|

市場調查報告書

商品編碼

1687209

紫外線穩定劑:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)UV Stabilizers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

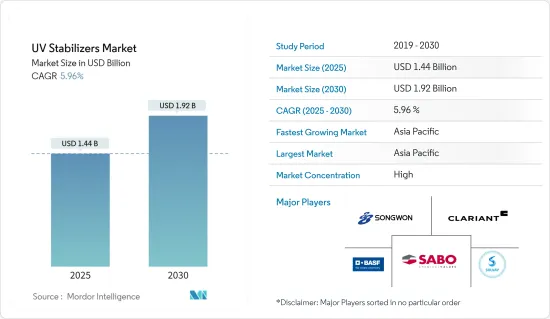

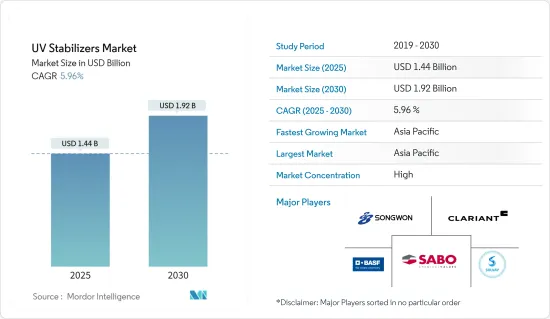

紫外線穩定劑市場規模預計在 2025 年為 14.4 億美元,預計到 2030 年將達到 19.2 億美元,預測期內(2025-2030 年)的複合年成長率為 5.96%。

2020 年,COVID-19 疫情對市場產生了負面影響。這是因為製造設施和工廠因封鎖和限制而關閉。供應鏈和運輸中斷進一步擾亂了市場。不過,2021年,產業復甦,市場需求回歸。

主要亮點

- 推動市場成長的關鍵因素包括聚合物產業對紫外線穩定劑的消費量增加以及木材塗料對紫外線穩定劑的需求不斷成長。

- 然而,預計 COVID-19 的負面經濟影響將阻礙市場成長。

- 在產品類型中,受阻胺光穩定劑(HALS)在預測期內佔據最高的市場佔有率。

紫外線穩定劑的市場趨勢

汽車產業佔市場主導地位

- 紫外線穩定劑在汽車中的主要應用領域包括內裝件(車門覆層、裝飾條、窗框、中央控制台等)和外部部件(保險桿、支架、側面裝飾條等)。

- 根據國際汽車工業組織(OICA)的數據,2022 年全球汽車及車輛總產量將達到 8,501 萬輛,而 2021 年為 8,014 萬輛。

- 此外,根據標普世界行動通訊公司的數據,2022年全球乘用車產量將達6,816萬輛,較去年同期成長7.9%。

- 2021年汽車產量亞洲及大洋洲為4,673萬輛,美洲為1,615萬輛,分別比2020年增加6%及3%。不過,2021年歐洲產量為1,634萬輛,較2020年產量下降4%。

- 阿根廷、印尼、摩洛哥、烏克蘭、泰國等新興經濟體汽車產量較去年與前一年同期比較成長均超過10%。

- 《華爾街日誌》引述汽車研究集團 LMC Automotive 和 EV-Volumes 的初步研究結果稱,2022 年全球電動車銷量將達到 780 萬輛,較 2021 年成長 68%。根據這些報告,到2022年電動車將佔全球汽車銷量的10%。一些研究人員預測,到2030年電動車產業的市場佔有率將增加一倍甚至四倍。

- 因此,未來幾年汽車產業的這些因素可能會對所研究市場的需求產生重大影響。

亞太地區佔市場主導地位

- 由於建築、包裝和汽車領域的顯著成長,預計亞太地區將主導市場。

- 自疫情爆發以來,中國汽車產業持續成長。預計汽車產量將從 2021 年的 2,608 萬輛增加到 2022 年的 2,702 萬輛,2022 年成長率為 3%。

