|

市場調查報告書

商品編碼

1683101

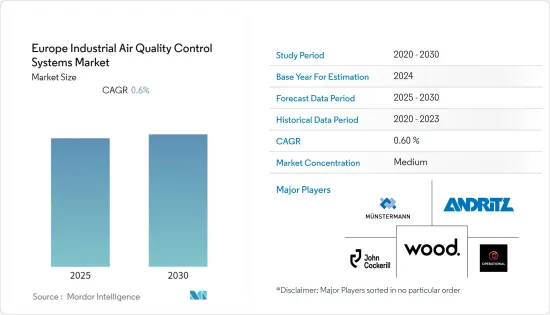

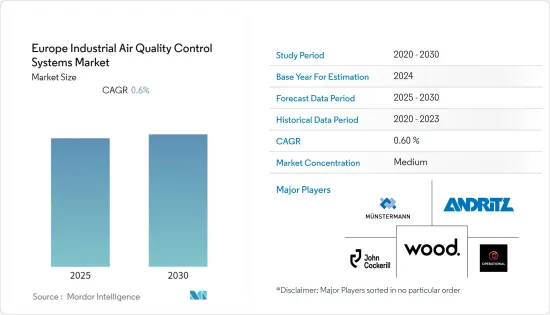

歐洲工業空氣品管系統市場 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Europe Industrial Air Quality Control Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

預測期內,歐洲工業空氣品管系統市場預期複合年成長率為 0.6%

關鍵亮點

- 歐盟的空氣品質政策旨在製定和實施適當措施,以長期改善空氣品質。消費者意識、嚴格的空氣品管法規以及不斷成長的終端用戶產業是推動市場發展的關鍵因素。

- 另一方面,減少/零排放的替代再生能源來源的出現,以及建立空氣品管系統所需的高額資本,預計將阻礙所調查市場的成長。

- 在預測期內,現有工廠的維修為歐洲工業空氣品管系統提供了重大機會。

- 由於對工業部門的依賴日益增加,預計德國在預測期內將實現顯著成長。

歐洲工業空氣品管系統市場趨勢

發電業板塊大幅成長

- 發電廠是二氧化硫、汞和酸性氣體的最大排放源。在電力業,煤炭約佔二氧化硫排放的98%、汞排放的94%、氮氧化物排放的86%和顆粒物排放的83%。

- 發電業排放的氮氧化物和二氧化硫會導致地面臭氧和細顆粒物的形成,從而導致呼吸和心血管問題,而汞暴露則會導致從癌症到免疫系統疾病等各種潛在的健康問題。

- 煤炭和天然氣發電廠向空氣中排放許多污染物。這些包括氮氧化物、臭氧、二氧化硫和一氧化碳 (NOx)。此外,還會排放非甲烷碳氫化合物、鉛和懸浮顆粒物(SPM)。

- 根據能源研究所《2023年世界能源統計評論》,石化燃料仍是歐洲主要的發電來源。 2022年,煤炭將佔歐洲電力結構的16.6%左右,而天然氣將佔19.6%。

- 在德國,燃煤發電廠在2022年第三季生產並輸入系統的電力佔發電量的三分之一以上。儘管出現能源危機,但歐洲最大經濟體德國的燃煤發電量年增率仍達13.3%。德國政府決定暫時轉向燃煤發電廠,以確保冬季電力供應穩定。

- 2022年6月,法國政府決定重啟法國東北部洛林地區的燃煤發電廠。政府表示,業者將透過重新造林等行動排放排放,並補充稱該計畫不會影響法國燃煤發電廠的逐步淘汰。

- 因此,由於上述因素,預測期內電力產業對空氣品質控制系統的需求預計將大幅成長。

德國經濟快速成長

- 由於發電、工業和汽車行業的溫室氣體排放量高,德國預計將成為歐洲最大的工業空氣品質控制系統市場之一。

- 由於工業成長和嚴格的排放控制政策,中國最近對工業空氣品質控制系統的需求強勁成長。

- 根據德國環境署統計,2022年德國約34%的能源相關溫室氣體排放來自能源部門本身。其他主要貢獻者是工業和運輸業。

- 近年來,德國的天然氣發電量大幅成長,從 2014 年的 60 TWh 成長到 2021 年的 89 TWh。天然氣發電量的成長主要得益於近年來煤炭和核能的轉移。

