|

市場調查報告書

商品編碼

1685941

鈧-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Scandium - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

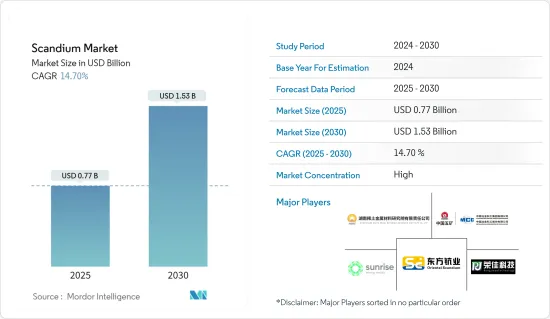

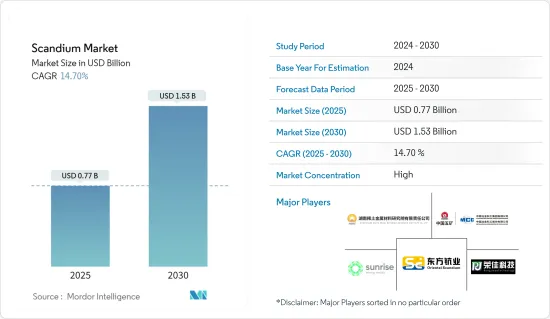

預計 2025 年鈧市場規模為 7.7 億美元,到 2030 年將達到 15.3 億美元,預測期內(2025-2030 年)的複合年成長率為 14.7%。

主要亮點

- 新冠疫情對鈧市場產生了負面影響。封鎖導致航太、國防、陶瓷和電子等主要終端用戶部門停工,減少了鈧的使用量。然而,疫情過後,隨著主要終端用戶領域的活動持續進行,市場穩定擴張。

- 短期內,固體氧化物燃料電池(SOFCS)的使用量增加以及航太和國防工業對鋁鈧合金的需求增加是推動研究市場發展的因素。

- 然而,高昂的鈧價可能會阻礙 2024 年至 2029 年的市場成長。

- 汽車產業的潛在應用和儲能技術的發展可能會在未來幾年為市場提供機會。

- 預計中國將主導市場,其次是歐盟,預計歐盟將在 2024 年至 2029 年期間實現最高的複合年成長率。

鈧市場趨勢

固體氧化物燃料電池(SOFC)領域預計將佔據市場主導地位

- SOFC 使用固體氧化物材料來幫助負氧離子從陰極移動到陽極。在這些電池中,陽極和陰極由覆蓋電解質的特殊油墨製成。因此,SOFC 不需要貴金屬、腐蝕性酸或熔融材料。

- 電解質材料暴露在高溫下作為催化劑,將天然氣轉化為能量。然而,催化轉化過程的高溫會導致陶瓷電解質快速劣化,增加資本和維護成本。

- 固體電解質中使用鈧可以使系統在比傳統 SOFC 低得多的溫度下運作。因此,鈧的使用有助於降低SOFC的成本,使其更容易在許多地方用於發電。

- 隨著電費上漲以及人們尋求以更環保的方式發電,這將為 SOFC 創造許多市場機會,並使鈧變得更加重要。

- 由於人們對煤炭和天然氣等傳統能源來源的環境擔憂日益加劇,固體氧化物燃料電池未來的需求可能會增加。

- 預計未來推動固體氧化物燃料電池需求成長的將是清潔能源需求的不斷成長,而不是對煤炭和天然氣等傳統能源來源發電的環境擔憂。固體氧化物燃料電池效率高,具有環境和經濟效益。固體氧化物燃料電池的電效率高達60%。這意味著燃料中儲存的60%的能量被轉化為有用的電能。這比燃煤發電廠效率高得多。

- 此外,根據美國能源資訊署的數據,2023年能源投資將達到約2.8兆美元,其中1.7兆美元將用於清潔能源,包括可再生、核能、電網、儲能、低排放燃料、效率改進、終端用途可再生和電氣化。

- 此外,根據美國能源局的數據,到2030年,來自清潔能源的電力比例可能會擴大到80%,幾乎是《通膨控制法案》通過前預測的兩倍。

- 此外,SOFC 市場的各種擴張也刺激了對鈧的需求。例如:

- HD Hyundai 於 2023 年 10 月宣布將向愛沙尼亞固體氧化物燃料電池公司 Elcogen 投資 4,500 萬歐元(4,760 萬美元)。透過這項新投資,兩家公司將專注於基於 Elcogen 專有的固體氧化物燃料電池 (SOFC) 的船舶推進系統和固定發電,以及基於 Elcogen 的固體氧化物電解槽(SOEC) 技術的綠色氫氣生產。

