|

市場調查報告書

商品編碼

1687211

一次電池:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Primary Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

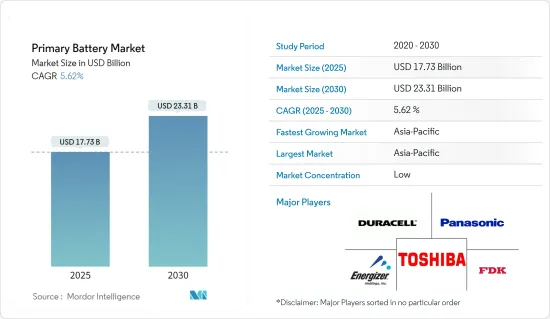

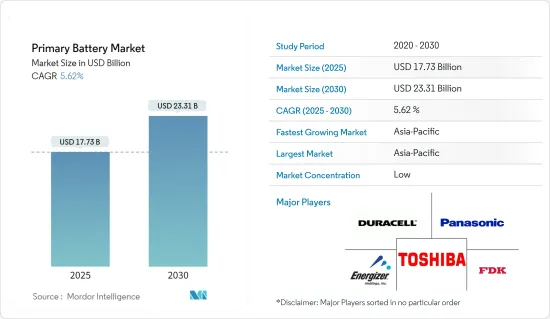

2025 年一次電池市值預估為 177.3 億美元,預計到 2030 年將達到 233.1 億美元,預測期內(2025-2030 年)的複合年成長率為 5.62%。

主要亮點

- 從中期來看,預計預測期內消費性電子、軍事和醫療保健應用對一次電池的需求增加等因素將推動市場發展。

- 另一方面,一次電池的佔有率不斷擴大,可能會抑制市場成長。

- 然而,一次電池在可攜式和物聯網(IoT)設備中的日益普及為一次電池市場提供了巨大的成長機會。

- 預計預測期內亞太地區將大幅成長,其中中國和印度等國家將推動大部分需求。

一次電池市場趨勢

鹼性一次電池可望佔據市場主導地位

- 鹼性一次電池是不可充電電池市場上最受歡迎的電池化學成分之一。它們比能量高、成本低、環保,即使完全放電也不會洩漏。鹼性電池的保存期限長達10年,安全性較高,可以攜帶上飛機,不受聯合國運輸法規或其他限制。

- 鹼性電池是使用鋅和二氧化錳作為電極的一次性電池。這些電池中使用的鹼性電解是氫氧化鉀或氫氧化鈉。這些電池電壓穩定,能量密度和抗漏液性比碳鋅電池更好。

- 此外,鹼性一次電池已成為日常生活中必不可少的一部分,尤其是在低能耗產品中。鹼性電池有多種尺寸,包括 AAA、AA 和 9V。 AAA和AA尺寸適用於家用電器遙控器等低功率應用,而C,D和9V尺寸則適用於高功率應用。然而,其他尺寸的電池如微型鹼性紐扣電池和鈕扣電池也用於一些工業和醫療用途。

- 鹼性電池的主要需求是由家用電器、醫療設備和國防工業的消費成長所推動的。例如,根據財務省和日本電池工業的預測,2022年日本電池產業鹼性一次電池的銷售量將達到約12.5億隻(較2020年成長0.8%)。

- 鹼性電池是環保的,可以當作垃圾處理。也不需要主動收集或回收。然而,目前幾乎所有主要製造商生產的電池都是無汞的,因此處理時不會造成環境污染或危害。這對這些電池產生了積極的需求,因為其他可充電電池必須妥善收集和回收。

- 在預測期內,一次鹼性電池市場預計比二次電池成長速度相對較慢。然而,鹼性電池的易於處理以及大多數家用電器仍然使用一次性鹼性電池等因素預計將推動市場發展。

亞太地區可望主導市場

- 亞太地區一直處於前列。預計該地區在預測期內仍將是一次電池市場的關鍵地區之一,因為它是玩具、遙控器、手錶等電子設備以及血糖儀和血壓計等醫療設備的製造熱點。

- 中國是可攜式電子設備的主要製造地和出口國之一。隨著年度可支配所得的增加,預測期內消費電子產品的需求預計將大幅成長。例如,根據世界銀行的數據,中國的人均購買力平價(PPP)自2012年以來持續上升,預計2022年將達到21,475.6美元,顯示可支配收入或購買力大幅提升。

