|

市場調查報告書

商品編碼

1685792

光照上網技術(Li-Fi) -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Light Fidelity (Li-Fi) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

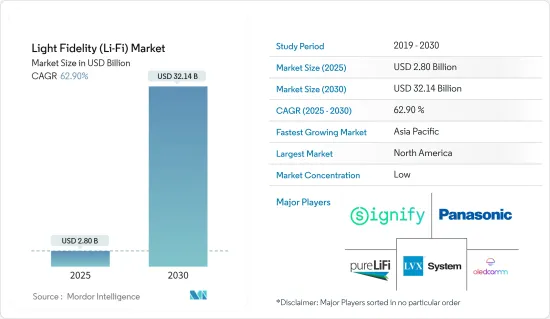

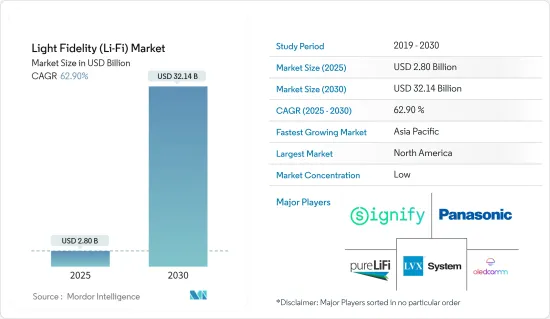

光照上網技術市場規模預計在 2025 年為 28 億美元,預計到 2030 年將達到 321.4 億美元,預測期內(2025-2030 年)的複合年成長率為 62.9%。

光照上網技術(Li-Fi)是一種透過發光二極體(LED)傳輸資料的無線光纖網路連結技術。新的無線連接使用光源而不是微波來傳輸資料。該技術的工作原理是,透過調變LED 發出的光來傳輸資料,感測器接收該光並將調變為資料。

主要亮點

- Li-Fi可以達到比Wi-Fi快約100倍的資料傳輸速度。光傳播速度極快,可實現近乎即時的連接和高速資料傳輸。 Li-Fi 使用高效率 LED 燈泡,與其他技術相比消費量更低。這可以節省能源使用成本。

- Li-Fi 也預設提供軍用級安全性。光線不會穿透牆壁或透過材料逸出,因此它可以被限制在一個空間內,從而消除覆蓋範圍之外的中間人攻擊。與其他無線通訊技術相比,Li-Fi 干擾較少。由於 Li-Fi 使用光頻率,因此不易受到其他設備和訊號的干擾。 Li-Fi 在 Wi-Fi 訊號擁擠或有限的密集區域有效發揮作用。這使得該技術適用於設備和用戶密度高的環境。

- Li-Fi 是一種利用紅外線和可見頻譜進行高速資料通訊的無線通訊技術。 Li-Fi技術以極高的速度傳輸資料,每秒能夠傳輸224GB的資料。 LED 作為可行解決方案的出現進一步簡化了 Li-Fi 的使用並實現了高速網路。 LED 燈泡是一種半導體元件,可調變電流來影響不同的光強度。該設備使用檢測器來捕獲 LED 的光並解調其中編碼的資料。該系統的工作原理類似於遙控器和電視或遙控汽車等設備之間的紅外線通訊。 LED 燈的高亮度使其能夠透過頻譜向任何配備檢測器的設備傳輸高速資料。 LED燈正常運作,調變過程是人眼不可見的。

- LED 節能且使用壽命長,因此用於室內和室外照明具有成本效益。智慧照明及其移動控制的變色功能正在推動全部區域商業空間的需求。根據美國能源局的數據,LED 照明通常消費量傳統白熾燈泡節能約 25% 至 80%。此外,LED 是定向光源,這意味著它們可以將光線引導到特定方向,從而更有效地利用光和能源。

- Li-Fi 解決方案的採用具有一定的限制,例如更多的技術意識、有限的範圍和對連接的需求。與傳統無線技術相比,LiFi 的覆蓋範圍也有限,因為訊號僅限於發送器和接收器之間的視線內。這意味著 LiFi 訊號無法穿透牆壁和其他物理障礙物,從而限制了其範圍和覆蓋範圍。相較之下,Wi-Fi 和行動電話網路的覆蓋範圍要大得多,並且可以在遠距上傳輸資料。

