|

市場調查報告書

商品編碼

1858885

風力渦輪機運轉及維護市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Wind Turbine Operation and Maintenance Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

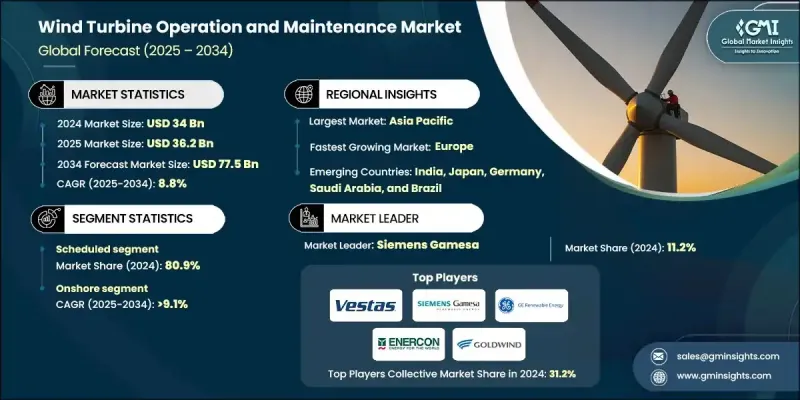

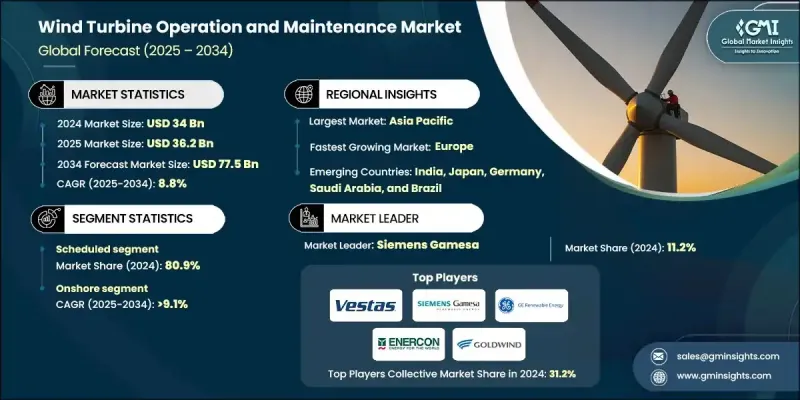

2024 年全球風力渦輪機運轉和維護市場價值為 340 億美元,預計到 2034 年將以 8.8% 的複合年成長率成長至 775 億美元。

全球風能基礎設施的日益成熟持續推動著可擴展且經濟高效的運維服務的需求。隨著風電在全球能源結構中佔據越來越大的佔有率,高效能、技術整合的維護變得愈發重要。自動化診斷、機器學習和數據驅動系統的創新正在顯著提高風扇效率並減少運行停機時間。這些智慧工具透過提供預測性洞察和即時監控,正在重塑運維格局。此外,隨著能源生產商轉向永續性和全生命週期效率,主動維護策略的角色正在迅速成長。預測分析和遠端存取工具正在取代傳統的維護模式,以確保最大限度地減少中斷並最佳化資產效能。無人機技術和機器人自動化正在進一步改變風扇的維護方式,尤其是在難以到達的地區。這些進步正在促進一個更精簡和永續的維運生態系統的發展,鞏固了陸上和海上資產市場的穩定擴張。數位化以及對清潔能源的政策支持,將持續加速全球風力發電機組維護服務的演進。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 340億美元 |

| 預測值 | 775億美元 |

| 複合年成長率 | 8.8% |

2024年,計畫性維護服務市佔率達到80.9%,預計到2034年將以9.3%的複合年成長率成長。這一主導地位反映了由數位化平台支援的主動式服務模式的廣泛應用。營運商擴大利用先進的診斷技術和性能資料來最佳化風扇的生命週期,避免代價高昂的故障。隨著風能資產老化以及偏遠或海上地區新裝置的出現,對智慧調度、資產追蹤和預測性洞察的需求不斷成長,以支援複雜的維護營運。

2024年,陸域風電市佔率達到88.5%,預計2025年至2034年將以9.1%的複合年成長率成長。陸域風電場正致力於數位轉型,以降低維護成本並提高可靠性。由於老舊風電場需要更專業的維護,營運商正在部署人工智慧驅動的分析、物聯網感測器和先進的監控工具,以預測零件故障並延長風扇壽命。這種向互聯、主動維護解決方案的轉變,使營運商能夠簡化工作流程、提高正常運作時間,並從其資產中獲得長期價值。

