|

市場調查報告書

商品編碼

1686574

指紋感測器:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)Fingerprint Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

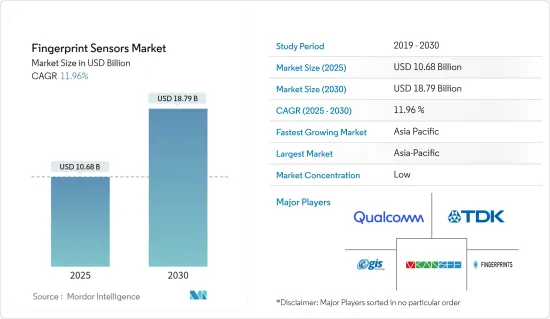

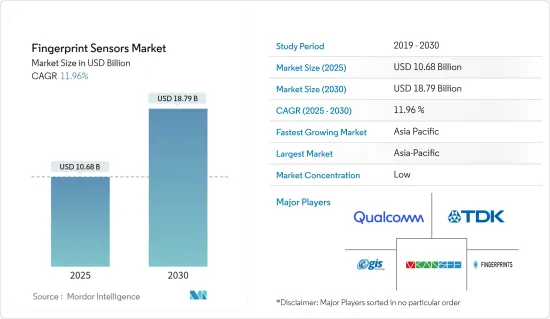

指紋感應器市場規模預計在 2025 年達到 106.8 億美元,預計到 2030 年將達到 187.9 億美元,預測期內(2025-2030 年)的複合年成長率為 11.96%。

指紋感應器市場在過去幾年中迅速擴張,預計在預測期內將進一步成長。智慧型手機的普及率不斷提高、安全應用程式的數量不斷增加以及政府採取生物識別的舉措是推動全球指紋感測器需求的主要趨勢。

主要亮點

- 指紋是各種設備和應用領域使用的主要生物識別類型之一,因此對指紋感應器的需求不斷增加。此外,根據生物特徵識別研究所進行的一項調查,人們對人工智慧 (AI) 的興趣成長了一倍多,從 2022 年的 8% 成長到 2023 年的 19%。短期內,人工智慧也有望超越數位身份,成為生物識別最重要的發展。

- 配備指紋感應器的智慧型手機日益普及是市場的主要驅動力之一。例如,根據 GSMA 報導,預計 2022 年全球智慧型手機普及率將達到 68%,這是自 2018 年以來的首次成長。這是基於全球整體約 63 億智慧型手機用戶和約 74 億全球人口。

- 因此,預計未來幾年人均智慧型裝置數量(包括平板電腦、筆記型電腦、智慧型手機和智慧型穿戴裝置)將會增加。這些設備擴大配備指紋感應器。

- 由於高速網路存取的影響力日益增強,智慧型手機的普及率呈指數級成長。隨著5G的到來,智慧型手機的普及率預計將進一步提高。根據GSMA預測,到2025年,北美智慧型手機用戶數量預計將達到3.28億。

- 此外,到 2025 年,該地區的行動用戶(86%)和網路普及率(80%)可能會增加。根據 GSMA 預測,到 2025 年,歐洲的網路普及率(82%)和智慧型手機普及率(88%)將位居世界第一。

- 臉部辨識系統擴大被安裝在各種設備中。例如,蘋果、三星、一加等主要智慧型手機廠商已經採用了這種用戶身份驗證。然而,此類替代技術的日益普及可能會阻礙指紋感測器市場的成長。

指紋感應器市場趨勢

預計智慧型手機將佔據應用領域的很大佔有率

- 在本研究中考慮的所有其他設備中,智慧型手機是利用指紋感應器進行用戶身份驗證的最大應用。東芝於 2011 年率先將指紋感應器應用於智慧型手機,但蘋果的 Touch ID 徹底改變了行動裝置上的指紋感應器。

- Apple 的 Touch ID 基於電容式技術,這使得它準確且易於使用,可以快速、流暢地進行用戶身份驗證。繼蘋果取得成功後,三星和其他大公司也開始使用不同的指紋技術進行身份驗證。

- 在技術方面,高階手機中的電容式觸控螢幕感應器正在被超音波指紋感應器和其他設備中的光學感應器所取代。放棄電容式感測器是由於將感測器整合到顯示器中的需求不斷增加。

- 另一方面,平板電腦使用電容式感應器,許多小型製造商選擇不在其平板電腦中安裝指紋感應器,以保留邊框。然而,三星、聯想和華碩等公司正在其平板電腦中使用電容式感測器。

- 智慧型手機的日益普及預計將在受調查的市場創造更多商機。例如,根據愛立信2023年6月行動報告,2023年新契約數將超過67.1億。

亞太地區將經歷最高成長

- 中國移動交易量的不斷成長,加上政府的舉措,預計將成為該國指紋感測器市場的主要推動力。中國正經歷大量的行動交易,預計將創造巨大的市場潛力。

- 根據中國網際網路絡資訊中心(CNNIC)的數據,截至2023年6月,中國約有9.4319億人使用行動付款。行動付款交易的激增導致對各種指紋感應器的需求增加。

- 這家日本汽車公司正積極期待在即將推出的車型中加入指紋感應器。例如,日產推出了一款概念車 Nissan Xmotion,該車採用指紋生物識別,增強了車輛的安全性。