- 新冠肺炎疫情和世界各地的封鎖規定嚴重影響了工業活動。封鎖的影響包括勞動力短缺、供應鏈中斷、製造過程中所用原料供應有限、價格波動可能導致最終產品產量增加並超出預算、運輸問題等。 COVID-19 疫情加速並再次強調了全球對自動化的需求。流程發現、智慧資料擷取和雲端原生機器人在自動化領域中得到越來越廣泛的應用。

光照上網技術(Li-Fi) 市場趨勢

汽車和運輸是成長最快的終端用戶產業

- 近年來,光照上網技術(Li-Fi)/可見光通訊(VLC)技術在車載通訊和聯網汽車中的應用顯著增加。隨著汽車產業擁抱數位化和互聯化,對高效可靠的無線通訊解決方案的需求日益成長,不僅在車輛內部,而且在車輛與周圍基礎設施之間。

- 隨著人工智慧、連網、電動車和道路安全標準的引入改變了道路運輸的模式,減少道路事故的需求也日益增加。 Li-Fi技術可以增強車輛的情境察覺,透過在多輛車之間以及車輛與道路基礎設施之間無延遲地傳輸資料,有助於減少事故。

- LiFi 有兩種用於智慧交通管理的方式:車對車 (V2V)通訊和車對基礎設施 (V2I)通訊。車對車通訊涉及透過前燈和後燈在車輛之間傳輸資料。它可以向後車和周圍其他車輛傳達車輛的煞車距離、速度、領先車前方的障礙物以及車輛穩定性喪失等資訊。這提高了自動駕駛汽車的情境察覺,使其能夠與其他車輛保持適當的距離。車輛之間通訊的改善和資料傳輸的零延遲將有助於減少道路事故。

- 為了提高自動駕駛汽車網路的安全性,現有的道路基礎設施也需要升級為智慧基礎設施。實現智慧化需要對道路標誌、人行道、交通和街道照明等部分進行改變。使用 LiFi 進行車對車通訊的智慧交通控制預計將涉及車輛和道路元素之間的雙向通訊。與 V2I通訊類似,透過 LiFi 進行的 V2V通訊也將透過實現快速資料傳輸來幫助提高道路安全。

- 此外,LiFi技術還可用於開發智慧高速公路導航系統。該技術採用可見光通訊,可用於車輛和基礎設施之間交換資料。此外,將Li-Fi技術引入高速公路導航,可利用可見光高速、低延遲通訊的優勢,有助於建立更有效率、更互聯、更安全的交通系統。

- 歐洲等地區汽車工業的崛起可能會進一步推動對機器人和協作機器人等自動化的需求。根據歐洲汽車工業協會(ACEA)數據顯示,2023年6月歐盟乘用車銷量較去年與前一年同期比較成長17.8%。歐洲市場客戶總合購買約127萬台,除一個國家外,其餘國家均實現正成長。德國當月乘用車銷量持續保持歐洲領先地位,約 281,000 輛。

北美佔據主要市場佔有率

- 該地區對所研究市場的成長做出了重大貢獻。隨著透過無線電頻率運行 Wi-Fi 時面臨的網路安全挑戰日益增加,對快速、可靠且安全的 Li-Fi 網路的需求日益增加。據IBM稱,截至2023年,美國資料外洩的平均成本為948萬美元,高於前一年的944萬美元。

- 此外,該地區對國防工業的持續投資可能會進一步刺激對 Li-Fi 技術的需求。根據美國預算辦公室的數據,預計到2033年,美國國防支出將逐年增加。到2023年,美國國防支出將達到7,460億美元。同一項預測也顯示,到2033年,國防支出將增加至1.1兆美元。

- 此外,由於早期採用工廠自動化,美國將在預測期內成為工業 4.0 供應商的重要成長市場。美國正處於第四次工業革命的邊緣,整合整個供應鏈中的各種製造系統和資料,同時利用資料進行規模化生產。這刺激了工業 4.0 的採用,從而帶動市場成長。

- 美國聯邦政府和私營部門正在投資工業 4.0 物聯網技術,以擴大已被中國和其他低勞動成本國家取代的美國工業基礎。先進製造業夥伴關係(AMP) 的成立舉措將工業界、大學和聯邦政府聯合起來投資新興自動化技術。