- 此外,根據工業和資訊化部預測,到2025年,國內汽車產量預計將達到3,500萬輛,進一步鞏固中國作為世界領先汽車製造國之一的地位。

- 在印度,隨著大量人口從農村遷移到都市區,食品服務業也隨之成長,食品包裝產業也經歷快速成長。印度每年消費200億包食品和飲料。

- 預計2030年全球包裝消費量將達500億個左右,其中飲料包裝增加8%。預測期內,該國食品包裝的成長預計將增加對紫外線穩定劑的需求。

- 由於木工和細木工應用的增加,黏合劑和密封劑成為韓國的主要市場之一。此外,家具需求的不斷成長也加速了對黏合劑的需求,從而支撐了整個行業的成長。隨著製造商產能的擴大,黏合劑在電子產業的需求也呈現上升趨勢。

- 例如,漢高韓國宣布其鬆島工廠將於2022年8月在仁川松島高科技產業叢集內完工。該工廠預計將成為黏合劑技術部門在亞太地區高衝擊電子解決方案的生產中心。

- 預計這些因素將在預測期內推動亞太地區紫外線穩定劑市場的發展。

紫外線穩定劑產業概況

全球紫外線穩定劑市場正在整合。市場的主要企業(不分先後順序)包括BASF SE、SONGWON、Solvay、CLARIANT 和 SABO SpA。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 聚合物產業消費量增加

- 木器塗料需求不斷成長

- 限制因素

- 原物料價格波動

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔

- 類型

- 紫外線吸收劑

- 受阻胺光穩定劑 (HALS)

- 猝滅劑

- 抗氧化劑

- 最終用戶產業

- 包裝

- 車

- 農業

- 建築和施工

- 黏合劑和密封劑

- 其他最終用戶產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作、協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- ADEKA CORPORATION

- ALTANA AG

- BASF SE

- Chitec Technology Co., Ltd.

- CLARIANT

- Eastman Chemical Company

- Everlight Chemical Industrial Co.

- Lycus Ltd., LLC.

- Mayzo, Inc.

- Rianlon Corporation

- SABO SpA

- SI Group Inc.(SK Capital Partners)

- Solvay

- SONGWON

- UniteChem Group

第7章 市場機會與未來趨勢

- 紫外線穩定劑奈米複合材料

- 擴大在製藥業的應用

The UV Stabilizers Market size is estimated at USD 1.44 billion in 2025, and is expected to reach USD 1.92 billion by 2030, at a CAGR of 5.96% during the forecast period (2025-2030).

The COVID-19 pandemic negatively impacted the market in 2020. This was because of the shutdown of the manufacturing facilities and plants due to the lockdown and restrictions. Supply chain and transportation disruptions further created hindrances for the market. However, the industry witnessed a recovery in 2021, thus rebounding the demand for the market studied.

Key Highlights

- The major factors driving the growth of the market include the rising consumption of UV stabilizers in the polymer industry and increasing demand for UV stabilizers from wood coatings.

- On the flip side, the negative economic effects of COVID-19 are expected to hinder the growth of the studied market.

- Among the product types, Hindered Amine Light Stabilizers (HALS) accounted for the highest market share during the forecast period.

UV Stabilizers Market Trends

Automotive Sector to Dominate the Market

- Some of the major application areas of UV stabilizers in automobiles include interior parts (door cladding, trim, window frame, center console, etc.) and exterior parts (bumper, bracket, side molding, etc.).

- According to the International Organization of Motor Vehicle Manufacturers (OICA), the total production of cars and vehicles globally in 2022 was 85.01 million units, compared to 80.14 million units in 2021.

- Additionally, according to S&P Global Mobility, global passenger car production reached 68.16 million units in 2022, an increase of 7.9% from the same period in the previous year.

