|

市場調查報告書

商品編碼

1687775

氫氣:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Hydrogen Gas - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

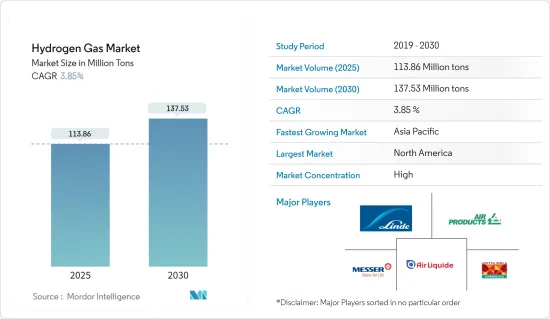

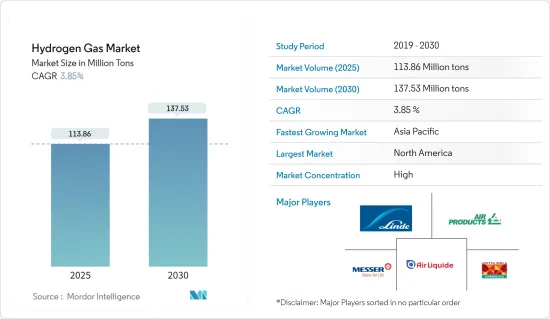

預計2025年氫氣市場規模為1.1386億噸,2030年將達到1.3753億噸,市場估計和預測期(2025-2030年)的複合年成長率為3.85%。

隨著政府和產業投資氫氣作為清潔能源解決方案,推動對燃料電池和基礎設施發展的需求,氫氣市場預計將擴大。

主要亮點

- 從中期來看,化學工業需求增加以及煉油廠氫氣使用增加等因素預計將推動市場發展。

- 另一方面,藍氫氫和綠色氫生產成本高、運輸和儲存成本上升等因素可能會抑制市場成長。

- 然而,太空探勘和航空領域的應用不斷增加、燃料電池電動車的需求不斷成長以及低碳經濟中氫能產業的準備等因素可能會成為預測期內市場成長的機會。

- 亞太地區在氫氣市場佔據主導地位,由於中國和印度的巨大需求,預計未來將繼續保持這一地位。

氫氣市場趨勢

預計氨生產將主導市場需求

- 氨是世界上最重要的化學物質之一。工業界主要使用哈伯-博施法(也稱為非生物或人工固氮)來生產氨。

- 哈伯-博施法是工業氨生產的基礎,它促進了大氣中氮和氫的化學反應。這是在高溫高壓下使用鐵或鉬等金屬基催化劑完成的。

- 通常,哈伯-博施法所需的氫氣來自石化燃料。生產氫氣的主要方法是透過蒸氣重組天然氣與蒸汽發生反應。

- 考慮到儲存和運輸氫氣的挑戰,氨和化肥生產設施通常會整合氫氣發生器(HGU)。這些裝置利用石化燃料(包括天然氣)和其他進料重整器。

- 根據美國地質調查局(USGS)的資料,預計2023年全球合成氨產量將達到1.5億噸,與前一年同期比較增加3.45%。

- 2023 年全球氨產量以東亞為主導,產量約 6,460 萬噸。尤其是中國,已成為世界上最大的氨生產國,產量約 4,300 萬噸。

- 美國地質調查局預測,未來四年全球氨產能將成長 6%。

- 美國是世界第三大氨生產國,擁有 16 家公司營運的 35 個生產設施,產量達 1,400 萬噸。

- 鑑於這些動態,未來幾年市場可能會發生重大變化。

亞太地區可望主導氫氣市場

- 亞太地區對氫氣的需求龐大。亞太地區是全球市場容量成長最快的地區,預計將在全球氫氣市場保持主導地位。

- 中國和印度是世界上最大的氫氣需求國之一,這得益於兩國在世界各地實施的支持政策和各種計劃。

- 2022年3月,中國政府公佈了首個涵蓋2021年至2035年的長期氫能規劃。此綜合戰略著重於分階段加速國內氫能產業的發展,重點在於技術進步和製造能力。該計畫的目標是到2025年實現每年利用可再生能源生產10萬至20萬噸氫氣的目標,並在2035年推動可再生氫能對經濟的滲透,以支持中國的綠色能源轉型。該計畫也鼓勵在未來15年內大幅擴大利用各種可再生能源生產氫氣的規模,並提倡採用多樣化的技術路徑,而不是依賴單一的方法。