- 2023 年 8 月,固體氧化物燃料電池製造商 Bloom Energy 與台灣著名晶片基板和印刷基板(PCB) 製造商欣興科技股份有限公司達成協議,成功完成了突破性的 10 兆瓦 (MW)固體氧化物燃料電池的初始安裝。

- 固體氧化物燃料電池市場對鈧的需求在不久的將來可能會大幅增加。

中國可望主導市場

- 中國的鈧是鈦、鐵礦石和鋯等其他材料的副產品。目前,中國鈧產量的60-70%以上用於鈦製品。中國也利用顏料廠二氧化鈦(TiO2)浸出液的殘留物來生產大量的鈧,例如中國攀枝花的磁鐵釩鐵礦等鈦礦石,其濃度達到 0.04%。

- 在全球範圍內,鈧的主要來源是鈮-稀土-稀土元素(Nb-FREE-Fe),它是世界上最大的稀土元素資源,也是第二大鈧資源。該礦位於中國內蒙古,約佔全球鈧產量的90%。在白雲鄂博,人們除了開採其他稀土和鐵礦產品外,還開採出了鈧。

- 隨著中國政府在低碳經濟轉型過程中越來越重視利用清潔能源技術,燃料電池市場潛力巨大。過去幾年,中國政府非常重視燃料電池汽車在國內的部署,將公眾支持的重點從純電動車略微轉向了燃料電池電動車。中國政府為每輛車提供50萬元人民幣(7.3萬美元)的補貼。

- 此外,中國政府已宣布計劃到2025年支持約5萬輛零排放燃料電池汽車,到2030年迅速擴大到100萬輛FCEV,這為該國的SOFC和鈧市場提供了機會。

- 中國是最大的飛機製造國之一,也是最大的國內航空客運市場之一。此外,該國的飛機零件和組裝製造業正在快速發展,擁有超過 200 家小型飛機零件製造商。此外,中國政府正大力投資擴大國內製造能力。

- 中國是全球最大的電子產品製造基地。中國正積極生產智慧型手機、電視、電線電纜、可攜式電腦、遊戲系統和其他個人電子設備等電子產品。中國經濟發展、人民生活水準不斷提高,帶動家電需求成長。智慧型手機、OLED電視和平板電腦等電子產品是家用電子電器市場中成長最快的需求部分。預計到 2025 年收益將以每年 2.04% 的速度成長。

- 因此,預計上述因素將影響研究市場的需求。

鈧行業概況

鈧市場本質上是整合的。市場的主要企業包括湖南稀土元素材料研究院、中冶集團、新升能源金屬有限公司、湖南東方鈧業、河南榮嘉鈧釩科技有限公司。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 固體氧化物燃料電池(SOFCS)的應用日益廣泛

- 航太和國防工業對鋁鈧合金的需求不斷增加

- 限制因素

- 鈧的高成本

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 定價分析

- 環境影響分析

第5章市場區隔

- 產品類型

- 氧化物

- 氟化物

- 氯化物

- 硝酸鹽

- 碘化物

- 合金

- 碳酸鹽和其他產品類型

- 最終用戶產業

- 航太與國防

- 固體氧化物燃料電池

- 陶瓷

- 照明

- 電子產品

- 3D列印

- 體育用品

- 其他最終用戶產業

- 地區

- 生產分析

- 中國

- 俄羅斯

- 菲律賓

- 世界其他地區

- 消費分析

- 美國

- 中國

- 俄羅斯

- 日本

- 巴西

- 歐洲聯盟

- 世界其他地區

- 生產分析

第6章競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Guangxi Maoxin Technology Co. Ltd

- Henan Rongjia Scandium Vanadium Technology Co. Ltd

- Huizhou Top Metal Materials Co. Ltd

- Hunan Rare Earth Metal Materials Research Institute Co. Ltd

- Hunan Oriental Scandium Co. Ltd

- JSC Dalur

- MCC Group

- NioCorp Development Ltd

- Rio Tinto

- Rusal

- Scandium International Mining Corporation

- Stanford Advanced Materials

- Sumitomo Metal Mining Co. Ltd(Taganito HPAL nickel Corp.)