- 根據加拿大政府介紹,加拿大汽車零件供應商的零件出口到世界各地,對加拿大汽車產業至關重要,該產業的年銷售額超過340億美元。汽車製造是加拿大製造業最大的收益來源之一。安大略省的汽車產業主要依靠人工智慧、機器學習和穿戴式智慧機器人等多種技術來協助人類進行製造。

光照上網技術(Li-Fi) 市場概覽

Li-Fi 市場高度分散,既有全球參與者,也有中小型企業。一些主要市場參與者正在採取合作和收購等策略來加強其產品供應並獲得永續的競爭優勢。

- 2023 年 9 月 - To Be Srl 在羅馬未來週期間舉辦了一次會議,由羅馬大學和主要合作夥伴 Signify 贊助。在國家範圍內營運的關鍵相關人員的證詞對於 LiFi 技術在文化遺產、醫療保健、零售、辦公室、學校和國防等關鍵戰略領域的科學傳播和應用至關重要。

- 2023 年 7 月-pureLiFi 和 Fraunhofer HHI 共同慶祝 IEEE 802.11bb 全球光纖通訊標準的發布。根據雙方介紹,新發布的IEEE 802.11 bb標準和成熟的IEEE 802.11 WiFi標準為LiFi技術的部署提供了全球認可的框架。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 和其他宏觀經濟因素對市場的影響

第5章市場動態

- 市場促進因素

- 對高速網路的需求不斷增加

- 對節能解決方案的需求不斷增加

- 市場限制

- 範圍和連接性通訊,缺乏技術意識

第6章 技術簡介

- Li-Fi 系統的組成部分

- 持續的技術進步

第7章市場區隔

- 按最終用戶產業

- 工業的

- 衛生保健

- 零售

- 企業大樓

- 教育機構

- 住宅

- 航太與國防

- 汽車與運輸

- 其他最終用戶產業(旅館業、災害管理等)

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第8章競爭格局

- 公司簡介

- Signify Holding BV

- Panasonic Corporation

- Purelifi Ltd

- LVX System

- Oledcomm SAS

- Slux

- Kyocera SLD Laser Inc.(Kyocera Corporation)

- Velmenni

- Lightbee Corp.

- Renesas Electronics Corporation

- Zero1

- Spectrum Networks LLC

- IDRO Co. Ltd

- To Be Srl

第9章投資分析

第10章 市場展望

The Light Fidelity Market size is estimated at USD 2.80 billion in 2025, and is expected to reach USD 32.14 billion by 2030, at a CAGR of 62.9% during the forecast period (2025-2030).

Light Fidelity (Li-Fi) is a wireless optical networking technology that transmits data through light-emitting diodes (LEDs). A new wireless connection uses light sources instead of microwaves to transmit data. The technology works by modulating the light emitted by LEDs to transmit data, which is then received by a sensor that interprets the modulations as data.

Key Highlights

- Li-Fi can achieve data transmission speeds that are about 100 times faster than those achievable by Wi-Fi. Light travels extremely fast, allowing almost instantaneous connections and faster data transmissions. Li-Fi uses highly efficient LED bulbs, resulting in lower energy consumption than other technologies. This can lead to cost savings in terms of energy usage.

- Li-Fi also offers military-grade security by default. Since light does not penetrate walls or leak through materials, it can be contained within a space, eliminating the ability for man-in-the-middle attacks outside the coverage area. This ensures privacy and security for users- li-fi experiences less interference compared to other wireless communication technologies. Li-Fi uses light frequencies, which are less prone to interference from other devices or signals. Li-Fi can work effectively in dense regions with congested or limited Wi-Fi signals. This makes it a suitable technology for environments with a high concentration of devices or users.

- Li-Fi is a wireless communication technology that uses the infrared and visible light spectrum for high-speed data communication. Li-Fi technology transmits data at a very high speed and is capable of delivering 224 GB of data per second. The emergence of LED as a viable solution has further simplified the use of LI-Fi, enabling high-speed networks. LED bulbs are semiconductor devices in which the current can be modulated to affect different intensities of light. A photo-detector is used on devices to capture the LED light and demodulate the data encoded in it. The system works similarly to how infrared communication works between devices, such as a remote control and a TV or a remote-controlled car. Due to the high intensities of LED lights, they can be used to send high-speed data across the light spectrum to any device with a photo-detector. The LED lights work as normal, and the modulation process is not visible to the human eye.

