|

市場調查報告書

商品編碼

1685783

北美塑膠瓶蓋和封口:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)North America Plastic Caps And Closures - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

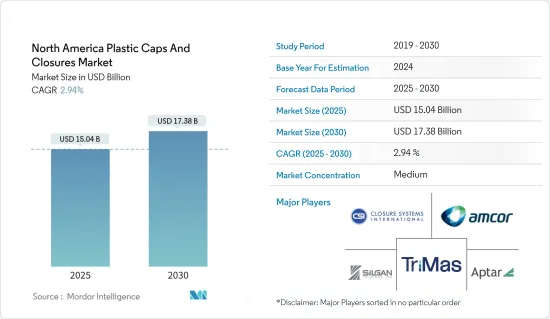

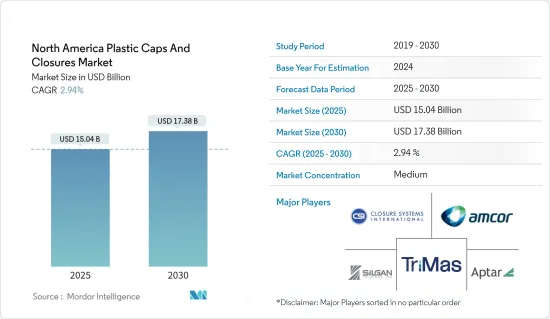

北美塑膠瓶蓋和封口市場規模預計在 2025 年為 150.4 億美元,預計到 2030 年將達到 173.8 億美元,預測期內(2025-2030 年)的複合年成長率為 2.94%。

從產量來看,預計將從 2025 年的 3,982.5 億件成長到 2030 年的 4,759.7 億件,預測期內(2025-2030 年)的複合年成長率為 3.63%。

塑膠瓶蓋和封蓋可密封各種容器,確保其安全性和完整性。它們由堅韌耐用的聚合物製成,例如聚丙烯 (PP) 和聚乙烯 (PE)。塑膠瓶蓋和封口通常用於包裝食品和飲料 (F&B)、藥品、化妝品、家用清洗產品等。

主要亮點

- 瓶蓋和封蓋主要由 PP 和 PE 製成。各行各業都嚴重依賴塑膠瓶蓋和封口作為一種經濟高效的密封解決方案。熱感應瓶蓋襯墊用於由多種塑膠材料製成的瓶子,包括 PP、HDPE 和 LDPE,以保護容器免於洩漏並提供防篡改證明。因此,預計預測期內市場將會成長。

- 隨著對瓶裝水和非酒精飲料的需求不斷增加,飲料行業的塑膠瓶市場預計將擴大,從而推動對塑膠瓶蓋和封蓋的需求。瓶裝水的需求是由消費者對高品質飲用水的趨勢所驅動,特別是對飲用受污染的自來水後感染疾病的擔憂,以及瓶裝水的便利性和便攜性。

- 瓶蓋和封口是飲料包裝的重要組成部分,可確保消費者收到優質的飲料。它確保產品的安全和質量,同時提供緊密的密封,方便最終用戶打開和關閉。由於塑膠包裝技術的進步,飲料瓶蓋和封口產業的產品開發和創新正在激增。許多公司投入大量資源進行研發,以打造獨特而經濟的產品,從而推動該領域的創新快速成長。

- 對於包裝來說,回收和環保至關重要。包裝廢棄物嚴重造成了海洋和垃圾掩埋場的塑膠污染。塑膠包裝也是環境塑膠污染的重要來源之一。塑膠需要數百年才能分解,可能會影響海洋生物和生態系統。

- 一次性包裝會被丟棄或回收,而不是重新使用。根據美國環保署 (EPA) 的數據,大約一半的城市固態廢棄物由食物和食品包裝材料組成。塑膠包裝的問題在於它需要數年時間才能自然分解,導致塑膠污染我們的海洋、河流和湖泊,並散落在街道上。

- 塑膠製造業依賴原油和天然氣等原料的成本和供應。這些價格波動會影響產業的盈利和永續性。石油是多種包裝材料使用的原料。因此,如果需求激增、供應鏈出現問題或價格上漲,包裝製造商將面臨挑戰。

北美塑膠瓶蓋和封蓋市場趨勢

飲料將成為最大的終端用戶產業

- 瓶裝水因其方便性而成為最常消費的飲料之一。瓶裝水包裝也適合遠距運輸,這就是為什麼瓶裝水包裝如此廣泛的原因。

- 根據國際瓶裝水協會(IBWA)和飲料行銷公司(BMC)的統計,美國人飲用的瓶裝水比其他飲料都多。健康意識、生活水準的提高以及瓶裝水的需求和消費的增加是推動北美瓶裝水需求的主要因素,從而推動全部區域對瓶裝水包裝的需求。預計這將推動瓶裝水塑膠瓶蓋和瓶塞的需求。