- 由於生物辨識支付卡的需求不斷增加,指紋感應器在韓國的需求量龐大,生物識別付款卡市場十分強勁。目前,各個供應商正致力於整合生物識別技術。這些供應商將提供真正顛覆性的產品,從而顯著擴大該國的銀行基本客群、各類終端用戶及其他用戶群。

指紋感應器產業概況

指紋感應器市場較為分散,高通、Fingerprint Card AB 和 Synaptics 等個別國際公司透過在一系列智慧型手機中部署其解決方案控制著相當大的市場佔有率。指紋感應器公司正在探索智慧型手機以外的新市場,進軍物聯網領域並將指紋感應器整合到智慧卡中。這些公司不斷採用不同的技術來改善最終用戶體驗。

- 2023年4月,UIDAI與印度理工學院孟買分校合作開發行動電話非接觸式指紋採集軟體。兩家公司計劃開發結合活體檢測的非接觸式指紋採集技術,以支援透過臉部以外的方式進行生物識別認證。該系統可同時捕捉多個手指以實現最高準確度,並計劃與更大的 Aadhaar 生態系統整合。

- 2023 年 2 月,德國公司 IDloop 開發了一種具有微觀解析度的非接觸式 3D 指紋掃描器。該公司將這種新的生物辨識技術推廣到可以快速將指紋與政府資料庫中現有的 30 億人的資料庫進行比對,這些資料庫是透過接觸式掃描器收集的。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 買家的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 競爭程度

- 替代品的威脅

- 產業價值鏈分析

- 評估主要宏觀經濟趨勢的市場影響

第5章市場動態

- 市場促進因素

- 指紋感應器在智慧型穿戴裝置和智慧型手機的應用日益增多

- 安全保障和商業用途的需求

- 政府計劃在多個領域採用生物識別

- 市場限制

- 擴大採用臉部和虹膜掃描等替代技術

第6章市場區隔

- 按類型

- 光學的

- 電容式

- 熱的

- 超音波

- 按應用

- 智慧型手機/平板電腦

- 筆記型電腦

- 智慧卡

- 物聯網及其他應用

- 按最終用戶產業

- 軍事和國防

- 家電

- BFSI

- 政府

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 亞洲

- 中國

- 日本

- 印度

- 韓國

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

- 北美洲

第7章競爭格局

- 公司簡介

- Qualcomm Technologies Inc.

- TDK Corporation

- Vkansee Technology Inc.

- Egis Technology Inc.

- Fingerprint Cards AB

- Shenzhen Goodix Technology Co. Ltd

- Idex Biometrics ASA

- NEC Corporation

- Next Biometrics Group ASA

- Synaptics Inc.

- Thales Group(Gemalto NV)

- Idemia France SAS

- Crucialtec Co. Ltd

- Sonavation Inc.

第8章投資分析

第9章:市場的未來

The Fingerprint Sensors Market size is estimated at USD 10.68 billion in 2025, and is expected to reach USD 18.79 billion by 2030, at a CAGR of 11.96% during the forecast period (2025-2030).

The fingerprint sensors market has expanded rapidly over the past few years and is projected to increase even further during the forecast period. Increased adoption of smartphones, increasing security applications, and government initiatives to adopt biometrics tend to be the key factors driving the demand for fingerprint sensors globally.

Key Highlights

- The fingerprint is among the prominent types of biometrics used in various devices and application fields, leading to the rise in demand for fingerprint sensors. Moreover, according to the survey carried out by the Biometrics Institute, interest in artificial intelligence (AI) more than doubled from 8% in 2022 to 19% in 2023. In the short term, AI is also expected to surpass digital identity as the most significant development in biometrics.

- The growing penetration of smartphones equipped with fingerprint sensors is among the prominent drivers of the market studied. For instance, as reported by GSMA, the global smartphone penetration rate was estimated at 68% in 2022, up for the first time since 2018. This is based on an estimated 6.3 billion smartphone subscriptions globally and a worldwide population of around 7.4 billion.

- In line with that, the number of intelligent devices, such as tablets, laptops, smartphones, and smart wearables per person, is expected to increase over the coming years. These devices are increasingly being incorporated with fingerprint sensors.

- Smartphone penetration is increasing exponentially, owing to the increasing influence of fast internet access. With the advent of 5G, smartphone penetration is expected to increase even further. According to GSMA, the number of smartphone subscribers in North America is expected to reach 328 million by 2025.

- Moreover, by 2025, the region may witness an increase in the penetration rates of mobile subscribers (86%) and the internet (80%). According to GSMA, by 2025, Europe is estimated to register the highest internet penetration rate (82%) and smartphones (88%).

