|

市場調查報告書

商品編碼

1687293

中東和非洲工業空氣品質控制系統市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Middle-East and Africa Industrial Air Quality Control Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

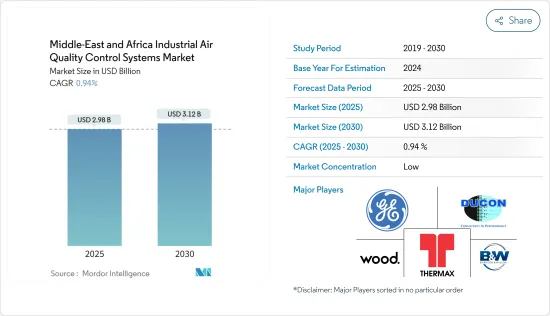

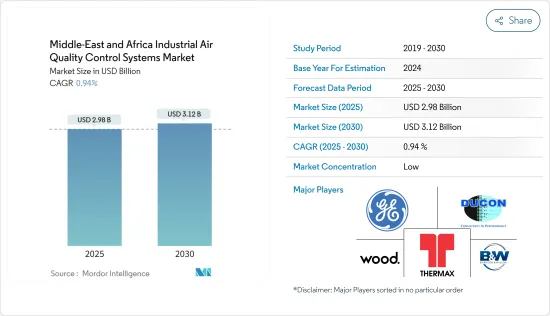

中東和非洲工業空氣品質控制系統市場規模預計在 2025 年為 29.8 億美元,預計到 2030 年將達到 31.2 億美元,預測期內(2025-2030 年)的複合年成長率為 0.94%。

主要亮點

- 從長遠來看,工業基礎設施的快速成長加上對空氣品質的擔憂預計將在預測期內推動中東和非洲空氣品質控制系統市場的發展。

- 另一方面,若干憲法障礙和可再生能源的持續使用預計將成為市場研究的主要限制因素。

- 然而,對舊工業廠房進行空氣品質控制系統的維修以滿足全部區域政府制定的嚴格監管標準可能會成為未來的機會。

中東和非洲工業空氣品質控制系統市場趨勢

鋼鐵可望佔較大市場佔有率

- 無論是採用綜合爐、直接還原爐或電弧爐製程生產鋼鐵,都需要將原料運輸、儲存、物料輸送、加熱和轉化。所有這些過程都會產生空氣排放,主要形式為灰塵(或顆粒物 (PM))、二氧化硫 (SO2) 和氧化亞氮(NOx)。其他小規模排放包括戴奧辛和重金屬,通常附著在灰塵顆粒中。

- 煉鐵和煉鋼作業產生的排放,包括高爐出鐵場地板的排放,透過建築物內的收集點和二次除塵系統(即袋式過濾器、濕式洗滌器、靜電除塵器等)進行控制。

- 所有鋼鐵廠都必須遵守環境法規,這些法規規定限制空氣排放。現代生活很大一部分由鋼鐵構成。基礎設施、建築、機械、電氣設備、汽車以及從烹調器具到家具等各種產品都需要大量的鋼鐵。預計到 2050 年鋼鐵需求將增加五倍。

- 根據世界鋼鐵協會統計,截至2022年,該地區粗鋼產量主要由土耳其、伊朗、沙烏地阿拉伯、南非、阿爾及利亞和阿拉伯聯合大公國等國家主導。

- 中東和非洲地區擁有豐富的高等級鐵礦石,具有巨大的鋼鐵生產潛力。此外,近年來該地區的鋼鐵產量經歷了顯著成長,部分原因是鋼鐵業的投資增加,特別是中東和北非地區。

- 2022年5月,安賽樂米塔爾與茅利塔尼亞鐵礦石開採公司SNIM簽署了一份不具約束力的合作備忘錄,以評估在茅利塔尼亞聯合開發球團廠和直接還原鐵生產廠的機會。

- 2022年9月,沙烏地阿拉伯宣布有意實施三個鋼鐵生產計劃,總價值93.2億美元,年產能為620萬噸。同月,埃薩集團宣布將投資 40 億美元在該國建立一座綜合扁平材廠。該廠年鋼鐵產能為400萬噸,預計2025年完工。

