|

市場調查報告書

商品編碼

1683100

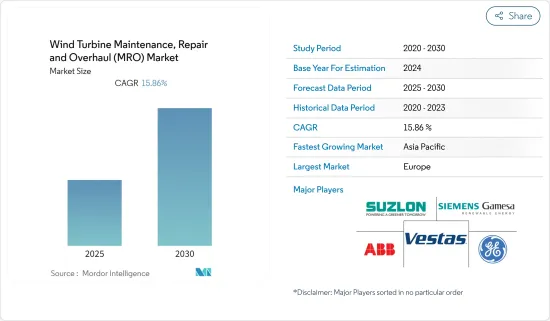

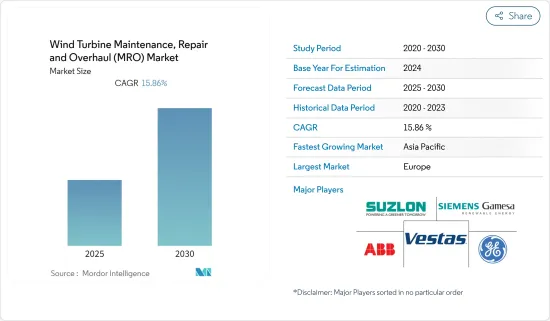

風力發電機維護、維修和大修 (MRO) 市場 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Wind Turbine Maintenance, Repair and Overhaul (MRO) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

風力發電機維護、維修和大修 (MRO) 市場預計在預測期內的複合年成長率為 15.86%

關鍵亮點

- 離岸風力發電機的不斷增加將推動全球風力發電機維護、維修和大修(MRO)市場的發展,這很可能成為預測期內成長最快的領域。

- 此外,利用風力發電的現像也顯著增加。隨著各國對風電市場的投資,維護需求可能增加。中東和非洲的風力發電廠正在顯著成長,預計將為全球風力發電機維護、維修和大修(MRO)市場的成長提供機會。

- 預計2020年亞太地區將成為全球風電裝置規模最大、成長最快的地區。

風力發電機MRO 市場趨勢

離岸風力發電設備可望大幅成長

- 隨著能源需求的增加,各大國家和企業紛紛轉向引進可以提供清潔能源的可再生能源。利用先進技術的離岸風力發電的引入,正吸引各國和企業的大量投資。

- 根據安裝位置,由於成本下降和技術進步,預計預測期內海上產業將繼續推動全球風力發電機產業的投資。

- 2020年全球海上市場維持穩定,新增裝置容量達606千萬瓦,與2019年大致持平。海上累積設置容量達3,530萬千瓦,與前一年同期比較成長21.7%。

- 2020年,離岸風電產業迎來大規模裝機,如中國一年內新增離岸風電3GW,其次是荷蘭(150萬千瓦)、比利時(706千萬瓦)、英國(483萬千瓦)、德國(237千萬瓦)。然而,英國新安裝速度的放緩主要是由於付款合約 (CfD) 第 1 輪和 CfD2 輪之間的計劃交付滯後。此外,在德國,新裝置容量放緩主要是由於不利條件和近期離岸風力發電計劃儲備水準較低。

- 預計風力發電機將擴大部署在更複雜、更具攻擊性的環境中,例如更遠的海上,再加上風力發電機容量的增加,這將對風力發電機的運行組件帶來額外的壓力。這可能會導致變速箱等零件過早失效,從而造成風電場的發電量大幅下降。此外,提供 MRO 服務的成本比在陸上站點提供 MRO 服務的成本高得多。與陸上設施相比,材料和服務增加以及地形不易到達等因素限制了成長。

- 因此,鑑於上述情況,預計在預測期內,離岸風力發電的採用將在風力發電機維護、維修和大修市場中呈現顯著成長。

亞太地區可望成為成長最快的市場

- 亞太地區是全球成長最快的風力發電市場,這主要得益於中國的貢獻。該地區累積設備容量346.70GW,其中陸上風電裝置容量336.29GW,離岸風力發電裝置容量10.41GW。

- 截至2020年,中國是亞太地區風電裝置容量最大的國家,約278.32吉瓦。它也是全球陸上風電市場的領導者。 2020年,全國新增風電裝置5893萬千瓦,其中,陸域風電4894萬千瓦,離岸風電999萬千瓦。這顯示中國有望成為亞太地區最大的維護、修理和大修(MRO)服務市場。