- The Asia-Oceania and Americas regions recorded automotive production of 46.73 million and 16.15 million units in 2021, respectively, registering an increase of 6% and 3% compared to 2020. However, Europe recorded a production of 16.34 million units in 2021, a decrease of 4% from the production achieved in 2020.

- Emerging countries like Argentina, Indonesia, Morocco, Ukraine, and Thailand saw an increase in automotive production of over 10% over the previous year.

- There were 7.8 million electric vehicles sold worldwide in 2022, a 68% increase from 2021, the Wall Street Journal reported, citing preliminary research from the automotive research groups LMC Automotive and EV-Volumes. According to these reports, electric vehicles accounted for 10% of global auto sales in 2022. Some researchers predict the EV industry's market share are expected to double or even quadruple by 2030.

- Hence, such factors from the automotive sector are likely to significantly impact the demand for the market studied in the coming years.

Asia-Pacific region to Dominate the Market

- Asia-Pacific is anticipated to dominate the market owing to its massive growth in the construction, packaging, and automotive sectors.

- The automotive industry in China increased post-pandemic. Automotive production increased from 26.08 million units in 2021 to 27.02 million units in 2022 and registered a 3% growth in 2022.

- Additionally, according to China's Ministry of Industry and Information Technology, domestic vehicle production will reach 35 million by 2025, further solidifying its position as the world's leading automobile manufacturer.

- In India, the food packaging industry is witnessing sharp growth as most of the population shifts from rural to urban areas, increasing food services, among others. India consumes 20 billion food and beverage packages annually.

- By 2030, the country is expected to consume around 50 billion packages, with a growth rate of 8% in beverage packaging. Food packaging growth in the country is anticipated to increase UV stabilizer demand over the forecast period.

- Adhesives and sealants are one of the major markets in South Korea, owing to increasing woodworking and joinery applications. Additionally, the rising demand for furniture is also accelerating the demand for adhesives, propelling overall industry growth. Adhesives are also increasing in the electronics industry, and manufacturers are expanding their business capabilities.

- For instance, in August 2022, Henkel Korea announced the completion of its Songdo Plant within the Songdo High-Tech Industrial Cluster in Incheon. This was expected to become the Asia-Pacific production hub for high-impact electronics solutions for the Adhesive Technologies business unit.

- Hence, such factors will help boost the UV stabilizer market in the Asia-Pacific region over the forecast period.

UV Stabilizers Industry Overview

The global UV Stabilizers market is consolidated in nature. Some of the major players in the market (not in any particular order) include BASF SE, SONGWON, Solvay, CLARIANT, and SABO S.p.A., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Consumption in Polymer Industry

- 4.1.2 Increasing Demand for Wood Coatings

- 4.2 Restraints

- 4.2.1 Fluctuations in Raw Material Prices

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 UV Absorbers

- 5.1.2 Hindered Amine Light Stabilizers (HALS)

- 5.1.3 Quenchers

- 5.1.4 Antioxidants

- 5.2 End-User Industry

- 5.2.1 Packaging

- 5.2.2 Automotive

- 5.2.3 Agriculture

- 5.2.4 Building and Construction

- 5.2.5 Adhesives and Sealants

- 5.2.6 Other End-User Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ADEKA CORPORATION

- 6.4.2 ALTANA AG

- 6.4.3 BASF SE

- 6.4.4 Chitec Technology Co., Ltd.

- 6.4.5 CLARIANT

- 6.4.6 Eastman Chemical Company

- 6.4.7 Everlight Chemical Industrial Co.

- 6.4.8 Lycus Ltd., LLC.

- 6.4.9 Mayzo, Inc.

- 6.4.10 Rianlon Corporation

- 6.4.11 SABO S.p.A.

- 6.4.12 SI Group Inc. (SK Capital Partners)

- 6.4.13 Solvay

- 6.4.14 SONGWON

- 6.4.15 UniteChem Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Nano-composites in UV Stabilizers

- 7.2 Increasing Application in the Pharmaceutical Industry