|

市場調查報告書

商品編碼

1687766

智慧卡:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Smart Card - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

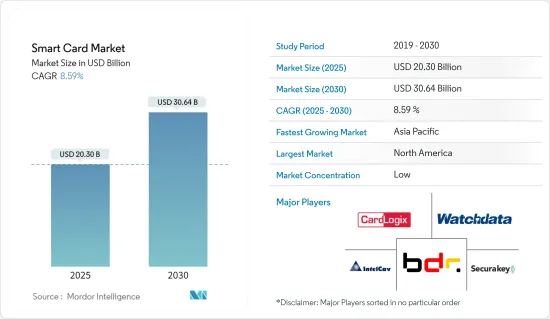

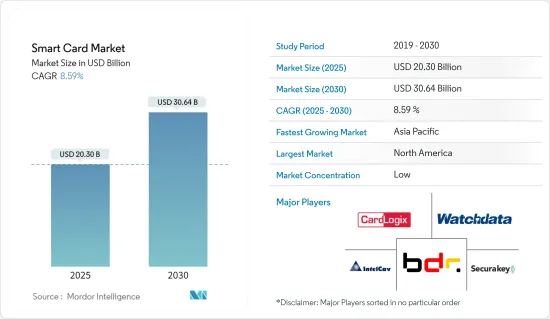

智慧卡市場規模預計在 2025 年為 203 億美元,預計到 2030 年將達到 306.4 億美元,預測期內(2025-2030 年)的複合年成長率為 8.59%。

數位化的提高、網路購物需求的增加、醫療保健需求以及存取控制應用是推動智慧卡市場成長的一些主要因素。

主要亮點

- 智慧卡提供了一種安全識別和驗證持卡人以及任何希望存取該卡的第三方的方法。例如,可以使用 PIN 碼或生物識別資料對持卡人進行身份驗證。智慧卡還提供了一種在卡上安全儲存資料並透過加密保護通訊的方法。

- 在日益數位化位化和互聯互通的世界中,安全問題至關重要。智慧卡具有強大的安全功能,包括加密和敏感資料的安全存儲,使其成為銀行、政府身分證和存取控制等需要安全認證的應用的理想選擇。

- 由於先進的智慧卡安全應用引入了其他安全和隱私問題,智慧卡在各種終端工業市場的需求多年來不斷成長。在全球範圍內,銀行和金融業預計將佔據智慧卡市場的很大佔有率。由於關鍵的金融業務是該行業的核心,因此安全仍然是首要關注點。這推動了先進身份驗證解決方案的採用,並加速了智慧卡在行業中的接受度。

- 用於存取控制和其他應用的智慧卡需要很高的初始成本,因為它們依賴高品質的讀卡機和晶片來運作。部署讀卡機和晶片需要額外的成本,這增加了智慧卡的整體成本並限制了其發展。

- 疫情期間,專注於通訊和醫療保健的智慧卡業務受到的影響小於其他垂直產業。醫療保健資料的爆炸性成長為提供高效的患者照護和隱私帶來了新的挑戰。智慧卡透過提供安全儲存(磁條卡上可儲存超過 150 個位元組)和輕鬆的資料分發解決了這兩個挑戰。預計醫療保健支出的增加將推動智慧卡在醫療保健市場的使用。

- 例如,根據美國醫療保險和醫療補助服務中心的數據,預計到2027年,美國的醫療保健支出將達到約6兆美元。此外,新冠疫情促使多個國家製定疫苗接種預防計劃,預計這也將有助於市場成長。預計數位證書將在疫情管理中發揮重要作用。

智慧卡市場趨勢

個人識別和存取控制應用的日益普及正在推動市場成長

- 智慧卡市場正在經歷顯著成長,主要原因是智慧卡在個人識別和存取控制應用中的部署日益增加。在日益數位化位化和互聯互通的世界中,強力的安全措施至關重要。智慧卡配備先進的微處理器和安全元件,為驗證身分和控制對敏感區域和資料的存取提供了理想的解決方案。

- 透過整合指紋掃描、虹膜辨識和臉部辨識等生物識別技術,智慧卡增加了額外的身份驗證層,增強了安全性並確保了使用者辨識的準確性。因此,政府、醫療保健、金融和交通等行業擴大採用智慧卡來保護身分驗證系統和存取控制通訊協定。