- 推動水瓶和容器需求的主要因素是消費者對健康和天然產品的興趣。塑膠被廣泛用作水包裝材料,進一步推動了該地區瓶蓋和封口市場的發展。

- 根據丹麥的一項研究,加拿大人平均每天消耗 335 公升水,相當於 670 個標準水瓶(500 毫升)。

- 該行業的製造商正致力於推出新產品作為業務擴展的一部分。例如,2024 年 5 月,AlpekPolyester USA LLC 在 NPE2024 上發布了一種用於瓶蓋的新型 PET 樹脂。該材料將以“CAPETall”品牌出售,並將滿足您所有瓶蓋生產需求。該材料預計將於2025年上市。該公司還表示,CaPETall 是100% PET 產品,可改善消費後寶特瓶回收和 PET 循環經濟。

- 2024年3月,Beyond Plastic宣布首批生物分解性寶特瓶瓶蓋之一進入市場。瓶蓋由聚羥基烷酯(PHA) 製成,這是一種透過細菌發酵產生的生物聚合物。新型環保瓶蓋看起來與傳統的石油基塑膠瓶蓋相同,但具有可回收、可堆肥和在敏感條件下生物分解等創新優勢。這種瓶蓋已在美國推出,可用於瓶裝水和其他行業。

預計美國將出現顯著成長

- 化妝品瓶蓋由於其衛生、使用方便、分配性能好以及能夠為香水和乳霜等產品帶來整體外觀的能力而在美國廣受歡迎。此外,各包裝公司均致力於生產符合永續包裝標準的瓶蓋和封口,例如新材料和輕量化特性。

- 根據美國人口普查局的數據,到2023年,美國食品和飲料年度零售額將達到約9,853億美元,而2017年為7,288億美元。隨著飲料消費量的消費量,尤其是瓶裝水、軟性飲料、果汁和酒精飲料,該國對飲料包裝解決方案的需求也相應增加。

- 消費者對改善外觀和保持個人衛生的興趣日益濃厚,加之提供價格更實惠的高級化妝品的公司不斷增多,推動了消費者在化妝品和個人保健產品上的支出增加。

- 據電子商務成長機構 CommonThreads 稱,美國化妝品和個人護理行業規模到 2023 年將達到 900 億美元。

- 由於美國化妝品和個人護理行業的擴張,該國對包括瓶蓋和封口在內的初級包裝的需求正在成長,從而促進了所研究市場在數量和金額方面的整體成長。

- 隨著瓶裝水作為更有益於健康的產品以及隨時隨地的補水需求的增加,美國瓶裝水市場近年來達到了新的高度,預計未來幾年還將繼續成長。

- 因此,預計未來幾年該國的產量將大幅成長,從而導致對瓶蓋的以金額為準需求增加。

北美塑膠瓶蓋和封蓋產業概況

北美塑膠瓶蓋和封口市場半固體,主要企業包括 Silgan Holdings Inc.、Amcor PLC、Closure Systems International Inc.、AptarGroup Inc. 和 TriMas Corporation。市場參與者正在採用聯盟、收購等各種策略來增強其產品供應並獲得永續的競爭優勢。

- 2024 年 5 月,Aptar Closures 推出了適用於美容、個人和家庭護理應用的新型電子商務桌面封口機。 Aptar Closures 的 E-Disc Top 可確保運輸過程中不會發生洩漏,並且無需使用襯墊,也無需承擔額外的運輸準備費用。

- 2023 年 12 月,TriMas 集團的包裝部門 Affaba &Ferrari 宣布與歐洲食品和飲料市場的客戶合作。該公司擴大了其產品組合,增加了與傳統封蓋設計相比更具永續的新型創新繫繩蓋產品。該公司最新推出的產品是專為可口可樂設計的 38 毫米運動飲料蓋,計劃於 2024 年推出。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 地緣政治情勢如何影響市場

第5章 市場動態

- 市場促進因素

- 瓶裝飲料需求推動塑膠瓶蓋和封口的需求

- 各類最終用戶對創新解決方案的需求不斷增加

- 市場限制

- 對製造商在環境惡化方面的監管更加嚴格

- 立式袋包裝的輕巧、經濟高效的替代品

第6章 市場細分

- 按材質

- 聚乙烯 (PE)

- 聚對苯二甲酸乙二醇酯(PET)

- 聚丙烯(PP)

- 其他材料

- 按類型

- 螺桿式

- 自動販賣機

- 無螺絲

- 兒童安全

- 按最終用戶產業

- 飲料

- 瓶裝水

- 軟性飲料

- 烈酒

- 其他飲料

- 食物

- 製藥和醫療保健

- 化妝品和盥洗用品

- 家用化學品(清潔劑、清潔劑、肥皂、拋光粉)

- 其他最終用戶產業

- 飲料

- 按國家

- 美國

- 加拿大

第7章 競爭格局

- 公司簡介

- Silgan Holdings Inc.