- 考慮到該地區鋼鐵和鋼鐵業的發展和投資,預計預測期內工業空氣品質控制系統的需求將大幅成長。

沙烏地阿拉伯主導市場

- 由於發電、水泥、石油和天然氣、金屬和其他行業的顯著成長,沙烏地阿拉伯很可能成為工業空氣品質控制系統最大和成長最快的市場之一。鑑於空氣品質控制系統(AQCS)對這些產業至關重要,預計市場在預測期內將以類似的速度成長,從而支持市場的成長。

- 沙烏地阿拉伯是該地區最大的污染國之一,2022 年二氧化碳排放達到約 7.24 億噸二氧化碳當量。日本是世界主要排放之一,人均二氧化碳排放量約 19 噸。

- 電力有一部分來自石油和天然氣等石化燃料,為引入空氣品質控制系統等更先進的技術鋪平了道路。 2022 年,石化燃料將佔沙烏地阿拉伯發電量的約 99.8%,其次是非水力可再生(約 0.2%)。

- 此外,該國繼續投資基於石化燃料的發電工程,預計將支持IAQCS市場的需求。例如,2022年9月,韓國斗山能源公司訂單了在沙烏地阿拉伯建造一座價值3.83億美元的熱電聯產廠的合約。該電廠預計於2025年完工,每小時將產生320兆瓦的電力和314噸蒸氣,為賈富拉天然氣田提供電力和熱能。

- 此外,石油和天然氣、採礦和金屬行業的快速成長大大增加了空氣中的污染物含量。因此,預計將採用工業空氣品管系統 (IAQCS)。

- 鋼鐵業也是空氣污染的主要原因之一。鋼鐵生產的主要能源來源是煤炭,而燃煤會產生大量排放。鋼鐵廠排放顆粒物(PM2.5 和 PM10)、二氧化碳、硫氧化物、氮氧化物和一氧化碳等空氣污染物,使其成為沙烏地阿拉伯工業空氣品質控制系統 (IAQCS) 的潛在終端用戶。

- 根據世界鋼鐵協會預測,2022年沙烏地阿拉伯的鋼鐵產量將達到約910萬噸,與前一年同期比較增加4.5%。投資部長表示,到2022年9月,得益於低成本電力和天然氣等技術選擇以及沙烏地阿拉伯綠色舉措等政府計劃,沙烏地阿拉伯鋼鐵業將有望向綠色和永續產品轉型。

- 此外,沙烏地阿拉伯正在建造新的煉油廠和石化綜合體。例如,2022年12月,沙烏地阿拉伯石油公司與道達爾能源公司達成最終投資決定,將興建一座世界級的石化設施。阿米爾綜合設施將與位於沙烏地阿拉伯東海岸朱拜勒的現有沙烏地阿美道達爾精製和石化 (SATORP) 煉油廠共同運作、擁有和整合。該石化設施的建設將使SATORP能夠將阿美公司提供的煉油廠廢氣、石腦油、乙烷和天然汽油轉化為更高價值的化學品,支持阿美公司的液體轉化學品策略。作為該綜合計畫的一部分,將建造一座年產 165 萬噸乙烯的混合進料裂解裝置。

- 鑑於目前南非各產業的投資及其價值鏈的成長,製造業對於該國工業空氣品質控制系統的發展至關重要。

中東和非洲工業空氣品質控制系統產業概況

中東和非洲工業空氣品質控制系統市場分散。主要企業(不分先後順序)包括 Alfa Laval AB、Aircure、CFW Environmental、Pure Air Solutions 和 ERG Group。

CFW Environmental 的空氣污染控制系統產品組合基於多種技術,以滿足眾多工業應用的要求和特定屬性。此外,該公司還提供全面的服務,從最初的諮詢到售後服務。我們也致力於在空氣污染控制系統的設計和製造方面採用國際最佳實踐。為了在全球市場保持永續,我們透過市場研究和創新產品開發評估客戶需求,不斷改進我們的產品。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 2028 年市場規模與需求預測(美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 下游產業需求

- 限制因素

- 採用可再生和清潔能源來源

- 驅動程式

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 類型

- 靜電除塵設備(ESP)

- 排煙脫硫(FGD) 和洗滌器

- 選擇性催化還原 (SCR)

- 袋濾式集塵器

- 其他

- 應用

- 發電業

- 水泥工業

- 化學品和肥料

- 鋼鐵業

- 汽車

- 石油和天然氣

- 其他用途

- 排放氣體

- 氮氧化物(NOX)

- 硫氧化物(SO2)

- 顆粒物 (PM)

- 地區

- 沙烏地阿拉伯

- 南非

- 阿爾及利亞

- 其他中東和非洲地區

第6章 競爭格局

- 併購、合資、合作、協議

- 主要企業策略

- 公司簡介

- Alfa Laval AB

- Aircure

- CFW Environmental

- Pure Air Solutions

- The ERG Group

- Redecam Group SpA

- Donaldson Company Inc.