- LEDs are energy efficient and may serve for a longer period, which makes them more cost-effective for use in indoor and outdoor lighting. Smart lighting and color-changing capabilities that mobile devices can control have added to the demand from commercial spaces across the region. According to the US Department of Energy, LED lights typically use about 25% to 80% less energy than traditional incandescent bulbs. LEDs are also directional light sources, which means they can emit light in a specific direction, allowing them to use light and energy more efficiently.

- Adopting the Li-Fi solution has certain constraints, such as the need for more technology awareness, restricted range, and connectivity. In addition, LiFi has a limited coverage area compared to traditional wireless technologies, as the signal is confined to the line of sight between the transmitter and receiver. This means LiFi signals cannot penetrate walls or other physical obstacles, limiting their range and coverage. In contrast, Wi-Fi and cellular networks offer much broader coverage areas and can transmit data over longer distances.

- The COVID-19 outbreak and lockdown restrictions worldwide severely affected industrial activities. The effects of the lockdown include labor shortages, disruptions in the supply chain, lack of availability of raw materials utilized in the manufacturing process, fluctuating prices that could force the production of the final product to increase and go beyond budget, shipping problems, etc. The COVID-19 pandemic expedited and re-emphasized the requirement for automation worldwide. The adoption of bots for process discovery, intelligent data capture, and cloud-native bots across the automation sector is growing.

Light Fidelity (Li-Fi) Market Trends

Automotive and Transportation to be the Fastest Growing End-user Industry

- In recent years, there has been a substantial increase in the use of Light Fidelity (Li-Fi)/Visible Light Communication (VLC) technologies in automotive communication and connected automobiles. As the automotive sector embraces digitalization and connection, there is an increasing demand for efficient and dependable wireless communication solutions within cars as well as between vehicles and the surrounding infrastructure.

- As there is a paradigm change in road transport with the introduction of AI-enabled, network-connected electric vehicles and road safety standards, there is a rising demand to reduce road accidents. Li-Fi technology can help reduce accidents by transmitting data between numerous vehicles and between the vehicle and road infrastructure without any lag, thereby enhancing the situational awareness of the vehicles.

- The use of LiFi for smart traffic management can be done in two ways: Vehicle-to-vehicle (V2V) communication and Vehicle-to-infrastructure (V2I) communication. In vehicle-to-vehicle communication, data transmission occurs between vehicles via the front and rear lights. Information such as the vehicle's braking distance, speed, obstacles in front of the lead vehicle, or other information like loss of vehicle stability can be passed on to the tailing vehicles or other nearby vehicles. This helps enhance the situational awareness of autonomous vehicles and can be used to maintain adequate distance between them. As the communication between vehicles is improved, with zero delay in data transmission, it can reduce road accidents.

- To improve the safety of an autonomous vehicle network, even the existing road infrastructure requires to be upgraded to smart infrastructure. Becoming smart will involve modifying components, such as road signage, pavement, traffic, and streetlights. The usage of LiFi for smart traffic control for vehicle-to-infrastructure communication is expected to include bidirectional communication between vehicles and road elements. Like V2I communication, V2V communication with LiFi will also help enhance road safety by allowing quick data transmission.

- Moreover, Li-Fi technology can be used to develop a smart highway navigation system. This technology can be utilized by employing visible light communication to exchange data between vehicles and infrastructure. Also, executing Li-Fi technology for highway navigation can contribute to a more efficient, connected, and safer transportation system by leveraging the advantages of high-speed, low-latency communication through visible light.

- Increasing the automotive industry in regions like Europe may further increase the demand for automation in the area, such as robots and cobots, among others, thereby driving the demand for the studied market. According to ACEA, In June 2023, passenger car sales in the European Union increased year-on-year at 17.8 percent. Customers in the European market purchased around 1.27 million units in total, and all but one of the countries experienced positive growth. At some 280,100 units, Germany remained the leading market for passenger car sales in Europe that month.

