|

市場調查報告書

商品編碼

1687167

非洲汽車:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)Africa Automotive - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

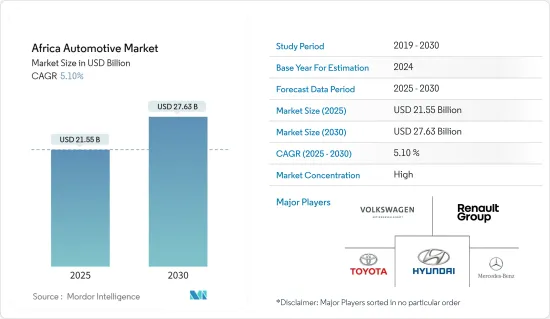

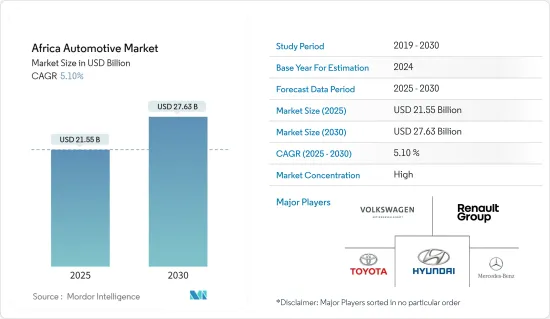

預計 2025 年非洲汽車市場規模為 215.5 億美元,到 2030 年將達到 276.3 億美元,預測期內(2025-2030 年)的複合年成長率為 5.1%。

從中期來看,非洲汽車市場預計將快速成長。這是因為政府激勵措施和都市化進程推動了該地區主要國家的基礎設施發展,市場前景樂觀。南非、奈及利亞、肯亞等幾個大國也正著力發展國內汽車生產計畫。例如

南非公平能源轉型 (JET) 交通電氣化計畫很可能最早在 2026 年生產第一輛電動車 (EV)。 JET 計畫估計,2023 年至 2027 年期間,交通運輸領域將需要投資 1,281 億南非蘭特(68.4 億美元),以履行南非的脫碳承諾。

南非的電動車市場為外國企業和投資者進入和擴展業務提供了新的機會。

例如,2023年6月,德國寶馬集團將開闢新市場,從2024年起在南非生產其X3車型,並投資42億南非蘭特(約2,509萬美元)實現其羅斯林工廠的電氣化。

此外,現代汽車所必需的非洲原料需要新技術才能實現淨零排放。銅、鈷、礬土、鋰等。考慮到整體經濟和工業因素,預計未來幾年市場將會成長。

非洲汽車市場趨勢

乘用車佔最大市場佔有率

近年來,乘用車以其時尚的設計、緊湊的尺寸和經濟的價值等特點,受到廣大駕駛員的歡迎。乘用車是許多已開發國家最常見的交通工具。生活方式的改善、購買力平價的提高、可支配收入的增加、品牌知名度的提高以及經濟的改善正在改變全球消費者的偏好,從而導致乘用車銷售的大幅成長。

據南非汽車工業協會稱,豐田、大眾等汽車巨頭的乘用車銷量正在快速成長。

國際汽車製造商和品牌在該地區的業務不斷成長,消費者購買和維護新車的能力不斷提高,再加上消費者對購買多輛汽車以滿足日常需求和旅行目的的興趣日益濃厚,可能會提振全部區域需求。

全球幾家大型OEM正在該地區推出其最新的乘用車型,以促進銷售並增加市場佔有率。例如

2023年6月,全球新能源車領跑者比亞迪在南非約翰尼斯堡的品牌發表會上發表了最新純電動車款比亞迪ATTO 3。該車型標準版起售價為 768,000 南非蘭特,加長版起售價為 835,000 南非蘭特,這是該車首次進軍南非乘用車市場。

隨著對提高燃油效率和減少排放的日益關注,電動車,尤其是電動車的需求和銷售量預計將在預測期內快速成長。

2023 年 11 月,梅賽德斯-奔馳南非公司 (MBSA) 計劃在全國安裝 127 個電動車 (EV) 充電站,並為此計畫投資 4,000 萬南非蘭特。 MBSA 與 2 級認證的公司 Chargify 合作,在連接大都會圈、機場、購物中心、餐飲中心、私人醫院、戰略擴張區、住宅和小城鎮的主要路線上部署交流電和快速充電直流站。

鑑於乘用車銷量的成長,這可能會對非洲汽車產業產生積極影響。

南非佔有最高市場佔有率

南非汽車工業對南非經濟至關重要。南非擁有發達的基礎設施和製造能力,是希望更有效地進入非洲大陸市場的公司的理想之地。

2021-2035年南非汽車總體規劃(SAAM)旨在2035年使南非的全球汽車產量每年增加1%。此外,還計劃在同年實現60%的本地化率,這將顯著提高南非在全球汽車生產排名中的地位。

