|

市場調查報告書

商品編碼

1686614

發泡聚丙烯(EPP) -市場佔有率分析、產業趨勢與成長預測(2025-2030)Expanded Polypropylene (EPP) Foam - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

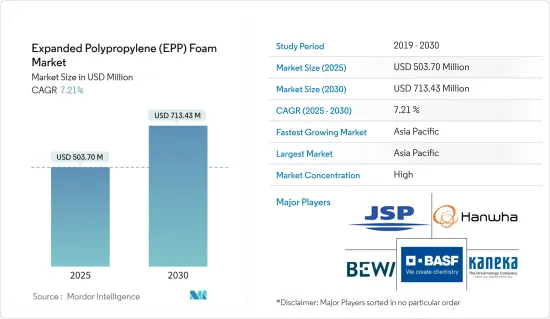

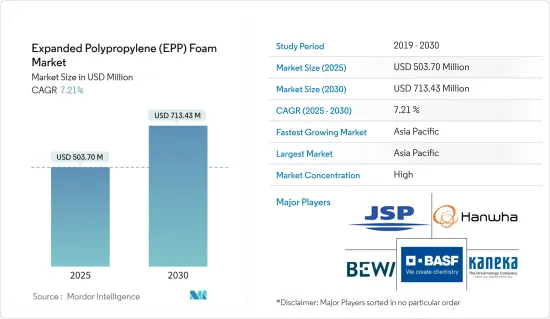

發泡聚丙烯市場規模預計在 2025 年為 5.037 億美元,預計到 2030 年將達到 7.1343 億美元,預測期內(2025-2030 年)的複合年成長率為 7.21%。

2020 年,市場受到了 COVID-19 疫情的負面影響。不過,預計 2021 年市場將復甦,並在整個預測期內穩定成長。

主要亮點

- 短期內,材料的無毒、可回收特性以及包裝行業日益成長的需求是刺激市場需求的驅動力之一。

- 過去幾年,汽車產業一直在衰退,與市場上其他結構發泡體相比,其價格較高可能會阻礙市場成長。

- 另一方面,與其他結構發泡體相比,其價格較高,這可能是預測期內研究市場的限制因素。

- 生物基聚丙烯泡沫的需求不斷成長、其作為其他產品替代品的出現以及電動車的日益普及可能會為未來幾年的市場提供機會。

- 亞太地區佔據市場主導地位,預計在預測期內將以最高的複合年成長率成長。

發泡聚丙烯(EPP)市場趨勢

在汽車產業的應用日益廣泛

- 汽車產業目前是EPP泡沫的最大消費者。由於歐盟排放法規趨嚴以及報廢汽車回收立法的訂定,EPP泡沫的需求量逐年增加。

- EPP發泡體具有優異的可恢復性,能吸收衝擊能量,在保險桿的應用日益廣泛。保險桿系統中整合的 EPP 模製部件可減少碰撞時的壓力,最大限度地減少傳遞底盤的衝擊能量。

- 在座椅和其他汽車零件中增加 EPP發泡體的使用可以將車輛整體重量減輕約 10%。燃料消費量減少約7%。車輛中可重複使用和可回收材料的比例也同時增加。

- 此外,電動車的興起正在推動EPP泡棉市場的成長。這是因為EPP在減輕電動車重量、絕緣和增強其能量吸收能力方面發揮著重要作用。

- EPP 泡棉也用於製作門墊、車頂內襯和墊子。 EPP泡棉有助於保持駕駛座內空氣溫度恆定,為電池的運作創造理想條件。

- 根據國際能源總署2021年展望,2021年全球電動車銷量預計將翻倍,達到660萬輛。預計2022年銷量將大幅成長,2022年第一季全球電動車銷量將達200萬輛。

- 2021年亞洲和大洋洲的汽車總產量為4,673萬輛,美洲的汽車總產量為1,615萬輛,分別比2020年增加6%和3%。不過,2021年歐洲的汽車產量為1,634萬輛,比2020年下降了4%。