- 該國計劃在 2045 年實現氣候中和,到 2030 年將溫室氣體排放在 1990 年的基礎上減少至少 65%,因此近期核能發電廠。上述因素正在增加該國電力產業對工業空氣品管系統的需求。

- 此外,俄烏衝突爆發後,來自俄羅斯的天然氣供應減少,德國政府運作了多座燃煤電廠,以維持穩定的電力供應。

- 隨著國家轉向可再生能源發電等更清潔的發電方式,預計煤炭和天然氣將在國家發電結構中佔據主要佔有率,以維持能源安全,從而推動電力產業對工業空氣品質控制系統的需求。

歐洲工業空氣品管系統產業概況

歐洲工業空氣品管系統市場適度細分。市場的主要企業(不分先後順序)包括 John Wood Group PLC、Andritz AG、John Cockerill Group、Operational Group Limited 和 Munstermann GmbH & Co.KG。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 至2028年市場規模及需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 存在嚴格的空氣品管規定

- 限制因素

- 安裝空氣品管系統的資本要求高

- 驅動程式

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 類型

- 靜電除塵設備(ESP)

- 排煙脫硫(FGD) 和洗滌器

- 選擇性催化還原 (SCR)

- 袋濾式集塵器

- 其他

- 應用

- 發電業

- 水泥工業

- 化學品和肥料

- 鋼鐵業

- 汽車

- 石油和天然氣

- 其他

- 排放(僅定性分析)

- 氮氧化物(NOx)

- 硫氧化物(SO2)

- 顆粒物 (PM)

- 地區

- 德國

- 法國

- 英國

- 歐洲其他地區

第6章 競爭格局

- 併購、合資、合作、協議

- 主要企業策略

- 公司簡介

- John Wood Group PLC

- Andritz AG

- John Cockerill Group

- Operational Group Limited

- Anguil Environmental Systems, Inc.

- Chemisch Thermische Prozesstechnik GmbH

- Munstermann GmbH & Co. KG

- Fives Group

- Exeon Ltd

- Tholander Ablufttechnik GmbH

第7章 市場機會與未來趨勢

- 各公司開發新的空氣品管系統

簡介目錄

Product Code: 48879

The Europe Industrial Air Quality Control Systems Market is expected to register a CAGR of 0.6% during the forecast period.

Key Highlights

- Over the long term, the European Union's policy on air quality aims to develop and implement appropriate instruments to improve air quality. Consumer awareness, stringent air quality control regulations, and growing end-user industries are major factors driving the market.

- On the other hand, the emergence of alternative and renewable energy sources with reduced/zero emissions and high capital required for installing an air quality control system is expected to hinder the growth of the market studied.

- Nevertheless, retrofitting the existing plants provides tremendous opportunities for European industrial air quality control systems during the forecast period.

- Germany is expected to witness significant growth over the forecast period owing to its growing dependence on the industrial sector.

Europe Industrial Air Quality Control Systems Market Trends

Power Generation Industry Segment to Witness Significant Growth

- Power plants are the largest sources of emission of SO2, mercury, and acid gases. In the power sector, coal accounts for about 98% of SO2 emissions, 94% of mercury emissions, 86% of NOx emissions, and 83% of fine particulate emissions.

- NOX and SO2 emissions from the power generation industry contribute to the formation of ground-level ozone and fine particulate matter, which can lead to respiratory and cardiovascular problems, and mercury exposure can supplement the possibility of health problems ranging from cancer to immune system damage.

- Coal and natural gas power stations release a number of pollutants into the atmosphere. These include Oxides of Nitrogen, Ozone, Sulfur Dioxide, and Carbon Monoxide (NOx). Non-Methane Hydrocarbons, Lead and Suspended Particulate Matter (SPM) are also discharged.

- As per the Energy Institute Statistical Review of World Energy 2023, fossil fuels remain Europe's major source of electricity generation. In 2022, coal accounted for roughly 16.6 percent of the Europe power mix, while natural gas was observed with a 19.6 percent share.