- Amcor PLC

- Closure Systems International Inc.

- AptarGroup Inc.

- TriMas Corporation

- Guala Closures SpA

- Berry Global Inc.

- Tetra Pak Group

- O.Berk Company LLC

- BERICAP Holding GmbH

- Pano Cap Canada Ltd

- Erie Molded Plastics Inc.

第8章投資分析

第9章:未來市場展望

The North America Plastic Caps And Closures Market size is estimated at USD 15.04 billion in 2025, and is expected to reach USD 17.38 billion by 2030, at a CAGR of 2.94% during the forecast period (2025-2030). In terms of production volume, the market is expected to grow from 398.25 billion units in 2025 to 475.97 billion units by 2030, at a CAGR of 3.63% during the forecast period (2025-2030).

Plastic caps and closures seal various containers to ensure their safety and integrity. They are made from strong, durable polymers, including polypropylene (PP) and polyethylene (PE). Plastic caps and closures are commonly used for packaging food and beverages (F&B), pharmaceuticals, cosmetics, and household cleaning products.

Key Highlights

- Caps and closures use PP and PE as the primary raw materials for manufacturing. Various industries rely heavily on plastic caps and closures for a cost-effective sealing solution. A heat induction cap liner could be used on bottles made of different plastic materials, such as PP, HDPE, and LDPE, to protect the container from leakage and provide tamper evidence characteristics to it. Due to this, the market is expected to witness growth during the forecast period.

- With the rising demand for bottled water and non-alcoholic beverages, the market for plastic bottles in the beverage industry is expected to expand, bolstering the demand for plastic caps and closures. The demand for bottled water is attributed to the predisposition of customers to want high-quality drinking water, specifically, their concern about contracting diseases after drinking tainted tap water and the convenience and portability of bottled water.

- Caps and closures comprise a significant part of beverage packaging, ensuring the delivery of top-notch beverages to consumers. They have seals that guarantee product safety and quality while allowing effortless opening and reclosing for end-users. The beverage caps and closure industry has seen a surge in product development and innovations due to technological advancements in plastic packaging. Numerous companies are dedicating substantial resources to research and development efforts to create distinctive and economical products, leading to a rapid increase in innovations within this sector.

- Recycling and environmental considerations are essential when it comes to packaging. Packaging trash significantly impacts plastic contamination in the oceans and landfills. Plastic packaging is also a significant cause of the environment's plastic pollution. Plastic can affect marine life and ecosystems since it takes hundreds of years to disintegrate.

- Single-use packaging is either thrown away or recycled instead of reused. According to the US Environmental Protection Agency (EPA), about half of all municipal solid waste comprises food and materials used in food packaging. The issue with plastic packaging is that its natural degradation can take many years, which leads to plastic polluting the oceans, rivers, and lakes and littering the streets.

- The plastic manufacturing industry depends on the cost and availability of raw materials like crude oil and natural gas. Any changes in these prices can have an impact on the industry's profitability and sustainability. Oil is the raw material used in a wide range of packaging materials. Hence, when there is an upsurge in demand, a problem with the supply chain or increased prices is where packaging manufacturers will face difficulties.

North America Plastic Caps And Closures Market Trends

Beverages to be the Largest End-user Industry

- Bottled water is one of the most consumed beverages due to its convenience. The packaging of bottled water makes it also suitable for long-distance transportation, and the packaging of bottled water is widespread.

- According to the International Bottled Water Association (IBWA) and the Beverage Marketing Corporation (BMC), Americans drink bottled water more than any other beverage. Health awareness, a higher standard of living, and rising demand and consumption of bottled water are major factors pushing the demand for bottled water in North America, consequently driving the demand for bottled water packaging across the region. This is expected to drive the demand for plastic caps and closures for bottled water.

- The major factor driving the demand for bottles and containers for water is consumers' interest in healthy and natural products. Plastic is a widely used packaging material for water, which further leverages the caps and closures market in the region.

- According to a study by Danamark, on average, a typical person in Canada consumes 335 liters of water daily, which is the equivalent of 670 standard water bottles (500 ml size).

- Manufacturers operating in the industry are focused on launching new products as part of their business expansion. For instance, in May 2024, AlpekPolyester USA LLC introduced a new PET resin for bottle caps at NPE2024. This material is marketed under the brand CAPETall, and it meets all the production needs of bottle caps. The material is expected to be available in 2025. The company also stated that CaPETall is a 100% PET product that improves post-consumer PET bottle recycling and the PET circular economy.

