|

市場調查報告書

商品編碼

1683954

日本 LED 照明:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Japan LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

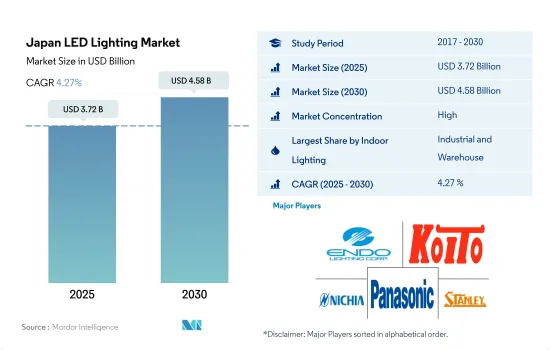

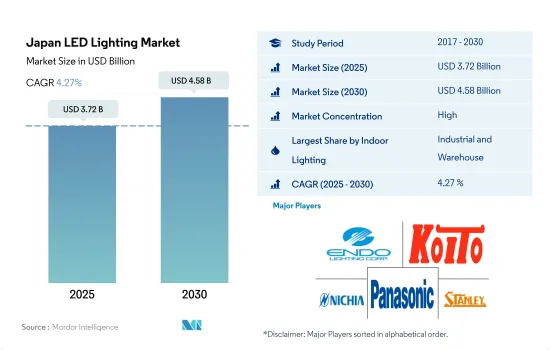

日本的 LED 照明市場規模預計在 2025 年為 37.2 億美元,預計到 2030 年將達到 45.8 億美元,預測期內(2025-2030 年)的複合年成長率為 4.27%。

工業部門和商業辦公室的需求將推動市場成長

- 從金額佔有率來看,2023年工業和倉儲業將佔多數,其次是商業業。 2019年第一季,日本經濟擴張超出預期,日本經濟成長率為1.8%。因此,各行各業對LED照明的需求都大幅成長,尤其是工業和商業領域。新冠疫情時代增加了對電子商務產品的需求,從而導致對LED照明的需求增加,主要是在B2C領域。目前,這兩個地區的市場需求都在成長。 2022年供應量將會增加,導致LED價格下降。日本2022年第四季商業房地產價格指數為146.6點,低於上一季的155.4點。

- 從成交量佔比來看,商業區佔最多,其次是住宅。 2023 年上半年,預計新增供應量將是 2022 年的三倍,約為東京五個中心區甲級辦公室歷史 10 年平均值的 1.5 倍。 2020 年疫情爆發後,2021 年住宅土地價格下跌了 0.5%。但儘管長期趨勢如此,該國大都會圈的住宅需求仍然強勁。預計札幌的住宅需求將大幅成長,2023 年的成長率將達到 11.8%。

- 在市場發展方面,農業和工業照明的需求預計將大幅成長。從面積來看,2020年日本僅有12%的土地用於農業。預計這一數字在未來一年將進一步下降,從而導致商業溫室的興起和對 LED 的進一步需求。

日本LED照明市場動向

家庭數量增加推動 LED 照明市場成長

- 2021年,日本總人口預計為1.2551億人。由於人口不斷成長,預計住宅空間也會增加。 2022年將建造約859,500套住宅。政府支出增加、住宅項目補貼以及政府對重大基礎設施計劃的關注預計將促進日本住宅市場的擴張。預計這將帶動住宅領域的 LED 銷售成長。因此,商業房地產價格下跌預計將推動更多的商業土地購買,這可能會促進未來幾年 LED 使用量的增加。

- 2020年日本個人家庭數約5,570萬戶。約54.2%為核心家庭,38.1%為單人家庭。 2021年日本家庭數為5,560萬戶。 2021年該指標與前一年同期比較增0.6%。從2010年到2021年,該指標成長了8.5%。至2022年,預計平均家庭規模為2.2人,平均每戶房間數為4.4間。預計日本家庭數量的成長將推動 LED 的擴張。

- 截至2020年8月31日,日本有近46.1%的家庭擁有一輛乘用車。日本新車註冊量將從去年的約445萬輛減少到2022年的約420萬輛。 2022年,日本新車註冊量約420萬輛。這些註冊表明汽車領域 LED 市場的成長。

人口老化和下降預計將阻礙房地產成長和需求

- 2022年,日本開工興建多用戶住宅約253,300棟。自住開發量與前一年同期比較去年同期下降11.3%。儘管每年都有新住宅開發,但成長率卻在下降。這表明,房地產價格上漲預計將推動該國採用 LED 來滿足照明需求。

- 日本的可支配所得高於其他開發中國家。例如,2022年,印度的平均人均收入將達到2,301.4美元,越南為3,716.8美元,中國為12,732.5美元,這將帶來更高的個人消費能力,並有能力為新的生活空間分配更多的資金。 2022 年 12 月,日本的人均收入達到 33,911.2 美元,而 2021 年 12 月為 39,916.1 美元。可支配所得較 2021 年下降的原因是,由於經濟活動受到大宗商品價格高企、供給側限制以及新冠疫情的影響,2022 年日本經濟成長較 2021 年有所放緩。

