|

市場調查報告書

商品編碼

1686612

木器塗料-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Wood Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

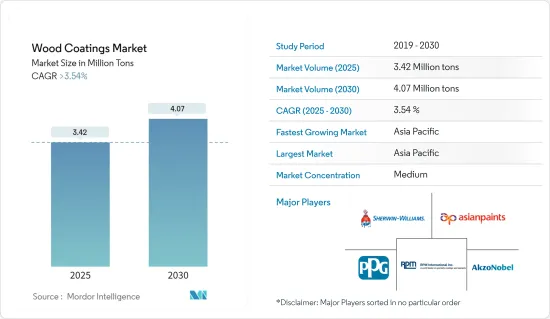

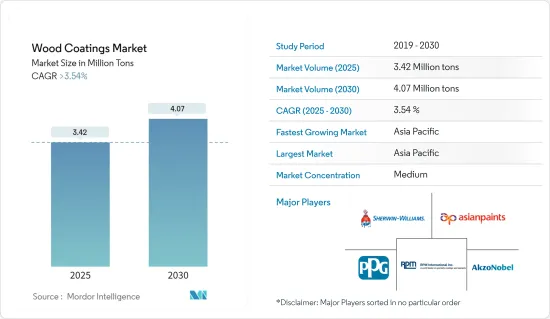

預計2025年木器塗料市場規模將達到342萬噸,2030年將達到407萬噸,預測期內(2025-2030年)的複合年成長率將超過3.54%。

由於新冠疫情,市場遭遇挫折。停工和限制導致製造設施和工廠關閉。供應鏈和運輸中斷帶來了額外的挑戰。儘管如此,2021年,該行業出現了顯著復甦,導致需求復甦。

主要亮點

- 短期內,家具產量增加以及室內設計和裝飾需求上升是推動受調查市場需求的關鍵因素。

- 然而,嚴格的環境法規預計會阻礙市場成長。

- 然而,對紫外線 (UV) 固化被覆劑的需求不斷增加預計將為市場創造新的機會。

- 預計亞太地區將主導全球市場,其中中國、印度和日本的需求將佔大部分市場。

木器塗料市場趨勢

家具領域佔市場主導地位

- 木材塗料是家具製造的重要組成部分,可以增加視覺吸引力並提供必要的保護。在家具業,木材塗料具有多種作用:增強美觀、防止日常磨損、防潮、防紫外線、提供多功能性並解決環境問題。

- 全球範圍內住宅建設的蓬勃發展、人口的成長和收入的提高,推動全球對木器塗料的需求激增。對椅子、桌子、床和櫥櫃等家具的需求不斷成長,推動了這項需求。

- 根據中國輕工業資訊中心的資料,中國家具產量預計將從2022年的119萬套增加到2023年的131萬套,推動市場成長。

- 在印度,家具租賃領域,尤其是辦公家具,在整個家具市場中佔有重要地位,預計到 2025 年將達到 130 億美元。這種動態支撐了印度家具領域對木器塗料日益成長的需求。

- 隨著可支配收入的增加和生活方式的改善,消費者越來越傾向於時尚、高品質的家具。這項變化將加強美國家具市場的國內銷售和出口。到2023年,美國將成為全球家具電子商務的領先者,預計銷售額將超過900億美元。

- 家具製造商正在活性化投資力度,市場需求預計將進一步擴大。值得注意的是,2023年4月,IKEA宣布將在未來三年內投資22億美元用於美國全通路成長策略。此策略包括開設新店、加強履約網路以改善配送,以及提供適合不同地區偏好的產品。

- 根據世界木材貿易網路的資料,2024 年第一季德國家具業出口下降。由於消費需求疲軟和住宅建設活動放緩影響了出口市場,出口額年減約 9% 至 20 億歐元(約 22 億美元)。

- 據森林經濟顧問有限責任公司稱,巴西木製家具出口額從 2023 年 5 月的 5,210 萬美元成長 5% 至 2024 年 5 月的 5,460 萬美元。

- 卡達商務和工業部報告稱,該國有 28 多家工廠生產各種家具,從木門到餐桌。 Almuftah Group、Al Rugaib Furniture、宜家和 HomeCenter 等主要參與者正在擴大生產能力並增加其在市場中的佔有率,從而推動所調查市場的成長。