- 由於上述所有原因,汽車應用可能會佔據市場主導地位。

亞太地區佔市場主導地位

- 亞太地區佔據全球市場佔有率的主導地位。在亞太地區,中國是GDP最大的經濟體。

- 中國是亞太地區最大的EPP泡沫消費國和生產國。該國活性化的製造業活動正在增加該地區的塑膠和聚合物的消費量,預計這將推動發泡聚丙烯 (EPP) 市場的發展。

- 該國的汽車產業正在塑造產品的演變,隨著人們對環境問題的日益關注(由於該國污染的增加),該國正專注於製造確保燃油效率和減少排放氣體的產品。

- 中國汽車製造業規模位居世界第一。 2021年汽車產量達2,608萬輛,較2020年的2,523萬輛成長3%。預計汽車產量的成長將推動EPP泡沫的需求。

- 此外,中國食品飲料產業面臨的市場競爭日益激烈,促使企業紛紛進軍海外市場,尋求更多的資源和商機。

- 印度包裝產業在進出口方面表現強勁,促進了該國技術和創新的成長,並為各個製造業增加了價值。包裝產業是推動印度所研究市場巨大成長的催化劑。此外,過去幾年印度對包裝食品的需求龐大。預計這種狀況將在預測期內持續,從而刺激市場需求。

- 印度的家具市場也表現良好。根據印度國家投資促進和便利化機構 (InvestIndia) 的數據,2021 會計年度印度家具和家電租賃市場總額達到 33,500 億印度盧比。預計到2023年底將達到610.9億美元。

- 由於這些因素,預計該地區的發泡聚丙烯市場在預測期內將穩定成長。

發泡聚丙烯(EPP)產業概況

發泡的聚丙烯市場正在整合。市場的主要企業包括(不分先後順序) BASF SE、JSP、Hanwha Solutions、BEWI(Izoblok)和工業, Ltd.。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 無毒、可回收的材料特性

- 包裝產業需求不斷成長

- 限制因素

- 汽車產業衰退

- 與其他結構發泡體相比價格較高

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 定價分析

第5章市場區隔

- 原料

- 合成聚丙烯

- 生物基聚丙烯

- 形式

- 加工過的EPP

- 模壓EPP

- 其他形式

- 應用

- 車

- 墊材

- 家具

- 食品包裝

- 空調設備

- 運動休閒

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章競爭格局

- 併購、合資、合作與協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- BASF SE

- BEWi(IZOBLOK)

- Clark Foam Products Corporation

- Hanwha Solutions

- JSP

- KK Nag Pvt. Ltd

- Kaneka Corporation

- Knauf Industries

- Polyfoam Australia Pty Ltd

- Signode Industrial Group Llc

- Sonoco Products Company

- Woodbridge

第7章 市場機會與未來趨勢

- 生物基聚丙烯泡沫的需求不斷成長

- 作為其他產品的替代品出現

- 電動車日益普及

The Expanded Polypropylene Foam Market size is estimated at USD 503.70 million in 2025, and is expected to reach USD 713.43 million by 2030, at a CAGR of 7.21% during the forecast period (2025-2030).

The market was negatively impacted due to the COVID-19 pandemic in 2020. However, the condition recovered in 2021, and it is expected to observe a stable growth trajectory over the forecast period.

Key Highlights

- Over the short term, the non-toxic and recyclable nature of the material and the rising demand from packaging industries are some of the driving factors which are stimulating the market demand.

- The declining automobile Industry through previous years and higher prices, among other structural foams available in the market, may hinder the market's growth.

- On the flip side, higher prices, among other structural foams, are likely to act as restraints for the market studied during the forecast period.

- The rising demand for bio-based polypropylene foam, its emergence as a replacement for other products, and the increasing adoption of electric vehicles are likely to create opportunities for the market in the coming years.

- The Asia-Pacific region dominated the market and is expected to witness the highest CAGR over the forecast period.

Expanded Polypropylene (EPP) Foam Market Trends

Increasing Usage in the Automotive Industry

- The automotive sector is currently the largest consumer of EPP foams. The demand for EPP foams has increased over the years as the EU regulations on emissions have become more rigorous, and laws on recycling vehicles withdrawn from use have been introduced.

- Excellent recoverability and the ability to absorb the impact energy of EPP foams increase the usage of EPP foams in bumpers. In a collision, molded EPP parts built into bumper bar systems reduce pressure and minimize the amount of impact energy transmitted to the chassis.

- Increasing usage of EPP foams in seating and other automotive components reduces the overall weight of the vehicle by ~10%. The fuel consumption was reduced by ~7%. The share of recyclable materials in vehicles that can be reused is increasing simultaneously.