- 據中國氫能聯盟稱,中國預計氫氣需求將激增,到 2030 年將達到 3,500 萬噸,佔全國能源供應的至少 5%。預計這項需求將進一步成長,到2050年將達到6,000萬噸(佔能源供應的10%),到2060年最終將達到1億噸(佔能源供應的20%)。預計到2025年,氫能產業的產值將達到1兆元(1,574.4億美元)。

- 2023年1月,印度政府宣布了國家氫能計畫。這是一項戰略舉措,旨在使該國成為綠色氫氣的主要生產國和出口國。該項目預算為 19,744 億印度盧比(約 23 億美元),目標是到 2030 年實現綠色氫氣年產量達到 500 萬噸(MMT),並增加約 125 吉瓦的可再生能源產能。

- 此外,中國和印度分別是世界上最大的氨生產國和消費量,這使得這些國家成為氫氣的主要市場。

- 預計在預測期內,該地區氫市場的成長將受到所有這些因素的推動。

氫氣產業概況

氫氣市場本質上是整合的。主要企業(不分先後順序)包括液化空氣集團、林德集團、空氣產品及化學品公司、Aditya Birla Chemicals 和 Messer SE &Co.KGaA。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 化學工業需求增加

- 擴大煉油廠氫氣的使用

- 其他

- 市場限制

- 藍氫和綠氫生產成本高

- 運輸和倉儲成本高

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 按通路

- 管道

- 高壓管拖車

- 圓柱

- 按應用

- 氨

- 甲醇

- 精製

- 直接還原鐵(DRI)

- 燃料電池汽車(FCV)

- 其他用途(玻璃、焊接、發電等)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 北歐的

- 土耳其

- 俄羅斯

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 奈及利亞

- 卡達

- 埃及

- 阿拉伯聯合大公國

- 其他中東和非洲地區

- 亞太地區

第6章競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Aditya Birla Chemicals

- Air Liquide

- Air Products and Chemicals Inc.

- BASF SE

- Equinor ASA

- Gujarat Alkalies and Chemicals Limited

- Gulf Cryo

- Linde PLC

- Lords Chloro Alkali Limited

- Matheson Tri-Gas Inc.

- Messer SE & Co. KGaA

- PAO NOVATEK

- Taiyo Nippon Sanso Corporation

- Universal Industrial Gases Inc.

第7章 市場機會與未來趨勢

- 增加航太航空業的就業機會

- 燃料電池電動車需求不斷成長

- 低碳經濟中的氫能產業

The Hydrogen Gas Market size is estimated at 113.86 million tons in 2025, and is expected to reach 137.53 million tons by 2030, at a CAGR of 3.85% during the forecast period (2025-2030).

The hydrogen gas market is expected to proliferate as governments and industries invest in hydrogen as a clean energy solution, driving demand for fuel cells and infrastructure development.

Key Highlights

- Over the medium term, factors such as increasing demand from the chemical industry and expanding usage of hydrogen in refineries are likely to drive the market studied.

- On the flip side, factors such as the high production cost of blue and green hydrogen and increased transportation and storage costs are likely to restrain the market's growth.

- However, factors such as increased space exploration and aviation adoption, increasing demand for fuel-cell electric vehicles, and industry readiness of hydrogen in a low-carbon economy are likely to act as growth opportunities for the market over the forecast period.

- Asia-Pacific dominates the market for hydrogen gas and is expected to remain so, owing to massive demand from China and India.

Hydrogen Gas Market Trends

Ammonia Production Expected to Dominate Market Demand

- Ammonia ranks among the world's most vital chemicals. Industries predominantly utilize the Haber-Bosch process, also referred to as abiotic or artificial nitrogen fixation, for ammonia production.

- The Haber-Bosch method, a cornerstone of industrial ammonia production, facilitates chemical reactions between atmospheric nitrogen and hydrogen. This occurs under elevated temperatures and pressures, employing metal-based catalysts like iron and molybdenum.

- Typically, hydrogen in the Haber-Bosch process is sourced from fossil fuel feedstocks. The predominant method for hydrogen generation involves reacting natural gas with steam in a steam reforming unit.

- Given the challenges associated with storing and transporting hydrogen gas, ammonia and fertilizer production facilities often integrate hydrogen generation units (HGUs). These units utilize fossil fuels (including natural gas) and other feed reformers.

- Data from the United States Geological Survey (USGS) revealed that in 2023, global ammonia production reached 150 million metric tons, marking a 3.45% increase from the previous year.