- 同時,亞太地區風電裝置容量第二大的印度,截至2020年也僅3,862.5萬千瓦。然而,在印度這個擁有13.5億人口的國家,未來10年的電力需求預計將會翻倍。印度政府因此設定了目標,到2022年將可再生能源發電至175GW,其中風電為60GW;到2030年將提升至450GW,其中風電為140GW。韓國擁有龐大的技術潛力,輪轂高度為120米,發電容量可達695GW。

- 韓國也計畫在2030年實現可再生能源裝置容量達到6,380萬千瓦,其中約1,800萬千瓦來自風能。 Orsted 等跨國公司表示,韓國有潛力在風力發電領域取得成功,尤其是考慮到其地理位置,在離岸風力發電領域。

- 預計這表明,在預測期內,亞太地區將成為全球風力發電機維護、維修和大修業務參與企業的主要業務目的地。

風力發電機MRO 產業概況

全球風力發電機維護、維修和大修(MRO)市場適度細分。該市場的主要企業包括西門子歌美颯可再生能源公司、通用電氣公司、蘇司蘭能源有限公司、ABB 有限公司和維斯塔斯風力系統公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概況

- 介紹

- 全球可再生能源結構(2020 年)

- 風電裝置容量(GW)及 2027 年預測

- 市場規模與需求預測(2027 年,單位:十億美元)

- 2018-2027 年全球平均風力發電機尺寸(MW)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場區隔

- 部署位置

- 陸上

- 海上

- 服務類型

- 維護

- 維修

- 大修

- 成分

- 變速箱

- 發電機

- 葉輪

- 其他

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 南美洲

- 中東和非洲

第6章 競爭格局

- 併購、合資、合作、協議

- 主要企業策略

- 公司簡介

- Siemens Gamesa Renewable Energy SA

- General Electric Company

- Stork(a Fluor Company)

- Moventas Gears Oy

- ZF Friedrichshafen AG

- Vestas Wind Systems A/S

- Suzlon Energy Ltd

- ABB Ltd

- Dana SAC UK Ltd

- Nordex SE

- Mistras Group

- Integrated Power Services LLC

第7章 市場機會與未來趨勢

簡介目錄

Product Code: 48701

The Wind Turbine Maintenance, Repair and Overhaul Market is expected to register a CAGR of 15.86% during the forecast period.

Key Highlights

- Increasing, offshore deployment of wind turbine is likely to drive the global wind turbine maintenance, repair, and overhaul (MRO) market, thus making it fastest growing segment during the forecast period.

- Moreover, the adoption of wind power for power generation is increasing significantly. Various countries are investing in the wind energy market which likely to increase the requirement for maintenance. Middle-East and Africa region witnessing significant growth in wind power plant which is likely to provide the opportunity to the growth of global wind turbine maintenance, repair & overhaul market.

- Asia-Pacific is expected to be the fastest growing region, owing to the largest and fastest increase in wind power installed capacity in 2020.

Wind Turbine MRO Market Trends

Offshore Wind Installations Expected to Witness Signifcant Growth

- As demand for energy is rising, major countries and companies are turning towards the adoption of renewable energy as it has the ability to provide clean energy. The adoption of offshore wind energy with advance technology attracted the countries and companies for high investment.

- By location of deployment, the offshore industry is expected to remain the driver of the global wind turbine industry investments during the forecast period, owing to declining costs and improved technology.

- The global offshore market remained stable in 2020, with 6.06 GW of new additions, almost the same as in 2019. The total cumulative offshore installations have reached 35.3 GW, representing a 21.7% increase in cumulative offshore wind installed capacity over the previous year.

- The offshore wind industry witnessed major installations in 2020. For instance, China installed a 3 GW offshore wind in a single year, followed by the Netherlands (installed 1.5 GW), Belgium (installed 706 MW), the United Kingdom (installed 483 MW), and Germany (237 MW). However, the slowdown of growth in terms of new installation in the United Kingdom was mainly due to the gap between the execution of projects in the Contracts for Difference (CfD) 1 and CfD 2 rounds. Furthermore, in Germany, the slowdown in new installations was primarily caused by unfavorable conditions and a lower level of the short-term offshore wind project pipeline.