- 例如,2024年6月,來自葡萄牙波爾圖的知名手工家具品牌LASKASAS計畫進軍卡達杜哈。過去三年,LASKASASS 在卡達的銷售額激增 70%,2023 年的銷售額達到 230 萬歐元(254 萬美元)。隨著品牌在中東的出口立足點牢固確立,在卡達首都開設工廠是經過深思熟慮的舉措。

- 這些不斷變化的動態有望推動全球家俱生產。鑑於木器塗料廣泛應用於家具產業,產量的增加將進一步加速木器塗料市場的成長。

亞太地區可望主導市場

- 亞太地區佔據全球市場的很大佔有率。中國是全球最大的家具產業基地,在國內和國際需求的共同推動下,家具產業正在快速成長。

- 中國家具業採用大工廠驅動模式,利用規模經濟推動大規模生產。市場競爭非常激烈,既有國內公司,也有國際公司。

- 雖然索菲亞、成都雙華實業公司、歐派家居和聯邦集團等國內主要企業佔據主導地位,但該行業的成長正在吸引國內外新參與企業。此外,中國是世界木製家具出口大國。

- 工業和資訊化部強調,中國家具業在2024年前幾個月呈現強勁復甦。中國主要家具製造商總營業收入達129.2億美元,年增14.9%。

- 印度家具市場是一個充滿活力的產業,對國內消費和出口有重大影響。根據「投資印度」的預測,它顯示出強勁的成長軌跡,從 2023 年到 2028 年的複合年成長率為 10.9%,到 2026 年達到 327 億美元。

- 由於住宅和商業領域的投資不斷增加以及政府的積極舉措,印度家具市場有望實現成長,並有望相應擴大木器塗料市場。

- 印度的住宅領域正在推動對木製家具的需求,其中餐具、桌子和椅子等產品的需求顯著成長,預計未來幾年還將持續成長。

- 印度政府在 2022-23 年聯邦預算中為「總理安居計畫」累計48,000 億印度盧比(約 58.4 億美元),強調其對「全民住宅」計畫的承諾,目標是在 2022-23 年建造 800 萬套經濟適用住宅。

- 日本的家居家具產業,包括客廳、餐廳、臥室和廚房家具,需求正在激增。這種不斷成長的需求是由建設活動的活性化、新建住宅數量的增加以及普通消費者可支配收入的增加所推動的。

- 根據國際貿易中心的資料,2023年菲律賓出口了4,606噸木門、框架和門檻,以及516噸木窗和框架落地窗,推動了市場成長。

- 此外,印度的多家家具製造商已做好策略性定位,以滿足日益成長的家具和櫥櫃應用需求,從而支持市場成長。例如

- 2023年12月,印度家具公司Stanley Group在印度古爾岡開設了旗艦店Stanley Next Level,展示其家居和廚房家具產品,包括廚房櫥櫃。

- 2023 年 11 月,中國廚房和家居佈置公司歐派家居集團在印度海得拉巴開設了一個佔地 372平方公尺的大型展示室。

- 鑑於這些動態,預計亞太地區將在預測期內保持主導地位。

木器塗料產業的細分

木器塗料市場部分分散。主要公司包括剪切機-Williams、Akzo Nobel NV、PPG Industries、RPM International 和 Asian Paints。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 家具產量增加

- 室內設計和裝飾的需求不斷增加

- 其他促進因素

- 限制因素

- 嚴格的環境法規

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 依樹脂類型

- 丙烯酸纖維

- 硝化纖維素

- 聚酯纖維

- 聚氨酯

- 其他樹脂類型

- 依技術

- 水

- 溶劑型

- UV固化型

- 粉末塗料

- 按應用

- 家具及設備

- 門窗

- 內閣

- 其他用途(包括地板、甲板和裝飾線條)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 土耳其

- 俄羅斯

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 卡達

- 阿拉伯聯合大公國

- 奈及利亞

- 埃及

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Akzo Nobel NV

- Asian Paints

- Axalta Coating Systems

- Benjamin Moore & Co.

- Ceramic Industrial Coatings

- Hempel AS

- Jotun

- Kansai Paint Co. Ltd

- KAPCI Coating

- MAS Paints

- National Paints Factories Co. Ltd

- Nippon Paint Holdings Co. Ltd

- PPG Industries Inc.

- Ritver

- RPM International Inc.