- East Asia led global ammonia production in 2023, churning out approximately 64.6 million metric tons. Notably, China emerged as the world's top ammonia producer, contributing around 43 million metric tons.

- USGS forecasts indicate a projected 6% rise in global ammonia capacity over the next four years.

- The United States, holding the position of the third-largest global ammonia producer, generated 14 million metric tons across 35 facilities operated by 16 companies.

- Given these dynamics, the market is poised for significant shifts in the coming years.

Asia-Pacific Expected to Dominate Hydrogen Gas Market

- Enormous demand for hydrogen gas exists in the Asia-Pacific region. It is expected to be the fastest-growing region in the world in terms of market volume and maintain its dominant position in the global hydrogen gas market.

- China and India are among the world's largest countries in terms of demand for hydrogen gas due to supportive policies and various projects undertaken by these countries worldwide.

- In March 2022, the Chinese government unveiled its first long-term hydrogen plan for the period of 2021-2035. This comprehensive strategy focuses on a phased approach to foster the development of a domestic hydrogen industry, emphasizing technological advancements and manufacturing capabilities. The plan aims to achieve an annual hydrogen production target of 100,000 to 200,000 tonnes from renewable sources by 2025 and facilitate the widespread adoption of renewable hydrogen in the economy to support China's transition toward green energy by 2035. Furthermore, the plan encourages the significant expansion of hydrogen production from various renewable sources over the next 15 years, promoting a diversified approach to technology pathways rather than relying on a single method.

- According to the China Hydrogen Alliance, China anticipates a surge in hydrogen demand, reaching 35 million tons by 2030, constituting at least 5% of the country's energy supply. This demand is projected to rise further to 60 million tons (10% of energy supply) by 2050, eventually reaching 100 million tons (20% of energy supply) by 2060. The hydrogen industry is expected to generate an output value of CNY 1 trillion (USD 157.44 billion) as early as 2025.

- In January 2023, the Government of India unveiled the National Hydrogen Mission, a strategic initiative to establish the country as a prominent producer and exporter of green hydrogen. With a budget of INR 19,744 crore (~USD 2.3 billion) approved by the Union Cabinet, the mission aims to have an annual production capacity of 5 million metric tonnes (MMT) of green hydrogen by 2030, accompanied by a renewable energy capacity addition of approximately 125 GW.

- In addition, the global production and consumption of ammonia are at their highest in China and India, with these countries becoming major markets for hydrogen gases.

- The growth of the hydrogen market in the region is likely to be driven by all these factors over the forecast period.

Hydrogen Gas Industry Overview

The hydrogen gas market is consolidated in nature. The major players (not in any particular order) include Air Liquide, Linde PLC, Air Products and Chemicals Inc., Aditya Birla Chemicals, and Messer SE & Co. KGaA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Demand From Chemical Industry

- 4.1.2 Expanding Usage of Hydrogen in Refineries

- 4.1.3 Other Drivers

- 4.2 Market Restraints

- 4.2.1 High Production Cost of Blue and Green Hydrogen

- 4.2.2 High Transportation and Storage Cost

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Distribution

- 5.1.1 Pipelines

- 5.1.2 High-pressure Tube Trailers

- 5.1.3 Cylinders

- 5.2 By Application

- 5.2.1 Ammonia

- 5.2.2 Methanol

- 5.2.3 Refining

- 5.2.4 Direct Reduced Iron (DRI)

- 5.2.5 Fuel Cell Vehicles (FCV)

- 5.2.6 Other Applications (Glass, Welding, Power Generation, etc.)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 Qatar

- 5.3.5.5 Egypt

- 5.3.5.6 United Arab Emirates

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Aditya Birla Chemicals

- 6.4.2 Air Liquide

- 6.4.3 Air Products and Chemicals Inc.

- 6.4.4 BASF SE

- 6.4.5 Equinor ASA

- 6.4.6 Gujarat Alkalies and Chemicals Limited

- 6.4.7 Gulf Cryo

- 6.4.8 Linde PLC

- 6.4.9 Lords Chloro Alkali Limited

- 6.4.10 Matheson Tri-Gas Inc.

- 6.4.11 Messer SE & Co. KGaA

- 6.4.12 PAO NOVATEK

- 6.4.13 Taiyo Nippon Sanso Corporation

- 6.4.14 Universal Industrial Gases Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increased Adoption in Space Exploration and Aviation Industry

- 7.2 Increasing Demand for Fuel Cell Electric Vehicles

- 7.3 Industry Readiness of Hydrogen in Low Carbon Economy