|

市場調查報告書

商品編碼

1750413

建築塗料、搪瓷、底漆、著色劑、溶劑和清漆市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Architectural Coatings, Enamels, Primers, Stains, Solvents, and Lacquers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

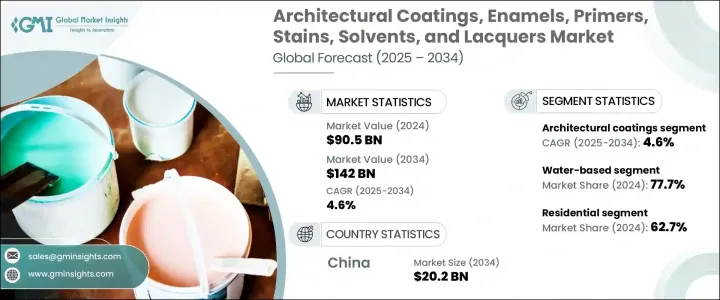

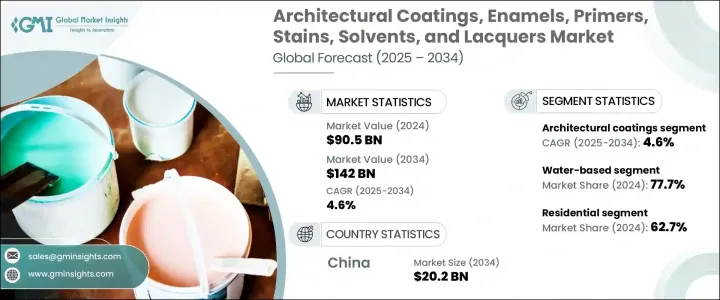

2024 年全球建築塗料、瓷漆、底漆、著色劑、溶劑和清漆市場價值為 905 億美元,預計到 2034 年將以 4.6% 的複合年成長率成長,達到 1420 億美元,因為瓷漆、底漆、著色劑、溶劑和清漆可滿足各行各業特定的美學和功能需求。市場成長主要受快速城市化(尤其是發展中國家)和成熟市場增加的翻新和維護活動所推動。隨著對環保解決方案的需求不斷成長,建築塗料、瓷漆、底漆、著色劑、溶劑和清漆市場正在轉向低 VOC(揮發性有機化合物)配方。對永續產品的日益偏好是由於人們對環境影響的認知不斷提高以及消費者對室內空氣品質的擔憂。

此外,塗料技術的進步提高了塗料在極端條件下的性能,例如住宅和商業建築中常見的高濕度和長時間紫外線照射。這些創新正在擴大塗料的應用範圍,並提高塗料的使用壽命和耐久性,使其對消費者和行業專業人士更具吸引力。隨著這些地區越來越多的人遷往城市,對新住房、商業空間和公共基礎設施的需求也隨之增加,所有這些都推動了對高品質塗料的需求。該地區對建築和翻新項目的關注,加上向現代永續生活方式的文化轉變,使亞太地區成為全球建築塗料成長最快的市場。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 905億美元 |

| 預測值 | 1420億美元 |

| 複合年成長率 | 4.6% |

2024年,建築塗料市場規模達905億美元,預計由於其在住宅和商業建築中的廣泛應用,市場規模將持續成長。這些塗料的價值不僅在於其美觀度,還在於其能夠保護表面免受磨損、潮濕和環境因素的影響。隨著政府和消費者對永續性的重視,對被認為更環保的水性和低VOC塗料的需求尤其強勁。此外,快乾型多表面塗料的創新也促使人們對這些兼具便利性和高性能的產品的青睞度不斷提升。

2024年,住宅塗料市場佔比達62.7%。新興經濟體(尤其是亞太地區)不斷成長的住房需求是推動這一趨勢的關鍵因素。此外,消費者偏好也不斷演變,更著重於兼具耐用性和環保性的多功能高性能塗料。對美觀多功能性更強的塗料(例如可應用於各種表面的多功能塗料)的需求持續成長,進一步推動了住宅塗料市場的成長。隨著城鎮住房建設的加速,尤其是在快速發展地區,對永續和創新塗料的需求預計將持續成長,這將為行業參與者創造新的機會。

2024年,中國建築塗料、瓷漆、底漆、著色劑、溶劑和清漆市場規模達126億美元,主要得益於中國快速的城市化發展。消費成長,尤其是在二、三線城市,推動了對性能卓越、美觀度更高的塗料的需求。隨著消費者偏好的演變,高階塗料(包括具有自清潔或抗菌性能的塗料)市場正在成長。企業正專注於產品創新並擴展分銷網路,力求在這個競爭激烈的市場中佔據更大的佔有率。

建築塗料、搪瓷漆、底漆、著色劑、溶劑和清漆市場的領先公司,包括宣偉、PPG工業、阿克蘇諾貝爾和亞洲塗料,正在採取併購等策略來鞏固市場佔有率。產品創新也是一大重點,這些公司在研發方面投入大量資金,以推出滿足不斷變化的消費者需求的全新解決方案。此外,策略合作夥伴關係和完善的分銷網路也有助於公司鞏固其市場地位,尤其是在中國和印度等快速成長的市場。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 川普政府關稅的影響—結構化概述

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 貿易統計(HS編碼)

- 主要出口國

- 主要進口國

註:以上貿易統計僅針對重點國家。

- 供應商格局

- 利潤率分析

- 監管格局

- 衝擊力

- 成長動力

- 住宅和商業建築活動激增

- 對環保和低VOC產品的需求不斷成長

- 配方和應用效率的技術創新

- 產業陷阱與挑戰

- 不穩定的原料和投入成本

- 溶劑型產品的監管壓力

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 建築塗料

- 琺瑯質

- 引子

- 污漬

- 溶劑

- 漆器

第6章:市場估計與預測:按技術,2021 - 2034 年

- 主要趨勢

- 水性

- 溶劑型

第7章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 住宅

- 商業的

- 工業的

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第9章:公司簡介

- AkzoNobel

- Asian Paints Limited

- Axalta Coating Systems

- BASF Coatings

- Benjamin Moore & Co.