- Teknos Group

- Sherwin-Williams Company

第7章 市場機會與未來趨勢

- 紫外線固化塗料需求不斷成長

- 其他機會

The Wood Coatings Market size is estimated at 3.42 million tons in 2025, and is expected to reach 4.07 million tons by 2030, at a CAGR of greater than 3.54% during the forecast period (2025-2030).

The market faced setbacks due to the COVID-19 pandemic. Lockdowns and restrictions caused the closure of manufacturing facilities and plants. Disruptions in supply chains and transportation posed further challenges. Nevertheless, in 2021, the industry made a notable recovery, leading to a resurgence in demand.

Key Highlights

- Over the short term, increasing furniture production and escalating demand for interior design and decoration are the major factors driving the demand for the market studied.

- However, stringent environmental regulations are expected to hinder the market's growth.

- Nevertheless, the increasing demand for ultraviolet (UV)-cured coatings is expected to create new opportunities for the market studied.

- Asia-Pacific is expected to dominate the global market, with the majority of demand coming from China, India, and Japan.

Wood Coatings Market Trends

Furniture Segment to Dominate the Market

- Wood coatings are vital in furniture production, enhancing visual appeal and offering essential protective benefits. In the furniture industry, wood coatings serve multiple purposes: they boost aesthetic appeal, shield against daily wear, resist moisture, protect from UV rays, offer versatility, and address environmental concerns.

- Global demand for wood coatings is surging, owing to the booming construction of housing, the growing population, and the rising global incomes. The increasing need for furniture, including chairs, tables, beds, and cupboards, fuels this demand.

- As per the data from the China National Information Center of Light Industry, China's production volume for furniture reached 1.31 million pieces in 2023 from 1.19 million pieces in 2022, thereby augmenting the growth of the market studied.

- In India, the furniture rental sector, especially for office furnishings, commands a notable portion of the overall furniture market, projected to hit USD 13 billion by 2025. Such dynamics underscore the rising demand for wood coatings in India's furniture segment.

- With rising disposable incomes and improving lifestyles, consumers are gravitating toward stylish, high-quality furniture. This shift is set to enhance domestic sales and exports in the furniture market in the United States. In 2023, the United States was the global frontrunner in furniture e-commerce, amassing estimated revenues exceeding USD 90 billion.

- With furniture companies ramping up investments, the market's demand is primed for further escalation. Notably, in April 2023, IKEA announced a hefty USD 2.2 billion investment in its omnichannel growth strategy for the United States, spanning the next three years. This initiative includes opening new stores, bolstering the fulfillment network for enhanced delivery, and tailoring product offerings to suit diverse regional preferences.

- The data from the Global Wood Trade Network indicates that the German furniture industry saw a dip in exports in Q1 2024. Exports plummeted by nearly 9% to around EUR 2 billion (~USD 2.2 billion) compared to the same quarter last year, attributed to weak consumer demand and stagnating housing construction activities impacting export markets.

- According to Forest Economic Advisors LLC, Brazil's wooden furniture exports grew from USD 52.1 million in May 2023 to USD 54.6 million in May 2024, marking a 5% uptick.

- Qatar's Ministry of Commerce and Industry reported that the country boasts over 28 factories producing diverse furniture items, from wooden doors to dining tables. Major players like Almuftah Group, Al Rugaib Furniture, IKEA, and HomeCenter are expanding their capacities, bolstering their market presence, and driving the growth of the market under study.

- For instance, in June 2024, LASKASAS, a prominent hand-crafted furniture brand from Porto, Portugal, intended to broaden its footprint in Doha, Qatar. Over the last three years, LASKASAS experienced a notable 70% sales surge in Qatar, achieving a turnover of EUR 2.3 million (USD 2.54 million) in 2023. With the brand's established export foothold in the Middle East, launching a facility in Qatar's capital is a calculated strategy.

- These shifting dynamics are poised to boost global furniture production volumes. Given the prevalent use of wood coatings in the furniture industry, this production increase further accelerates the growth of the wood coatings market.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific commands a significant portion of the global market. China, home to the world's largest furniture industry, is witnessing a surge driven by domestic and international demand.

- China's furniture industry operates on a large-scale, factory-centric model, capitalizing on economies of scale to drive high-volume production. The market is fiercely competitive, hosting a mix of domestic and international players.