- 智慧卡在個人識別和存取控制領域日益普及的關鍵促進因素之一是生物識別技術的整合。指紋掃描、虹膜辨識和臉部認證等生物識別方法因其準確性和獨特性而備受關注。具有嵌入式生物識別功能的智慧卡透過將持卡人的生物識別資料與其身分證件綁定在一起,增加了一層額外的安全性,使得冒名頂替者幾乎不可能獲得存取權限。

- 此外,根據生物辨識研究所的調查,到 2022 年,大多數受訪者認為臉部認證將成為未來幾年使用成長最快的生物識別技術。相較之下,只有 3% 的受訪者認為指紋認證的使用率將顯著增加,因為它已經是最常用且最發達的生物識別技術。隨著企業和組織擴大採用具有臉部認證功能的智慧卡來增強其存取控制和個人識別系統,這一趨勢預計將推動智慧卡市場的成長。

- 智慧卡在這些應用中的便利性、可靠性和擴充性使其成為尋求保護業務和用戶隱私的組織的重要工具。隨著企業和機構繼續優先考慮業務的安全性和效率,個人識別和存取控制應用的日益普及預計將在未來幾年進一步推動智慧卡市場的成長。

亞太地區成長率強勁

- 在亞太地區,隨著智慧卡的廣泛應用,BFSI、醫療保健、零售和政府部門的需求可能會主導市場。此外,該地區物聯網應用、智慧城市計劃和連網型設備的興起正在推動對安全和擴充性驗證解決方案的需求,其中智慧卡發揮關鍵作用。此外,人們對資料安全和隱私的意識不斷增強,促使企業和組織採用智慧卡進行存取控制和安全資料儲存。

- 鑑於中國龐大的消費群和主要智慧卡製造商的存在,預計中國對智慧卡的需求將會強勁。智慧卡已被許多銀行機構採用,促進了市場擴張。

- 例如,中國建設銀行(CCB)去年宣布正在測試一種生物識別硬錢包智慧卡,該卡將允許用戶儲存數位人民幣並使用指紋使用央行數位貨幣進行支付。借助尖端的指紋認證和識別技術,卡片中儲存的價值得到進一步保護。

- 在該地區營運的幾家銀行已經與 IC 卡生產公司合作,在該國建立不同類型的 IC 卡。 Axis Bank、ICICI Bank 和 SBM Bank 等印度銀行均在去年下半年或第一季推出了晶片卡。

- 此外,總部位於東京的電子公司 MoriX Co. 去年與 Fingerprint Cards AB 合作,開發並推出了使用 Fingerprints T 形模組的生物識別付款卡。預計這些卡將採用傳統的自動化製造技術與付款卡整合。

- 為了幫助擴大市場,新的措施和發展正在鼓勵其他最終用戶使用智慧卡。香港晶片卡營運商之一八達通最近向中國300多個城市的公共交通用戶推出了交通卡。作為八達通海外發展計畫的一部分,八達通交通卡用戶將可以在中國當地乘坐公車、火車和渡輪等公共交通工具時使用八達通卡支付。八達通卡初期充值限額為3,000港幣(386美元),第二階段可轉換為數位八達通卡。

智慧卡產業概況

智慧卡市場分散,由多家全球企業組成。主要參與者有 HID Global Corporation、CardLogix Corporation、Thales Group 等。該市場的主要企業正在建立夥伴關係和聯盟,以推出創新的新產品並獲得競爭優勢。

- 2023 年 7 月:IDEX Biometrics 宣布與金邦達集團旗下的金邦達金融科技香港有限公司進行全球合作,部署基於 IDEX Biometrics 完整指紋認證解決方案的生物識別智慧卡,用於付款和身分存取。

- 2023 年 1 月:為了提高乘客的便利性,德里地鐵與 Airtel Payments Bank 合作增加了智慧卡儲值服務。客戶的網路銀行資訊安全地儲存在應用程式內,確保所有交易的安全。使用此功能充值快速簡便,為通勤者提供無縫體驗。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 擴大在識別和存取控制應用中的部署

- 廣泛應用於旅行識別和交通運輸

- 非接觸式付款需求不斷成長

- 市場限制

- 隱私和安全問題、標準問題

第6章市場區隔

- 按類型

- 接觸類型

- 非接觸式

- 按最終用戶產業

- BFSI

- 資訊科技/通訊

- 政府

- 運輸

- 其他(教育、醫療保健、娛樂等)

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 世界其他地區

- 北美洲

第7章競爭格局

- 公司簡介

- CardLogix Corporation

- Watchdata Technologies

- Bundesdruckerei GmbH

- IntelCav

- Secura Key

- Alioth LLC

- Gemalto NV(Thales Group)

- Giesecke & Devrient GmbH(MC Familiengesellschaft mbH)

- HID Global Corporation(Assa Abloy AB)

- IDEMIA France SAS

- Infineon Technologies AG

- Fingerprint Cards AB

- Samsung Electronics Co. Ltd

- CPI Card Group Inc.

