|

市場調查報告書

商品編碼

1698326

電轉氣市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Power to Gas Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

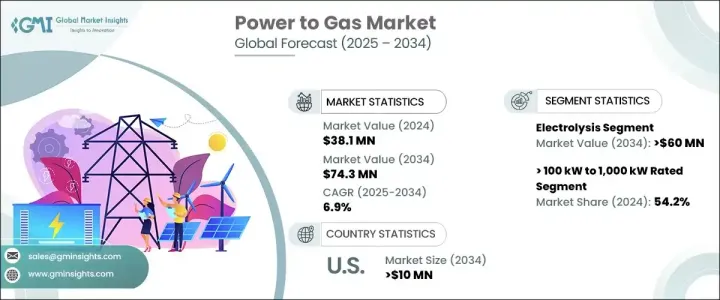

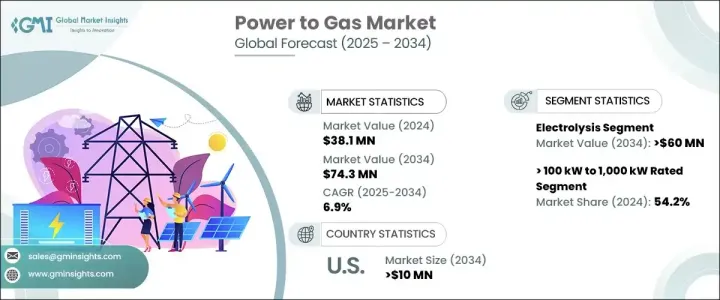

2024 年全球電轉氣市場價值為 3,810 萬美元,預計 2025 年至 2034 年期間的複合年成長率為 6.9%,這得益於向再生能源的日益轉變以及對能源儲存解決方案的需求不斷成長。隨著世界各國政府制定雄心勃勃的碳中和目標,各行各業正迅速採用傳統能源的永續替代方案。電轉氣技術在這一轉變中發揮關鍵作用,它能夠將剩餘電力轉化為氫氣或合成甲烷,確保提高電網穩定性和能源效率。風能和太陽能的日益普及,加劇了對高效能能源儲存解決方案的需求,使得電轉氣成為清潔能源生態系統的重要組成部分。隨著各國對氫氣生產和天然氣基礎設施的大量投資,將電轉氣技術納入再生能源策略,市場正在獲得發展動力。

政府對綠氫計畫的激勵和財政支持正在加速電轉氣解決方案的採用,而電解和甲烷化技術的進步則不斷提高效率和可擴展性。隨著越來越多的行業尋求永續的替代方案,電轉氣正在成為一種可行的長期能源儲存解決方案,可確保再生能源無縫連接到電網。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 3810萬美元 |

| 預測值 | 7430萬美元 |

| 複合年成長率 | 6.9% |

根據容量,市場滿足不同的能源儲存和生產需求。受分散式製氫和儲能需求不斷成長的推動,額定功率 >100 kW 至 1,000 kW 的部分將在 2024 年佔據行業佔有率的 54.2%。中檔容量解決方案因其能夠支援脫碳計畫同時確保能源可靠性而成為首選。甲烷生產技術的快速擴張,加上對分散式氫解決方案的投資增加,進一步推動了市場成長。隨著全球經濟體實施嚴格的減排目標,再生能源與電轉氣系統的結合正得到廣泛的應用。

技術進步繼續塑造電轉氣產業,重點關注質子交換膜 (PEM)、鹼性和固體氧化物電解等電解技術。預計到 2034 年,光電解技術就將創造 6,000 萬美元的收入,成為將多餘電力轉化為氫氣的關鍵推動因素。這些創新正在提高效率、可擴展性和成本效益,使氫氣生產更適合工業和商業應用。天然氣基礎設施投資的擴大以及氫氣生產能力的提高正在進一步推動市場擴張。

受益於支持部署再生能源解決方案的優惠監管政策和財政激勵措施,美國電轉氣市場在 2024 年創造了 670 萬美元的收入。政府支持的低碳技術推廣措施正在推動對氫氣生產和儲存基礎設施的投資。能源儲存需求的不斷成長,加上再生能源專案數量的不斷增加,正在促進產業成長。隨著監管框架不斷發展以適應新興清潔能源技術,電轉氣解決方案有望在未來能源格局中發揮不可或缺的作用,促進全球向更永續、更有效率的能源系統轉型。

