|

市場調查報告書

商品編碼

1687185

平板玻璃:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Flat Glass - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

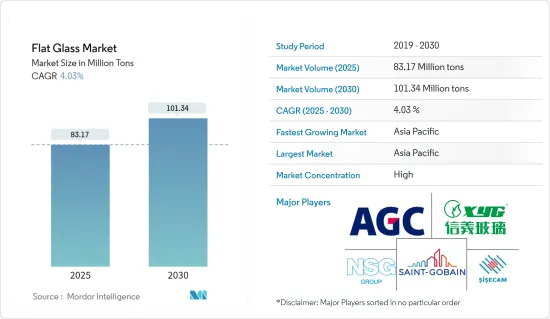

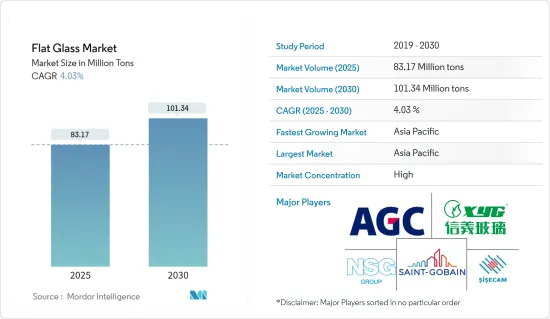

2025年平板玻璃市場規模預估為8,317萬噸,預估至2030年將達到1.0134億噸,預測期間(2025-2030年)複合年成長率為4.03%。

COVID-19 對市場產生了負面影響。疫情導致大多數製造工廠關閉,嚴重影響了汽車生產。此外,疫情爆發帶來的經濟不確定性也導致建築業的衰退。目前,市場已從疫情中恢復並呈現顯著成長。

關鍵亮點

- 短期內,建築業投資增加和汽車產業需求增加是推動市場成長的主要因素。

- 然而,替代品的可用性可能會抑制市場成長。

- 然而,太陽能領域的新興機會可能很快為全球市場創造有利的成長機會。

- 預計亞太地區將主導市場,並在預測期內實現最高的年成長率。

平板玻璃市場趨勢

建築業可望主導市場

- 平板玻璃作為建築業的關鍵組成部分,發揮著至關重要的作用。薄玻璃是透明的,可以讓自然光照進來,並彌合室內和室外之間的差距。這改善了居住者的社會福利並減少了對人工照明的需求。

- 平板玻璃的多功能性顯而易見,因為它可以輕鬆切割、成型和製造,以滿足各種美學和功能要求。無論是有色玻璃、反光玻璃還是節能鍍膜玻璃,現代平板玻璃都因其強度、抗刮擦性和耐候性而脫穎而出。平板玻璃不僅可回收,還可以由回收材料製成。

- 亞太地區是全球最大的建築業地區,人口快速成長、中等收入群體不斷增加以及都市化加快推動了亞太地區的成長。目前正在進行的大量住宅和商業計劃進一步增強了這一勢頭,支持了對該產品的需求。

- 耗資 3000 萬美元的 Arkade Aspire 住宅綜合體計劃正在印度孟買進行中。該雄心勃勃的項目包括建造兩棟 18 層的住宅大樓,總面積為 35,366平方公尺,計劃於 2022 年第二季度開工,並於 2025 年第一季竣工。

- 美國建築業仍然是經濟的重要組成部分。根據美國人口普查局的數據,2023年建築總價值為1.9787兆美元,比2022年的1.8487兆美元成長7%。其中,住宅建築在2023年佔8649億美元。

- 此外,美國商業建築計劃的激增預計將推動工業需求。值得注意的是,2024 年 1 月,印第安納州政府與 Meta Platforms Inc. 合作,開始在印第安納州建造一個價值 8 億美元的資料中心園區。該設施佔地 70 萬平方英尺,位於 River Ridge 商業中心,預計將於 2026 年完工。

- 此外,南非政府還啟動了一系列住宅計劃,為中低收入者提供經濟適用住宅。

- 2020 年宣布的豪登省 Mooikloof特大城市計劃就是其中之一。第一階段計劃於 2023 年完工,這是 2030 年完工的宏偉願景的一部分。這個雄心勃勃的計劃預計將建造 50,000 套住宅,包括住宅、商業和教育設施。