- Sunrise Energy Metals Limited

- Treibacher Industrie AG

第7章 市場機會與未來趨勢

- 汽車產業的潛在應用

- 不斷發展的能源儲存技術

簡介目錄

Product Code: 49669

The Scandium Market size is estimated at USD 0.77 billion in 2025, and is expected to reach USD 1.53 billion by 2030, at a CAGR of 14.7% during the forecast period (2025-2030).

Key Highlights

- The COVID-19 pandemic negatively impacted the scandium market. Due to the lockdown, major end-user segments such as aerospace and defense, ceramics, and electronics were suspended, reducing the usage of scandium. However, post-pandemic, the market expanded steadily because of the continued activities in major end-user segments.

- In the short term, increasing usage in solid oxide fuel cells (SOFCS) and increasing demand for aluminum-scandium alloys in the aerospace and defense industry are the factors driving the studied market.

- However, the high price of scandium may hinder the growth of the studied market between 2024 and 2029.

- Potential applications in the automotive industry and growing technology for storing energy are likely to give the market opportunities in the coming years.

- China is expected to dominate the market, and the European Union is expected to see the highest CAGR between 2024 and 2029.

Scandium Market Trends

The Solid Oxide Fuel Cells (SOFCs) Segment is Expected to Dominate the Market

- SOFCs use a solid oxide material called an electrolyte, which helps move negative oxygen ions from the cathode to the anode. In these cells, anodes and cathodes are made from special inks that cover the electrolyte. Therefore, SOFCs do not require any precious metal, corrosive acids, or molten material.

- Electrolyte materials are subjected to high temperatures to catalyze natural gas conversion to energy. However, the high temperature for the catalyzing conversion process can lead to the quick degradation of ceramic electrolytes, adding to the capital and maintenance costs.

- Using scandium in solid electrolytes helps the system work at much lower temperatures than traditional SOFCs. So, the use of scandium helped lower the cost of SOFCs, which made them easier to use for power generation in many places.

- As electricity prices go up, people will need to use more environmentally friendly ways to make power, which is likely to create many market opportunities for SOFCs and make scandium even more important.

- Due to growing environmental concerns regarding traditional energy sources like coal and natural gas, solid oxide fuel cells are likely to see increased demand in the future.

- The increasing demand for clean energy over environmental concerns of energy generation from conventional sources, such as coal and natural gas, is expected to drive the demand for solid oxide fuel cells in the future. Solid oxide fuel cells offer high efficiency and deliver environmental and financial benefits. The electrical efficiency of solid oxide fuel cells reaches up to 60%. This means 60% of the energy stored in the fuel is converted to useful electrical energy. This is much higher than the efficiency of coal power plants.

- Furthermore, according to the Energy Information Administration, around USD 2.8 trillion was invested in energy in 2023, out of which USD 1.7 trillion was used for clean energy, including renewable power, nuclear, grids, storage, low-emission fuels, efficiency improvements, and end-use renewables and electrification.

- In addition, according to the US Department of Energy, the share of electricity from clean sources in 2030 could grow to 80%, nearly twice the expected amount before the Inflation Reduction Act passed.

- Furthermore, various expansions in the SOFC market are fueling the demand for scandium. For instance:

- In October 2023, HD Hyundai announced an investment of EUR 45 million (USD 47.6 million) in Estonian solid oxide fuel cell firm Elcogen. With the new investment, the two companies intend to focus on marine propulsion systems and stationary power generation based on Elcogen's proprietary solid oxide fuel cell (SOFC) and green hydrogen production based around Elcogen's solid oxide electrolyzer cell (SOEC) technology.

- In August 2023, Bloom Energy, a manufacturer of solid oxide fuel cells, successfully installed the initial phase of a groundbreaking 10-megawatt (MW) solid oxide fuel cell contract with Unimicron Technology Corp., a prominent chip substrate and printed circuit board (PCB) manufacturer in Taiwan.

- The solid oxide fuel cell market is likely to witness a big increase in demand for scandium in the near future.

China is Expected to Dominate the Market

- Scandium in China is produced as a by-product of other materials such as titanium, iron ore, and zirconium. Nowadays, more than 60-70 % of the scandium production in China is as titanium by-products. The sizeable chuck of scandium in the country is also produced by exploiting the residue from titanium dioxide (TiO2) leach streams in pigment plants such as titanium ore like magnetovana-ilmenite located in Panzhihua, China, at a concentration as high as 0.04%.

