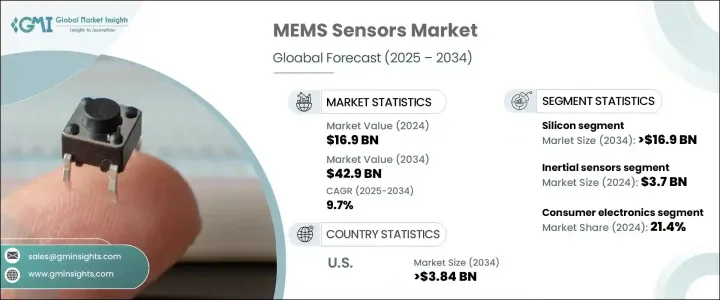

2024 年全球 MEMS 感測器市場價值為 169 億美元,預計到 2034 年將以 9.7% 的複合年成長率成長,達到 429 億美元。受各行各業加速採用互聯技術的推動,該市場正呈現強勁發展動能。從下一代智慧型手機和智慧手錶到自動駕駛汽車和工業自動化系統,對智慧、微型感測器的需求從未如此高漲。 MEMS(微機電系統)感測器因其能夠收集精確資料,同時保持低功耗和緊湊的外形而越來越受到重視。

隨著消費者對更智慧、響應更快的設備的期望不斷提高,製造商正在整合 MEMS 技術來提升用戶體驗並實現即時分析。此外,工業 4.0 的快速發展、對電動車的投資不斷成長以及物聯網 (IoT) 生態系統的不斷擴大,正在強化 MEMS 感測器在重塑技術基礎設施中的作用。全球原始設備製造商也專注於多功能感測器整合,以提高設備效率並最大限度地減少組件冗餘,從而進一步推動市場成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 169億美元 |

| 預測值 | 429億美元 |

| 複合年成長率 | 9.7% |

MEMS 感測器在消費性電子產品和汽車應用中發揮越來越重要的作用。在汽車領域,對高級駕駛輔助系統 (ADAS) 和安全技術日益成長的需求推動了 MEMS 感測器的整合。這些系統依賴精確和即時的資料,隨著全球汽車安全法規的收緊,MEMS 感測器確保了準確性和響應能力。在電子產品中,MEMS 感測器透過實現手勢識別、運動追蹤和環境監測等功能來提高設備性能,從而滿足消費者對智慧、多功能設備的期望。

製造 MEMS 感測器所使用的材料包括矽、聚合物、陶瓷和金屬。其中,矽繼續佔據主導地位,預計到 2034 年該領域將創造 169 億美元的產值。矽與 CMOS 製造製程的兼容性,加上其卓越的機械和熱穩定性,使其成為高性能應用中的首選材料。隨著對輕量、耐用組件的需求不斷增加,其在醫療保健、穿戴式裝置和消費性電子產品領域的應用正在迅速擴大。

市場按感測器類型細分,例如慣性感測器、壓力感測器、麥克風、環境感測器、光學感測器和超音波感測器。光是慣性感測器一項,2024 年的市場規模將達到 37 億美元,應用範圍涵蓋工業自動化、機器人、無人機和汽車系統(包括自動駕駛汽車)。這些感測器對於運動偵測、定位和穩定至關重要,這些都是新興智慧技術的關鍵要求。

美國 MEMS 感測器市場呈上升趨勢,預計到 2034 年將達到 38.4 億美元。美國的成長歸因於航太、國防、醫療保健和自主系統等領域的部署不斷增加。人工智慧、機器人和醫療創新的進步進一步增強了需求。羅伯特博世有限公司、意法半導體、博通公司、德州儀器和 Qorvo 公司等領導企業正專注於擴大產品線、推動研發和建立策略聯盟,以加強其全球市場地位。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 消費性電子產品需求不斷成長

- 汽車應用的進步

- 工業自動化和物聯網的擴展

- 醫療保健和生物醫學應用的成長

- 小型化和能源效率創新

- 產業陷阱與挑戰

- 製造複雜性高且成本高

- 整合和標準化挑戰

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按感測器類型,2021 - 2034 年

- 慣性感測器

- 壓力感測器

- 麥克風

- 環境感測器

- 光學感測器

- 超音波感測器

- 其他

第6章:市場估計與預測:按材料,2021 - 2034 年

- 矽

- 聚合物

- 陶瓷

- 金屬材料

第7章:市場估計與預測:依最終用途,2021 - 2034 年

- 消費性電子產品

- 汽車

- 衛生保健

- 工業的

- 航太與國防

- 電信

- 其他

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- Robert Bosch GmbH

- STMicroelectronics

- Broadcom Inc.

- Texas Instruments

- Qorvo Inc.

- Goertek Inc.

- Hewlett Packard Enterprise Development LP

- TDK Corporation

- Knowles Electronics LLC

- Infineon Technologies AG

- Honeywell International

- Analog Devices Inc.

- Murata Manufacturing Co. Ltd.

- Teledyne DALSA

- Sony Semiconductor

- X-FAB Silicon Foundries

- Tower Semiconductor

- TSMC (Taiwan Semiconductor Manufacturing Company)

- United Microelectronics Corporation (UMC)

- Safran Sensing Technologies Norway AS

- MEMS Engineering Limited

- Redbud Labs

- USound

- Windfall Bio

- ZERO POINT MOTION LTD.

