|

市場調查報告書

商品編碼

1683760

北美建築塗料:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)North America Architectural Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

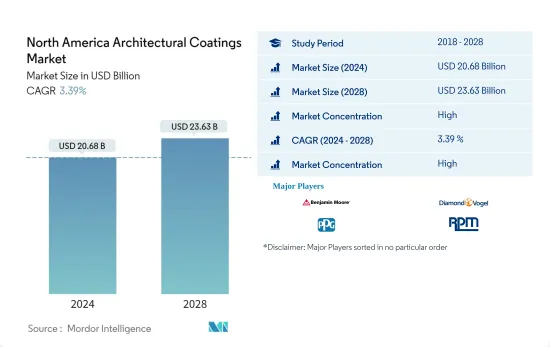

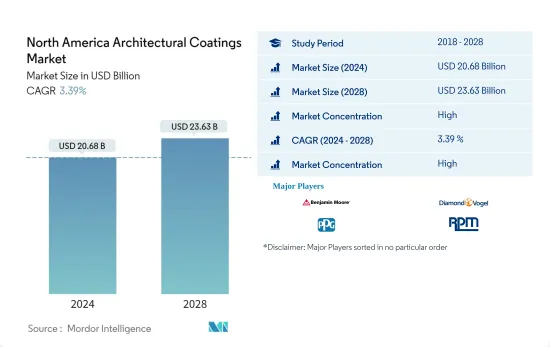

北美建築塗料市場規模預計在 2024 年為 206.8 億美元,預計到 2028 年將達到 236.3 億美元,預測期內(2024-2028 年)的複合年成長率為 3.39%。

主要亮點

- 從中期來看,該地區建設活動的活性化是預測期內推動北美建築塗料市場成長的關鍵因素。

- 另一方面,該地區日益成長的環境問題,加上原料價格和供應鏈中斷,是預計在預測期內抑制該行業成長的關鍵因素。

- 然而,建築塗料和塗層的永續性不斷提高可能在不久的將來為全球市場提供豐厚的成長機會。

- 與該地區其他國家相比,美國由於住宅存量和翻新指數較高,是建築塗料消費的領先國家。

北美建築塗料市場趨勢

住宅市場預計將佔據市場主導地位

- 建築油漆和被覆劑包括住宅內牆和外牆油漆、底漆、清漆、密封劑和著色劑。

- 這些油漆和被覆劑對於提供節能建築圍護結構所必需的空氣阻隔性起著重要作用。在住宅中,建築塗料可提供一種空氣屏障,阻止建築物內的空氣流動,從而保護建築結構並提高加熱和冷卻系統的效率。

- 這種空氣屏障也有助於滿足所有綠色建築標準中的能源效率性能要求。

- 在北美,政府在房地產市場住宅方面的支出增加以及對住宅的需求不斷成長可能會有利於市場成長。此外,房地產成本的上漲,尤其是該地區獨戶住宅和多層公寓大樓的發展,預計將進一步推動建築塗料市場的發展。

- 此外,家庭收入水準的提高加上農村人口向都市區的轉移預計將繼續推動北美住宅建築業的需求。公共和私營部門對經濟適用住宅的日益關注推動了該地區住宅的成長。

- 據加拿大建築協會稱,建築業是加拿大最大的就業行業之一,也是加拿大經濟成功的主要貢獻者。該產業每年創造約 1,410 億美元的收入,佔國內生產總值) 的 7.5%。

- 此外,根據加拿大統計局的數據,2023 年第二季住宅建設呈上升趨勢,住宅量約為 64,042 套。

- 隨著加拿大經濟繼續從新冠疫情中復甦,供應鏈中斷和勞動力短缺對大多數行業構成了挑戰,建築業也不例外。不過,住宅和住宅投資正從疫情初期的放緩中逐步復甦。

- 由於 2022 年投資增加,預計 2023 年的油漆消費量將保持在高位。預計這種成長態勢將持續到 2024 年,因為政府將在當年提高移民目標。

- 鑑於上述情況,預計預測期內住宅領域將在北美建築塗料市場中發揮主導作用。

以國家來算,美國是最大的。

- 美國是世界上最大的經濟體之一。然而,該國的GDP受到疫情的嚴重影響,2020年下降了-2.8%。此外,預計2021年將成長5.9%,2022年將達到2.1%左右。國際貨幣基金組織預測2023年GDP成長率約為1.6%。

- 美國擁有龐大的建築業,僱用了超過760萬人。美國建築業在商業和住宅建築中發揮關鍵作用,是該國經濟的主要貢獻者。由於美國建設活動的增加,預計該國建築塗料和被覆劑的消費量將會增加。

- 在美國,2020 年住宅塗料消費量大幅增加。這主要得益於住宅重新粉刷細分市場的推動,該細分市場的消費量出現了最高成長,尤其是在 DIY 塗料市場,因為人們重建房屋以創造新的在家辦公環境。