- 根據中國國家統計局的數據,2021年中國家電及消費性電子產品零售貿易額為1,270億美元,與前一年同期比較去年同期成長6.16%。

- 預計這一趨勢將促進該國的家用電器銷售。因此,未來幾年家電市場可能主導中國一次電池銷售領域。

- 同樣地,一次電池通常用於為電視遙控器供電。根據中國國家統計局統計,2021年,我國每百戶家庭擁有彩色電視119台,電視已成為最常見的家庭用品之一。

- 日本是世界主要家電消費國之一。日本的快速都市化和人口可支配收入的提高推動了該地區家用電器消費量的增加。此外,該地區的技術進步導致當地家電製造商數量增加,從而導致對一次電池的需求增加。

- 根據日本電子情報技術產業協會統計,2022年日本電子產業總產值將達到近779.3億美元,這些產品包括消費性電子產品、工業電子產品以及電子元件及設備。

- 作為日本電子產業的一部分,家用電器在 2022 年的銷售額約為 26 億美元。消費性電子與工業設備和電子元件並列為該產業最重要的細分市場之一。

- 因此,鑑於上述情況,預計亞太地區將在預測期內主導一次電池市場。

一次電池產業概況

一次電池市場比較分散。該市場的主要企業(不分先後順序)包括金霸王公司、勁量控股公司、FDK 公司、松下公司、東芝公司等。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 2028 年市場規模與需求預測(美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 消費性電子產品市場的成長

- 醫療保健領域擴大採用一次電池

- 限制因素

- 與二次電池的競爭

- 驅動程式

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 類型

- 鹼性一次電池

- 鋰一次電池

- 其他類型

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 法國

- 英國

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 泰國

- 印尼

- 馬來西亞

- 印度

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭格局

- 併購、合資、合作、協議

- 主要企業策略

- 公司簡介

- Camelion Battery Co. Ltd

- Duracell Inc.

- Energizer Holdings Inc.

- Ultralife Corporation

- FDK Corporation

- GP Batteries International Ltd

- Panasonic Corporation

- Saft Groupe SA

- Toshiba Corporation

第7章 市場機會與未來趨勢

- 對攜帶式和物聯網 (IoT) 設備的需求不斷成長

簡介目錄

Product Code: 56585

The Primary Battery Market size is estimated at USD 17.73 billion in 2025, and is expected to reach USD 23.31 billion by 2030, at a CAGR of 5.62% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as rising demand for consumer electronics and primary batteries in military and healthcare applications are expected to drive the market during the forecast period.

- On the other hand, the increasing share of secondary batteries that replace primary battery functions is likely to restrain the market's growth.

- Nevertheless, the increasing popularity of primary batteries in portable and Internet of Things (IoT) devices offers a significant growth opportunity for the primary battery market.

- Asia-Pacific is expected to grow significantly during the forecast period, with countries like China and India driving most of the demand.

Primary Battery Market Trends

Primary Alkaline Battery Expected to Dominate the Market

- Primary alkaline batteries are among the most popular battery chemistries in the non-rechargeable battery market. It has a high specific energy and is cost-effective, environment-friendly, and leak-proof, even when fully discharged. Alkaline can be stored for up to 10 years, has a good safety record, and can be carried on an aircraft without being subject to UN Transport and other regulations.

- Alkaline batteries are the type of disposable batteries that have zinc and manganese dioxide as electrodes. The alkaline electrolyte used in these batteries is either potassium or sodium hydroxide. These batteries have a steady voltage, offering better energy density and leakage resistance than carbon-zinc batteries.

- In addition, primary alkaline batteries have become an indispensable part of daily lives, especially for products with low energy demand. Alkaline batteries come in various sizes ranging from AAA, AA, and 9V, where AAA and AA are suited for low-drain applications like consumer electronic remotes, and C, D, and 9V are used for high-drain applications. However, other sizes, such as micro alkaline coin cells and button cells, are used in a few industrial and medical applications.