- 鑑於建築業該業務的規模和發展勢頭,預計未來幾年平板玻璃在各種應用領域的需求將激增。

亞太地區可望主導市場

- 由於建築、汽車和太陽能玻璃等應用的需求不斷增加,預計亞太地區將主導平板玻璃市場。

- 根據中國工業協會(CAAM)的最新資料,預計2023年全國汽車產量將超過3,016萬輛,與前一年同期比較增加11.6%。預計2023年乘用車銷量為3,009萬輛,與前一年同期比較成長12%。

- 此外,根據印度汽車製造商協會(SIAM)發布的資料,2023 會計年度汽車產量為 458 萬輛,而 2022 會計年度為 365 萬輛。 2023會計年度汽車產量較上年度長約25%。

- 此外,根據國土交通省發布的最新資料,2023會計年度新建住宅數量達819,620套。

- 此外,印度政府已於2023年11月核准在全國12個邦興建50個太陽能園區,總合容量約3,749萬千瓦。 2023 年 1 月至 11 月期間,併網屋頂太陽能計畫安裝了超過 741 兆瓦的容量。

- 因此,預計預測期內汽車、建築和其他行業的成長將推動該地區平板玻璃市場的發展。

平板玻璃產業概況

平板玻璃市場部分整合。主要企業(排名不分先後)包括旭硝子株式會社、信義玻璃控股有限公司、聖戈班、日本板硝子株式會社和Sisecam。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 增加建築業投資

- 汽車產業需求增加

- 限制因素

- 替代產品的可用性

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 產品類型

- 退火玻璃

- 透明玻璃

- 有色玻璃

- 鍍膜玻璃

- 反光玻璃

- 低輻射玻璃

- 加工玻璃

- 夾層玻璃

- 強化玻璃

- 鏡面玻璃

- 花紋玻璃

- 退火玻璃

- 最終用戶產業

- 建築與施工

- 車

- 太陽能玻璃

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章競爭格局

- 併購、合資、合作與協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- Adamant Holding Company

- AGC Inc.

- Cardinal Glass Industries Inc.

- Central Glass Co. Ltd

- China Glass Holdings Limited

- Euroglas

- Guardian Industries

- Nippon Sheet Glass Co. Ltd

- Phoenicia

- Saint-Gobain

- SCHOTT

- Sisecam

- Taiwan Glass Ind. Corp.

- Vitro

- Xinyi Glass Holdings Limited

第7章 市場機會與未來趨勢

- 太陽能的新機會

The Flat Glass Market size is estimated at 83.17 million tons in 2025, and is expected to reach 101.34 million tons by 2030, at a CAGR of 4.03% during the forecast period (2025-2030).

COVID-19 negatively impacted the market. Most manufacturing facilities were shut down due to the pandemic, severely affecting automotive production. Further, economic instability caused by the pandemic outbreak also led to a downfall in the construction industry. Currently, the market has recovered from the pandemic and is growing at a significant rate.

Key Highlights

- Over the short term, the growing investments in the construction sector and increasing demand from the automotive industry are major factors driving the growth of the market.

- However, the availability of alternatives is likely to restrain the growth of the market.

- However, emerging opportunities in the solar energy sector will likely create lucrative growth opportunities for the global market soon.

- Asia-Pacific is expected to dominate the market and is likely to witness the highest annual growth rate during the forecast period.

Flat Glass Market Trends

The Construction Industry is Expected to Dominate the Market

- Flat glass, a cornerstone of the building and construction industry, plays a pivotal role. It offers clarity, ushering in natural light, and bridges the gap between indoor and outdoor spaces. This enhances occupant well-being and reduces the need for artificial lighting.

- Its versatility shines as flat glass can be easily cut, shaped, and treated to meet diverse aesthetic and functional demands. Whether tinted, reflective, or energy-efficiently coated, modern flat glass stands out for its strength, scratch resistance, and durability against weathering. Additionally, flat glass is not only recyclable but can also be crafted with recycled content.

- Asia-Pacific boasts the world's largest construction industry, a growth primarily fueled by a burgeoning population, rising middle-class incomes, and rapid urbanization. This momentum is further bolstered by a slew of ongoing residential and commercial projects, underpinning the demand for the product.

