|

市場調查報告書

商品編碼

1687351

東協商用車:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)ASEAN Commercial Vehicles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

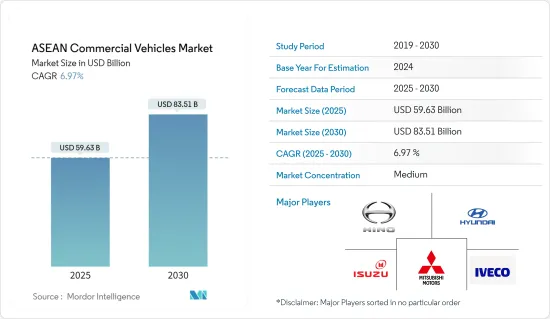

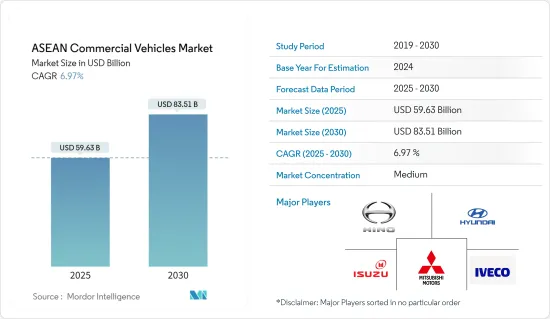

2025年東協商用車市場規模預估為596.3億美元,預估至2030年將達835.1億美元,預測期間(2025-2030年)複合年成長率為6.97%。

隨著基礎設施建設的改善、電子商務活動的增加對物流車輛的需求以及該地區電子商務熱潮帶來的經濟復甦,東協商用車市場預計將在 2023 年實現強勁成長。快速的都市化和大規模貨物運輸的需求改善了市場條件。

從長遠來看,嚴格的車輛排放法規、車輛安全性的提高、新車採用ADAS(駕駛輔助系統)以及東協零售和電子商務領域物流的快速成長預計將主要推動對新型和先進商用車的需求。隨著物流和電子商務行業的快速擴張,對輕型商用車的需求預計會增加。

東協各國政府都在向汽車製造商施壓,要求他們減少燃燒柴油產生的碳排放並解決溫室氣體排放,迫使OEM投資開發電動卡車。

自1998年以來,泰國污染控制部(PCD)要求所有新型重型卡車必須符合歐盟6排放標準,以抑制車輛污染。這刺激了人們對新型改裝商用車的購買。

整體而言,由於經濟發展、私人消費以及持續的排放氣體相關政策調整,預測期內東協商用車市場預計將持續成長。

東協商用車市場趨勢

輕型商用車市場佔據主導地位

- 輕型商用車主要用於近距離運輸。電子商務導致的商品需求不斷成長,推動了輕型商用車在物流領域的應用,為市場成長鋪平了道路。眾多電商、物流公司紛紛進入東協地區,帶動當地商用車市場發展。因此,該地區的主要企業正在以更低的價格推出改良產品來提高銷售量。

- 在道路狹窄、交通擁擠的東南亞國協都市區中,小型車輛被證明能夠幫助無縫應對這些基礎設施挑戰。

- 此外,輕型商用車在採集費用和營運成本方面都具有成本效益,這對該地區的中小企業 (SME) 和新創新興企業來說提案。認知到這一潛力,一些東協政府正在積極實施政策,包括稅收優惠和貸款計劃,以鼓勵企業採用輕型商用車。

- 總體而言,輕型商用車正在成為東協地區最主要的商用車型,這與城市經濟狀況和青睞較小、更靈活的交通工具的經營模式一致。

印尼的複合年成長率最高

近年來,印尼已崛起成為東協商用車市場的領先國家。這種成長歸功於幾個關鍵因素。

中國強勁的經濟成長和日益發展的基礎建設正推動各領域對商用車的龐大需求。政府雄心勃勃的基礎設施建設計劃,包括建造新的收費公路、港口和交通樞紐,需要部署大型重型卡車和工程車輛。

此外,印尼快速發展的物流和電子商務行業極大地推動了對輕型商用車(LCV)的需求,以促進最後一英里的交付。此外,印尼的商用車市場也受惠於政府旨在促進國內製造和汽車普及的優惠政策。