2034年,歐洲風力渦輪機運維市場規模將達190億美元。這一成長主要得益於離岸風電項目投資的增加以及人工智慧診斷、機器人技術和遠端控制系統等智慧技術的日益普及。該地區許多陸上風電場正在進行改造升級,從而催生了對客製化運維服務的新需求。政府政策、環境目標以及對低排放能源的監管支持,都鼓勵營運商投資於智慧且永續的維護解決方案,進而推動了整體市場成長。

全球風力渦輪機運作和維護市場的主要參與者包括維斯塔斯風力系統公司 (Vestas Wind Systems A/S)、Enercon GmbH、蘇司蘭能源有限公司 (Suzlon Energy Ltd)、弗雷德·奧爾森風力運輸公司 (Fred. Olsen Windcarrier)、RTS Wind AG、B9 Energy Group、Moventas Windtechnik)、ABB有限公司、比爾芬格公司 (Bilfinger Inc.)、Dana SAC UK Ltd、Global Wind Service company、採埃孚股份公司 (ZF Friedrichshafen AG)、Mistras Group、Mitarsh Energy、NORDEX SE、REETEC、西門子歌美颯 (Siemens Gamesa) 和藍水航運航運。為了鞏固其在全球風力渦輪機運行和維護市場的地位,主要參與者正在積極推動數位轉型並投資先進技術。各公司擴大採用預測性維護平台,利用人工智慧、巨量資料和基於感測器的診斷技術來即時監測渦輪機的健康狀況。與軟體供應商和技術創新者的策略合作有助於將自動化、無人機和機器人技術整合到其服務產品中,從而降低成本並提高工人安全。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系統

- 監管環境

- 產業影響因素

- 成長促進因素

- 產業陷阱與挑戰

- 成長潛力分析

- 價格趨勢分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 按地區分類的公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 拉丁美洲

- 戰略儀錶板

- 策略舉措

- 公司標竿分析

- 創新與技術格局

第5章:市場規模及預測:依類型分類,2021-2034年

- 主要趨勢

- 已安排

- 非計劃性

第6章:市場規模及預測:依地區分類,2021-2034年

- 主要趨勢

- 陸上

- 離岸

第7章:市場規模及預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 法國

- 瑞典

- 英國

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 中東和非洲

- 埃及

- 南非

- 摩洛哥

- 沙烏地阿拉伯

- 拉丁美洲

- 巴西

- 墨西哥

- 智利

第8章:公司簡介

- ABB

- B9 Energy Group

- Bilfinger Inc.

- Dana SAC UK Ltd

- Deutsche Windtechnik

- Enercon GmbH

- Fred. Olsen Windcarrier

- Global Wind Service company

- GoldWind

- Mistras Group,

- Mitarsh Energy

- Moventas Gears Oy

- NORDEX SE

- REETEC

- RTS Wind AG

- Siemens Gamesa

- Suzlon Energy Limited

- Suzlon Energy Ltd

- Vestas Wind Systems A/S

- ZF Friedrichshafen AG

The Global Wind Turbine Operation and Maintenance Market was valued at USD 34 billion in 2024 and is estimated to grow at a CAGR of 8.8% to reach USD 77.5 billion by 2034.

The increasing maturity of global wind energy infrastructure continues to drive demand for scalable and cost-effective O&M services. As wind power claims a larger share of the global energy portfolio, the need for efficient, technology-integrated maintenance becomes more critical. Innovations in automated diagnostics, machine learning, and data-driven systems are significantly enhancing turbine efficiency and reducing operational downtime. These smart tools are reshaping the O&M landscape by offering predictive insights and real-time monitoring. Additionally, with energy producers shifting toward sustainability and lifecycle efficiency, the role of proactive maintenance strategies is growing rapidly. Predictive analytics and remote access tools are replacing traditional maintenance models to ensure minimal disruptions and optimized asset performance. Drone technology and robotic automation are further transforming the way turbines are serviced, especially in hard-to-reach locations. These advancements are fostering a more streamlined and sustainable O&M ecosystem, reinforcing the market's steady expansion across both onshore and offshore assets. Digitalization, combined with policy support for clean energy, continues to accelerate the evolution of wind turbine servicing across global markets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $34 Billion |

