|

市場調查報告書

商品編碼

1687759

汽車汽缸套:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Automotive Cylinder Liner - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

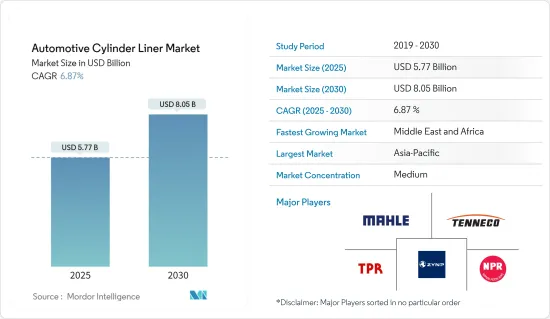

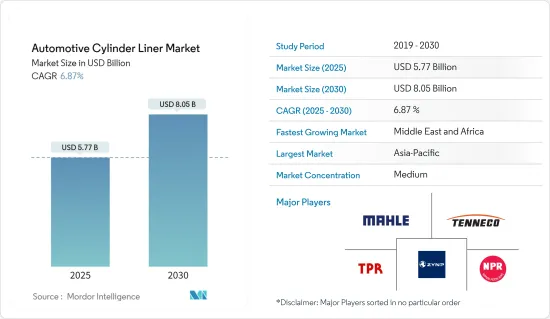

預計 2025 年汽車汽缸套市場規模將達到 57.7 億美元,到 2030 年將達到 80.5 億美元,預測期內(2025-2030 年)的複合年成長率為 6.87%。

商用車銷量增加和汽車持有上升是全球汽車產業成長的主要決定因素,進而對汽車汽缸套的需求產生正面影響。商用車的成長主要受到電子商務的擴張和商用車運輸使用量的增加的推動。此外,支持汽車工業進步和發展的工業化和基礎設施建設不斷提高,正在推動商用車市場的成長。

根據國際汽車工業理事會的預測,2022年全球新商用車銷售量將達到2,410萬輛。

此外,重點地區對氫電商用車的需求不斷成長,也促使汽缸套製造商開發先進技術。幾家主要企業正在引入氫電動卡車的氣缸套技術,以促進市場成長。車輛報廢計劃以及有關車輛長度和負載容量限制的嚴格監管規範也有望推動市場成長。

由於印度和中國汽車行業的不斷成長的潛力,預計亞太地區將佔據汽車氣缸套消費的主導地位。包括美國在內的世界許多國家都從中國、日本和其他經濟體採購原料和引擎零件,並在完整的引擎室內組裝。隨著汽車銷售和產量的增加,該地區對汽缸套的需求預計將保持在高位。

汽車汽缸套市場趨勢

預測期內乘用車市場將獲得發展動力

乘用車是新興國家最常見的交通途徑。由於人均收入的提高,新興國家的持有數量正在增加,預計這將對汽車氣缸套市場產生積極影響。印度等新興國家正在尋求更好的燃料,例如用於乘用車的乙醇,這可以對市場成長產生積極影響。

例如,2023 年 8 月,Toyota Innova 成為世界上第一款僅靠乙醇運作的彈性燃料汽車。豐田汽車公司預計將成為世界上第一家推出 100% 乙醇燃料汽車的汽車製造商。 2023年8月,印度聯邦部長推出了一款基於豐田最受歡迎的乘用車Innova的汽車。 Innova成為全球首款配備 Bharat Phase VI 靈活燃料電動證書的車型。一年前,這家日本汽車製造商推出了使用氫燃料電池的 Mirai。

更嚴格的排放法規、電動車的日益普及以及內燃機(ICE)汽車對環境的有害影響所導致的石化燃料蘊藏量稀缺可能會對市場成長構成挑戰。然而,新興經濟體電動車基礎設施和充電設施的發展預計將在預測期內推動內燃機市場的擴張。根據國際汽車工業組織(OICA)預測,2022年全球新車銷量將達5,740萬輛,較2021與前一年同期比較增1.9%。 2022年南非新車銷量較去年與前一年同期比較19.5%,泰國成長10.0%。

都市化的上升和消費者對私人交通途徑的偏好的改變預計將推動全球汽車行業的發展,這反過來又將推動先進汽車市場對氣缸套的需求。根據世界銀行預測,到2022年,印度的都市化將達到36%,而2018年為34%。隨著越來越多的消費者遷移到新興市場的都市區,對個人出行的偏好日益增加,這很可能導致全球整體汽車汽缸套市場的成長。