- The primary alkaline battery demand is driven by the growing consumption of consumer electronics, medical devices, and the defense industry. For instance, according to the Ministry of Finance Japan and the Battery Association of Japan, in 2022, the sales quantity of primary alkaline batteries in Japan's cells and batteries industry registred about 1.25 billion units (+0.8%) compared to 2020.

- Alkaline batteries are environmentally friendly and can be disposed of as trash. Moreover, they do not require active collection and recycling. However, the batteries made currently by almost all major manufacturers are mercury-free and hence, do not pose any environmental pollution or hazard on disposal. This creates a positive demand for these batteries since other rechargeable consumer batteries must be appropriately collected and recycled.

- The primary alkaline battery market is expected to witness growth during the forecast period at a relatively slower rate than secondary batteries. However, factors such as the easy disposal of alkaline batteries and most of the consumer electronics still operating on primary alkaline batteries are anticipated to drive the market.

Asia-Pacific Expected to Dominate the Market

- Asia-Pacific has been at the forefront in the past. It is likely to continue its dominance as one of the major regions in the primary battery market during the forecast period as well due to the region being the hotspot for the manufacturing of toys, electronic devices, like remote controls, watches, and medical equipment, like glucose monitors and blood pressure monitors.

- China is one of the major manufacturing hubs and exporters of portable electronic devices. With increasing annual disposable income, the demand for consumer electronics is expected to witness considerable growth during the forecast period. For instance, according to the World Bank, purchasing parity per capita (PPP) in China has increased since 2012 and reached USD 21,475.6 in 2022, indicating a substantial increase in disposable income or buying power.

- According to the National Bureau of Statistics of China, retail trade revenue for household appliances and consumer electronics in China was USD 127 billion in 2021, with a growth rate of 6.16% from the previous year.

- The trend is expected to drive consumer electronics sales in the country. As a result, the consumer electronics market is likely to dominate the primary battery sales segment in China in the coming years.

- Similarly, primary batteries are commonly used to power TV remote controls. According to the National Bureau of Statistics of China, in 2021, there were almost 119 color TV sets per hundred households in China, making TVs one of the most common household items.

- Japan is one of the largest consumers of consumer electronics products in the world. The rapid urbanization of Japan and the increase in its citizens' disposable income have contributed to the increased consumption of consumer electronics products in the region. Also, technological advances in the region have increased the number of local consumer electronics manufacturers, leading to increased demand for primary batteries.

- According to the Japan Electronics and Information Technology Industries Association, the total production value of the electronics industry in Japan reached close to USD 77.93 billion in 2022. These products include consumer electronics, industrial electronics, and electronics components and devices.

- As part of the Japanese electronics industry, consumer electronics equipment accounted for approximately USD 2.6 billion in 2022. Consumer electronics is one of the industry's most significant segments, alongside industrial equipment and electronics components.

- Therefore, owing to the above-mentioned points, Asia-Pacific is expected to dominate the primary battery market during the forecast period.

Primary Battery Industry Overview

The primary battery market is fragmented. Some of the major players operating in this market (in no particular order) include Duracell Inc., Energizer Holdings Inc., FDK Corporation, Panasonic Corporation, and Toshiba Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Consumer Electronics Market

- 4.5.1.2 Increasing Adoption of Primary Batteries in the Healthcare Sector

- 4.5.2 Restraints

- 4.5.3 Competition from Secondary Batteries

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Primary Alkaline Battery

- 5.1.2 Primary Lithium Battery

- 5.1.3 Other Types

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 France

- 5.2.2.3 United Kingdom

- 5.2.2.4 Russia

- 5.2.2.5 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 Thailand

- 5.2.3.4 Indonesia

- 5.2.3.5 Malaysia

- 5.2.3.6 India

- 5.2.3.7 Rest of Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 United Arab Emirates

- 5.2.5.3 South Africa

- 5.2.5.4 Rest of Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Camelion Battery Co. Ltd

- 6.3.2 Duracell Inc.

- 6.3.3 Energizer Holdings Inc.

- 6.3.4 Ultralife Corporation

- 6.3.5 FDK Corporation

- 6.3.6 GP Batteries International Ltd

- 6.3.7 Panasonic Corporation

- 6.3.8 Saft Groupe SA

- 6.3.9 Toshiba Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand for Portable And Internet Of Things (IoT) Devices

02-2729-4219

+886-2-2729-4219