|

市場調查報告書

商品編碼

1685888

工業澱粉:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Industrial Starches - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

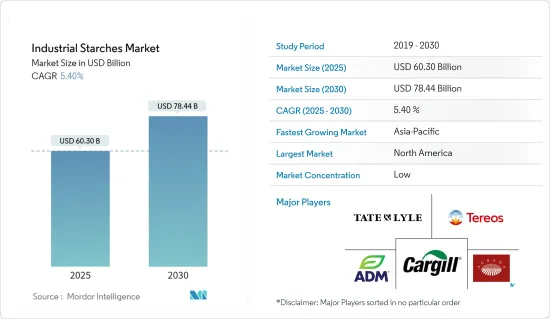

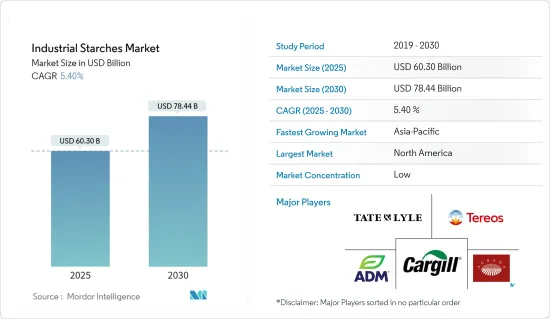

工業澱粉市場規模在 2025 年預計為 603 億美元,預計到 2030 年將達到 784.4 億美元,預測期內(2025-2030 年)的複合年成長率為 5.4%。

澱粉是從農業原料中提取的碳水化合物,具有許多常見的食品和非食品應用。工業澱粉來自多種來源,包括玉米、馬鈴薯和小麥。隨著全球經濟逐漸好轉,加工食品和簡便食品的攝取量增加,在這些食品應用中具有廣泛應用的工業澱粉市場需求正在增加,從而帶動整體市場的發展。

隨著食品工業的快速發展,對改性澱粉的需求也日益增加。改性澱粉為各種食品提供許多功能性益處,包括烘焙食品、點心、食品和飲料以及營養產品。目前,市面上有各種類型的澱粉,並以原料澱粉、改性澱粉、麥芽糊精、澱粉基糖等形式進行研究。這些澱粉的用途十分廣泛,主要用於飲料和糖果零食行業,以及製藥和發酵行業,並推動市場的發展。

工業澱粉市場趨勢

玉米作為工業澱粉的潛在來源

玉米澱粉因其質地特性而備受青睞,尤其是作為乳製品和飲料等行業的增稠劑。這種成分在無麩質產品的開發中也具有優勢。對於小麥澱粉來說,這是一個挑戰,因為在萃取過程中可能會殘留一些痕跡。清潔標籤成分和產品趨勢對全球食品和飲料產業產生重大影響。此外,食品加工產業的快速擴張為原料製造商採取策略措施滿足日益成長的需求提供了巨大的機會。在非食品應用方面,造紙業利用玉米粉作為填充物和上漿材料。它還可應用於紡織、洗衣、鑄造、氣浮和黏合劑行業。玉米粉在各行業的廣泛應用推動了市場的成長。

北美佔工業澱粉市場主要佔有率

北美食品工業高度發達,原料使用範圍廣泛,在區域工業澱粉市場中佔據領先地位。在全球範圍內,美國是最大的玉米生產國,2021-2022年產量為3.8394億噸,用於包括澱粉生產在內的多種用途。在政府對無麩質成分產品標籤的嚴格監管下,市場嚴重傾向於無麩質食品的消費。因此,在美國,大多數改性食品澱粉都不含麩質,並且來自玉米、糯玉米和馬鈴薯。因此,小麥澱粉的市場佔有率較低。由於消費者對更健康、更清潔成分的需求不斷增加,加拿大的工業澱粉市場正在快速成長。淺色且具有微妙風味的應用尤其推動了該國對傳統澱粉的需求。當地製造商在加工食品中使用它,幫助他們保持產品的吸引力。

工業澱粉產業概況

工業澱粉市場高度分散,許多本地、地區和國際參與者爭奪市場佔有率。市場的主要參與者包括阿徹丹尼爾斯米德蘭公司、嘉吉公司、泰特萊爾公司和 Tereos 集團。為了加強業務,公司正在採取業務擴張、新產品推出和創新等關鍵策略。與當地企業簽訂新合約和夥伴關係的策略幫助該公司擴大了海外影響力,根據行業需求偏好推出新產品,並利用這些地區小型企業的專業知識。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 市場限制

- 波特五力分析

- 新進入者的威脅

- 購買者和消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 按類型

- 本國的

- 澱粉衍生物和甜味劑

- 按原料

- 玉米

- 小麥

- 木薯

- 馬鈴薯

- 其他

- 按應用

- 食物

- 餵食

- 造紙工業

- 製藥業

- 其他用途

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 西班牙

- 英國

- 德國

- 俄羅斯

- 法國

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 南非

- 阿拉伯聯合大公國

- 其他中東和非洲地區

- 北美洲

第6章 競爭格局

- 最受歡迎的策略

- 市場佔有率分析

- 公司簡介

- Cargill Incorporated

- Archer Daniels Midland Company

- Ingredion Incorporated

- Tate & Lyle PLC

- Agrana Beteiligungs AG

- Kent Nutrition Group Inc.(Grain Processing Corp.)