- Durr AG

- FLSmidth & Co. A/S

- Siloxa Engineering AG

第7章 市場機會與未來趨勢

- 本公司開發新技術空氣品管系統

The Middle-East and Africa Industrial Air Quality Control Systems Market size is estimated at USD 2.98 billion in 2025, and is expected to reach USD 3.12 billion by 2030, at a CAGR of 0.94% during the forecast period (2025-2030).

Key Highlights

- Over the longer term, a surge in industrial infrastructure, coupled with air quality issues, is expected to drive the market for air quality control systems in Middle-East and Africa over the forecast period.

- On the other hand, several constitutional barriers and growth in renewable energy usage which is pollution-free are expected to act as major restraints for the market studied.

- Nevertheless, retrofitting of old industrial plants with air quality control system to meet stringent regulatory norms set up by governments across the region is likely to acts as an opportunity in the future.

MEA Industrial Air Quality Control Systems Market Trends

Iron and Steel is Expected to Have Significant Share in the Market

- Steel, produced by either integrated, direct reduced iron, or electric arc furnace route, requires transportation, storage, handling, heating, and transformation of raw materials. All these processes have the potential to generate emissions into the air, primarily in the form of dust (or particulate matter (PM), sulfur dioxide (SO2), and nitrous oxides (NOx). Other emissions generated in small quantities include dioxins and heavy metals, typically attached to dust particles.

- Emissions from iron and steelmaking operations, including cast house floor emissions from blast furnaces, are controlled via secondary dedusting systems (i.e., bag filters, wet scrubbers, ESPs, etc.) with a collection point inside the building.

- All steel plants are subject to environmental regulation, which sets the requirements to restrict emissions into the air. A large portion of modern life is comprised of steel. Infrastructure, buildings, machinery, electrical equipment, automobiles, and various products, from cookware to furniture, require large amounts of iron and steel. The steel demand is estimated to increase by five times by 2050.

- According to the World Steel Association statistics, as of 2022, the crude steel production in the region is mainly dominated by countries like Turkey, Iran, Saudi Arabia, South Africa, Algeria, and the United Arab Emirates, amongst others.

- The Middle East and Africa region has a very high potential for steel production due to the availability of high-grade iron ore. Additionally, in recent years steel production in the area has witnessed significant growth, mainly driven by increasing investments in the sector, especially in the Middle East and North Africa.

- In May 2022, ArcelorMittal signed a non-binding Memorandum of Understanding with SNIM, an iron ore mining company based in Mauritania, to evaluate an opportunity to jointly develop a pelletization plant and a direct reduced iron production plant in Mauritania.

- In September 2022, Saudi Arabia announced that it intends to implement three steel production projects worth USD 9.32 billion with a total production capacity of 6.2 million tons annually. In the same month, Essar Group announced it is looking to invest USD 4 billion in setting up an integrated flat steelworks plant in the country. The plant will have a steel production capacity of 4 million tonnes annually and will be completed by 2025.

- Considering the developments and investments in the steel and iron industry in the region, the demand for industrial air quality control systems is expected to witness significant growth during the forecast period.

Saudi Arabia to Dominate the Market

- Due to the significant growth in its power generation, cement, oil & gas, metal, and other sectors, Saudi Arabia is likely to be one of the largest and fastest-growing markets for industrial air quality control systems. The market is expected to grow at a similar rate during the forecast period, supporting the market growth, as air quality control systems (AQCS) are crucial to these industries.

- Saudi Arabia is one of the largest polluters in the region, with CO2 emissions amounting to approximately 724 million tonnes of CO2 equivalent in 2022. The country is one of the largest producers of CO2 emissions per capita worldwide, at about 19 metric tons per person.

- A significant share of power generated from fossil fuels, such as oil and gas, paving the way for more advanced technologies, such as air quality control systems, to be implemented. In 2022, Saudi Arabia's power generation was dominated by fossil fuels, which account for approximately 99.8% of the electricity generated, followed by non-hydro renewable sources (~0.2%).