- In Germany, coal-fired power plants produced more than one-third of the electricity generated and fed into the system during the third quarter (Q3) of 2022. Despite the energy crisis, coal electricity generation rose by 13.3% annually in the biggest economy in Europe. The German government has decided to temporarily switch back to coal-fired power plants to ensure electricity supply security over the winter.

- In June 2022, the French administration decided to reopen a coal-fired power plant in the Lorraine region of northeastern France. The government announced that the operator would offset the emissions through actions like reforestation, adding that the plans would not affect the phase-out of coal plants in France.

- Therefore, owing to above factors, power industry is expected to witness significant demand for air quality control systems during the forecast period.

Germany to Witness Significant Growth

- Germany is expected to be one of the largest markets for industrial air quality control systems in Europe, owing to the significant greenhouse gas emissions contributions from power generation, Industrial, and automobile sectors.

- The country has recently witnessed significant demand for industrial air quality control systems, mainly driven by industrial growth and stringent emissions control policies.

- According to German Environment Agency, in 2022, around 34% of energy-related greenhouse gas emissions in Germany resulted from the energy sector itself. Other leading contributors were industry and transport.

- Electricity generation from natural gas has recently witnessed significant growth in the country, from 60 TWh in 2014 to 89 TWh in 2021. The increase in electricity generation from natural gas has been mainly driven by the country's shift from coal and nuclear energy in recent years.

- Several nuclear energy and coal power plants have been decommissioned recently as the country moves toward reaching climate neutrality by 2045 and aims to reduce greenhouse gas emissions by at least 65% by 2030 compared to 1990 levels. The factor above has led to an increase in demand for industrial air quality control systems in the power sector in the country.

- Additionally, after the outbreak of the Russia-Ukraine conflict led to a decrease in the supply of natural gas from Russia, the German government reactivated several coal power plants to maintain a steady supply of electricity.

- While the country shifts toward cleaner forms of electricity generation like renewable energy, coal and natural gas are expected to hold a significant share in the country's power generation mix to maintain energy security, thereby driving the demand for industrial air quality control systems in the power sector

Europe Industrial Air Quality Control Systems Industry Overview

The Europe industrial air quality control systems market is moderately fragmented in nature. Some of the major players in the market (in no particular order) include John Wood Group PLC, Andritz AG, John Cockerill Group, Operational Group Limited, and Munstermann GmbH & Co. KG., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Presence of Stringent Regulation for Air Quality Management

- 4.5.2 Restraints

- 4.5.2.1 High Capital is Required for the Installation of an Air Quality Control System

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Electrostatic Precipitators (ESP)

- 5.1.2 Flue Gas Desulfurization (FGD) and Scrubbers

- 5.1.3 Selective Catalytic Reduction (SCR)

- 5.1.4 Fabric Filters

- 5.1.5 Others

- 5.2 Application

- 5.2.1 Power Generation Industry

- 5.2.2 Cement Industry

- 5.2.3 Chemicals and Fertilizers

- 5.2.4 Iron and Steel Industry

- 5.2.5 Automotive Industry

- 5.2.6 Oil & Gas Industry

- 5.2.7 Other Applications

- 5.3 Emissions (Qualitative Analysis only)

- 5.3.1 Nitrogen Oxides (NOx)

- 5.3.2 Sulphur Oxides (SO2)

- 5.3.3 Particulate Matter (PM)

- 5.4 Geography

- 5.4.1 Germany

- 5.4.2 France

- 5.4.3 United Kingdom

- 5.4.4 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 John Wood Group PLC

- 6.3.2 Andritz AG

- 6.3.3 John Cockerill Group

- 6.3.4 Operational Group Limited

- 6.3.5 Anguil Environmental Systems, Inc.

- 6.3.6 Chemisch Thermische Prozesstechnik GmbH

- 6.3.7 Munstermann GmbH & Co. KG

- 6.3.8 Fives Group

- 6.3.9 Exeon Ltd

- 6.3.10 Tholander Ablufttechnik GmbH

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 New Technology Air Quality Control System Developments by Various Companies

02-2729-4219

+886-2-2729-4219