- The Tereos Group

- Cooperatie Koninklijke Cosun UA

- Altia PLC

- Angel Starch and Food Pvt. Ltd

- Manildra Group

- Japan Corn Starch Co. Ltd

第7章 市場機會與未來趨勢

第8章 免責聲明

The Industrial Starches Market size is estimated at USD 60.30 billion in 2025, and is expected to reach USD 78.44 billion by 2030, at a CAGR of 5.4% during the forecast period (2025-2030).

Starch is a carbohydrate extracted from agricultural raw materials, which finds applications in many everyday food and non-food products. Industrial starches are derived from various sources, including corn, potato, wheat, and other sources. With the global economy gradually improving and resulting in an increased intake of processed and convenience foods, the market for industrial starch, which finds substantial usage in these food applications, is finding increased demand, thereby driving the overall market.

The demand for modified starches is increasing in parallel with the rapid development of the food industry. Modified starches offer many functional benefits to various foods, such as bakeries, snacks, beverages, and nutritional foods. Currently, a wide range of starches are available in the market, studied in the form of native starches, modified starches, malt dextrin, starch-based sugars, and others. These starches have expanding applications, primarily in the beverage and confectionery industries and the pharmaceutical and fermentation industries, among others, driving the market.

Industrial Starch Market Trends

Corn as one of the Prominent Source of Industrial Starch

Starch derived from corn is in high demand because of its textural properties, especially as a thickening agent in industries such as dairy and beverages. The ingredient also gains an edge in the development of gluten-free products, which is a challenge for starch sourced from wheat, considering the potential remains of traces during extraction. The trend of clean-label ingredients and products is drastically impacting the global food and beverage industry. Moreover, the rapid expansion of the food processing industry offers a significant opportunity for ingredient manufacturers to adopt strategic measures to cater to the growing demand. When it comes to non-food applications, the paper industry utilizes corn starch as a filler and sizing material. It also finds applications in the textile, laundry, foundry, air flotation, and adhesive industries. The wide applications of corn starch in various industries drive market growth.

North America Holds a Major Share in the Industrial Starches Market

With a highly developed food industry utilizing all ingredients, North America occupies the pole position in the Industrial Starches Market by region. Globally, the United States is the largest producer of corn, with a production of 383.94 million metric tons in 2021-2022, which is utilized in various application areas, including starch production. The market is significantly inclined toward the consumption of gluten-free food, supported by the country's government with its stringent regulations regarding product labeling of gluten-free ingredients. Thus, most modified food starches in the United States are gluten-free and derived from corn, waxy maize, and potatoes. Consequently, the wheat-sourced starches amount to a lower share of the market. The Canadian industrial starches market is growing rapidly, owing to rising consumer demand for healthy and cleaner ingredients. Light-colored applications with subtle flavors especially drive the demand for native starches in the country. Local manufacturers are using it in processed food products, aiding in maintaining the product's appeal.

Industrial Starch Industry Overview

The industrial starch market is highly fragmented, with many local, regional, and international players competing for market share. Some of the major players in the market are Archer Daniels Midland Company, Cargill Incorporated, Tate & Lyle PLC, and The Tereos Group. Companies adopt major strategies for expansion, new product launches, and innovations to strengthen their business. The strategy of forming new agreements and partnerships with local players helped the companies increase their footprint in foreign countries and release new products according to the industrial requirements preferences and leverage the expertise of these small regional companies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Native

- 5.1.2 Starch Derivatives & Sweeteners

- 5.2 By Source

- 5.2.1 Corn

- 5.2.2 Wheat

- 5.2.3 Cassava

- 5.2.4 Potato

- 5.2.5 Other Sources

- 5.3 By Application

- 5.3.1 Food

- 5.3.2 Feed

- 5.3.3 Paper Industry

- 5.3.4 Pharmaceutical Industry

- 5.3.5 Other Applications

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Spain

- 5.4.2.2 United Kingdom

- 5.4.2.3 Germany

- 5.4.2.4 Russia

- 5.4.2.5 France

- 5.4.2.6 Italy

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Cargill Incorporated

- 6.3.2 Archer Daniels Midland Company

- 6.3.3 Ingredion Incorporated

- 6.3.4 Tate & Lyle PLC

- 6.3.5 Agrana Beteiligungs AG

- 6.3.6 Kent Nutrition Group Inc. (Grain Processing Corp.)

- 6.3.7 The Tereos Group

- 6.3.8 Cooperatie Koninklijke Cosun UA

- 6.3.9 Altia PLC

- 6.3.10 Angel Starch and Food Pvt. Ltd

- 6.3.11 Manildra Group

- 6.3.12 Japan Corn Starch Co. Ltd