- 美國是世界上最大的建築業之一,2021 年建築業價值為 16.3 億美元,2022 年建築業價值為 17.9 億美元。該國約佔全球建築支出的 10%。此外,美國商業建築投資將達到 1,147.9 億美元,而 2021 年為 949.5 億美元。

- 根據美國人口普查局的數據,2022 年私人建築業價值為 14,292 億美元,比 2021 年的 12,795 億美元成長 11.7%(+-1.0%)。 2022 年住宅建築支出為 8,991 億美元,比 2021 年的 7,937 億美元成長 13.3% (+-2.1%),而非住宅建築支出為 5,301 億美元,比 2021 年的 4,858 億美元下降 9.1% (+-2.1%)。

- 此外,該國正在升級現有機場。即將實施的重大機場擴建計劃包括芝加哥奧黑爾國際機場跑道系統的重新配置、丹佛國際機場票務區和安檢站的新建、休斯頓喬治布什洲際機場的新國際航站樓、洛杉磯國際機場 2.25 英里的自動旅客運輸車和新停車場、奧蘭多國際機場航站樓新增 15 個登機口和與拉格啤酒航站樓的國際航站樓與國際航站樓的國際航站樓容量。

- 因此,所有上述因素都可能影響未來幾年該國對建築被覆劑的需求。

北美建築塗料產業概況

北美建築塗料市場本質上是整合的。市場的主要企業(不分先後順序)包括 Benjamin Moore Company、Diamond Vogel、PPG Industries、RPM International 和剪切機-Williams。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 北美建設活動成長

- 限制因素

- 該地區日益嚴重的環境問題

- 原料價格和供應鏈中斷

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔

- 最終用戶產業

- 商業的

- 住宅

- 科技

- 水

- 溶劑型

- 樹脂

- 丙烯酸纖維

- 醇酸

- 聚氨酯

- 環氧樹脂

- 聚酯纖維

- 其他樹脂類型

- 地區

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)分析

- 主要企業策略

- 公司簡介

- Beckers Group

- Benjamin Moore & Co.

- Champion Coat Pinturas Y Recubrimientos

- Cloverdale Paint Inc.

- COREV DE MEXICO

- Diamond Vogel

- DUNN-EDWARDS Corporation

- JOTUN

- Kelly-moore Paints

- Masco Corporation

- Micca Paint Inc.

- Pinturas Acuario

- Pinturas Berel SA De Cv

- PPG Industries Inc.

- Pinturas PRISA

- RPM International Inc.

- Selectone Paints Inc.

- Societe Laurentide

- The Sherwin-williams Company

- Farrow & Ball Ltd

- Fine Paints of Europe

第7章 市場機會與未來趨勢

- 建築油漆和塗料的永續性不斷提高

簡介目錄

Product Code: 93077

The North America Architectural Coatings Market size is estimated at USD 20.68 billion in 2024, and is expected to reach USD 23.63 billion by 2028, growing at a CAGR of 3.39% during the forecast period (2024-2028).

Key Highlights

- Over the medium term, the rising construction activities in the region are the major factors driving the North American architectural coatings market growth during the forecast period.

- On the other hand, the growing environmental concerns in the region, coupled with raw material prices and supply chain disruptions, are key factors anticipated to restrain the growth of the target industry over the forecast period.

- Nevertheless, the growing sustainability in architectural paints and coatings is likely to create lucrative growth opportunities for the global market soon.

- The United States is the leading country in architectural coatings consumption due to its higher housing stocks and remodeling index compared to other countries in the region.

North America Architectural Coatings Market Trends

Residential Segment is Expected Dominate the Market

- Architectural paints and coatings include interior and exterior house paints, primers, varnishes, sealers, and stains.

- These paints and coatings are critical in providing air barriers essential for energy-efficient building enclosures. In residential buildings, air barriers provided by architectural coatings stop the flow of air through the building, protect the structure, and increase the efficiency of heating and cooling systems.

- These air barriers also contribute to the energy efficiency performance requirements found in all green building standards.

- In the North American region, the increased government spending in the real estate market for residential construction and the growing demand for high-class residential homes are likely to benefit the market's growth. In addition, rising real estate costs, particularly the development of single-family homes and multistory apartments in the region, are anticipated to boost the architectural paints and coatings market further.

- Moreover, the rising household income levels, combined with the population migrating from rural to urban areas, are expected to continue to drive the demand for the residential construction sector in North America. The increased focus on affordable housing by both the public and private sectors is driving the growth in the residential construction sector in the region.

- According to the Canadian Construction Association, the construction sector is one of Canada's largest employers and a major contributor to the country's economic success. The industry generates about USD 141 billion annually and contributes 7.5% of the country's gross domestic product (GDP).

- Further, according to StatCan, there was an increasing trend in new housing constructions in Q2 2023, where around 64,042 units of new housing were started.