- In March 2024, Beyond Plastic introduced one of the first biodegradable plastic bottle caps to enter the market. The closure is made from polyhydroxyalkanoate (PHA), a biopolymer created using bacteria fermentation. The new, eco-friendly cap looks just like traditional petroleum-based plastic caps but brings transformative advantages such as being recyclable, compostable, and biodegradable, even in sensitive conditions. Such caps launched in the country can be used for bottled water and in other industries.

The United States is Expected to Witness Significant Growth

- Closures for cosmetics are also gaining traction in the United States due to their hygienic qualities, ease of use, dispensing characteristics, and ability to provide a cohesive look to products such as fragrances and face creams. Various packaging companies also emphasize manufacturing caps and closures that meet sustainable packaging criteria, including new materials and lightweight nature.

- According to the US Census Bureau, the annual sales of US retail food and beverage stores reached approximately USD 985.3 billion in 2023, compared to USD 728.8 billion in 2017. As beverage consumption increases, particularly bottled water, soft drinks, juices, and alcoholic beverages, the demand for beverage packaging solutions in the country rises correspondingly.

- The rising focus of consumers on enhancing physical appearance and maintaining personal hygiene, along with the rise of companies offering more affordable versions of high-end cosmetic products, has increased consumer spending on cosmetics and personal care products.

- According to Common Thread Co., an e-commerce growth agency, the US cosmetics and personal care industry reached USD 90 billion in 2023.

- In response to the expansion of the cosmetics and personal care industry in the United States, the demand for primary packaging, including caps and closures, is growing in the country, thus contributing to the overall growth of the market studied in terms of volume and value.

- Due to the growing demand for bottled water as a better-for-you product and for on-the-go hydration, the bottled water market in the United States has reached new heights in recent years, and it is expected to witness growth in the upcoming years.

- In response, production is expected to boom in the country in the upcoming years, which, in turn, is expected to bolster the demand for bottle caps in terms of value.

North America Plastic Caps And Closures Industry Overview

The North American plastic caps and closures market is semi-consolidated with the presence of key players like Silgan Holdings Inc., Amcor PLC, Closure Systems International Inc., AptarGroup Inc., and TriMas Corporation. Players in the market are adopting various strategies, such as partnerships and acquisitions, to enhance their product offerings and gain sustainable competitive advantage.

- In May 2024, Aptar Closures introduced a new e-commerce Disc Top Closure for beauty, personal, and home care applications. Aptar Closures' E-Disc Top securely protects against in-transit leakage while eliminating the need for liners and extra shipping preparation fees.

- In December 2023, TriMas Corporation's packaging division, Affaba & Ferrari, announced its collaboration with customers in the European food and beverage market. The company expanded its portfolio by adding new and innovative products for tethered caps that are sustainable compared to traditional closure designs. The company's latest addition to the lineup included a 38 mm sports drink cap designed for Coca-Cola, which is scheduled to be launched in 2024.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of Geopolitical Scenarios on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Demand for Bottled Beverages Drive the Demand for Plastic Caps and Closures

- 5.1.2 Increased Demand for Innovative Solutions from Different End Users

- 5.2 Market Restraints

- 5.2.1 Stringent Regulations on Manufacturers Pertaining to Environmental Degradation

- 5.2.2 Lightweight and Cost-effective Stand-up Pouch Packaging Alternatives

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Polyethylene (PE)

- 6.1.2 Polyethylene Terephthalate (PET)

- 6.1.3 Polypropylene (PP)

- 6.1.4 Other Types of Materials

- 6.2 By Type

- 6.2.1 Threaded

- 6.2.2 Dispensing

- 6.2.3 Unthreaded

- 6.2.4 Child-resistant

- 6.3 By End-user Industry

- 6.3.1 Beverage

- 6.3.1.1 Bottled Water

- 6.3.1.2 Soft Drinks

- 6.3.1.3 Spirits

- 6.3.1.4 Other Beverages

- 6.3.2 Food

- 6.3.3 Pharmaceutical and Healthcare

- 6.3.4 Cosmetics and Toiletries

- 6.3.5 Household Chemicals (Detergents, Cleaners, Soaps, and Polishes)

- 6.3.6 Other End-user Industries

- 6.3.1 Beverage

- 6.4 By Country

- 6.4.1 United States

- 6.4.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Silgan Holdings Inc.

- 7.1.2 Amcor PLC

- 7.1.3 Closure Systems International Inc.

- 7.1.4 AptarGroup Inc.

- 7.1.5 TriMas Corporation

- 7.1.6 Guala Closures SpA

- 7.1.7 Berry Global Inc.

- 7.1.8 Tetra Pak Group

- 7.1.9 O.Berk Company LLC

- 7.1.10 BERICAP Holding GmbH

- 7.1.11 Pano Cap Canada Ltd

- 7.1.12 Erie Molded Plastics Inc.