- Hempel

- Jotun Group

- Kansai Paint

- Masco Corporation

- Nippon Paint Holdings

- PPG Industries

- RPM International

- Sherwin-Williams Company

- Tikkurila Oyj

The Global Architectural Coatings, Enamels, Primers, Stains, Solvents, and Lacquers Market was valued at USD 90.5 billion in 2024 and is estimated to grow at a CAGR of 4.6% to reach USD 142 billion by 2034 as enamels, primers, stains, solvents, and lacquers, cater to specific aesthetic and functional needs across various industries. The market growth is largely driven by rapid urbanization, particularly in developing countries, and increased renovation and maintenance activities in mature markets. As the demand for eco-friendly solutions continues to rise, the architectural coatings, enamels, primers, stains, solvents, and lacquers market is witnessing a shift towards low-VOC (volatile organic compound) formulations. This growing preference for sustainable products is driven by increasing awareness of environmental impact and consumer concerns about indoor air quality.

Moreover, advancements in coating technologies have enhanced performance under extreme conditions, such as high humidity and prolonged UV exposure, which are common in both residential and commercial buildings. These innovations are expanding the range of applications and improving the longevity and durability of coatings, making them more attractive to both consumers and industry professionals. As more people in these regions migrate to urban areas, there is a corresponding need for new housing, commercial spaces, and public infrastructure, all of which drive demand for high-quality coatings. The region's focus on construction and renovation projects, paired with a cultural shift towards modern, sustainable living, positions Asia-Pacific as the fastest-growing market for architectural coatings globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $90.5 Billion |

| Forecast Value | $142 Billion |

| CAGR | 4.6% |

The architectural coatings segment generated USD 90.5 billion in 2024, and it is projected to continue its expansion due to its widespread use in both residential and commercial buildings. These coatings are valued not only for their aesthetic appeal but also for their ability to protect surfaces from wear, moisture, and environmental factors. The demand for water-based and low-VOC coatings, which are considered more eco-friendly, is particularly strong, as governments and consumers alike prioritize sustainability. Additionally, innovations in fast-drying, multi-surface paints have contributed to an increased preference for these products, offering both convenience and performance.

The residential segment held a 62.7% share in 2024. The expanding demand for housing in emerging economies, particularly in the Asia-Pacific region, is a key factor behind this trend. Furthermore, consumer preferences are evolving, with a stronger focus on versatile, high-performance coatings that are both durable and eco-friendly. The demand for coatings with improved aesthetic versatility, such as multi-functional paints that can be applied to various surfaces, continues to rise, further fueling growth in the residential sector. As urban housing construction accelerates, particularly in rapidly developing regions, the need for sustainable and innovative coatings is expected to grow, creating new opportunities for industry players.

China Architectural Coatings, Enamels, Primers, Stains, Solvents, and Lacquers Market generated USD 12.6 billion in 2024, largely due to the country's rapid urban development. Increased consumption, particularly in tier-2 and tier-3 cities, is fueling demand for coatings with enhanced performance and aesthetic appeal. The market for premium coatings, including those with self-cleaning or antibacterial properties, is growing as consumer preferences evolve. Companies are responding by focusing on product innovation and expanding their distribution networks, aiming to capture a larger share of this highly competitive market.

Leading companies in Architectural Coatings, Enamels, Primers, Stains, Solvents, and Lacquers Market, including Sherwin-Williams, PPG Industries, AkzoNobel, and Asian Paints, are adopting strategies such as mergers and acquisitions to consolidate market share. Product innovation is also a key focus, with these companies investing heavily in research and development to introduce new solutions that meet changing consumer needs. Additionally, strategic partnerships and improved distribution networks are helping companies strengthen their presence, particularly in rapidly growing markets like China and India.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Impact of trump administration tariffs - structured overview

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS code)

- 3.3.1 Major exporting countries

- 3.3.2 Major importing countries

note: the above trade statistics will be provided for key countries only.

- 3.4 Supplier landscape

- 3.5 Profit margin analysis

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Surge in residential and commercial construction activity

- 3.7.1.2 Rising demand for eco-friendly and low-voc products

- 3.7.1.3 Technological innovation in formulations and application efficiency

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Volatile raw material and input costs

- 3.7.2.2 Regulatory pressure on solvent-based products

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Tons)

- 5.1 Key trends

- 5.2 Architectural coatings

- 5.3 Enamels

- 5.4 Primers

- 5.5 Stains

- 5.6 Solvents

- 5.7 Lacquers

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 (USD Billion) (Tons)

- 6.1 Key trends

- 6.2 Water-based

- 6.3 Solvent-based

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Tons)

- 7.1 Key trends

- 7.2 Residenial

- 7.3 Commercial

- 7.4 Industrial

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 AkzoNobel

- 9.2 Asian Paints Limited

- 9.3 Axalta Coating Systems

- 9.4 BASF Coatings

- 9.5 Benjamin Moore & Co.

- 9.6 Hempel

- 9.7 Jotun Group

- 9.8 Kansai Paint

- 9.9 Masco Corporation

- 9.10 Nippon Paint Holdings

- 9.11 PPG Industries

- 9.12 RPM International

- 9.13 Sherwin-Williams Company

- 9.14 Tikkurila Oyj