- The expected increase in the deployment of wind turbines in more complex and challenging environments, such as farther offshore, coupled with the growing capacity of the wind turbine capacity, has put additional pressure on the operating components of the wind turbine. This results in premature failure of the components, such as gearbox and other components, and is likely to cause a significant downturn in wind farms. Additionally, the costs involved in providing MRO services are much higher than onshore sites. Factors, such as increased material, service, and hard-to-access terrains, are restraining growth compared to onshore facilities.

- Therefore, owing to the above points, offshore wind deployments are expected to witness significant growth in wind turbine maintenance, repair & overhaul market during the forecast period.

Asia-Pacific Expected to be the Fastest Growing Market

- Asia-Pacific is the fastest growing wind energy market in the world, owing to the contribution of China. The region has a cumulative installed capacity of 346.70 GW, of which onshore wind power installed capacity is 336.29 GW and offshore wind power installed capacity is 10.41 GW.

- As of 2020, China had the largest wind power installed capacity in Asia-Pacific, around 278.32 GW. The country is also considered among the top markets in the onshore wind power industry globally. In 2020, China added up to 58.93 GW of new wind power, with 48.94 GW onshore installations and 9.99 GW offshore installations. All of this indicates that China is expected to be the largest market for maintenance, repair, and overhaul services in the Asia-Pacific region.

- On the other hand, India, the second-largest country in the Asia-Pacific region in terms of wind energy installed capacity, sat only with a capacity of 38.625 GW as of 2020. However, over the next ten years, the electricity demand is expected to double in the country of 1.35 billion people. Accordingly, the Indian government has set a target of 175 GW of renewable energy capacity by 2022, of which 60 GW is expected to come from wind energy, and a target of 450 GW by 2030, of which 140 GW is expected to be wind-based generation. The country boasts a technical potential at a 120-meter hub height of a vast 695 GW.

- South Korea also aims to have a total renewable energy capacity of 63.8 GW by 2030, with approximately 18 GW coming from wind power. The international players, such as Orsted, have stated that South Korea may thrive from wind power generation, particularly in offshore areas considering its geographical characteristics.

- This, in turn, is expected to present Asia-Pacific as an excellent business destination for players involved in the global wind turbine maintenance, repair & overhaul business during the forecast period.

Wind Turbine MRO Industry Overview

The global wind turbine maintenance, repair, and overhaul market is moderately fragmented. Some of the key players in this market include Siemens Gamesa Renewable Energy SA, General Electric Company, Suzlon Energy Ltd, ABB Ltd, and Vestas Wind Systems A/S among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Global Renewable Energy Mix, 2020

- 4.3 Wind Power Installed Capacity and Forecast in GW, till 2027

- 4.4 Market Size and Demand Forecast in USD billion, till 2027

- 4.5 Global Average Size of Wind Turbine in MW, 2018-2027

- 4.6 Recent Trends and Developments

- 4.7 Government Policies and Regulations

- 4.8 Market Dynamics

- 4.8.1 Drivers

- 4.8.2 Restraints

- 4.9 Supply Chain Analysis

- 4.10 Porter's Five Forces Analysis

- 4.10.1 Bargaining Power of Suppliers

- 4.10.2 Bargaining Power of Consumers

- 4.10.3 Threat of New Entrants

- 4.10.4 Threat of Substitutes Products and Services

- 4.10.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Location of Deployment

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 Service Type

- 5.2.1 Maintenance

- 5.2.2 Repair

- 5.2.3 Overhaul

- 5.3 Component

- 5.3.1 Gearbox

- 5.3.2 Generators

- 5.3.3 Rotor Blades

- 5.3.4 Other Components

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 South America

- 5.4.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Siemens Gamesa Renewable Energy SA

- 6.3.2 General Electric Company

- 6.3.3 Stork (a Fluor Company)

- 6.3.4 Moventas Gears Oy

- 6.3.5 ZF Friedrichshafen AG

- 6.3.6 Vestas Wind Systems A/S

- 6.3.7 Suzlon Energy Ltd

- 6.3.8 ABB Ltd

- 6.3.9 Dana SAC UK Ltd

- 6.3.10 Nordex SE

- 6.3.11 Mistras Group

- 6.3.12 Integrated Power Services LLC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219