- In Mumbai, India, the Arkade Aspire Residential Complex project, valued at USD 30 million, is underway. This ambitious endeavor involves erecting two 18-story residential towers covering a total area of 35,366 sq. m construction commenced in Q2 2022 and is slated for completion by Q1 2025.

- The building and construction industry in the United States remains a cornerstone of its economy. In 2023, the US Census Bureau reported a total construction value of USD 1,978.7 billion, marking a 7% increase from the USD 1,848.7 billion spent in 2022. Notably, residential construction accounted for USD 864.9 billion in 2023.

- In addition, the United States is witnessing a surge in commercial construction projects, promising a heightened demand for the industry. Notably, in January 2024, Indiana's government, in collaboration with Meta Platforms Inc., commenced the construction of a USD 800 million data center campus in Hoosier State. This 700,000-square-foot facility at the River Ridge Commerce Center is slated for completion by 2026.

- Moreover, the South African government has embarked on numerous residential projects to provide affordable housing to its middle and lower-income populations.

- One such initiative is the Mooikloof Mega City project in Gauteng, which was announced in 2020. Its Phase 1, set to conclude in 2023, is part of a larger vision that anticipates completion by 2030. The ambitious project envisions 50,000 units, encompassing residential spaces, commercial establishments, and educational facilities.

- Given the scale and momentum of such ventures in the construction industry, the demand for flat glass is set to surge across various applications in the coming years.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific is expected to dominate the market for flat glass with the increasing demand for applications in building and construction, automobiles, solar glasses, etc.

- According to the most recent data from the China Association of Automobile Manufacturers (CAAM), car production in the country surpassed 30.16 million units in 2023, marking an 11.6% increase compared to the previous year. A total of 30.09 million units of passenger cars were sold in the country in 2023, registering a 12% increase compared to the previous year.

- Further, according to the data released by the Society of India Automotive Manufacturing (SIAM), 4.58 million automotive vehicles were manufactured in the financial year 2023, compared to 3.65 million vehicles produced in the financial year 2022. The country saw a rise of around 25% in automotive production in 2023 compared to the previous year.

- In addition, according to the latest data released by the Ministry of Land Infrastructure, Transport and Tourism (MLIT) Japan, a total of 819.62 thousand new construction houses started in 2023.

- Also, the Government of India approved 50 solar parks with an aggregate capacity of around 37,490 MW in 12 states across the country in November 2023. More than 741 MW capacity was installed under the grid-connected rooftop solar program from January to November 2023.

- Therefore, the growth in automotive, construction, and other industries is likely to drive the market for flat glass in the region during the forecast period.

Flat Glass Industry Overview

The flat glass market is partially consolidated in nature. The major players (not in any particular order) include AGC Inc., Xinyi Glass Holdings Limited, Saint-Gobain, Nippon Sheet Glass Co. Ltd, and Sisecam.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Investments in the Construction Industry

- 4.1.2 Increasing Demand From the Automotive Industry

- 4.2 Restraints

- 4.2.1 Availability of Alternatives

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Annealed Glass

- 5.1.1.1 Clear Glass

- 5.1.1.2 Tinted Glass

- 5.1.2 Coater Glass

- 5.1.2.1 Reflective Glass

- 5.1.2.2 Low E Glass

- 5.1.3 Processed Glass

- 5.1.3.1 Laminated Glass

- 5.1.3.2 Tempered Glass

- 5.1.4 Mirror Glass

- 5.1.5 Patterned Glass

- 5.1.1 Annealed Glass

- 5.2 End-user Industry

- 5.2.1 Building and Construction

- 5.2.2 Automotive

- 5.2.3 Solar Glass

- 5.2.4 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Adamant Holding Company

- 6.4.2 AGC Inc.

- 6.4.3 Cardinal Glass Industries Inc.

- 6.4.4 Central Glass Co. Ltd

- 6.4.5 China Glass Holdings Limited

- 6.4.6 Euroglas

- 6.4.7 Guardian Industries

- 6.4.8 Nippon Sheet Glass Co. Ltd

- 6.4.9 Phoenicia

- 6.4.10 Saint-Gobain

- 6.4.11 SCHOTT

- 6.4.12 Sisecam

- 6.4.13 Taiwan Glass Ind. Corp.

- 6.4.14 Vitro

- 6.4.15 Xinyi Glass Holdings Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emerging Opportunity in the Solar Energy