由於南非良好的商業環境和擴大市場佔有率的潛力,許多大型目標商標產品製造商(OEM )都在投資南非。此外,一些OEM正在推出有吸引力的車型來擴大基本客群。此外,其他幾家OEM也積極尋求將其最新車型出口到南非市場。例如

2023年12月,現代汽車承諾在2024年推出改款的i20和Tucson車型,並在下半年推出新款聖塔菲SUV。

多家汽車零件供應商已在其南非業務和其他國際相關人員之間建立了牢固的業務聯繫。由此建立的商業聯繫增加了企業和政府之間互利貿易的潛力。例如

2023 年 3 月,Stellantis 與工業發展公司 (IDC) 和貿易、工業和競爭部 (DTIC) 簽署了一份合作備忘錄,以在南非建立一家製造工廠。

此外,南非對售後專用汽車設備和配件的需求正在快速成長,使得汽車的配件和性能升級成為一種成熟且競爭激烈的文化。

預計預測期內市場將獲得顯著發展動能。

非洲汽車產業概況

非洲汽車市場由知名的全球和區域參與企業鞏固和主導。公司正在採取新產品發布、合作和合併等方式來保持其市場地位。例如

2023年4月,非洲汽車科技公司Autochek宣布收購AutoTager的多數股權。這家埃及汽車技術公司正在簡化汽車買賣的流程。這將使 Autoshek 能夠深化其在北非的業務並支持 Autotagger 的持續成長。

2024 年 1 月,泛非洲線上二手車平台 AUTO24.africa 收購了坦尚尼亞領先的數位分類廣告網站 Kupatana.com。從母公司 Euroafrica Digital Ventures 收購是 AUTO24.africa 的一個里程碑,鞏固了其在撒哈拉以南非洲蓬勃發展的二手車市場的主導地位。

市場的主要企業包括大眾汽車公司、豐田汽車公司、雷諾集團(包括達契亞銷售公司)、戴姆勒汽車公司、福特汽車公司、現代汽車公司和五十鈴汽車公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 全部區域乘用車銷量增加

- 市場限制

- 交通基礎建設發展

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場區隔

- 汽車模型

- 搭乘用車

- 商用車

- 國家

- 南非

- 摩洛哥

- 阿爾及利亞

- 埃及

- 奈及利亞

- 迦納

- 肯亞

- 其他非洲國家

第6章競爭格局

- 供應商市場佔有率

- 公司簡介

- Toyota Motor Corporation

- Volkswagen AG

- Groupe Renault

- Hyundai Motor Company

- Ford Motor Company

- Innoson Vehicle Manufacturing Company

- Daimler AG

- Volvo Group

- Isuzu Motors Ltd

- Tata Motors Limited

- Ashok Leyland

第7章 市場機會與未來趨勢

The Africa Automotive Market size is estimated at USD 21.55 billion in 2025, and is expected to reach USD 27.63 billion by 2030, at a CAGR of 5.1% during the forecast period (2025-2030).

Over the medium term, the African automotive market is expected to grow rapidly due to supportive government incentives and increasing urbanization in the major countries in the region, which are encouraging infrastructural developments, thus creating a positive outlook for the market. Several larger countries, such as South Africa, Nigeria, and Kenya, also focus on developing domestic automotive production plans. For instance,

South Africa's policy for electrification of transport under South Africa's Just Energy Transition (JET) plan will likely produce its first electric vehicle (EV) in 2026. The JET plan estimates that the transport sector would need an investment of ZAR 128.1 billion (USD 6.84 billion) from 2023 to 2027 to contribute to South Africa's decarbonization commitments.

The South African electric mobility market offers new opportunities for foreign companies and investors to enter and expand operations.

For example, in June 2023, Germany's BM opened a new tab and will build its X3 model in South Africa from 2024, investing ZAR 4.2 billion (USD 25.09 million) to electrify its plant in Rosslyn.

Moreover, Africa's vital raw materials for modern vehicles require new technologies to reach net zero. They include copper, cobalt, bauxite, and lithium. Considering the overall economic and industrial factors, the market is expected to grow in the coming years.

Africa Automotive Market Trends

Passenger Car holds Highest Share in the Market

Passenger cars have gained immense popularity among drivers over the past few years due to features such as stylish design, compact size, and economic value. Passenger cars are the most common mode of transportation in numerous advanced countries. The improving lifestyles, increasing power purchase parity, disposable income, raising brand awareness, and improving the economy are leading to changes in customer preference across the globe, resulting in high sales of passenger cars.

According to the National Association of Automobile Manufacturers of South Africa, automotive giants such as Toyota and Volkswagen have experienced exponential growth in the sale of passenger cars.