North America Holds Significant Market Share

- The region significantly contributes to the growth of the market studied. With the rising number of cybersecurity challenges faced while operating wi-fi over radio frequencies, the need for high-speed, reliable, and safe li-fi networks has witnessed a remarkable uptick in demand. According to IBM, as of 2023, the average data breach cost in the United States amounted to USD 9.48 million, up from USD 9.44 million in the previous year.

- In addition, the region is constantly investing in the defense industry, which may further propel the demand for Li-Fi technologies. According to the U.S. Congressional Budget Office, defense spending in the United States is predicted to increase yearly until 2033. Defense outlays in the United States amounted to USD 746 billion in 2023. The forecast predicts an increase in defense outlays up to USD 1.1 trillion in 2033.

- Moreover, the United States is a substantial market for vendors offering Industry 4.0 to grow significantly over the forecast period, owing to the early adoption of factory automation. The United States is on the verge of the fourth industrial revolution, where data is being used on a large scale for production while integrating the data with various manufacturing systems throughout the supply chain. This is fueling the adoption of Industry 4.0 and, thereby, the growth studied in the market.

- The Federal Government and the private sector in the United States are investing in Industry 4.0 IoT technologies to increase the American industrial base, which China and other low-labor-cost countries have taken over. The formation of the "Advanced Manufacturing Partnership (AMP)" is an initiative undertaken to make the industry, various universities, and the federal government invest in emerging automation technologies.

- According to the Government of Canada, the country's automotive suppliers export parts globally and are integral to Canada's automotive sector, which accounts for over USD 34 billion in sales annually. Automotive manufacturing has been one of the largest revenue generators for the country in the manufacturing sector. Ontario's automotive sector primarily relies on mixed technologies such as AI, ML, and wearable intelligent robots that assist humans in manufacturing.

Light Fidelity (Li-Fi) Market Overview

The Li-Fi market is highly fragmented due to the presence of both global players and small and medium-sized enterprises. Some of the major players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- September 2023 - To Be Srl has organized a conference on the Rome Future Week with the patronage of Sapienza - University of Rome and leading partner Signify; it represented a critical moment of meeting and discussion in the evolution path of LiFi technology, providing a snapshot of the Punctual and complete state of the art. The testimonies of the main stakeholders operating within the national panorama are valuable in scientific dissemination and the adoption of LiFi technology in vital and strategic sectors ranging from cultural heritage to healthcare, retail to offices, and schools to defense.

- July 2023 - pureLiFi and Fraunhofer HHI welcomed the release of the IEEE 802.11 bb global light communications standard, a significant development for the wireless communications industry. According to the two technology companies, the newly released IEEE 802.11 bb standard and the well-established IEEE 802.11 WiFi standards provide a globally recognized framework for deploying LiFi technology.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 Aftereffects and other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand For High-Speed Network

- 5.1.2 Increasing Demand for Energy-efficient Solutions

- 5.2 Market Restraints

- 5.2.1 Limited Range and Connectivity and Lack of Awareness about the Technology

6 TECHNOLOGY SNAPSHOT

- 6.1 Components of a Li-Fi System

- 6.2 Ongoing Technological Advancements

7 MARKET SEGMENTATION

- 7.1 By End-user Industry

- 7.1.1 Industrial

- 7.1.2 Healthcare

- 7.1.3 Retail

- 7.1.4 Corporate Buildings

- 7.1.5 Education

- 7.1.6 Residential

- 7.1.7 Aerospace and Defense

- 7.1.8 Automotive and Transportation

- 7.1.9 Other End-user Industries (Hospitality, Disaster Management, and Others)

- 7.2 By Geography

- 7.2.1 North America

- 7.2.2 Europe

- 7.2.3 Asia-Pacific

- 7.2.4 Latin America

- 7.2.5 Middle East and Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Signify Holding BV

- 8.1.2 Panasonic Corporation

- 8.1.3 Purelifi Ltd

- 8.1.4 LVX System

- 8.1.5 Oledcomm SAS

- 8.1.6 Slux

- 8.1.7 Kyocera SLD Laser Inc. (Kyocera Corporation)

- 8.1.8 Velmenni

- 8.1.9 Lightbee Corp.

- 8.1.10 Renesas Electronics Corporation

- 8.1.11 Zero1

- 8.1.12 Spectrum Networks LLC

- 8.1.13 IDRO Co. Ltd

- 8.1.14 To Be Srl