|

市場調查報告書

商品編碼

1687129

甘油 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Glycerin - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

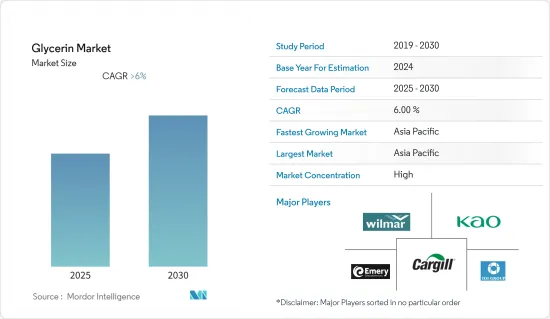

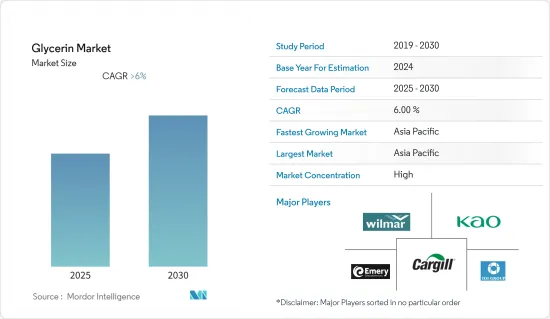

預計預測期內甘油市場的複合年成長率將超過 6%。

新冠疫情對甘油的主要消費產業之一——化妝品產業產生了影響。數月的居家令、國際旅行禁令和零售店關閉導致許多美容產品的銷售、購買和使用量下降。然而,由於甘油在乾洗手劑、肥皂、洗手液和清潔劑中的使用增加,疫情期間製藥和個人護理等終端用戶行業對甘油的需求增加。

關鍵亮點

- 短期內,製藥業的強勁需求以及個人護理和化妝品行業的使用量增加預計將推動市場研究。

- 另一方面,替代品的可用性預計會阻礙市場成長。替代品包括二伸乙甘醇、神經醯胺、油和奶油。

- 它作為防凍劑和除冰劑中丙二醇和乙二醇的替代品,可能為全球市場提供豐厚的成長機會。

- 由於中國、印度和日本等國家的快速成長,亞太地區很可能在預測期內佔據市場主導地位。

甘油市場趨勢

個人護理和化妝品應用將主導市場成長

- 甘油可安全用於許多個人護理和化妝品中,包括牙膏、肥皂、刮鬍膏以及皮膚和頭髮產品,以提供平滑和潤滑性能。這可以防止產品失去水分。因此,甘油被用作變性劑、香料成分、口腔清潔用品劑、頭髮調理劑、皮膚保護劑和黏度降低劑。

- 根據聯合國商品貿易統計資料庫,2021 年英國甘油進口英國為 263.74 億英鎊(320.472 億美元),較 2020 年的 163 億英鎊(197.7997 億美元)有所成長。

- 甘油對人體皮膚來說是理想的。它可以修復皮膚屏障,減少經表皮水分流失,恢復脂質水分屏障功能。甘油是肥皂、消毒劑和保濕劑等個人保健產品中最常使用的保濕劑。

- 根據歐盟統計局的數據,2021 年歐盟(歐盟 27 國)生產的固態和有機表面活性產品的產值達到約 2.1 億歐元(2.2333 億美元)。

- 甘油是藥物中常見的成分,有助於改善藥物的光滑度和口感。過去幾年,製藥業取得了長足的發展,影響了甘油市場的成長。

- 根據經濟合作暨發展組織(OECD)的數據,2021年英國進口藥品價值達200.61億美元。

- 甘油被列入歐盟化妝品成分清單,且不受管制。然而,源自動物性原料的甘油必須符合歐盟動物產品的具體規定。

- 聯合利華、強生、寶潔等全球化妝品製造商已大量採用天然甘油作為成分,以滿足日益成長的需求。

- 因此,在預測期內,所有這些因素都將推動甘油在個人護理和化妝品中的應用。

亞太地區佔市場主導地位

- 由於中國、印度和日本等新興經濟體,亞太地區佔據了整個甘油市場的大部分佔有率。

- 中國是甘油最大的消費國之一。化妝品和個人護理是該國成長最快的行業之一。中國化妝品及個人護理市場涵蓋彩妝、護膚、護髮、個人衛生、香水等多個行業,呈現正成長態勢。

- 近年來,受奢侈品需求成長和女性勞動力數量增加的推動,中國化妝品產業穩步成長。 2021年,中國化妝品零售達4,026億元人民幣(577.4億美元),成為最大的美容和個人保健產品市場之一。

- 預計食品加工產業在中國甘油市場將以良好的速度擴張。該國有超過 35,000 家加工和製造工廠為居民生產食品。

- 根據中國國家統計局的數據,2021年,中國食品工業實現利潤總額約6,187億元人民幣(887.4億美元),其中食品製造業貢獻的利潤總額約1,654億元人民幣(237.2億美元)。