此外,印尼致力於實現主要經濟體能源與氣候論壇 (MEF) 的目標,即到 2030 年使全球中型和重型汽車銷售的 30% 成為零排放汽車 (ZEV)。這項承諾反映了印尼對交通運輸領域永續性和碳中和的關注。

印尼市場的主要企業正在加快引進創新和先進的商用車,以滿足該國的需求。

- 2023 年 8 月,三菱扶桑卡客車公司宣布將在印尼推出全電動式eCanter 卡車。 eCanter 配備了電力傳動系統,零排放氣體,噪音極小,預計將為改善雅加達的生活品質做出貢獻。

東協商用車產業概況

東協商用車市場處於中等整合狀態,僅有少數幾家企業佔據明顯的市場主導地位。東協商用車市場的主要企業包括豐田汽車公司、五十鈴汽車公司、工業和日野汽車公司。合資企業、夥伴關係、工業部門不斷成長的需求以及新興國家的政府發展計劃等因素顯著推動了這一市場的發展。

例如,2022 年 9 月,Nex Point PLC (NEX) 宣布將與 Energy Absolute (EA) PCL 合作建立泰國首家商用電動車製造和組裝工廠 Absolute Assembly (AAB),年生產能力高達 9,000 輛。該公司訂單,其中200輛已成功交付。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 基礎設施支出和貿易活動增加

- 市場限制

- 滿足嚴格的汽車廢氣排放法規是一項挑戰

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 按車型

- 輕型商用車

- 中型商用車

- 重型商用車

- 透過推進力

- 內燃機

- 純電動車

- 插電式混合動力汽車

- 燃料電池電動車

- 按國家

- 印尼

- 泰國

- 越南

- 新加坡

- 馬來西亞

- 菲律賓

- 其他東南亞國協

第6章 競爭格局

- 供應商市場佔有率

- 公司簡介

- Isuzu Motors Limited

- Mitsubishi Motors Corporation

- Honda Motor Co. Ltd

- Daihatsu Motor Co. Ltd

- Ford Motor Company

- UD Trucks Corp.

- Scania

- FCA US LLC

- Hyundai Motor Company

- IVECO

- Hino Motors Ltd

- Tata Motors

第7章 市場機會與未來趨勢

- 隨著物流和電子商務行業的快速擴張,對輕型商用車的需求預計將增加

第8章商用車區域法規分析

The ASEAN Commercial Vehicles Market size is estimated at USD 59.63 billion in 2025, and is expected to reach USD 83.51 billion by 2030, at a CAGR of 6.97% during the forecast period (2025-2030).

The ASEAN commercial vehicle market saw robust growth in 2023, driven by rising infrastructure development, an increase in e-commerce activities requiring more logistics vehicles, and economic recovery from the COVID-19 pandemic in the region. Rapid urbanization and the need for mass material movement improved the market conditions.

Over the long term, stringent vehicle emission regulations, advancements in vehicle safety, the introduction of driver-assist systems in new vehicles, and rapidly growing logistics in the retail and e-commerce sectors across ASEAN are primarily expected to drive demand for new and advanced commercial vehicles. LCV demand is expected to rise as the logistics and e-commerce industries expand rapidly.

Governments throughout the ASEAN region are putting pressure on vehicle manufacturers to reduce carbon emissions from diesel fuel combustion and address greenhouse gas emissions, compelling OEMs to invest in developing electric trucks.

As per regulations of the Pollution Control Department (PCD) in Thailand since 1998, all new heavy trucks must meet Euro 6 emission standards to curb vehicular pollution. This spurred purchases of newer, compliant commercial vehicles.

Overall, the ASEAN commercial vehicle market is projected to continue its growth curve during the forecast period owing to economic development, consumer spending, and ongoing policy adjustments related to emissions.

ASEAN Commercial Vehicles Market Trends

Light Commercial Vehicle Segment Dominates the Market

- Light commercial vehicles are mainly used to transport goods over short distances. The increased demand for goods via e-commerce is driving the use of LCV in logistics, paving the way for the market's growth. Many e-commerce and logistics companies are expanding in the ASEAN region, driving the commercial vehicles market in the region. Thus, key players in the region are coming up with revised products at lower prices to improve sales.

- With urban areas across ASEAN nations grappling with narrow streets and traffic congestion, these compact vehicles have proven instrumental in navigating such infrastructural challenges seamlessly.