The Global MEMS Sensors Market was valued at USD 16.9 billion in 2024 and is estimated to grow at a CAGR of 9.7% to reach USD 42.9 billion by 2034. The market is witnessing robust momentum, driven by the accelerating adoption of connected technologies across industries. From next-gen smartphones and smartwatches to autonomous vehicles and industrial automation systems, the demand for intelligent, miniaturized sensors has never been higher. MEMS (Micro-Electro-Mechanical Systems) sensors are gaining prominence for their ability to collect precise data while maintaining low power consumption and compact form factors.

As consumer expectations for smarter, more responsive devices continue to rise, manufacturers are integrating MEMS technology to elevate user experiences and enable real-time analytics. Additionally, the rapid evolution of Industry 4.0, growing investments in electric vehicles, and the expanding footprint of the Internet of Things (IoT) ecosystem are reinforcing the role of MEMS sensors in reshaping technological infrastructures. Global OEMs are also focusing on multi-functional sensor integration to enhance device efficiency and minimize component redundancy, further boosting market growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $16.9 Billion |

| Forecast Value | $42.9 Billion |

| CAGR | 9.7% |

MEMS sensors play an increasingly critical role in both consumer electronics and automotive applications. In the automotive sector, the growing demand for advanced driver-assistance systems (ADAS) and safety technologies is fueling the integration of MEMS sensors. These systems rely on precise and real-time data, and MEMS sensors ensure accuracy and responsiveness as global regulations around automotive safety tighten. In electronics, MEMS sensors enhance device performance by enabling features like gesture recognition, motion tracking, and environmental monitoring, thus aligning with consumer expectations for intelligent, multifunctional gadgets.

The materials used in manufacturing MEMS sensors include silicon, polymers, ceramics, and metals. Among these, silicon continues to dominate, with the segment projected to generate USD 16.9 billion by 2034. Silicon's compatibility with CMOS fabrication processes, along with its superior mechanical and thermal stability, makes it a preferred material across high-performance applications. Its adoption is expanding rapidly in healthcare, wearables, and consumer electronics as demand for lightweight, durable components increases.

The market is segmented by sensor types such as inertial sensors, pressure sensors, microphones, environmental sensors, optical sensors, and ultrasonic sensors. Inertial sensors alone accounted for USD 3.7 billion in 2024, with applications spanning industrial automation, robotics, drones, and automotive systems, including self-driving vehicles. These sensors are vital for motion detection, orientation, and stabilization, key requirements for emerging smart technologies.

The U.S. MEMS sensors market is on an upward trajectory, projected to reach USD 3.84 billion by 2034. Growth in the U.S. is attributed to increasing deployment across aerospace, defense, healthcare, and autonomous systems. Progress in AI, robotics, and medical innovations further reinforces demand. Leading players such as Robert Bosch GmbH, STMicroelectronics, Broadcom Inc., Texas Instruments, and Qorvo Inc. are focusing on expanding product lines, advancing R&D, and forming strategic alliances to strengthen their global market presence.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for consumer electronics

- 3.2.1.2 Advancements in automotive applications

- 3.2.1.3 Expansion of industrial automation and iot

- 3.2.1.4 Growth in healthcare and biomedical applications

- 3.2.1.5 Miniaturization and energy efficiency innovations

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High manufacturing complexity and costs

- 3.2.2.2 Integration and standardization challenges

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Sensor Type, 2021 - 2034 (USD Million and Units)

- 5.1 Inertial sensors

- 5.2 Pressure sensors

- 5.3 Microphones

- 5.4 Environmental sensors

- 5.5 Optical sensors

- 5.6 Ultrasonic sensors

- 5.7 Others

Chapter 6 Market estimates & forecast, By Material, 2021 - 2034 (USD Million and Units)

- 6.1 Silicon

- 6.2 Polymers

- 6.3 Ceramics

- 6.4 Metallic materials

Chapter 7 Market estimates & forecast, By End Use, 2021 - 2034 (USD Million and Units)

- 7.1 Consumer electronics

- 7.2 Automotive

- 7.3 Healthcare

- 7.4 Industrial

- 7.5 Aerospace & defense

- 7.6 Telecommunications

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million and Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Robert Bosch GmbH

- 9.2 STMicroelectronics

- 9.3 Broadcom Inc.

- 9.4 Texas Instruments

- 9.5 Qorvo Inc.

- 9.6 Goertek Inc.

- 9.7 Hewlett Packard Enterprise Development LP

- 9.8 TDK Corporation

- 9.9 Knowles Electronics LLC

- 9.10 Infineon Technologies AG

- 9.11 Honeywell International

- 9.12 Analog Devices Inc.

- 9.13 Murata Manufacturing Co. Ltd.

- 9.14 Teledyne DALSA

- 9.15 Sony Semiconductor

- 9.16 X-FAB Silicon Foundries

- 9.17 Tower Semiconductor

- 9.18 TSMC (Taiwan Semiconductor Manufacturing Company)

- 9.19 United Microelectronics Corporation (UMC)

- 9.20 Safran Sensing Technologies Norway AS

- 9.21 MEMS Engineering Limited

- 9.22 Redbud Labs

- 9.23 USound

- 9.24 Windfall Bio

- 9.25 ZERO POINT MOTION LTD.