預測期內,亞太地區將佔據最大市場佔有率

由於中國和印度汽車產業的擴張,汽缸套產品銷售量不斷增加,帶動了亞太地區汽車汽缸套市場的發展。這兩個國家都在刺激汽車銷售,對引擎的需求龐大。

印度是該地區主要的汽車出口國之一,從目前的機動性擴張計劃來看,預計出口將很快強勁成長。此外,印度政府對汽車產業的大力扶持以及主要汽車製造商在印度市場的存在,幫助印度發展成為領先的汽車出口國之一。 2000年4月至2022年9月,中國汽車產業累計獲得直接投資約337.7億美元。政府預計,到2024年,汽車產業規模將翻倍,達到180億美元。此外,中國在汽車加工能力和引擎產量方面在亞太地區佔據主導地位。

2022年中國汽車銷量預計將達到2,680萬輛,高於2021年的2,627萬輛,與前一年同期比較去年同期成長2.2%。該地區主要引擎製造商和目標商標產品製造商(OEM)的投資、擴張和發展正在增加。預計這將在預測期內減緩對汽缸套的需求。

例如,2022年3月,哈爾濱東安汽車動力股份有限公司宣布2022年投資計劃,建造高效增程式引擎生產線,預計包括加工中心、打標機、擰緊機、塗膠機等設備。此計劃擬由哈爾濱東安汽車動力股份有限公司下屬子公司哈爾濱東安汽車動力有限公司共同開發,總投資7,233萬元人民幣(1,085萬美元)。

因此,隨著該地區乘用車和商用車行業的擴張,預計未來幾年汽車氣缸套市場的需求將迅速成長。然而,各國政府將重點轉向電動車可能會成為亞太地區長期產品成長的重大阻礙因素。然而,短期內,汽車電氣化的競爭轉變對這些政府構成了重大挑戰。因此,預計預測期內汽車汽缸套的需求將保持強勁。

汽車汽缸套產業概況

汽車汽缸套市場呈現中度分散態勢,有組織和無組織的參與者共同塑造產業格局。汽缸套市場的主要競爭對手包括 Mahle GmBH、Tenneco Inc.、TPR、Nippon Piston Ring 和 ZYNP。領先的製造商正在大力投資汽車汽缸套的研究和開發,以提高盈利和產品效率。

為了降低與原料採購相關的風險,公司正在採取積極主動的方式並擴大與主要原料供應商的關係。這項策略成功地確保了生產汽缸套所需原料的穩定、持續供應。

2022年10月:萊茵金屬股份公司(萊茵金屬與華域汽車系統的合資企業)鑄造業務部門贏得一項重要訂單,向英國一家知名跑車製造商供應V8引擎缸體。 V8 引擎擁有接近四位數的驚人馬力。

2022 年 4 月:豐田北美公司宣布打算在美國四家工廠投資 3.83 億美元。該投資旨在為混合動力和傳統動力傳動系統的新型四缸引擎的生產做準備。引擎生產範圍包括端到端組裝,包括引擎缸蓋、襯套和各種其他部件。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 商用車銷售量增加

- 其他

- 市場限制

- 電動車迅速普及

- 其他

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 依材料類型

- 鑄鐵

- 防鏽的

- 鋁

- 鈦

- 按燃料

- 汽油

- 柴油引擎

- 按接觸點

- 濕式汽缸套

- 乾式汽缸套

- 按車型

- 搭乘用車

- 輕型商用車

- 中大型商用車

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 韓國

- 其他亞太地區

- 拉丁美洲

- 墨西哥

- 巴西

- 阿根廷

- 其他拉丁美洲國家

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 其他中東和非洲地區

- 北美洲

第6章 競爭格局

- 供應商市場佔有率

- 公司簡介

- Mahle GmbH

- Tenneco Inc.

- GKN Zhongyuan Cylinder Liner Company Limited

- Melling Cylinder Sleeves

- TPR Co. Ltd

- Westwood Cylinder Liners Ltd

- Darton International Inc.

- ZYNP International Corporation

- Laystall Engineering Co. Ltd

- India Pistons Ltd

- Nippon Piston Ring Co. Ltd

- Motordetal

- Kusalava International

- Cooper Corp.

- Yoosung Enterprise Co. Ltd

- Yangzhou Wutingqiao Cylinder Liner Co. Ltd

- Chengdu Galaxy Power Co. Ltd

第7章 市場機會與未來趨勢

- 混合襯墊的採用日益增多

The Automotive Cylinder Liner Market size is estimated at USD 5.77 billion in 2025, and is expected to reach USD 8.05 billion by 2030, at a CAGR of 6.87% during the forecast period (2025-2030).