目錄

第1章:方法論與範圍

- 市場範圍和定義

- 市場估計和預測參數

- 預測計算

- 資料來源

- 基本的

- 次要

- 有薪資的

- 民眾

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL 分析

第4章:競爭格局

- 介紹

- 戰略展望

- 創新與永續發展格局

第5章:市場規模及預測:依技術分類,2021 年至 2034 年

- 主要趨勢

- 電解

- 甲烷化

第6章:市場規模及預測:依產能,2021 年至 2034 年

- 主要趨勢

- ≤ 100 千瓦

- > 100 千瓦至 1,000 千瓦

- > 1,000 千瓦

第7章:市場規模及預測:依應用,2021 年至 2034 年

- 主要趨勢

- 商業的

- 公用事業

- 工業的

第8章:市場規模及預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 丹麥

- 荷蘭

- 瑞士

- 亞太地區

- 中國

- 日本

- 澳洲

第9章:公司簡介

- AquaHydrex

- Baker Hughes

- Electrochaea

- Engie

- GRTgaz

- Hitachi Zosen Inova Schmack

- ITM Power

- John Cockerill

- Krajete

- Linde

- MAN Energy Solutions

- McPhy Energy

- NEL

- Ren-Gas

- Siemens Energy

- Thyssenkrupp

The Global Power To Gas Market was valued at USD 38.1 million in 2024 and is projected to expand at a CAGR of 6.9% between 2025 and 2034, driven by the increasing shift toward renewable energy and the rising demand for energy storage solutions. As governments worldwide set ambitious carbon neutrality goals, industries are rapidly adopting sustainable alternatives to conventional energy sources. Power-to-gas technology plays a pivotal role in this transition by enabling the conversion of surplus electricity into hydrogen or synthetic methane, ensuring enhanced grid stability and energy efficiency. The growing penetration of wind and solar power has intensified the need for efficient energy storage solutions, positioning power-to-gas as a critical component of the clean energy ecosystem. With substantial investments in hydrogen production and gas infrastructure, the market is gaining traction as countries integrate power-to-gas technologies into their renewable energy strategies.

Government incentives and financial support for green hydrogen projects are accelerating the adoption of power-to-gas solutions while advancements in electrolysis and methanation technologies continue to enhance efficiency and scalability. As more industries seek sustainable alternatives, power-to-gas is emerging as a viable long-term energy storage solution that ensures the seamless integration of renewable energy into power grids.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $38.1 Million |

| Forecast Value | $74.3 Million |

| CAGR | 6.9% |

Based on capacity, the market caters to different energy storage and production needs. The >100 kW to 1,000 kW rated segment accounted for 54.2% of the industry share in 2024, driven by the growing demand for decentralized hydrogen production and energy storage. Mid-range capacity solutions have become a preferred choice due to their ability to support decarbonization initiatives while ensuring energy reliability. The rapid expansion of methane production technologies, coupled with increased investment in decentralized hydrogen solutions, is further propelling market growth. As global economies implement stringent emission reduction targets, integrating renewable energy sources with power-to-gas systems is gaining widespread adoption.

Technological advancements continue to shape the power-to-gas industry, with a strong focus on electrolysis technologies such as proton exchange membrane (PEM), alkaline, and solid oxide electrolysis. Electrolysis technology alone is expected to generate USD 60 million by 2034, serving as a key enabler in converting excess electricity into hydrogen. These innovations are improving efficiency, scalability, and cost-effectiveness, making hydrogen production more viable for industrial and commercial applications. Expanding investments in gas infrastructure, along with increasing hydrogen production capacity, are further driving market expansion.

The U.S. power-to-gas market generated USD 6.7 million in 2024, benefiting from favorable regulatory policies and financial incentives that support the deployment of renewable energy solutions. Government-backed initiatives promoting low-carbon technologies are driving investment in hydrogen production and storage infrastructure. The rising demand for energy storage, coupled with the growing number of renewable energy projects, is amplifying industry growth. As regulatory frameworks evolve to accommodate emerging clean energy technologies, power-to-gas solutions are expected to play an integral role in the future energy landscape, facilitating the global transition toward a more sustainable and efficient energy system.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 – 2034 (kW & USD Million)

- 5.1 Key trends

- 5.2 Electrolysis

- 5.3 Methanation

Chapter 6 Market Size and Forecast, By Capacity, 2021 – 2034 (kW & USD Million)

- 6.1 Key trends

- 6.2 ≤ 100 kW

- 6.3 > 100 kW to 1,000 kW

- 6.4 > 1,000 kW

Chapter 7 Market Size and Forecast, By Application, 2021 – 2034 (kW & USD Million)

- 7.1 Key trends

- 7.2 Commercial

- 7.3 Utility

- 7.4 Industrial

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (kW & USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Denmark

- 8.3.5 Netherlands

- 8.3.6 Switzerland

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 Australia

Chapter 9 Company Profiles

- 9.1 AquaHydrex

- 9.2 Baker Hughes

- 9.3 Electrochaea

- 9.4 Engie

- 9.5 GRTgaz

- 9.6 Hitachi Zosen Inova Schmack

- 9.7 ITM Power

- 9.8 John Cockerill

- 9.9 Krajete

- 9.10 Linde

- 9.11 MAN Energy Solutions

- 9.12 McPhy Energy

- 9.13 NEL

- 9.14 Ren-Gas

- 9.15 Siemens Energy

- 9.16 Thyssenkrupp