- 由於死亡率上升、出生率下降,日本人口已連續12年下降。 2022年預計人口為1.2449億,較上年減少55.6萬。這意味著未來幾年平均家庭規模預計會減少,進一步導致房屋所有權飽和。

- 2017年,東京都政府發起了宣傳活動,鼓勵人們改用LED燈泡以節省能源。該宣傳活動鼓勵當地居民利用LED燈的節能特性。該計劃有望減少日本的電力消耗並推動LED照明的採用。

日本LED照明產業概況

日本LED照明市場格局較為集中,前五大廠商佔71.60%的市佔率。市場的主要企業有:遠藤照明株式會社、小糸製作所、日亞化學株式會社、松下控股株式會社和史丹利電氣(按字母順序排列)。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 汽車產量

- 人口

- 人均收入

- 汽車貸款利率

- 充電站數量

- 持有汽車數量

- LED進口總量

- 照明耗電量

- #家庭數量

- 道路網路

- LED滲透率

- #體育場數量

- 園藝區

- 法律規範

- 室內照明

- 日本

- 戶外照明

- 日本

- 汽車照明

- 日本

- 室內照明

- 價值鍊和通路分析

第5章 市場區隔

- 室內照明

- 農業照明

- 商業照明

- 辦公室

- 零售

- 其他

- 工業/倉庫

- 住宅照明

- 戶外照明

- 公共設施

- 路

- 其他

- 汽車實用照明

- 日間行車燈 (DRL)

- 方向指示器

- 頭燈

- 倒車燈

- 紅綠燈

- 尾燈

- 其他

- 汽車照明

- 二輪車

- 商用車

- 搭乘用車

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介(包括全球概況、市場層級概況、主要業務部門、財務狀況、員工人數、關鍵資訊、市場排名、市場佔有率、產品和服務、最新發展分析)

- Endo Lighting Corporation

- GRUPO ANTOLIN IRAUSA, SA

- HELLA GmbH & Co. KGaA

- KOITO MANUFACTURING CO., LTD.

- Marelli Holdings Co., Ltd.

- Nichia Corporation

- OSRAM GmbH.

- Panasonic Holdings Corporation

- Stanley Electric Co., Ltd.

- Toshiba Corporation

第7章:執行長的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源和進一步閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 50001652

The Japan LED Lighting Market size is estimated at 3.72 billion USD in 2025, and is expected to reach 4.58 billion USD by 2030, growing at a CAGR of 4.27% during the forecast period (2025-2030).

Increasing development in the industrial sector and commercial office demand states to drive market growth

- In terms of value share, in 2023, the industrial and warehouse segment accounts for a majority share, followed by commercial. Japan's economy expanded more than expected in the opening quarter of 2019. Japan's economy grew at an annual rate of 1.8%. This has led to a major demand for LED lighting in all sectors, mainly in the industrial and commercial segments. The COVID-19 era increased the demand for e-commerce goods, leading to more demand for LED lighting, majorly in B2C. Currently, the market demand is increasing for both sectors. In 2022, the supply increased, leading to low LED pricing. In Q4 2022, the commercial property price index for retail properties, warehouses, factories, apartment buildings, and commercial and industrial land in Japan stood at 146.6, down from 155.4 points in the previous quarter.

- In volume share, commercial accounts for the majority of the share, and then residential stands at the second spot. Over the next six months in 2023, new supply is expected to triple from 2022, at around 1.5 times higher than the 10-year historical average in Tokyo Central 5 Wards Grade A office. With the onset of the pandemic in 2020, residential land prices plunged 0.5% in 2021. However, despite the long-term trend, housing demand remained strong in the country's metropolitan areas. Sapporo is expected to have major residential demand, having an 11.8% growth rate in 2023.

- In terms of development, the market is expected to see major demand growth in agriculture and industrial lighting. In terms of area, only 12% of Japan's land was dedicated to agriculture in 2020. In the coming year, this number is expected to decrease further, leading to the penetration of commercial greenhouses, which will cater to more demand for LEDs.

Japan LED Lighting Market Trends

Increasing number of households drive the growth of the LED lighting market

- In 2021, the overall population of Japan was estimated to be 125.51 million. Given a rising population boost, a rise in residential space availability is anticipated. Approximately 859,500 houses were built in the country in 2022. Increased government spending, housing program subsidies, and the government's anticipated focus on major infrastructure projects are expected to contribute to Japan's residential market expansion. This is anticipated to lead to higher LED sales in the residential sector. Consequently, more commercial land is expected to be purchased due to the drop in commercial real estate prices, thus contributing to an increased use of LEDs in coming years.