- In addition, increasing electric cars are promoting the EPP foam market's growth, as EPP plays a significant role in making electric cars lightweight and thermally insulated and enhancing energy absorption capabilities.

- EPP foams are also used in the manufacturing of door pads, headliners, and mats. They make it possible to maintain a constant air temperature in the cockpit and generate ideal conditions for battery operations.

- According to the IEA 2021 Outlook, worldwide electric car sales doubled in 2021 and reached 6.6 million. The sales increased strongly in 2022, with 2 million electric cars sold across the globe in the first quarter of 2022.

- The Asia-Oceania and Americas regions recorded 46.73 million and 16.15 million of total automotive production in 2021, registering an increase of 6% and 3%, respectively, compared to 2020. However, Europe recorded 16.34 million of automotive production in 2021, a decrease of 4% compared to 2020.

- The aforementioned aspects may result in the automotive application dominating the market.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominated the global market share. In Asia-Pacific, China is the largest economy in terms of GDP.

- China is the largest consumer and manufacturer of EPP foams in the Asia-Pacific region. The growing manufacturing activities in the country are increasing the consumption of plastics and polymers in the region, which is expected to drive the expanded polypropylene (EPP) foam market.

- The country's automotive sector has been shaping product evolution, with the country focusing on manufacturing products that ensure fuel economy and minimize emissions, owing to the increasing environmental concerns (due to mounting pollution in the country).

- The Chinese automotive manufacturing industry is the largest in the world. In 2021, the automotive production in the country reached 26.08 million, which increased by 3%, compared to 25.23 million vehicles produced in 2020. The increase in automotive production is estimated to drive the demand for EPP foam.

- Additionally, the market competition in China has become increasingly fierce in the food and beverage industry, which has enabled companies to tap into overseas markets to seek more resources and business opportunities.

- The Indian packaging industry has made a mark with its exports and imports, thus driving technology and innovation growth in the country and adding value to the various manufacturing sectors. The packaging industry is enacting the role of catalyst in promoting the huge growth of the market studied in India. Furthermore, the country has been exhibiting a significant demand for packed foods for the past few years. This scenario is expected to continue during the forecast period, thus boosting the demand for the market studied.

- The Indian furniture market is also very strong. According to InvestIndia (National Investment Promotion and Facilitation Agency), the total rental furniture and appliances market in India reached INR 33,500 crores during FY21. The market is expected to garner USD 61.09 billion by the end of 2023.

- Due to all such factors, the market for expanded polypropylene foam in the region is expected to have steady growth during the forecast period.

Expanded Polypropylene (EPP) Foam Industry Overview

The expanded polypropylene foam market is consolidated. Some of the major players in the market include BASF SE, JSP, Hanwha Solutions, BEWI (Izoblok), and Kaneka Corporation, among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Non-toxic and Recyclable Nature of the Material

- 4.1.2 Rising Demand from the Packaging Industry

- 4.2 Restraints

- 4.2.1 Declining Automobile Industry Through Previous Years

- 4.2.2 Higher Price Among Other Structural Foams

- 4.3 Industry Value Chain Analysis

- 4.4 Porter Five Forces

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Price Analysis

5 MARKET SEGMENTATION (Market Size by Revenue)

- 5.1 Raw Material

- 5.1.1 Synthetic Polypropylene

- 5.1.2 Bio-based Polypropylene

- 5.2 Foam

- 5.2.1 Fabricated EPP

- 5.2.2 Molded EPP

- 5.2.3 Other Foams

- 5.3 Application

- 5.3.1 Automotive

- 5.3.2 Dunnage

- 5.3.3 Furniture

- 5.3.4 Food Packaging

- 5.3.5 HVAC

- 5.3.6 Sports and Leisure

- 5.3.7 Other Applications

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 BEWi (IZOBLOK)

- 6.4.3 Clark Foam Products Corporation

- 6.4.4 Hanwha Solutions

- 6.4.5 JSP

- 6.4.6 K K Nag Pvt. Ltd

- 6.4.7 Kaneka Corporation

- 6.4.8 Knauf Industries

- 6.4.9 Polyfoam Australia Pty Ltd

- 6.4.10 Signode Industrial Group Llc

- 6.4.11 Sonoco Products Company

- 6.4.12 Woodbridge

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand for Bio-based Polypropylene Foam

- 7.2 Emergence as a Replacement for Other Products

- 7.3 Increasing Adoption Of Electric Vehicles