- KONA I Co. Ltd

第 8 章供應商定位分析

第9章投資分析

第10章:投資分析市場的未來

The Smart Card Market size is estimated at USD 20.30 billion in 2025, and is expected to reach USD 30.64 billion by 2030, at a CAGR of 8.59% during the forecast period (2025-2030).

The rising digitalization, increasing demand from online shopping, demand for healthcare, and access control applications are the primary factors augmenting the growth of the smart card market.

Key Highlights

- Smart cards provide methods to securely identify and authenticate the cardholder and third parties who want access to the card. For instance, a cardholder can use a PIN code or biometric data for authentication. Smart cards also provide a way to securely store data on the card and protect communications with encryption.

- In an increasingly digital and interconnected world, security concerns have become paramount. Smart cards offer robust security features, including encryption and secure storage of sensitive data, making them an ideal choice for applications that require secure authentication, such as banking, government IDs, and access control.

- The demand for smart cards has been growing each year with applications in various end-use industry markets due to the recent introduction of other security and privacy issues for advanced smart card security applications. Globally, the banking and finance industry is expected to account for a significant share of the smart card market. With critical financial operations being the industry's core, security remains the primary focus. This supports the adoption of advanced authentication solutions and promotes the acceptance of the smart card within the sector.

- The initial cost required for the smart card used for access control and other applications is high as it uses readers and chips of high quality for its functioning. The deployment of readers and chips requires additional costs, which increases the overall cost of smart cards, restraining the growth of smart cards.

- During the COVID-19 pandemic, the business for smart cards specific to telecommunications and healthcare was less affected than other verticals. The upsurge of healthcare data brings up new challenges in providing efficient patient care and privacy. Smart cards solved both challenges by providing secure storage (dramatically more than 150 bytes that can be stored on a magnetic stripe card) and easy data distribution. Increasing healthcare expenditure is anticipated to propel the use of smart cards in the healthcare market.

- For instance, according to the Centers for Medicare & Medicaid Services, US health spending is projected to reach nearly USD 6 trillion by 2027. Moreover, the emergence of COVID-19 has prompted several nations to develop vaccination-proofing plans, which are also anticipated to aid market growth. Digital credentials are expected to play a major role in managing the pandemic.

Smart Card Market Trends

Growing Deployment in Personal Identification and Access Control Applications to Drive the Market Growth

- The smart card market is experiencing significant growth, primarily driven by the expanding deployment of smart cards in personal identification and access control applications. Robust security measures have become paramount in the increasingly digital and interconnected world. Smart cards with advanced microprocessors and secure elements offer an ideal solution for verifying identities and controlling access to sensitive areas or data.

- With the integration of biometric technologies, such as fingerprint scanning, iris recognition, and facial recognition, smart cards provide an added layer of authentication, enhancing security and ensuring user identification accuracy. As a result, various industries, including government, healthcare, finance, and transportation, are increasingly adopting smart cards to secure their identification systems and access control protocols.

- One of the key drivers behind the growing deployment of smart cards in personal identification and access control is the integration of biometric technology. Biometric authentication methods, such as fingerprint scanning, iris recognition, and facial recognition, are gaining prominence due to their accuracy and uniqueness. Smart cards with embedded biometric capabilities add an extra layer of security by binding the cardholder's biometric data to their identification, making it virtually impossible for imposters to gain access.

- Moreover, according to the Biometrics Institute, in 2022, most respondents considered that face recognition was the biometric technology likely to deliver the most significant increase in usage over the next few years. By contrast, only three percent of respondents believed that fingerprint identification would significantly increase usage, as it is already the most used and developed biometric technology. This trend will likely drive the smart card market's growth as businesses and organizations increasingly adopt smart cards with face recognition capabilities to bolster access control and personal identification systems.