| Forecast Value | $77.5 Billion |

| CAGR | 8.8% |

In 2024, the scheduled maintenance services segment held an 80.9% share and is forecasted to grow at a CAGR of 9.3% through 2034. This dominance reflects the widespread adoption of proactive service models supported by digital platforms. Operators are increasingly using advanced diagnostics and performance data to optimize turbine life cycles and avoid costly breakdowns. As wind energy assets age and new installations emerge in remote or offshore areas, demand is rising for smart scheduling, asset tracking, and predictive insights to support complex maintenance operations.

The onshore segment held an 88.5% share in 2024 and is expected to grow at a CAGR of 9.1% from 2025 to 2034. Onshore wind farms are focusing on digital transformation to reduce maintenance costs and improve reliability. With older wind farms requiring more specialized care, operators are deploying AI-driven analytics, IoT-enabled sensors, and advanced monitoring tools to anticipate component failures and extend turbine life. This shift toward connected, proactive maintenance solutions allows operators to streamline workflows, improve uptime, and drive long-term value from their assets.

Europe Wind Turbine Operation and Maintenance Market will reach USD 19 billion by 2034. This growth is propelled by rising investments in offshore wind projects and increasing integration of intelligent technologies like AI-based diagnostics, robotics, and remote control systems. Many onshore fleets across the region are undergoing repowering, which is creating fresh demand for tailored O&M services. Government policy, environmental targets, and regulatory backing for low-emission energy sources are encouraging operators to invest in smart and sustainable maintenance solutions, which in turn boosts overall market growth.

Leading companies active in the Global Wind Turbine Operation and Maintenance Market include Vestas Wind Systems A/S, Enercon GmbH, Suzlon Energy Ltd, Fred. Olsen Windcarrier, RTS Wind AG, B9 Energy Group, Moventas Gears Oy, GoldWind, Deutsche Windtechnik, ABB Ltd., Bilfinger Inc., Dana SAC UK Ltd, Global Wind Service company, ZF Friedrichshafen AG, Mistras Group, Mitarsh Energy, NORDEX SE, REETEC, Siemens Gamesa, and Blue Water Shipping. To strengthen their foothold in the Global Wind Turbine Operation and Maintenance Market, major players are embracing digital transformation and investing in advanced technologies. Companies are increasingly adopting predictive maintenance platforms that utilize AI, big data, and sensor-based diagnostics to monitor turbine health in real time. Strategic collaborations with software providers and tech innovators help integrate automation, drones, and robotics into their service offerings, reducing costs and improving worker safety.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.1.3 Base estimates and calculations

- 1.1.4 Base year calculation

- 1.1.5 Key trends for market estimates

- 1.2 Forecast model

- 1.3 Primary research & validation

- 1.3.1 Primary sources

- 1.4 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Type trends

- 2.4 Location trends

- 2.5 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Price trend analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Company benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Type, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Scheduled

- 5.3 Unscheduled

Chapter 6 Market Size and Forecast, By Location, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Onshore

- 6.3 Offshore

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 France

- 7.3.3 Sweden

- 7.3.4 UK

- 7.3.5 Spain

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.5 Middle East & Africa

- 7.5.1 Egypt

- 7.5.2 South Africa

- 7.5.3 Morocco

- 7.5.4 Saudi Arabia

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Mexico

- 7.6.3 Chile

Chapter 8 Company Profiles

- 8.1 ABB

- 8.2 B9 Energy Group

- 8.3 Bilfinger Inc.

- 8.4 Dana SAC UK Ltd

- 8.5 Deutsche Windtechnik

- 8.6 Enercon GmbH

- 8.7 Fred. Olsen Windcarrier

- 8.8 Global Wind Service company

- 8.9 GoldWind

- 8.10 Mistras Group,

- 8.11 Mitarsh Energy

- 8.12 Moventas Gears Oy

- 8.13 NORDEX SE

- 8.14 REETEC

- 8.15 RTS Wind AG

- 8.16 Siemens Gamesa

- 8.17 Suzlon Energy Limited

- 8.18 Suzlon Energy Ltd

- 8.19 Vestas Wind Systems A/S

- 8.20 ZF Friedrichshafen AG