- Key domestic names like Suofeiya, Chengdu Shuanghau Industrial Company, Oppein Homes, and Landbond Group dominate, while the sector's growth is luring new entrants, both local and foreign. Moreover, China is a global leader in wooden furniture exports.

- The Chinese furniture industry showcased a robust recovery in the initial months of 2024, as highlighted by the Ministry of Industry and Information Technology. The collective operating revenue of the nation's major furniture manufacturers surged by 14.9% Y-o-Y, reaching USD 12.92 billion.

- India's furniture market is a dynamic industry that significantly impacts local consumption and exports. Projections from Invest in India indicate a robust growth trajectory, with a CAGR of 10.9% from 2023 to 2028, targeting a milestone of USD 32.7 billion by 2026.

- Boosted by rising investments in residential and commercial sectors and proactive government initiatives, India's furniture market is poised for growth, which is expected to subsequently uplift the wood coatings market.

- India's residential sector drives the demand for wooden furniture in the country, with items like dining sets, tables, and chairs witnessing a notable uptick, which is projected to maintain this momentum.

- Reinforcing this growth, the Indian government allocated a substantial INR 48,000 crore (~USD 5.84 billion) in its Union Budget 2022-23 for the 'PM Aawas Yojana' scheme, underscoring its commitment to the 'Housing for All' initiative, targeting 8 million affordable homes in FY 2022-23.

- Japan's home furniture sector, encompassing living, dining, bedroom, and kitchen furniture, is experiencing a surge in demand. This uptick is fueled by heightened construction activities, a rise in new housing units, and an increase in the average consumer's disposable income.

- Data from the International Trade Centre revealed that in 2023, the Philippines exported 4,606 tons of wooden doors, frames, and thresholds and 516 tons of wooden windows and French windows with their frames, bolstering the market's growth.

- Additionally, several furniture companies in India are strategically positioned to amplify demand for furniture and cabinet applications, thereby supporting the market's growth. For instance:

- In December 2023, Stanley Group, an India-based furniture company, inaugurated its flagship store, Stanley Next Level, in Gurugram, India, showcasing a range of home and kitchen furnishing products, including kitchen cupboards.

- In November 2023, Oppein Home Group Inc., a China-based kitchen and home-furnishing company, celebrated the launch of its expansive 372 sq. m showroom in Hyderabad, India, prominently featuring products like kitchen closets.

- Considering these dynamics, Asia-Pacific is set to uphold its market dominance throughout the forecast period.

Wood Coatings Industry Segmentation

The wood coatings market is partially fragmented in nature. The major players include Sherwin-Williams Company, Akzo Nobel NV, PPG Industries Inc., RPM International Inc., and Asian Paints.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Furniture Production

- 4.1.2 Escalating Demand for Interior Design and Decoration

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Environmental Regulations

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Resin Type

- 5.1.1 Acrylic

- 5.1.2 Nitrocellulose

- 5.1.3 Polyester

- 5.1.4 Polyurethane

- 5.1.5 Other Resin Types

- 5.2 By Technology

- 5.2.1 Water-borne

- 5.2.2 Solven-borne

- 5.2.3 UV-cured

- 5.2.4 Powder Coatings

- 5.3 By Application

- 5.3.1 Furniture and Fixtures

- 5.3.2 Doors and Windows

- 5.3.3 Cabinets

- 5.3.4 Other Applications (including Floors, Decks, and Molding Products)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 NORDIC Countries

- 5.4.3.7 Turkey

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 Qatar

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Nigeria

- 5.4.5.5 Egypt

- 5.4.5.6 South Africa

- 5.4.5.7 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Akzo Nobel NV

- 6.4.2 Asian Paints

- 6.4.3 Axalta Coating Systems

- 6.4.4 Benjamin Moore & Co.

- 6.4.5 Ceramic Industrial Coatings

- 6.4.6 Hempel AS

- 6.4.7 Jotun

- 6.4.8 Kansai Paint Co. Ltd

- 6.4.9 KAPCI Coating

- 6.4.10 MAS Paints

- 6.4.11 National Paints Factories Co. Ltd

- 6.4.12 Nippon Paint Holdings Co. Ltd

- 6.4.13 PPG Industries Inc.

- 6.4.14 Ritver

- 6.4.15 RPM International Inc.

- 6.4.16 Teknos Group

- 6.4.17 Sherwin-Williams Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand for UV-cured Coatings

- 7.2 Other Opportunities