- The convenience, reliability, and scalability of smart cards in such applications make them essential tools for organizations seeking to safeguard their operations and protect their users' privacy. This growing deployment in personal identification and access control applications is expected to drive the smart card market's growth further in the coming years as businesses and institutions continue to prioritize security and efficiency in their operations.

Asia Pacific to Witness a Significant Growth Rate

- Since smart cards are more widely used in the Asia Pacific area, demand from the BFSI, healthcare, retail, and government sectors is likely to dominate the market. Additionally, the growth of IoT applications, smart city projects, and connected devices in the region are creating a demand for secure and scalable authentication solutions, where smart cards play a crucial role. Moreover, the growing awareness of data security and privacy concerns is encouraging enterprises and organizations to adopt smart cards for access control and secure data storage.

- A big consumer base and the presence of major smart card manufacturers in China are expected to result in a strong demand for smart cards in the region. Smart cards were adopted by a number of banking institutions, which helped the market expand.

- For instance, China Construction Bank (CCB) declared last year that they are testing a biometric 'hard wallet' smart card that enables users to store digital yuan and confirm payments made using the central bank's digital currency with their fingerprints. With the help of cutting-edge fingerprint authentication and recognition, the stored value on the card is further protected.

- To establish various types of smart cards in the nation, several banks operating in the region have partnered with smart card creators. Axis Bank, ICICI Bank, and SBM Bank are a few Indian banks that released smart cards in the latter or first quarter of the previous year.

- In addition, MoriX Co., a Tokyo-based electronics company, collaborated with Fingerprint Cards AB last year to develop and introduce biometric payment cards using the T-Shape module from Fingerprints. These cards are anticipated to be integrated with payment cards using conventional automated manufacturing techniques.

- To support market expansion, new initiatives, and developments are encouraging other end users to use smart cards. Transit cards were recently offered for users of public transportation in more than 300 Chinese cities by Octopus, one of the smart card operators in Hong Kong. Users of Octopus transit cards will be able to pay for public transportation in mainland China's buses, trains, and ferries as part of the company's offshore development plan. The maximum top-up amount for the Octopus card will initially be HKD 3,000 (USD 386), with the option to convert to digital Octopus cards in a phase two launch.

Smart Card Industry Overview

The Smart Card market is fragmented because of the presence of several global companies. Some key players are HID Global Corporation, CardLogix Corporation, Thales Group, etc. Key players in this market are introducing new innovative products and forming partnerships and collaborations to gain competitive advantages.

- July 2023- IDEX Biometrics announced a global collaboration with Goldpac Fintech Hong Kong Limited, a Goldpac Group company, to deploy biometric smart cards based on IDEX Biometrics' complete fingerprint solution for payments and identity access.

- January 2023: To enhance the convenience of passengers, the Delhi Metro has collaborated with Airtel Payments Bank, offering an additional smart card top-up facility. Customers' Internet banking details will be securely stored within the app, ensuring the utmost safety for all transactions. Taking advantage of this feature for recharging purposes will be both swift and effortless, providing a seamless experience for commuters.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Deployment in Personal Identification and Access Control Applications

- 5.1.2 Extensive Use in Travel Identity and Transportation

- 5.1.3 Growing Demand for Contactless Payments

- 5.2 Market Restraints

- 5.2.1 Privacy and Security Issues and Standardization concerns

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Contact-based

- 6.1.2 Contact-Less

- 6.2 By End-user Vertical

- 6.2.1 BFSI

- 6.2.2 IT & Telecommunication

- 6.2.3 Government

- 6.2.4 Transportation

- 6.2.5 Other End-User Industries (Education, Healthcare, Entertainment, etc.)

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of Asia Pacific

- 6.3.4 Rest of the World

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 CardLogix Corporation

- 7.1.2 Watchdata Technologies

- 7.1.3 Bundesdruckerei GmbH

- 7.1.4 IntelCav

- 7.1.5 Secura Key

- 7.1.6 Alioth LLC

- 7.1.7 Gemalto NV (Thales Group)

- 7.1.8 Giesecke & Devrient GmbH (MC Familiengesellschaft mbH)

- 7.1.9 HID Global Corporation (Assa Abloy AB)

- 7.1.10 IDEMIA France SAS

- 7.1.11 Infineon Technologies AG

- 7.1.12 Fingerprint Cards AB

- 7.1.13 Samsung Electronics Co. Ltd

- 7.1.14 CPI Card Group Inc.

- 7.1.15 KONA I Co. Ltd