- Around 55.7 million private households existed in Japan in 2020. About 54.2% were nuclear families, and 38.1% were single-person households. In 2021, Japan had 55.6 million homes. In 2021, the indicator showed a 0.6% Y-o-Y growth. The indicator increased by 8.5% from 2010 to 2021. In 2022, there were 2.2 household members on average and an estimated 4.4 rooms per home. The expansion of LEDs in Japan is expected to be fueled by the increased number of households.

- Nearly 46.1% of households in Japan had one passenger car as of August 31, 2020. The number of newly registered motor cars in Japan fell from roughly 4.45 million the year before to about 4.2 million in 2022. In 2022, Japan saw the registration of almost 4.2 million new cars. These registrations exhibit the growing market for LEDs in the automobile sector.

Increasing aging and shrinking population are expected to hinder the growth and demand for real estate

- In 2022, construction for owned housing complexes began at about 253,300 projects in Japan. Owner-occupied home developments fell by 11.3% from the previous year. Though new house constructions are developing yearly, the growth percentage has declined. This suggests that the increase in properties is expected to create more LED penetration for the need for illumination in the country.

- Disposable income in Japan is high compared to other developing nations. For instance, in 2022, India had USD 2301.4, Vietnam 3716.8, and China USD 12,732.5, which resulted in the rising spending power of individuals and affording more money on new residential spaces. Japan's per capita income reached USD 33,911.2 in December 2022, compared with USD 39,916.1 in December 2021. Compared to 2021, the disposable income was reduced because Japan's economic growth slowed in 2022 compared with 2021, as economic activity was affected by high commodity prices, supply-side constraints, and the impact of the COVID-19 pandemic.

- Japan's population has decreased for the 12th year in a row due to increased deaths and declining birth rates. In 2022, there were 124.49 million people, a decrease of 556,000 from the year before. This suggests that the average household size will decrease in the coming years, and it is further expected that the number of house owners will reach a saturation point.

- The Tokyo Metropolitan Government started a campaign in 2017 to encourage families to switch to LED bulbs to save energy. The campaign encouraged locals to take advantage of the energy-saving features of LED lamps. This program is expected to reduce the nation's electricity consumption and encourage the adoption of LED lighting.

Japan LED Lighting Industry Overview

The Japan LED Lighting Market is fairly consolidated, with the top five companies occupying 71.60%. The major players in this market are Endo Lighting Corporation, KOITO MANUFACTURING CO., LTD., Nichia Corporation, Panasonic Holdings Corporation and Stanley Electric Co., Ltd. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Automotive Production

- 4.2 Population

- 4.3 Per Capita Income

- 4.4 Interest Rate For Auto Loans

- 4.5 Number Of Charging Stations

- 4.6 Number Of Automobile On-road

- 4.7 Total Import Of Leds

- 4.8 Lighting Electricity Consumption

- 4.9 # Of Households

- 4.10 Road Networks

- 4.11 Led Penetration

- 4.12 # Of Stadiums

- 4.13 Horticulture Area

- 4.14 Regulatory Framework

- 4.14.1 Indoor Lighting

- 4.14.1.1 Japan

- 4.14.2 Outdoor Lighting

- 4.14.2.1 Japan

- 4.14.3 Automotive Lighting

- 4.14.3.1 Japan

- 4.14.1 Indoor Lighting

- 4.15 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Indoor Lighting

- 5.1.1 Agricultural Lighting

- 5.1.2 Commercial

- 5.1.2.1 Office

- 5.1.2.2 Retail

- 5.1.2.3 Others

- 5.1.3 Industrial and Warehouse

- 5.1.4 Residential

- 5.2 Outdoor Lighting

- 5.2.1 Public Places

- 5.2.2 Streets and Roadways

- 5.2.3 Others

- 5.3 Automotive Utility Lighting

- 5.3.1 Daytime Running Lights (DRL)

- 5.3.2 Directional Signal Lights

- 5.3.3 Headlights

- 5.3.4 Reverse Light

- 5.3.5 Stop Light

- 5.3.6 Tail Light

- 5.3.7 Others

- 5.4 Automotive Vehicle Lighting

- 5.4.1 2 Wheelers

- 5.4.2 Commercial Vehicles

- 5.4.3 Passenger Cars

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 Endo Lighting Corporation

- 6.4.2 GRUPO ANTOLIN IRAUSA, S.A.

- 6.4.3 HELLA GmbH & Co. KGaA

- 6.4.4 KOITO MANUFACTURING CO., LTD.

- 6.4.5 Marelli Holdings Co., Ltd.

- 6.4.6 Nichia Corporation

- 6.4.7 OSRAM GmbH.

- 6.4.8 Panasonic Holdings Corporation

- 6.4.9 Stanley Electric Co., Ltd.

- 6.4.10 Toshiba Corporation

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219