- As Canada's economic recovery from COVID-19 continues, supply chain disruptions and labor shortages contribute to the challenges felt across most industries, and the construction sector is no exception. However, residential and non-residential investments are increasingly recovering from the early pandemic slowdown.

- Due to increased investments in 2022, the consumption of paints is expected to be high in 2023. This growth scenario is further expected to continue till 2024 due to the government's upgradation of immigration targets in 2024.

- From the above points, it can be inferred that the residential segment is set to play the dominant role in the North American architectural coatings market during the forecast period.

United States is the largest segment by Country.

- The United States is one of the world's largest and most powerful economies. However, the country's GDP declined to -2.8% in 2020, severely impacted by the pandemic. Furthermore, the country recorded a growth of 5.9% in 2021, and it reached about 2.1% in 2022. In 2023, the IMF has estimated that the GDP would grow by about 1.6%.

- The United States boasts a colossal construction sector with over 7.6 million employees. Playing a prominent role in commercial and residential construction, the US construction sector significantly contributes to the country's economy. Due to increasing construction activities in the United States, the consumption of architectural paints and coatings in the country is expected to increase.

- In the United States, residential paint consumption grew substantially in 2020. This was due to the residential repaint segment, which saw the highest jump in consumption, especially in the DIY paint market, as people remodeled their homes to build new work-from-home environments.

- The United States has one of the world's largest construction industries, valued at USD 1,630 million in 2021 and USD 1,790 million in 2022. The country accounts for around 10% of global construction spending. Furthermore, the commercial construction value in the United States was registered at USD 114.79 billion in 2022, compared to USD 94.95 billion in 2021.

- According to the US Census Bureau, the value of private construction in 2022 was USD 1,429.2 billion, 11.7% (+- 1.0%) higher than the USD 1,279.5 billion in 2021. Residential construction spending in 2022 was USD 899.1 billion, up by 13.3% (+-2.1%) from USD 793.7 billion in 2021, while non-residential construction spending amounted to USD 530.1 billion, down by 9.1% (+-2.1%) from USD 485.8 billion in 2021. 1.0%).

- Additionally, the country is upgrading its existing airports. Some of the upcoming major airport expansion projects include the reconfiguration of the runway system at Chicago O'Hare International Airport, the construction of new ticketing areas and the addition of new security checkpoints at the Denver International Airport, the construction of a new international terminal at Houston George Bush Intercontinental Airport, the construction of a 2.25-mile automated people mover and new parking facilities at Los Angeles International Airport, the addition of 15 gates and an Intermodal Terminal Facility to link with rail systems at Orlando International Airport, building a new terminal at New York LaGuardia Airport, doubling the capacity of San Francisco International Airport's international terminal, and many more.

- Therefore, all the aforementioned factors are likely to affect the demand for architectural paints and coatings in the country in the coming years.

North America Architectural Coatings Industry Overview

The North American architectural coatings market is consolidated in nature. Some of the major players in the market (in no particular order) include Benjamin Moore & Co., Diamond Vogel, PPG Industries Inc., RPM International Inc., and The Sherwin-Williams Company, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET Dynamics

- 4.1 Drivers

- 4.1.1 Growing Construction Activities In North America

- 4.2 Restraints

- 4.2.1 Growing Environmental Concerns In the Region

- 4.2.2 Raw Material Prices and Supply Chain Disruptions

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products And Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 End-user Industry

- 5.1.1 Commercial

- 5.1.2 Residential

- 5.2 Technology

- 5.2.1 Water Borne

- 5.2.2 Solvent Borne

- 5.3 Resin

- 5.3.1 Acrylic

- 5.3.2 Alkyd

- 5.3.3 Polyurethane

- 5.3.4 Epoxy

- 5.3.5 Polyester

- 5.3.6 Other Resin Types

- 5.4 Geography

- 5.4.1 United States

- 5.4.2 Canada

- 5.4.3 Mexico

- 5.4.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Beckers Group

- 6.4.2 Benjamin Moore & Co.

- 6.4.3 Champion Coat Pinturas Y Recubrimientos

- 6.4.4 Cloverdale Paint Inc.

- 6.4.5 COREV DE MEXICO

- 6.4.6 Diamond Vogel

- 6.4.7 DUNN-EDWARDS Corporation

- 6.4.8 JOTUN

- 6.4.9 Kelly-moore Paints

- 6.4.10 Masco Corporation

- 6.4.11 Micca Paint Inc.

- 6.4.12 Pinturas Acuario

- 6.4.13 Pinturas Berel SA De Cv

- 6.4.14 PPG Industries Inc.

- 6.4.15 Pinturas PRISA

- 6.4.16 RPM International Inc.

- 6.4.17 Selectone Paints Inc.

- 6.4.18 Societe Laurentide

- 6.4.19 The Sherwin-williams Company

- 6.4.20 Farrow & Ball Ltd

- 6.4.21 Fine Paints of Europe

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Sustainability In Architectural Paints and Coatings

02-2729-4219

+886-2-2729-4219