The rising sales of commercial vehicles and increasing vehicle parc globally serve as major determinants for the growth of the automotive industry across the world, which, in turn, is positively impacting the demand for automotive cylinder liners. Commercial vehicle growth is primarily influenced by the expansion of e-commerce and the increasing use of commercial vehicles for transportation. Aside from that, rising industrialization and infrastructure development, which support advancement and development in the automotive industry, are driving market growth for commercial vehicles.

According to the International Organization of Motor Vehicle Manufacturers, the global sales of new commercial vehicles touched 24.1 million units in 2022.

Furthermore, rising demand for hydrogen electric commercial vehicles across major regions is pushing cylinder liner manufacturers to develop advanced technology. Several key players are introducing cylinder liner technology for hydrogen-electric trucks, boosting market growth. Vehicle scrappage programs and stringent regulatory norms for vehicle length and loading limits, among other parameters, are also expected to drive the growth of the market.

Asia-Pacific is expected to dominate the consumption of automotive cylinder liners, owing to the increased potential of the automotive industry in India and China. Many countries across the world, such as the United States, source their raw materials and engine components from China, Japan, and other economies to assemble them under complete engine chambers. With rising automotive sales and production, the region's demand for cylinder liners is expected to remain high.

Automotive Cylinder Liner Market Trends

The Passenger Car Segment of the Market to Gain Traction During the Forecast Period

Passenger cars are the most common form of transport in emerging countries. The number of passenger cars is increasing in developing countries with the rise in per capita income, and such factors are likely to impact the automotive cylinder liner market positively. Emerging countries, such as India, are looking for better fuels, like ethanol, for their passenger cars, which may positively impact the market growth.

For instance, in August 2023, Toyota Innova became the world's first flexible fuel vehicle that can run entirely on ethanol. Toyota Motor is projected to become the first automaker in the world to introduce cars powered by 100% ethanol. In August 2023, the Union Minister of India launched a vehicle based on Toyota's most popular passenger car, Innova. Innova became the first model in the world to feature a Bharat Phase VI vehicle with a flexible fuel electric certificate. The launch came a year after the Japanese auto giant introduced Mirai, which uses hydrogen fuel cells.

Increasing emission regulations, penetration of electric vehicles, and lack of fossil fuel reserves due to the toxic impact of internal combustion engine (ICE) vehicles on the environment could challenge the growth of the market. However, in emerging countries, there needs to be more infrastructure for electric vehicles, and charging facilities are expected to facilitate the expansion of the internal combustion engine market during the forecast period. According to the International Organization of Motor Vehicle Manufacturers (OICA), global new passenger car sales touched 57.4 million in 2022, recording a Y-o-Y growth of 1.9% compared to 2021. Countries such as South Africa and Thailand recorded 19.5% and 10.0% Y-o-Y growth, respectively, in new passenger car sales in 2022 compared to the previous year.

The rising urbanization rate and the shifting preference of consumers toward availing private transportation mediums are anticipated to drive the automotive industry across the world, which, in turn, is expected to drive the demand for the advanced automotive cylinder liner market. According to the World Bank, the urbanization rate in India stood at 36% in 2022, compared to 34% in 2018. As more consumers migrate to urban areas in developing nations, there will be a preference for personal mobility, which, in turn, may lead to the growth of the automotive cylinder liner market across the world.

Asia-Pacific to Hold the Largest Market Share During Forecast Period

The Asia-Pacific automotive cylinder liner market is witnessing elevated sales of cylinder liner products owing to the expanding auto sector of China and India. Both countries are fuelling vehicle sales, generating significant engine demand.

India is one of the major automobile exporters in the region, and strong export growth is expected shortly, seeing its present mobility expansion projects. Furthermore, favorable initiatives by the Indian government to support the automotive industry and the presence of major automakers in its market are assisting in developing the country into one of the major automobile exporters. The automotive industry in the country received a cumulative FDI inflow of approximately USD 33.77 billion between April 2000 and September 2022. The government expects to double the size of the automotive industry to USD 18 billion by 2024. Furthermore, China holds the dominant hand in Asia-Pacific in terms of auto industry throughput and engine production.