- Facial recognition systems are becoming increasingly common in various devices. For instance, major smartphone vendors, such as Apple, Samsung, and OnePlus, have already incorporated this user authentication. However, this increase in the adoption of substitute technology can hamper the growth of the fingerprint sensors market.

Fingerprint Sensors Market Trends

Smartphones Under the Application Segment is Expected to Hold a Major Share

- Smartphones are the largest application to utilize fingerprint sensors for user authentication among all the other devices considered in the study. Toshiba's earliest application of fingerprint sensors in smartphones was in 2011, but Apple Touch ID revolutionized fingerprint sensors in mobile devices.

- Apple's Touch ID, based on capacitive technology, was accurate and easy to use, making user authentication fast and smooth. After Apple's success, Samsung and other major players also started using different fingerprint technologies for authentication.

- Regarding technology, the capacitive touchscreen sensors are being replaced by ultrasonic fingerprint sensors in premium phones and optical sensors in the rest of the devices. The shift from capacitive sensors has been due to the growing demand to integrate sensors in the display.

- On the other hand, tablets have been using capacitive sensors, and many small manufacturers have opted not to use fingerprint sensors on their tablets to keep the bezels. However, companies like Samsung, Lenovo, and Asus have used capacitive sensors in their tablets.

- The increasing penetration of smartphones is expected to create more opportunities in the market studied. For instance, Ericsson Mobility Report June 2023 showed more than 6.71 billion new smartphone subscriptions in 2023.

Asia-Pacific to Witness Highest Growth

- Increasing mobile transactions in China, coupled with the government's initiatives, are expected to be the major drivers for the fingerprint sensor market in the country. China is witnessing a high volume of mobile transactions, which is expected to create a potential for the market studied.

- According to the China Internet Network Information Center (CNNIC), as of June 2023, around 943.19 million people used mobile payments in China. This upsurge in mobile payment transactions increases the need for various fingerprint sensors.

- Japanese automotive companies are actively looking forward to integrating fingerprint sensors in their upcoming models. For instance, Nissan introduced its concept car, Nissan Xmotion, which features fingerprint biometric authentication for enhanced vehicle security.

- Fingerprint sensors are witnessing significant demand in South Korea due to the increasing demand for biometric payment cards, which have a robust market. Various market vendors are currently working to integrate biometric technology. They will have a genuinely disruptive offering that will significantly expand the country's banking customer base, various end-users, and beyond.

Fingerprint Sensors Industry Overview

The fingerprint sensor market is fragmented, with individual international companies such as Qualcomm, Fingerprint Card AB, and Synaptics occupying a significant market share by deploying their solutions in various smartphones. Fingerprint sensor firms are unlocking new markets beyond smartphones, exploring the IoT field, and integrating fingerprint sensors into smart cards. They are constantly incorporating different technologies to enhance the end-user experiences.

- In April 2023, UIDAI partnered with IIT Bombay to develop contactless fingerprint capture software for phones. The partners plan to develop touchless fingerprint capture technology with built-in liveness detection to support biometric authentication with a modality other than face. The system will capture multiple fingers simultaneously to maximize accuracy and is planned for integration with the larger Aadhaar ecosystem.

- In February 2023, IDloop, a Germany-based company, developed a contactless 3D fingerprint scanner with microscopic resolution. The company pitched its new biometric technology as a way to quickly compare fingerprints against existing databases collected with contact-based scanners, such as the three billion people already registered in government databases.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Degree of Competition

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of Key Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Usage of Fingerprint Sensors for Smart Wearable Devices and Smartphones

- 5.1.2 Need for Secured Security and Business Applications

- 5.1.3 Government Initiatives to Adopt Biometrics in Various Fields

- 5.2 Market Restraints

- 5.2.1 Increase in Adoption of Substitute Technologies, such as Face and Iris Scanning

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Optical

- 6.1.2 Capacitive

- 6.1.3 Thermal

- 6.1.4 Ultrasonic

- 6.2 By Application

- 6.2.1 Smartphones/Tablets

- 6.2.2 Laptops

- 6.2.3 Smartcards

- 6.2.4 IoT and Other Applications

- 6.3 By End-user Industries

- 6.3.1 Military and Defense

- 6.3.2 Consumer Electronics

- 6.3.3 BFSI

- 6.3.4 Government

- 6.3.5 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 France

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 South Korea

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Qualcomm Technologies Inc.

- 7.1.2 TDK Corporation

- 7.1.3 Vkansee Technology Inc.

- 7.1.4 Egis Technology Inc.

- 7.1.5 Fingerprint Cards AB

- 7.1.6 Shenzhen Goodix Technology Co. Ltd

- 7.1.7 Idex Biometrics ASA

- 7.1.8 NEC Corporation

- 7.1.9 Next Biometrics Group ASA

- 7.1.10 Synaptics Inc.

- 7.1.11 Thales Group (Gemalto NV)

- 7.1.12 Idemia France SAS

- 7.1.13 Crucialtec Co. Ltd

- 7.1.14 Sonavation Inc.