- Globally, the principal source of scandium is niobium-rare earth element-iron (Nb-REE-Fe), the world's largest REE resource and second largest resource of scandium. It is located in Inner Mongolia, China, and accounts for approximately 90% of global scandium production. In Bayan Obo, scandium is regenerated as a by-product of the mining of the other REEs and iron.

- China has great potential in the fuel cell market as the government increasingly focuses on utilizing clean energy technology to switch to a low-carbon economy. For the past 2-3 years, the Chinese government put great emphasis on the roll-out of fuel cell mobility in the country, shifting the public support focus slightly away from BEV to FCEV. The national government offers CNY 500,000 (USD 73 thousand) as a subsidy for each vehicle.

- Furthermore, the Chinese government announced plans to support around 50,000 zero-emissions fuel cell vehicles by 2025, with plans to rapidly expand to 1 million FCEVs in service by 2030, providing opportunities to SOFCs and the scandium market in the country.

- China is one of the largest aircraft manufacturers and one of the largest markets for domestic air passengers. Moreover, the country's aircraft parts and assembly manufacturing sector has been growing rapidly, with the presence of over 200 small aircraft parts manufacturers. Also, the Chinese government is investing heavily in increasing its domestic manufacturing capacities.

- China is the largest base for electronics production in the world. China is actively engaged in manufacturing electronic products, such as smartphones, TVs, wires, cables, portable computing devices, gaming systems, and other personal electronic devices. Economic development in China and improving living standards among the population drive consumer electronics demand. Electronic products, such as smartphones, OLED TVs, and tablets, have the highest growth rates in the consumer electronics segment of the market in terms of demand. The revenue is expected to show an annual growth rate of 2.04% by 2025.

- Therefore, the above-mentioned factors are expected to impact the demand for the studied market.

Scandium Industry Overview

The scandium market is consolidated in nature. Some of the major players in the market are Hunan Institute of Rare Earth Metal Materials, MCC Group, Sunrise Energy Metals Limited, Hunan Oriental Scandium Co. Ltd, and Henan Rongjia Scandium Vanadium Technology Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Usage in Solid Oxide Fuel Cells (SOFCS)

- 4.1.2 Increasing Demand for Aluminum-Scandium Alloys in the Aerospace and Defense Industry

- 4.2 Restraints

- 4.2.1 High Cost of Scandium

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Price Analysis

- 4.6 Environmental Impact Analysis

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Oxide

- 5.1.2 Fluoride

- 5.1.3 Chloride

- 5.1.4 Nitrate

- 5.1.5 Iodide

- 5.1.6 Alloy

- 5.1.7 Carbonate and Other Product Types

- 5.2 End-user Industry

- 5.2.1 Aerospace and Defense

- 5.2.2 Solid Oxide Fuel Cells

- 5.2.3 Ceramics

- 5.2.4 Lighting

- 5.2.5 Electronics

- 5.2.6 3D Printing

- 5.2.7 Sporting Goods

- 5.2.8 Other End-user Industries

- 5.3 Geography

- 5.3.1 Production Analysis

- 5.3.1.1 China

- 5.3.1.2 Russia

- 5.3.1.3 Philippines

- 5.3.1.4 Rest of the World

- 5.3.2 Consumption Analysis

- 5.3.2.1 United States

- 5.3.2.2 China

- 5.3.2.3 Russia

- 5.3.2.4 Japan

- 5.3.2.5 Brazil

- 5.3.2.6 European Union

- 5.3.2.7 Rest of the World

- 5.3.1 Production Analysis

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) **/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Guangxi Maoxin Technology Co. Ltd

- 6.4.2 Henan Rongjia Scandium Vanadium Technology Co. Ltd

- 6.4.3 Huizhou Top Metal Materials Co. Ltd

- 6.4.4 Hunan Rare Earth Metal Materials Research Institute Co. Ltd

- 6.4.5 Hunan Oriental Scandium Co. Ltd

- 6.4.6 JSC Dalur

- 6.4.7 MCC Group

- 6.4.8 NioCorp Development Ltd

- 6.4.9 Rio Tinto

- 6.4.10 Rusal

- 6.4.11 Scandium International Mining Corporation

- 6.4.12 Stanford Advanced Materials

- 6.4.13 Sumitomo Metal Mining Co. Ltd (Taganito HPAL nickel Corp.)

- 6.4.14 Sunrise Energy Metals Limited

- 6.4.15 Treibacher Industrie AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Potential Applications in the Automotive industry

- 7.2 Growing Technology for Storing Energy

02-2729-4219

+886-2-2729-4219