In 2022, the total number of vehicles sold in China stood at 26.8 million units, compared to 26.27 million units in 2021, registering a year-on-year growth of 2.2%. The region is witnessing extended investment, expansion, and development, proliferated by key engine manufacturers and original equipment manufacturers (OEMs). This is expected to mitigate the demand for cylinder liners over the forecast period.

For instance, in March 2022, Harbin Dongan Auto Engine Co. Ltd unveiled its investment plan for 2022 for building a production line for high-efficiency extended-range engines, which was expected to involve machining center, marking machines, tightening machines, gluing machines, and other equipment. The project was planned to be jointly maintained by Harbin Dongan Automotive Engine Manufacturing Co. Ltd, the subsidiary of Harbin Dongan Auto Engine, with a total investment of CNY 72.33 million (USD 10.85 million).

Therefore, with the region's expanding passenger car and commercial vehicle industry, the demand for the automotive cylinder liner market will showcase a rapid surge in the coming years. However, shifting the government's focus to promote the adoption of electric vehicles could act as a major deterrent to the growth of these products in the long run in Asia-Pacific. However, a competitive shift toward electrification of vehicle fleets in the short run is a major challenge for these governments. Therefore, the demand for automotive cylinder liners is expected to remain strong during the forecast period.

Automotive Cylinder Liner Industry Overview

The automotive cylinder liner market exhibits moderate fragmentation, with a mix of organized and unorganized players shaping the industry landscape. Among the key contenders in the cylinder liner market, notable players include Mahle GmBH, Tenneco Inc., TPR Co. Ltd, Nippon Piston Ring Co. Ltd, and ZYNP. Significant manufacturers are channeling substantial investments into the research and development of automotive cylinder liners to enhance profitability and product efficiency.

To mitigate the risks associated with raw material procurement, companies have adopted a proactive approach, maintaining extended relationships with their primary raw material suppliers. This strategy has proven successful in ensuring a consistent and uninterrupted supply of materials necessary for cylinder liner production.

October 2022: Rheinmetall AG's Castings business unit, a joint venture between Rheinmetall and HUAYU Automotive Systems Co. Ltd, secured a significant order to supply a V8 engine block to a renowned English sports car manufacturer. Notably, the V8 engines boast an impressive horsepower output, approaching four figures.

April 2022: Toyota Motor North America disclosed its intention to invest USD 383 million in four US-based plants. This investment is aimed at preparing to produce a new four-cylinder engine variant tailored for hybrid and conventional powertrains. The scope of engine production encompasses end-to-end assembly, encompassing engine heads, liners, and various other components.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rising Sales of Commercial Vehicles

- 4.1.2 Others

- 4.2 Market Restraints

- 4.2.1 Rapid Adoption of Electric Vehicles

- 4.2.2 Others

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD)

- 5.1 By Material Type

- 5.1.1 Cast Iron

- 5.1.2 Stainless Steel

- 5.1.3 Aluminum

- 5.1.4 Titanium

- 5.2 By Fuel Type

- 5.2.1 Gasoline

- 5.2.2 Diesel

- 5.3 By Contact

- 5.3.1 Wet Cylinder Liner

- 5.3.2 Dry Cylinder Liner

- 5.4 By Vehicle Type

- 5.4.1 Passenger Cars

- 5.4.2 Light Commerical Vehicles

- 5.4.3 Medium and Heavy-duty Commercial Vehicles

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Spain

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 India

- 5.5.3.2 China

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Latin America

- 5.5.4.1 Mexico

- 5.5.4.2 Brazil

- 5.5.4.3 Argentina

- 5.5.4.4 Rest of Latin America

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Mahle GmbH

- 6.2.2 Tenneco Inc.

- 6.2.3 GKN Zhongyuan Cylinder Liner Company Limited

- 6.2.4 Melling Cylinder Sleeves

- 6.2.5 TPR Co. Ltd

- 6.2.6 Westwood Cylinder Liners Ltd

- 6.2.7 Darton International Inc.

- 6.2.8 ZYNP International Corporation

- 6.2.9 Laystall Engineering Co. Ltd

- 6.2.10 India Pistons Ltd

- 6.2.11 Nippon Piston Ring Co. Ltd

- 6.2.12 Motordetal

- 6.2.13 Kusalava International

- 6.2.14 Cooper Corp.

- 6.2.15 Yoosung Enterprise Co. Ltd

- 6.2.16 Yangzhou Wutingqiao Cylinder Liner Co. Ltd

- 6.2.17 Chengdu Galaxy Power Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Adoption of Hybrid Liners