- 日本是世界第三大醫藥市場,也是與甘油使用和生產密切相關的美國藥品的重要出口市場。根據經濟產業省統計,2021年日本化學工業生產了3.53萬噸精製甘油。

- 「清潔印度」運動等政府舉措促進了印度的健康和衛生事業。這些努力促進了肥皂製造業的成長以及肥皂和清潔劑使用量的增加,進一步刺激了該國對甘油的需求。

- 根據聯邦預算,印度2021年藥品和醫藥產品進口額將達到5,173.7億印度盧比(62.4億美元),較2020年的4,572.7億印度盧比(55.2億美元)有所增加。

- 因此,由於上述因素,亞太地區很可能在預測期內佔據市場主導地位。

甘油產業概況

甘油市場呈現盤整態勢。主要參與企業(不分先後順序)包括 Emery Oleochemicals、IOI Corporation Berhad、Wilmar International Ltd、Cargill, Incorporated 和 Kao Corporation。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 製藥業需求強勁

- 個人護理和化妝品行業的使用日益增多

- 限制因素

- 替代產品的可用性

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 原料分析

- 價格分析(歷史和預測)

第5章市場區隔

- 年級

- 粗甘油

- 精製甘油

- 來源

- 生質柴油

- 脂肪酸

- 脂醇類

- 其他成分

- 應用

- 製藥

- 飲食

- 醇酸樹脂

- 個人護理和化妝品

- 工業化學品

- 聚醚多元醇

- 煙草保濕劑

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 其他中東和非洲地區

- 亞太地區

第6章競爭格局

- 併購、合資、合作與協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- Archer Daniels Midland Company

- Aemetis

- BASF SE

- Biodex-SA

- Cargill Incorporated

- Dow

- Emery Oleochemicals

- Godrej Industries Limited

- IOI Corporation Berhad

- Kao Corporation

- KLK OLEO

- Louis Dreyfus Company

- Munzer Bioindustrie GmbH

- Musim Mas

- Oleon NV

- P& G Chemicals

- RB FUELS

- Sebacic India Limited

- Thai Glycerine Co. Ltd

- Vance Group Ltd

- Vantage Specialty Chemicals

- Wilmar International Ltd

第7章 市場機會與未來趨勢

- 在防凍和除冰應用中替代丙二醇和乙二醇

- 市場的未來

The Glycerin Market is expected to register a CAGR of greater than 6% during the forecast period.

The COVID-19 pandemic impacted the cosmetics industry, one of the major industries of glycerin consumption. As a result of months of lockdowns, international travel bans, and retail business closures; sales, purchases, and usage fell across many beauty segments. However, the demand for glycerin increased for end-user industries like pharmaceutical and personal care during the pandemic, owing to its increased usage in hand sanitizers, soaps, handwash, and detergents.

Key Highlights

- In the short term, the strong demand from the pharmaceutical industry coupled with increasing usage in the personal care and cosmetics industries are expected to drive the market studied.

- On the flip side, the availability of substitutes is expected to hinder the market's growth. Some substitutes include diethylene glycol, ceramides, oils, and butter.

- Nevertheless, the antifreeze and de-icing applications as substitutes for propylene and ethylene glycols will likely create lucrative growth opportunities for the global market.

- Asia-Pacific is likely to dominate the market during the forecast period owing to the rapid growth of countries like China, India, and Japan.

Glycerin Market Trends

Personal Care and Cosmetics Application to Dominate the Market Growth

- Glycerin is used safely in numerous personal care and cosmetics, such as toothpaste, soaps, shaving creams, and skin and hair products, to provide smoothness and lubrication. It helps prevent the loss of moisture from products. Thus, glycerin is used as denaturants, fragrance ingredients, oral care agents, hair conditioning agents, skin protectants, and viscosity-decreasing agents.

- According to UN Comtrade, in 2021, imports of glycerine to the United Kingdom (UK) were valued at approximately GBP 26,374 million (USD 32,004.72 million) and registered growth compared to GBP 16,300 million (USD 19,779.97 million) in 2020.

- Glycerin is perfect for the human skin. It helps repair the skin barrier, reduce transepidermal water loss, and restore the lipid's water barrier function. Glycerin is the most popular among the humectants used in personal care products, including soaps, sanitizers, and moisturizers.

- As per Eurostat, the production value of soap in bars and organic surface-active products manufactured in the European Union (EU-27) amounted to roughly EUR 210 million (USD 223.33 million) in 2021.

- Glycerol is a common ingredient in pharmaceuticals that helps to improve the smoothness and taste of medicines. The pharmaceutical sector registered massive growth in the past few years, thus impacting the growth of the glycerin market.