- Moreover, the cost advantages associated with LCVs, both in terms of acquisition and operational expenses, have rendered them an attractive proposition for small and medium-sized enterprises (SMEs) and start-ups operating in the region. Recognizing their potential, several ASEAN governments have proactively implemented policies, such as tax incentives and lending programs, to stimulate LCV adoption among businesses.

- Overall, LCVs emerge as the preeminent commercial vehicle type in the ASEAN region, aligning with the urban economic landscape and business models that favor smaller, more agile modes of transportation.

Indonesia to Register Highest CAGR

Indonesia has emerged as the leading nation in the ASEAN commercial vehicle market in recent years. This growth can be attributed to several key factors.

The nation's robust economic growth and increasing infrastructure development have fueled significant demand for commercial vehicles across various segments. The government's ambitious infrastructure push, including the construction of new toll roads, ports, and transportation hubs, has necessitated the deployment of a vast array of heavy-duty trucks and construction vehicles.

Furthermore, Indonesia's burgeoning logistics and e-commerce sectors have driven substantial demand for light commercial vehicles (LCVs) to facilitate last-mile deliveries. Additionally, Indonesia's commercial vehicle market has also benefited from favorable government policies aimed at promoting domestic manufacturing and vehicle adoption.

Moreover, Indonesia has also pledged to the Major Economies Forum on Energy and Climate (MEF) objective of achieving 30% of global medium and heavy-duty vehicle sales as zero-emission vehicles (ZEVs) by 2030. This commitment reflects the country's focus on sustainability and carbon neutrality in its transportation sector.

The key players operating in the Indonesian market are increasingly launching innovative and advanced commercial vehicles to cater to the country's requirements.

- In August 2023, Mitsubishi Fuso Truck and Bus Corporation announced the launch of its all-electric eCanter trucks in Indonesia. The eCanter, with its locally emission-free and nearly noiseless electric drivetrain, is expected to contribute to a better quality of life in Jakarta.

ASEAN Commercial Vehicles Industry Overview

The ASEAN commercial vehicle market is moderately consolidated, with few players having a significant hold of the market. Some of the key players in the ASEAN commercial vehicles market are Toyota Motor Corporation, ISUZU, Mitsubishi Motor Corporation, and Hino Motors. The market studied is highly driven by factors like joint ventures, partnerships, and growing demand from the industrial sector and government development initiatives across ASEAN countries.

For instance, in September 2022, Nex Point PLC (NEX) announced a collaboration with Energy Absolute (EA) PCL to establish Thailand's first commercial EV manufacturing and assembly plant, Absolute Assembly Co. Ltd (AAB), with an annual production capacity of up to 9,000 cars. The company received orders to produce 3,195 electric buses, with 200 units successfully delivered.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Higher Infrastructure Spending and Trade Activities

- 4.2 Market Restraints

- 4.2.1 Complying to the Stringent Vehicle Emission Regulations is a Challenge

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value and Volume)

- 5.1 By Vehicle Type

- 5.1.1 Light Commercial Vehicles

- 5.1.2 Medium-duty Commercial Vehicles

- 5.1.3 Heavy-duty Commercial Vehicles

- 5.2 By Propulsion

- 5.2.1 Internal Combustion Engine

- 5.2.2 Battery Electric Vehicle

- 5.2.3 Plug-in Hybrid Electric Vehicle

- 5.2.4 Fuel Cell Electric Vehicle

- 5.3 By Country

- 5.3.1 Indonesia

- 5.3.2 Thailand

- 5.3.3 Vietnam

- 5.3.4 Singapore

- 5.3.5 Malaysia

- 5.3.6 Philippines

- 5.3.7 Rest of ASEAN

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Isuzu Motors Limited

- 6.2.2 Mitsubishi Motors Corporation

- 6.2.3 Honda Motor Co. Ltd

- 6.2.4 Daihatsu Motor Co. Ltd

- 6.2.5 Ford Motor Company

- 6.2.6 UD Trucks Corp.

- 6.2.7 Scania

- 6.2.8 FCA US LLC

- 6.2.9 Hyundai Motor Company

- 6.2.10 IVECO

- 6.2.11 Hino Motors Ltd

- 6.2.12 Tata Motors

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 LCV Demand is Expected to Rise as the Logistics and E-Commerce Industries Expand Rapidly