The growing presence of international automobile manufacturers and brands in the region and the consumer's ability to purchase new cars and maintain those, coupled with the ever-increasing consumer interest in buying more than one passenger car to suit their daily needs and travel purposes, may improve the demand for vehicles across the region.

Several significant OEMs from different parts of the world are launching the latest passenger car models in the region to enhance their sales and gain market share. For instance,

In June 2023, BYD, the global frontrunner in new energy vehicle production, introduced its latest all-electric model, the BYD ATTO 3, during a brand launch event in Johannesburg, South Africa. It unveiled the model's pricing, with the standard range starting at ZAR 768,000 and the extended range at ZAR 835,000, marking its initial step into the South African passenger vehicle market.

With the growing focus on improved fuel economy and reduced exhaust emissions, the demand for and sales of electric vehicles, especially electric cars, is expected to grow rapidly during the forecast period.

In November 2023, Mercedes-Benz South Africa (MBSA) planned to implement 127 electric vehicle (EV) charging stations nationwide, investing ZAR 40 million in this initiative. Teaming up with Chargify, a Level 2 empowered company, MBSA aims to deploy AC and fast-charging DC stations along major routes, interconnecting metropolitan areas, airports, shopping centers, dining hubs, private hospitals, strategic expansion zones, residential estates, and smaller towns across South Africa.

Considering the growing passenger car sales, it will create a positive impact on the African automotive sector.

South Africa Holds the Highest Market Share

The South African automotive industry is vital to South Africa's economy. With its advancement in infrastructure and developed manufacturing capacity, South Africa is the ideal location for any company aspiring to reach the continental market more effectively.

The South African Automotive Masterplan (SAAM) for 2021-2035 aims to increase the country's global vehicle production by 1% annually by 2035. In addition, it seeks to achieve a localization rate of 60% by the same year, which will significantly enhance South Africa's position in the global vehicle production ranking.

Many major original equipment manufacturers (OEMs) invest in South Africa due to the positive business environment and potential for growth in the market share. Some OEMs are also launching attractive models to expand their customer base. Additionally, several other OEMs actively seek to export their latest models to the South African market. For instance,

In December 2023, Hyundai SA promised to introduce the updated i20 and Tucson in 2024 and the all-new Santa Fe SUV in the year's second half.

Several automotive component suppliers have built strong business links between their South African operations and other international stakeholders. These established business links enhance the potential for mutually beneficial trade between companies and the government. For example,

In March 2023, Stellantis signed an MoU with the Industrial Development Corporation (IDC) and the Department of Trade, Industry, and Competition (DTIC) to develop a manufacturing facility in South Africa.

Also, there has been a rapid growth in demand for automotive aftermarket specialty equipment and accessories in South Africa, as accessorizing and improving the performance of vehicles has transformed into a fully-fledged culture of fierce competition.

Considering such developments, the market is expected to gain significant momentum during the forecast period.

Africa Automotive Industry Overview

The African automotive market is consolidated and led by globally and regionally established players. The companies adopt new product launches, collaborations, and mergers to sustain their market positions. For instance

In April 2023, Autochek, the African-based automotive technology company, announced its latest acquisition of a majority stake in AutoTager. This Egyptian automotive technology company simplifies the car buying and selling process. This allows Autochek to deepen its presence in North Africa and support the ongoing growth of AutoTager.

In January 2024, Pan-African online used car platform AUTO24.africa acquired Tanzania's leading digital classifieds property, Kupatana.com. The purchase from parent company Euroafrica Digital Ventures represents a milestone for AUTO24.africa as it solidifies the dominance of Sub-Saharan Africa's thriving pre-owned automotive market.

Some of the major players in the market include Volkswagen AG, Toyota Motor Corporation, Groupe Renault (including Dacia Sales), Daimler AG, Ford Motor Company, Hyundai Motor Company, and Isuzu Motors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing in The Passenger Car Sales Across the Region

- 4.2 Market Restraints

- 4.2.1 Transportation Infrastructure Development

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value)

- 5.1 Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Commercial Vehicles

- 5.2 Country

- 5.2.1 South Africa

- 5.2.2 Morocco

- 5.2.3 Algeria

- 5.2.4 Egypt

- 5.2.5 Nigeria

- 5.2.6 Ghana

- 5.2.7 Kenya

- 5.2.8 Rest of Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Toyota Motor Corporation

- 6.2.2 Volkswagen AG

- 6.2.3 Groupe Renault

- 6.2.4 Hyundai Motor Company

- 6.2.5 Ford Motor Company

- 6.2.6 Innoson Vehicle Manufacturing Company

- 6.2.7 Daimler AG

- 6.2.8 Volvo Group

- 6.2.9 Isuzu Motors Ltd

- 6.2.10 Tata Motors Limited

- 6.2.11 Ashok Leyland