- As per Organisation for Economic Co-operation and Development (OECD), the value of pharmaceutical products imported into the United Kingdom reached USD 20,061 million in 2021.

- Glycerin is listed in the EU's Inventory of Cosmetic Ingredients and is not restricted. However, glycerin derived from raw materials of animal origin must comply with the European Union animal by-products regulations.

- Some global cosmetics manufacturers such as Unilever, Johnson & Johnson, and P&G are significantly adopting natural glycerol as raw material to meet the growing demand.

- Hence, all these factors will drive the application of glycerin in personal care and cosmetic products during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific accounted for the major share of the overall glycerin market, owing to emerging countries like China, India, and Japan.

- China is one of the largest consumers of glycerin. Cosmetics and personal care are one of the fastest-growing sectors in the country. Covering various industries, such as makeup, skincare, haircare, personal hygiene, fragrances, etc., the Chinese cosmetics and personal care market experienced positive growth.

- The cosmetics industry in China has experienced steady growth in recent years, driven by rising demand for premium products and an increasing number of working women. The retail sales value of cosmetics in China reached CNY 402.6 billion (USD 57.74 billion) in 2021, making it one of the largest beauty and personal care product markets.

- The food processing industry is expected to expand at a lucrative rate in the Chinese glycerin market. The country has over 35,000 processing and manufacturing plants that manufacture food products for its residents.

- As per the National Bureau of Statistics of China, in 2021, the food industry in China generated a total profit of about CNY 618.7 billion (USD 88.74 billion), and the food manufacturing industry contributed approximately CNY 165.4 billion (USD 23.72 billion) to the total profits.

- Japan is the world's third largest pharmaceutical market and a significant export market for US pharmaceuticals that are closely related to glycerin usage and manufacture. According to the Ministry of Economy, Trade, and Sector, Japan's chemical industry produced 35.3 thousand tonnes of refined glycerin in 2021.

- Government initiatives such as the Swachh Bharat Mission promote health and hygiene in India. Such initiatives, along with the growing usage of soaps and detergents, have led to the growth of the soap manufacturing industry, further boosting the demand for glycerin in the country.

- India is also one of the major countries in the pharmaceutical industry, according to the Union Budget of India, the value of India's medicine and pharmaceutical product imports reached INR 517.37 billion (USD 6.24 billion) in 2021 and registered growth when compared to INR 457.27 billion (USD 5.52 billion) in 2020.

- Hence, due to the above-mentioned factors, Asia-Pacific is likely to dominate the market during the forecast period.

Glycerin Industry Overview

The glycerin market is consolidated in nature. The major players (in no particular order) include Emery Oleochemicals, IOI Corporation Berhad, Wilmar International Ltd, Cargill, Incorporated, and Kao Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Strong Demand from the Pharmaceutical Industry

- 4.1.2 Increasing Use in the Personal Care and Cosmetics Industries

- 4.2 Restraints

- 4.2.1 Availability of Substitutes

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Feedstock Analysis

- 4.6 Price Analysis (Historical and Forecast)

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Grade

- 5.1.1 Crude Glycerin

- 5.1.2 Refined Glycerin

- 5.2 Source

- 5.2.1 Biodiesels

- 5.2.2 Fatty Acids

- 5.2.3 Fatty Alcohols

- 5.2.4 Other Sources

- 5.3 Application

- 5.3.1 Pharmaceuticals

- 5.3.2 Food and Beverage

- 5.3.3 Alkyd Resins

- 5.3.4 Personal Care and Cosmetics

- 5.3.5 Industrial Chemicals

- 5.3.6 Polyether Polyols

- 5.3.7 Tobacco Humectants

- 5.3.8 Other Applications

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.2.4 Rest of North America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Archer Daniels Midland Company

- 6.4.2 Aemetis

- 6.4.3 BASF SE

- 6.4.4 Biodex-SA

- 6.4.5 Cargill Incorporated

- 6.4.6 Dow

- 6.4.7 Emery Oleochemicals

- 6.4.8 Godrej Industries Limited

- 6.4.9 IOI Corporation Berhad

- 6.4.10 Kao Corporation

- 6.4.11 KLK OLEO

- 6.4.12 Louis Dreyfus Company

- 6.4.13 Munzer Bioindustrie GmbH

- 6.4.14 Musim Mas

- 6.4.15 Oleon NV

- 6.4.16 P&G Chemicals

- 6.4.17 RB FUELS

- 6.4.18 Sebacic India Limited

- 6.4.19 Thai Glycerine Co. Ltd

- 6.4.20 Vance Group Ltd

- 6.4.21 Vantage Specialty Chemicals

- 6.4.22 Wilmar International Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Antifreeze and De-icing Applications as a Substitute for Propylene and Ethylene Glycols

- 7.2 Future of the Market