- Further, the country continues to invest in fossil fuel-based power projects, which are expected to support the demand for the IAQCS market. For instance, in September 2022, South Korean company Doosan Enerbility was awarded a contract to construct a combined heat and power plant in Saudi Arabia valued at USD 383 million. Upon completion of the construction work scheduled for 2025, the plant will generate 320 MWs of electricity and 314 tons per hour of steam to supply electricity and heat to the Jafurah gas field.

- Further, the rapid growth of the oil & gas, mining, and metal sectors has resulted in a massive increase in the levels of pollutants in the air. Accordingly, the adoption of industrial air quality control systems (IAQCS) is anticipated.

- The Iron and Steel industry is another significant contributor to air pollution. Steel mainly requires coal for energy, so considerable emissions are caused by coal combustion. Steel plants emit air pollutants, such as particulate matter (PM2. 5 and PM10), carbon dioxide, sulfur oxides, nitrogen oxides, carbon monoxide, etc. hence, being a potential end-user for the industrial air quality control systems (IAQCS) in Saudi Arabia.

- According to World Steel Association, in 2022, steel production in Saudi Arabia was approximately 9.1 million, an increase of 4.5% from the previous year. In September 2022, according to the minister of investment, In Saudi Arabia, the iron and steel industry is well positioned for the transition to green and sustainable products due to its technology options, such as low-cost electricity and natural gas, and government programs, such as the Saudi Green Initiative.

- Further, the country has been constructing new refineries and petrochemical complexes. For instance, in December 2022, Saudi Arabian Oil Company and TotalEnergies reached a final investment decision on constructing a world-scale petrochemical facility. The "Amiral" complex is going to be operated, owned, and integrated with the existing Saudi Aramco Total Refining and Petrochemical Co. (SATORP) refinery located on Saudi Arabia's eastern coast, Jubail. With the construction of the petrochemical facility, SATORP will be able to convert its refinery off-gases, naphtha, ethane, and natural gasoline supplied by Aramco into higher-value chemicals, thus supporting Aramco's liquids-to-chemicals strategy. As part of the complex, there will be a mixed feed cracker capable of producing 1.65 million tons of ethylene annually, a first of its kind in the region that will be integrated with a refinery.

- Considering the current investments in the various industries and the increased growth of its value chain in South Africa, the manufacturing sector is critical to the growth of the country's industrial air quality control systems.

MEA Industrial Air Quality Control Systems Industry Overview

The Middle-East and Africa industrial air quality control systems market is fragmented. some of the key players (in no particular order) include Alfa Laval AB, Aircure, CFW Environmental, Pure Air Solutions, and ERG Group, among others.

CFW Environmental's portfolio of air pollution control systems is based on a range of technologies to comply with the numerous industrial application requirements and specific attributes. Furthermore, the company provides comprehensive services, ranging from first inquiry to after-sales service. It also focused on adopting international best practices in designing and manufacturing air pollution control systems. To remain sustainable in the global market, the products are constantly enhanced by evaluating customers' requirements through market research and innovative product development.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Demand from the Downstream Industry

- 4.5.2 Restraints

- 4.5.2.1 Adoption of Renewable and Clean Energy Sources

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Electrostatic Precipitators (ESP)

- 5.1.2 Flue Gas Desulfurization (FGD) and Scrubbers

- 5.1.3 Selective Catalytic Reduction (SCR)

- 5.1.4 Fabric Filters

- 5.1.5 Others

- 5.2 Application

- 5.2.1 Power Generation Industry

- 5.2.2 Cement Industry

- 5.2.3 Chemicals and Fertilizers

- 5.2.4 Iron and Steel Industry

- 5.2.5 Automotive Industry

- 5.2.6 Oil & Gas Industry

- 5.2.7 Other Applications

- 5.3 Emissions

- 5.3.1 Nitrogen Oxides (NOX)

- 5.3.2 Sulphur Oxide (SO2)

- 5.3.3 Particulate Matter (PM)

- 5.4 Geography

- 5.4.1 Saudi Arabia

- 5.4.2 South Africa

- 5.4.3 Algeria

- 5.4.4 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Alfa Laval AB

- 6.3.2 Aircure

- 6.3.3 CFW Environmental

- 6.3.4 Pure Air Solutions

- 6.3.5 The ERG Group

- 6.3.6 Redecam Group SpA

- 6.3.7 Donaldson Company Inc.

- 6.3.8 Durr AG

- 6.3.9 FLSmidth & Co. A/S

- 6.3.10 Siloxa Engineering AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 New Technology Air Quality Control System Developments by Various Companies